Yen Trades Higher Amid Virus Fears

09 Marzo 2020 - 5:15AM

RTTF2

The Japanese yen traded higher against its major counterparts on

Monday amid risk aversion, as a plunge in crude oil prices added to

worries about the rapid spread of the coronavirus outbreak across

the world.

Crude oil plummeted amid fears of a price war after a proposal

by the Organization of the Petroleum Exporting Countries or OPEC

for deeper output cuts was rejected by its allies. Saudi Arabia

slashed its official oil prices and reportedly plans to ramp up

production following the breakdown in talks between OPEC and

Russia.

Data showed China's exports contracted sharply in the first two

months of the year, worsening a global market rout.

China's exports and imports both plunged over the first two

months of the year due to the virus impact, customs data

showed.

Exports shrank by 17.2 percent in January and February combined,

down from 7.9 percent growth in December. Imports dropped an annual

4 percent, down from 16.5 percent growth in December.

Data from the Cabinet Office showed that Japan's gross domestic

product saw a downward revision to -7.1 percent on year in the

fourth quarter of 2019.

That was worse than expectations for -6.6 percent after last

month's preliminary reading suggested a decline of 6.3 percent.

The yen rose to a 3-1/2-year high of 101.54 against the

greenback and more than a 6-month high of 116.36 against the euro,

from its early low of 104.60 and a 1-week low of 118.70,

respectively. Next key resistance for the yen is seen around 100.00

against the greenback and 114.00 against the euro.

Reversing from its early lows of 112.27 against the franc and

136.86 against the pound, the yen spiked up to a 3-month high of

110.06 and a 5-month high of 132.89, respectively. If the yen rises

further, 107.00 and 130.5 are likely seen as its next resistance

levels against the franc and the pound, respectively.

The yen moved up to more than an 8-year high of 73.86 against

the loonie, 7-1/2-year high of 61.29 against the kiwi and an

11-year high of 64.49 against the aussie, from its early more than

3-year low of 77.02, multi-year lows of 66.14 and 69.17,

respectively. The next possible resistance for the yen is seen

around 72.00 against the loonie, 60.00 against the kiwi and 61.00

against the aussie.

The Australian and New Zealand dollars fell amid a plunge in

Asian shares.

The aussie fell to an 11-year low of 0.6314 against the

greenback and near an 11-year low of 1.8146 against the euro, from

its early high of 0.6625 and a multi-year high of 1.7125,

respectively. The aussie is seen finding support around 0.63

against the greenback and 1.85 against the euro.

The aussie dropped to a 6-day low of 0.8717 against the loonie

and near a 5-week low of 1.0370 against the kiwi, reversing from

its early 1-1/2-month high of 0.9016 and a 4-day high of 1.0510,

respectively. The aussie may locate support around 0.85 against the

loonie and 1.02 against the kiwi.

The kiwi depreciated to near an 11-year low of 0.6008 against

the greenback and a 9-year low of 1.9127 against the euro, off its

early highs of 0.6342 and 1.7932, respectively. The kiwi is poised

to challenge support around 0.58 against the greenback and 2.1

against the euro.

Looking ahead, Eurozone Sentix investor confidence for March is

due out in the European session.

At 8:15 am ET, Canada housing starts for February are set for

release.

Canada building permits for January will be released in the New

York session.

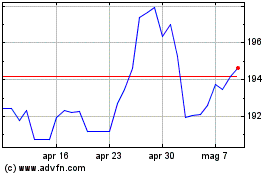

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

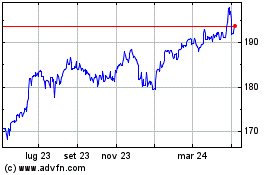

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024