TIDMSBTX

RNS Number : 7630E

SkinBioTherapeutics PLC

03 March 2020

SkinBioTherapeutics plc

Half year results

Manchester, UK - 03 March 2020 - SkinBioTherapeutics plc (AIM:

SBTX or the "Company") a life sciences company focused on skin

health, announces its unaudited half year results for the six

months to 31 December 2019.

Operational and financial highlights

-- New strategy presented to shareholders, defining five pillars

of development and commercial focus

-- Signed first commercial agreement in November 2019, with

Croda International Plc ("Croda"), using SkinBiotix (R) as the

foundation of an active skincare ingredient

-- Post period end, signed a development agreement around the

skin-gut axis with Winclove Probiotics B.V. ("Winclove") to create

a specialist probiotic food supplement targeting psoriasis

-- Loss from operations of GBP889k (H1 2018: GBP632k) with

increase due to R&D and operating expenditure

-- Cash as at 31 December 2019 GBP2.5m (30 June 2019: GBP3.1m),

in line with management's expectations

Stuart Ashman, CEO of SkinBioTherapeutics, said:

"The first half of the year has been focused on refining and

starting to deliver on our strategy to commercialise the SkinBiotix

(R) technology. The five pillars of the strategy comprise

SkinBiotix(R), AxisBiotix(TM), MediBiotix(TM), CleanBiotix(TM) and

PharmaBiotix(TM) demonstrating our belief in the applicability of

our technology.

"From talks initiated by Prof. Cath O'Neill, we have concluded

agreements around two of the pillars already - SkinBiotix (R) and

AxisBiotix(TM) - with Croda and Winclove respectively. Both

companies are specialists in their fields and we believe both deals

offer good growth and value opportunities to the Company, whilst

aligning with our current cash position and timeline.

"As we integrate these initial agreements into our day to day

working practices, we continue to seek other commercial partners as

well as furthering the scientific base behind our technology."

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 and has been arranged for

release by Doug Quinn, CFO of the Company. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

-Ends-

For more information, please contact:

SkinBioTherapeutics plc Tel: +44 (0) 161 468 2760

Stuart Ashman, CEO

Doug Quinn, CFO

Cairn Financial Advisers LLP Tel: +44 (0) 20 7213 0880

(Nominated Adviser)

Tony Rawlinson / Sandy Jamieson

Turner Pope Investments (Joint Tel: +44 (0) 20 3657 0050

Broker)

Andy Thacker / Zoe Alexander

Tel: +44 (0) 20 3470 0470

SP Angel Corporate Finance (Joint

Broker)

Vadim Alexandre / Abigail Wayne

Instinctif Partners Tel: +44 (0) 20 7457 2020

Melanie Toyne-Sewell / Phillip SkinBio@instinctif.com

Marriage / Nathan Billis

About SkinBioTherapeutics plc

SkinBioTherapeutics is a life science company focused on skin

health. The Company's proprietary platform technology,

SkinBiotix(R), is based upon discoveries made by Professor

Catherine O'Neill and Professor Andrew McBain.

The Company has demonstrated, through scientific testing, that

the SkinBiotix(R) platform can improve the barrier effect of skin

models, protect from infection and repair wounds. Proof of

principle studies have also shown that the SkinBiotix(R) platform

has beneficial attributes applicable to each of these areas. The

technology achieved positive results in clinical studies in human

volunteers in early 2019.

The Company listed on AIM in April 2017 and is based in

Manchester, UK. For more information, visit:

www.skinbiotherapeutics.com .

Chairman and Chief Executive's Statement

During the first half of the financial year, the Company began

its transition from one of scientific focus to progressing

opportunities to commercialise its technology. SkinBioTherapeutics

seeks to harness the microbiome for human health and has identified

five channels in which it intends to develop its focus,

encompassing both existing and new technology.

-- SkinBiotix (R) - the Company's core technology that is

designed to promote skin health by harnessing the beneficial

properties of probiotic bacteria

-- AxisBiotix(TM) - addressing the emerging area of science that

is focused on the gut-skin axis and its role in various

diseases

-- MediBiotix(TM) - this channel is targeting the use of the

SkinBiotix(R) technology for medical device applications including

the treatment of eczema and woundcare

-- CleanBiotix(TM) - targeting the use of the SkinBiotix (R)

technology to address certain categories of health care acquired

infections

-- PharmaBiotix(TM) - an extension to the medical device and

AxisBiotix(TM) applications through a pathway of medicinal

prescription registrations.

