Pound Advances After Dropping On BoE Rate Cut

11 Marzo 2020 - 7:04AM

RTTF2

After initially falling in response to the Bank of England's

surprise rate cut in the early European session on Wednesday, the

pound rebounded against its major peers.

The Bank of England unexpectedly cut its key interest rate to

contain the economic fallout from the coronavirus outbreak.

The Monetary Policy Committee unanimously voted to cut the bank

rate by 50 basis points to a record low 0.25 percent, following a

special meeting on March 10, the central bank said in a

statement.

The MPC also voted unanimously to introduce a new Term Funding

scheme with additional incentives for Small and Medium-sized

Enterprises, or TFSME, financed by the issuance of central bank

reserves.

"These measures will help to keep firms in business and people

in jobs and help prevent a temporary disruption from causing

longer-lasting economic harm," the central bank said.

The special measures were announced ahead of the budget

presentation by Chancellor Rishi Sunak at 6.30 am ET.

The currency fell against its major rivals in the Asian session,

with the exception of the dollar.

The pound appreciated to 0.8739 against the euro, after falling

to a 5-month low of 0.8847 at 3:00 am ET. The pound was trading at

0.8736 a euro at Tuesday's close. The pound is seen finding

resistance around the 0.85 mark.

The pound bounced off to 1.2955 against the greenback, from a

1-week low of 1.2827 seen immediately after the decision. At

yesterday's trading close, the pair was valued at 1.2903. Next key

resistance for the pound is likely seen around the 1.32 level.

Reversing from a low of 134.01 hit quickly after the BoE action,

the pound rebounded to 136.30 against the yen. Should the pound

strengthens further, it is likely to test resistance around the

138.00 region.

Having declined to more than a 6-month low of 1.1979 against the

franc upon the BoE announcement, the pound turned higher and was

trading at 1.2107. The pound-franc pair was worth 1.2131 when it

ended deals on Tuesday. Further uptrend may take the pound to a

resistance around the 1.24 area.

Looking ahead, the Chancellor of the Exchequer, Rishi Sunak,

will present U.K. annual budget at 6:30 am ET.

In the New York session, U.S. CPI and monthly budget statement

for February are scheduled for release.

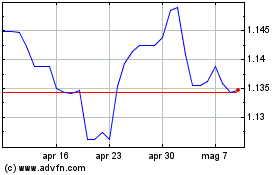

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Apr 2023 a Apr 2024