The Next Wave in Shareholder Activism: Socially Responsible Investing

08 Marzo 2020 - 3:29PM

Dow Jones News

By Corrie Driebusch

The biggest activist hedge funds are jumping on the wave of

socially responsible investing.

Elliott Management Corp., known for waging campaigns for share

buybacks and executive change, suggested in its recent public

letter to Evergy Inc. that the utility consider reducing its carbon

footprint. In its February letter to management at Prudential PLC,

Third Point LLC highlighted the excessive carbon footprint it says

is created by having a London headquarters for the British

insurer's American and Asian businesses. And Jeff Ubben, an

activist known for nudging companies to focus on what they are best

at, has bought into BP PLC as a vote of confidence in the British

oil giant's plan to eliminate most of its carbon emissions.

In the latest trend in shareholder activism, the firms are

adding to their standard list of demands improvements in companies'

environmental, social and governance, or ESG, practices.

ESG represents a big opportunity -- and challenge -- for

investors.

Individual investors have moved billions of dollars into funds

that prioritize issues like sustainability and diversity, and the

activists are hoping to tap into that stream of cash.

Meanwhile, the largest institutional investors, including

BlackRock Inc. and Vanguard Group, have emphasized their commitment

to these issues. Earlier this year, BlackRock, which manages about

$7 trillion, said it is divesting itself of thermal coal producers

held in actively managed portfolios, adding that it will likely

vote against management and boards of companies that don't disclose

how climate change could hurt their businesses.

Highlighting ESG could help activists win the support of the big

funds that is crucial to their success -- and ignoring the issues

could make their backing harder to win. BlackRock, Vanguard and

State Street Corp. collectively hold roughly a fifth of the S&P

500 through funds they run for investors, so their influence is

essential in most activism campaigns.

The activists who are emphasizing ESG say it is an extension of

their focus on corporate governance. In the past decade, the

investors largely shifted away from demanding capital

redistribution, positioning themselves instead as advocates of

improving governance shortcomings.

"ESG is so top-of-mind right now throughout the investment

world, but with the exception of board diversity, we have yet to

really see the E and S be the center of an activism campaign," said

Andrew Freedman, a lawyer at Olshan Frome Wolosky LLP who works

with activists. "In the next year, we believe we'll see campaigns

where those factors are front and center."

Critics say the firms aren't pivoting out of a desire to save

the world, and to be sure, their ultimate goals remain the same:

higher stock prices and, in many cases, bigger payouts to

shareholders.

"Activists will try to co-opt what index funds care about," said

Avinash Mehrotra, global head of activism defense at Goldman Sachs

Group Inc.

It is far from guaranteed that the efforts will yield more

assets or better returns for a group that has struggled to keep up

with the surging stock market in recent years.

Jana Partners LLC has delayed its goal of launching a new

vehicle focused on ESG after it found more demand for case-by-case

partnership investments with an ESG thrust, according to a person

familiar with the matter. Jana was an early mover in activist ESG,

pushing Apple Inc. to address concerns about teenage iPhone

addiction in 2018 in partnership with the giant union California

State Teachers' Retirement System, or Calstrs.

Other activists haven't gone out of their way to talk about

environmental or social failings at the companies they target, with

some saying it is not their place to do so. Carl Icahn and Jeff

Smith of Starboard Value LP rarely incorporate such complaints in

their campaigns. Mr. Icahn hasn't managed outside money for years

and much of Starboard's capital comes from investors who likely

aren't pressing for such moves.

That contrasts with the likes of Elliott and Third Point.

Elliott made Christine O'Brien, a former research analyst at the

fund, head of investment stewardship last year, while Third Point

carved out a similar role for firm veteran Elissa Doyle.

And earlier this year, Mr. Ubben, a founder of ValueAct Capital

Management LP, officially stepped down from his role as chief

executive to focus on managing the firm's $1 billion socially

responsible Spring Fund.

Other funds that have taken into consideration environmental and

social issues, include Barington Capital Group LP, which has a

formal ESG policy. Its campaign at L Brands Inc. centered on

pushing the Victoria's Secret parent to break up, and it criticized

the fashion icon as "tone deaf," given women's current views of

beauty, diversity and inclusion. Ultimately, in a nod to such

criticism, L Brands added two new female directors, and in February

embattled founder Leslie Wexner agreed to step down as chairman and

CEO.

Write to Corrie Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

March 08, 2020 10:14 ET (14:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

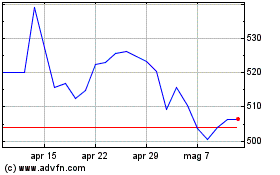

Grafico Azioni Bp (LSE:BP.)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Bp (LSE:BP.)

Storico

Da Apr 2023 a Apr 2024