In support of the commercial focus and broader technology scope

for the Company, Stuart Ashman and Prof. Cath O'Neill transitioned

to their respective roles of Chief Executive Officer and Chief

Scientific Officer in July 2019. This change coincided with both

Prof. Cath O'Neill and Stephen O'Hara stepping down from the Board

of the Company.

The first step on the delivery of the new strategy was a

commercial agreement with Croda International Plc (RNS 20 November

2019) for the development and commercialisation of a new active

skincare cosmetic ingredient, incorporating the Company's

SkinBiotix(R) technology.

The Company has also been exploring other opportunities for

microbiome-related technologies, and post period end, in February

2020 (RNS 19 February 2020), signed an agreement with Winclove

Probiotics B.V. for the joint development and subsequent

commercialisation of a food supplement to help manage symptoms

associated with the skin condition psoriasis. This is the second

channel of the five identified by the Company.

Financial review

Research and development expenditure in the period was GBP455k

(H1 2018: GBP392k), incorporating development work with the

University of Manchester and ongoing formulation work. All such

expenditure was expensed in the period. Ongoing operating costs

were GBP434k (H1 2018: GBP240k) covering employment, consultancy,

PLC support costs and marketing. Overall the Company made a loss

from operations of GBP889k (H1 2018: GBP632k).

Cash burn during the period was GBP642k (H1 2018: GBP666k) and

in line with management's expectations. Having raised GBP1.5m in

gross proceeds through a placing in February 2019 the Company

finished the six month period to 31 December 2019 with a cash

balance of GBP2.5m (H1 2018: GBP2.5m).

Operational review

SkinBiotix(R)

The Company completed its human safety study for the cosmetic

application in early 2019 and having generated positive data,

progressed its discussions with third parties interested in

licencing the technology. This culminated in the agreement with

Croda (RNS 20 November 2019).

Under the terms of the agreement, SkinBioTherapeutics'

proprietary SkinBiotix(R) platform will be paired with Croda's

expertise in the development and commercialisation of unique,

sustainable, cosmetic ingredients, focusing specifically on the

growing skincare actives market. Sederma, part of Croda

International plc, is a specialist manufacturer of bioactive

ingredients for the cosmetic industry, and will be responsible for

the development, manufacturing and commercialisation of the

SkinBiotix(R) technology.

Croda will be creating a separate manufacturing line for the

technology and as design and manufacture of the active ingredient

is carried out, there will be concurrent testing in focused

ingredient application areas which will be detailed in further,

additional agreements.

Any licensed products resulting from these agreements will be

sold to Croda's global portfolio of Personal Care customers, which

amount to >12,000, some of which are the leading companies and

brands in the market. SkinBioTherapeutics will be paid tiered

royalties based on global sales revenues on any licensed products

subsequently derived from the successful development of the

partnership. Recognising the development activity required by

Croda, the Company anticipates revenue generation to commence from

these additional agreements during 2021.

Sales and distribution rights are for the cosmetic sector alone,

leaving SkinBioTherapeutics to focus on further applications of its

technology in other sectors. A key component of the Croda agreement

is access to a reliable supply of material and Croda will supply

SkinBiotix(R) for the Company to be able to use in sectors outside

of those covered by this agreement.

AxisBiotix(TM)

Within the emerging area of science focused on the gut-skin

axis, one disease that is considered to be influenced by the

gut-skin axis is psoriasis. This is a chronic relapsing

inflammatory condition of the skin with a prevalence of c.2-3% in

the western world. The worldwide market for psoriasis treatments

was valued at approximately $30bn in 2018 and is expected to grow

to $47bn in 2022 with a CAGR of 11.5%.

Current treatments include emollients for relatively mild

disease, through to the biologic therapies in severe cases. For the

group with mild-to-moderate psoriasis, the mainstay therapies tend

to be steroid-based, which cannot be used long term and have side

effects. Thus, there is an unmet clinical need for new, safer ways

of treating patients with mild to moderate psoriasis. Anecdotal

evidence from patients suggests that many of them have turned to

oral probiotics as an 'alternative' therapy and report success in

control of their disease. However, the effects of probiotics on

psoriasis has been investigated in only two studies which did not

make the choice of probiotic organisms based on known disease

pathways.

As detailed in the RNS of 19 February 2020, SkinBioTherapeutics

has signed an agreement with Winclove Probiotics to jointly develop

a probiotic food supplement to help manage the symptoms associated

with psoriasis. SkinBioTherapeutics and Winclove will design and

develop a probiotic blend of 'good' bacterial strains based on the

modifying properties of specific bacterial species on known

psoriasis disease pathways.

