Cheaper Oil Ratchets Up Pressure on Energy Sector

09 Marzo 2020 - 6:24PM

Dow Jones News

By Sarah McFarlane

Oil companies are expected to slash investments and cut

shareholder returns after crude prices sank to their lowest level

in four years.

The Saudi Arabian Oil Co. this past weekend decided to discount

oil prices after the Organization of the Petroleum Exporting

Countries and Russia failed to agree to a production cut in

response to the coronavirus epidemic. The move, along with the

kingdom's plan to increase production starting in April, threatens

to exacerbate a glut in oil supply. And publicly traded oil

companies -- including Aramco, as the Saudi state-run oil giant is

known -- are collateral damage in the conflict.

BP PLC's shares fell by more than 20% on Monday, while Royal

Dutch Shell PLC was down 14%, France's Total SA off 12%, and Exxon

Mobil Corp. down 9%. On Sunday, Aramco's shares fell below their

December listing price, in what was the world's largest initial

public offering.

Oil companies were already the laggards of equity markets.

Shareholders are questioning their long-term future in a lower

carbon world where oil demand is expected to decline. At the same

time, companies' earnings are eroding due to lower energy prices in

2019 compared with the previous year.

The latest price slide will mean they will be hard pressed to

meet hefty shareholder returns and maintain investments, all the

while paying down debt.

"The first thing to go will probably be the share buybacks,"

said Santander analyst Jason Kenney. "Then there will be an

assessment of absolute capital expenditure needs. Maintenance capex

levels are somewhere in the 30-40% range of annual spend, so

there's a lot of money that can be flexed."

Shell already sounded a warning on the sustainability of its $25

billion share-buyback plan in January, when Chief Executive Ben Van

Beurden said the program's pace was "subject to macro conditions

and further debt reduction." With $15 billion in buybacks completed

by January, the company was due to conclude the program by the end

of this year, having launched it in mid-2018.

Total was due to buy back $2 billion in shares this year, but

its plan assumes an oil price of $60 a barrel. Brent oil prices --

the global benchmark -- have almost halved since the start of the

year to around $35 a barrel. According to estimates from

consultancy WoodMackenzie, a $10 a barrel move in oil price has a

$40 billion impact on global cash flow per quarter for the oil

sector.

If companies rein in spending, the belt-tightening is likely to

hasten a peak in oil supply which Christyan Malek, JP Morgan's head

of oil research for Europe and the Middle East, forecasts was

already due in 2022. "All you are doing now is accelerating

it."

The sharp drop in oil prices will hit companies' debt positions

at a time when many balance sheets were already stretched.

In the fouth quarter, BP's gearing -- the ratio of net debt to

the total of net debt and equity -- was 35% including leases, down

from 36% in the third quarter but above the company's long-term

target of between 20% and 30%.

"Considering both the financial framework and balance sheet

position, we see BP as in the most-stressed position, largely due

to the starting point on gearing, which is the highest in the

sector, followed by ENI and Exxon," said Biraj Borkhataria, co-head

of European energy research at RBC Capital Markets.

Shell said in January that its gearing was likely to remain

above its target of 25% this year.

Dividends are expected to remain sacrosanct, analysts said.

Exxon has increased its dividend annually for 37 years and Shell

hasn't cut its since World War II.

"I think there's going to be every effort to cover dividends...

it's a red line really," said Santander's Mr. Kenney.

Cheaper oil could also slow the energy transition to the lower

carbon future that investors and policymakers are increasingly

demanding. The move toward electric vehicles and renewable energy

has threatened business models and deterred some investors from

holding oil stocks due to the growing risks around their

future.

"The worst thing that those people need is a low oil price, as

that will certainly discourage substitution away from oil," said

Mr. Kenney, referring to climate activists.

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

March 09, 2020 13:09 ET (17:09 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

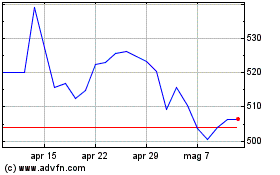

Grafico Azioni Bp (LSE:BP.)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Bp (LSE:BP.)

Storico

Da Apr 2023 a Apr 2024