SQN Asset Finance Income Fund Ltd Conclusion of a further Anaerobic Digestion plant (0015F)

05 Marzo 2020 - 8:00AM

UK Regulatory

TIDMSQN

RNS Number : 0015F

SQN Asset Finance Income Fund Ltd

05 March 2020

5 March 2020

SQN Asset Finance Income Fund Limited

Conclusion of a further Anaerobic Digestion ("AD") plant

SQN Asset Finance Income Fund Limited (the "Company"), is

pleased to announce the exit of a further AD Plant investment, at

the end of February, and at a premium above the initially targeted

yield.

The Company received an annualized investment yield of 13.51%

against the originally booked figure of 11.16%. This is the fifth

AD Plant investment, of the fifteen made by the Company, to be

exited at a premium.

This disposition is consistent with the Investment Managers'

plan to reduce the Company's exposure to this sector and evidences

the ability of well performing assets in this sector to generate

yield premiums.

The Company now has ten remaining AD Plant investments, six of

which are subject to a review being undertaken by KPMG to assist

the Board in determining their current fair value.

Each of the AD Plant investments concluded so far have been

either joint ventures or smaller-scale plants. The larger

investments made by the Company are still to be realised. The

Investment Managers believe that these remaining assets will follow

the same eventual pattern of reaching a steady-state of energy

production and income and then be subsequently refinanced or sold

as the method of exiting the transaction.

For further information please contact:

SQN Capital Management, LLC

Jeremiah Silkowski jsilkowski@sqncapital.com

Nicola Bird nbird@sqncapital.com

Catherine Halford Riera chalford@sqncapital.com 01932 575 888

Winterflood Securities Limited 020 3100 0000

Neil Langford

Chris Mills

Buchanan

Charles Ryland

Victoria Hayns

Henry Wilson 020 7466 5000

Notes to Editor

The Company invests in equipment lease and asset finance

arrangements across a diverse portfolio of assets and industries

predominantly in the UK, Northern Europe and US. The Company

focuses on business-essential, revenue-producing (or cost saving)

equipment and other assets with high in-place value and long

economic life relative to the investment term.

The Company's Investment Managers are SQN Capital Management,

LLC, a Registered Investment Advisor with the United States

Securities and Exchange Commission and its subsidiary, SQN Capital

Management (UK) Limited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PFUEAFDLEAPEEFA

(END) Dow Jones Newswires

March 05, 2020 02:00 ET (07:00 GMT)

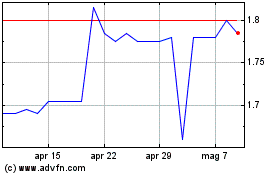

Grafico Azioni Slf Realisation (LSE:SLFR)

Storico

Da Mar 2024 a Apr 2024

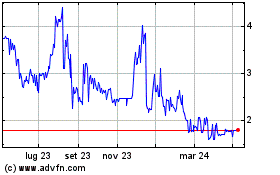

Grafico Azioni Slf Realisation (LSE:SLFR)

Storico

Da Apr 2023 a Apr 2024