This blend will be developed into a probiotic food supplement

which will be called AxisBiotix(TM). SkinBioTherapeutics will be

responsible for the identification and selection of the bacterial

strains and patient testing; Winclove will be responsible for the

formulation and manufacture of AxisBiotix (TM) . The development

agreement is for a period of three years but can be extended by

mutual agreement. Each party retains ownership of its respective

intellectual property and will be responsible for their own costs

in relation to the development programme.

As a pre-requisite to commercialisation, AxisBiotix(TM) will be

tested in a UK human study for patients suffering from mild to

moderate psoriasis. The study, to be managed by

SkinBioTherapeutics, is expected to start in 2020 on completion of

the development phase and is estimated to take approximately 12-18

months to complete. On the basis of a positive read-out of the

study, SkinBioTherapeutics will then proceed with

commercialisation, concluding discussions with third parties that

will run in parallel to the human study.

MediBiotix(TM)

The MediBiotix channel will focus on medical device applications

incorporating the SkinBiotix(R) technology. The initial target is

eczema and, having completed its lab work to demonstrate the

required characteristics of a medical device application, the

Company is preparing a data pack for review by the MHRA (Medicines

and Healthcare products Regulatory Agency).

The management also believes there is utility for the technology

in the treatment of various classes of skin wounds and is in

discussion with a number of global advanced woundcare companies in

this regard. The Company is targeting a commercial agreement to

develop and test the SkinBiotix(R) technology in these indications

by the end of 2020.

CleanBiotix(TM)

Healthcare acquired infections (HAI) remains an area of critical

concern for healthcare providers. The growing resistance of certain

infection strains and the lack of new antibiotics is driving the

need to discover and develop new methods of controlling bacterial

growth and infection.

Staphylococcus aureus (SA) is the most common skin pathogen and

one of the major causes of HAI. The Company's SkinBiotix(R)

technology has been shown to have capabilities in preventing SA

from adhering to and growing on the skin and thus offers a

potential route of protection from SA-induced healthcare acquired

infections.

The Company is investigating whether SkinBiotix(R) offers

utility to protect other non-human surfaces and interfaces from SA

induced healthcare acquired infections. This potential application

of the SkinBiotix(R) technology is attracting early attention from

potential partners.

Outlook

Securing its first commercial agreement with Croda, a FTSE 100

company, has been a significant achievement for SkinBioTherapeutics

and is a strong validation of the technology and its potential. The

agreement with Winclove incorporates a different aspect of the

microbiome, recognising the influence of the gut-skin axis and in

an area of significant unmet clinical need. However, this second

agreement also demonstrates the management team's commitment and

drive to deliver on the commercial strategy. The team is targeting

further commercial progress in the areas of MediBiotix (TM) and

CleanBiotix (TM) during the course of the year. The scientific

focus will also continue with the intended commencement of a human

study for psoriasis and clarity on the regulatory pathway for the

treatment of eczema.

Martin Hunt (Non-executive Chairman)

Stuart J. Ashman (Chief Executive Officer)

2 March 2020

Statement of Comprehensive Income

For the 6 months ended 31 December 2019

Notes 6 months 6 months 12 months

to to to

31 Dec 31 Dec 2018 30 Jun

2019 2019

Unaudited Unaudited Audited

GBP GBP GBP

Continuing operations

Research and development (455,052) (391,907) (708,081)

Operating expenses (433,950) (240,372) (652,400)

-------------------------------- ------ ---------- ------------- ------------

Loss from operations (889,002) (632,279) (1,360,481)

Loss before taxation (889,002) (632,279) (1,360,481)

Taxation 4 64,698) 99,546) 212,388)

-------------------------------- ------ ---------- ------------- ------------

Loss for the period (824,304) (532,733) (1,148,093)

Total comprehensive loss for

the period (824,304) (532,733) (1,148,093)

Basic and diluted loss per

share (pence) 6 (0.64) (0.45) (0.94)

-------------------------------- ------ ---------- ------------- ------------

Statement of Financial Position

As at 31 December 2019

As at As at As at

Note 31 Dec 31 Dec 2018 30 Jun 2019

2019

Unaudited Unaudited Audited

GBP GBP GBP

ASSETS

Non-current assets

Property, plant & equipment 4,250 9,350 6,800

Intangible assets 378,949 308,104 346,870

-------------------------------- ------- ------------ ------------- -------------

