By Matthew Dalton

Italy's coronavirus lockdown has the global luxury-goods

industry straining to keep factories open in the country while

adopting precautionary measures to fight the spread of the disease

in its ranks.

The makers of luxury goods -- from industry giants like LVMH

Moët Hennessy Louis Vuitton SE and Prada SpA to smaller ateliers

with global markets -- are providing workers with protective gear,

closing workplace cafeterias and warning employees to keep their

distance from each other. The Italian government order, issued

Monday night, has barred travel and public gatherings across the

nation, but it contains an exception to allow business activity to

continue.

While the initial outbreak in China took a big bite out of

demand for luxury products, the disease's spread to Italy is now

testing its ability to make many of those items. The luxury

business is one of the few industries in recent years that has

boosted its production in Italy, drawing on the country's mystique

and heritage as a key selling point with shoppers from New York to

Beijing.

Telling staff to simply work from home or avoid physical contact

is difficult in an industry whose beating heart is the workshop

where dozens of artisans collaborate, often in close quarters.

Shutting that production would be a huge blow to the Italian

economy. Luxury goods companies employ tens of thousands of people

and are among the country's biggest exporters.

"On the production side, remote working is not possible, so it's

a question of managing risk by reducing contact between people,"

says Matteo Lunelli, chairman of Altagamma, which represents

Italy's luxury industry. "It should be possible to find a solution

to protect the flow of goods and at the same time the health of the

people."

Big firms like Franco-Italian EssilorLuxottica SA, which makes

eyeglasses for luxury brands like Persol and Bulgari, as well as

Oakley and Ray-Ban, continue to operate their factories in Italy.

Louis Vuitton, owned by LVMH, has kept open its global shoe factory

in the Venice region, site of one of Italy's biggest disease

clusters.

But others worry the government might need to impose a hard

lockdown, with no exceptions for business. That helped China tamp

down the outbreak in Wuhan province, where the coronavirus first

emerged and swept across the globe.

"I fear we may be underestimating what needs to be done to

contain the problem," says Luca Solca, luxury goods analyst at

Bernstein. "The risk is that the government may have to implement

more draconian measures, in a similar manner to what the Chinese

did in Wuhan."

Pelletteria Graziella, a leather-goods supplier near Venice, has

taken a host of steps to keep the virus out of its factory as it

continues production. The threat has been at its doorstep for

several weeks, since a cluster of cases emerged in the region.

Now, the workshop's 50 artisans wear masks while they work. Last

week, the factory installed air filters. Each worker's temperature

is taken at the start of the day. Truck drivers making deliveries

to the facility aren't allowed to get out of their vehicles.

"It's a little sad to see, but you can understand that it's a

difficult situation," says Davide Zampieri, development and

production coordinator for the company, which supplies a host of

luxury brands such as Bottega Veneta and Dries Van Noten.

The company is also considering closing the factory for at least

a week and relying on a network of external workers. For more than

a century, the region, known as Riviera del Brenta, has specialized

in making shoes and leather goods, fostering a network of artisans

that have small workshops in their houses. They often worked by day

in factories and then in the evening from home.

"This is our Plan B," Mr. Zampieri said.

The company is under pressure to fill orders made before the

coronavirus outbreak spread in Italy. The next round of orders,

however, is likely to show a major decline, as luxury shoppers

world-wide have cut their spending during the epidemic.

"We are waiting right now to receive the orders, but the

feedback is very negative," he says. "For sure, a decrease of

40%."

On the other side of Italy near Florence, leather goods

suppliers are still producing as usual. The region, centered on the

Florentine suburb of Scandicci, has been spared a major disease

outbreak compared with the areas around Milan and Venice to the

north.

"The situation [we see elsewhere] on TV is worse than in

Scandicci," says Massimiliano Guerrini, whose family owns Almax,

which produces handbags for Balenciaga, Fendi and other global

fashion brands.

So far, his clients haven't notified him of any canceled orders.

The company is advising its workers on proper hygiene and decided

this week to close the company cafeteria, to keep large numbers of

people from gathering in one place.

Almax runs a factory with 200 artisans, and doesn't have the

option of relying on outside workers like Pelletteria Graziella,

the leather-goods maker near Venice.

"It's impossible," Mr. Guerrini says. "We are too big."

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

March 11, 2020 05:41 ET (09:41 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

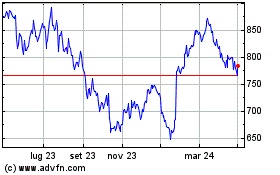

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Mar 2024 a Apr 2024

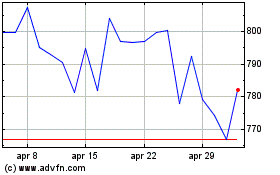

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Apr 2023 a Apr 2024