Total non-current assets 383,199 317,454 353,670

-------------------------------- ------- ------------ ------------- -------------

Current assets

Other receivables 78,167 26,227 242,580

Corporation tax receivable 275,049 185,818 210,351

Cash and cash equivalents 2,483,243 2,516,876 3,124,864

-------------------------------- ------- ------------ ------------- -------------

Total current assets 2,836,459 2,728,921 3,577,795

-------------------------------- ------- ------------ ------------- -------------

Total assets 3,219,658 3,046,375 3,931,465

-------------------------------- ------- ------------ ------------- -------------

EQUITY AND LIABILITIES

Equity

Capital and reserves

Called up share capital 5 1,280,835 1,187,085 1,280,835

Share premium 4,923,890 3,577,640 4,923,890

Other reserves 301,554 205,166 247,672

Accumulated deficit (3,466,570) (2,026,906) (2,642,266)

-------------------------------- ------- ------------ ------------- -------------

Total equity 3,039,709 2,942,985 3,810,131

-------------------------------- ------- ------------ ------------- -------------

Liabilities

Current liabilities

Trade and other payables 179,949 103,390 121,334

Total current liabilities 179,949 103,390 121,334

-------------------------------- ------- ------------ ------------- -------------

Total liabilities 179,949 103,390 121,334

-------------------------------- ------- ------------ ------------- -------------

Total equity and liabilities 3,219,658 3,046,375 3,931,465

-------------------------------- ------- ------------ ------------- -------------

Statement of Cash Flows

For the 6 months ended 31 December 2019

6 months 6 months 12 months

to to to

31 Dec 2019 31 Dec 30 Jun 2019

2018

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating activities

Loss before tax for the period (889,002) (632,279) (1,360,481)

Depreciation 2,550 850 3,400

Share option expenses 53,882 34,748 77,254

(832,570) (596,681) (1,279,827)

---------------------------------------------- ------------- ---------- -------------

Changes in working capital

Decrease / (increase) in trade and

other receivables 164,413 67,194 (146,160)

Increase / (decrease) in trade and

other payables 58,615 (105,903) (90,958)

---------------------------------------------- ------------- ---------- -------------

Cash generated by / (used in) operations 223,028 (38,709) (237,118)

---------------------------------------------- ------------- ---------- -------------

Taxation received - - 88,309

Net cash used in operating activities (609,542) (635,390) (1,428,636)

---------------------------------------------- ------------- ---------- -------------

Cash flows from investing activities

Purchase of property, plant & equipment - (10,200) (10,200)

Payments for intangible assets (32,079) (20,432) (59,198)

---------------------------------------------- ------------- ---------- -------------

Net cash used in investing activities (32,079) (30,632) (69,398)

---------------------------------------------- ------------- ---------- -------------

Cash flows from financing activities

Net proceeds from issue of equity

instruments of the Company - - 1,440,000

---------------------------------------------- ------------- ---------- -------------

Net cash generated by financing activities - - 1,440,000

---------------------------------------------- ------------- ---------- -------------

Net decrease in cash and cash equivalents (641,621) (666,022) (58,034)

Cash and cash equivalents at the beginning

of the period 3,124,864 3,182,898 3,182,898

---------------------------------------------- ------------- ---------- -------------

Cash and cash equivalents at the end

of the period 2,483,243 2,516,876 3,124,864

---------------------------------------------- ------------- ---------- -------------

Statement of Changes in Equity

For the 6 months ended 31 December 2019

Other Retained

Share capital Share premium reserves earnings Total

GBP GBP GBP GBP GBP

As at 1 Jul 2018 1,187,085 3,577,640 170,418 (1,494,173) 3,440,970

Loss for the period - - - (532,733) (532,733)

Share-based payments - - 34,748 - 34,748

As at 31 Dec 2018 1,187,085 3,577,640 205,166 (2,026,906) 2,942,985

------------------------ -------------- -------------- ---------- ------------ ----------

As at 1 Jan 2019 1,187,085 3,577,640 205,166 (2,026,906) 2,942,985

Loss for the period - - - (615,360) (615,360)

Issue of shares 93,750 1,406,250 - - 1,500,000

Costs of share issue - (60,000) - - (60,000)

Share-based payments - - 42,506 - 42,506

As at 30 Jun 2019 1,280,835 4,923,890 247,672 (2,642,266) 3,810,131

------------------------ -------------- -------------- ---------- ------------ ----------

As at 1 Jul 2019 1,280,835 4,923,890 247,672 (2,642,266) 3,810,131

Loss for the period - - - (824,304) (824,304)

Share-based payments - - 53,882 - 53,882

As at 31 Dec 2019 1,280,835 4,923,890 301,554 (3,466,570) 3,039,709

------------------------ -------------- -------------- ---------- ------------ ----------

Share capital is the amount subscribed for shares at nominal value.

Share premium is the amount subscribed for share capital in excess

of nominal value.

Other reserves arise from the equity element of a convertible loan

issued and converted in the period to

30 June 2017, and from share options granted on 5 April 2017.

Retained earnings represents accumulated profit or losses to date.

Notes to the half yearly report

1. General information

SkinBioTherapeutics plc is a public limited company incorporated

in England under the Companies Act and quoted on the AIM market of

the London Stock Exchange (AIM: SBTX). The address of its

registered office is 15 Silk House, Park Green, Macclesfield, SK11

7QJ.

The principal activity of the Company is that of research and

development into the effects of lysates derived from the human

microbiome on skin.

The financial information set out in this half yearly report

does not constitute statutory accounts as defined in Section 434 of

the Companies Act 2006. The statutory financial statements for the

year ended 30 June 2019, prepared under International Financial

Reporting Standards ("IFRS"), have been filed with the Registrar of

Companies. The auditor's report on those financial statements was

unqualified and did not contain statements under Sections 498(2)

and 498 (3) of the Companies Act 2006.

Copies of the annual statutory accounts and the half yearly

report can be found on the Company's website at

www.skinbiotherapeutics.com/ .

2. Significant accounting policies and basis of preparation

2.1 Statement of compliance

This half yearly report has been prepared using the historical

cost convention, on a going concern basis and in accordance with

International Financial Reporting Standards ("IFRS") as adopted by

the European Union, IFRS Interpretations Committee (IFRIC) and the

Companies Act 2006 applicable to companies reporting under IFRS,

using accounting policies which are consistent with those set out

in the financial statements for the year ended 30 June 2019.

2.2 Application of new and revised International Financial Reporting Standards (IFRSs)

There are no IFRSs or IFRIC interpretations that are effective

for the first time in this financial period that would be expected

to have a material impact on the Company.

3. Segmental reporting

The Company has one reportable segment, namely the research and

development of the SkinBiotix(R) technology, all within the United

Kingdom.

4. Taxation

6 months 6 months 12 months

to to to

Income taxes recognised in 31 Dec 31 Dec 2018 30 Jun

profit or loss 2019 2019

GBP GBP GBP

Current tax

R&D tax credit 64,698 97,509 210,350

R&D tax credit - prior

year - 2,037 2,038

--------------------------------------- ---- ---- ---- ----------------- ------------------ ------------

Tax credit for the period 64,698 99,546 212,388

--------------------------------------- ---- ---- ---- ----------------- ------------------ ------------

5. Share capital

Issued share capital 31 Dec 31 Dec 2018 30 Jun 2019

comprises 2019

GBP GBP GBP

128,083,494 ordinary shares

of GBP0.01 each 1,280,835 1,187,085 1,280,835

6. Loss per share

6 months 6 months 12 months

to to to

31 Dec 31 Dec 2018 30 Jun

2019 2019

GBP GBP GBP

Basic and diluted loss per

share

Loss after tax (GBP) (824,304) (532,733) (1,148,093)

Weighted average number of

shares 122,047,535 118,708,494 122,047,535

Basic and diluted loss per

share (pence) (0.64) (0.45) (0.94 )

--------------------------------------------- ---- ---- ----------------- ------------------ ------------

As the Company is reporting a loss from continuing operations for the period

then, in accordance with IAS 33, the share options are not considered dilutive

because the exercise of the share options would have an anti-dilutive effect.

The basic and diluted earnings per share as presented on the face of the

income statement are therefore identical.

7. Events after the reporting date

The Company has evaluated all events and transactions that occurred after

31 December 2019 up to the date of signing of the financial statements.

No material subsequent events have occurred that would require adjustment

to or disclosure in the financial statements.

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BIGDXIGGDGGD

(END) Dow Jones Newswires

March 03, 2020 02:00 ET (07:00 GMT)

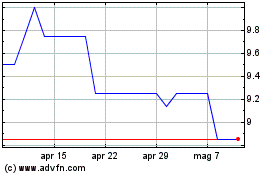

Grafico Azioni Skinbiotherapeutics (LSE:SBTX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Skinbiotherapeutics (LSE:SBTX)

Storico

Da Apr 2023 a Apr 2024