Australian Dollar Drops Amid Risk Aversion

12 Marzo 2020 - 4:28AM

RTTF2

The Australian dollar declined against its major counterparts on

Thursday amid risk aversion, as the World Health Organization

declared the coronavirus outbreak a global pandemic and as U.S.

President Donald Trump's address on the coronavirus failed to ease

investors' concerns about the economic impact of the outbreak.

Trump announced that all travel from Europe to the U.S. will be

suspended for 30 days, in an attempt to curb the spread of the

coronavirus. Investors are worried that the travel ban will further

add to the existing business disruptions.

Meanwhile, the Australian government unveiled a A$17.6 billion

economic plan to tackle the significant challenges posed by the

spread of the coronavirus.

"Our targeted stimulus package will focus on keeping Australians

in jobs and keeping businesses in business so we can bounce back

strongly," Prime Minister Scott Morrison said.

The aussie declined to a 3-day low of 0.6442 against the

greenback from Wednesday's closing value of 0.6484. The next

possible support for the aussie is seen around the 0.62 level.

The aussie fell to 3-day lows of 1.7557 against the euro and

0.8874 against the loonie, from its early highs of 1.7335 and

0.8945, respectively. The aussie is poised to challenge support

around 1.9 against the euro and 0.87 against the loonie.

The aussie slipped to more than a 7-month low of 1.0301 against

the kiwi, from an early high of 1.0355. The aussie may locate

support around the 1.02 level.

The aussie held steady against the yen, after having fallen to a

3-day low of 66.57 at 10:00 pm ET. The pair had finished

yesterday's deals at 67.76.

Data from the Bank of Japan showed that Japan producer prices

fell 0.4 percent on month in February.

That was shy of expectations for a decline of 0.3 percent

following the 0.2 percent increase in January.

Looking ahead, Eurozone industrial production for January is due

out in the European session.

The European Central Bank will announce interest rate decision

at 7:45 am ET. The ECB is expected to hold its main refi rate at a

record low zero percent and the deposit rate at -0.50 percent.

U.S. producer prices for February and weekly jobless claims for

the week ended March 6 are scheduled for release in the New York

session.

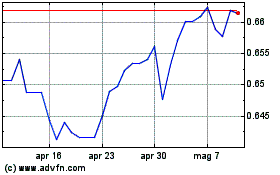

Grafico Cross AUD vs US Dollar (FX:AUDUSD)

Da Mar 2024 a Apr 2024

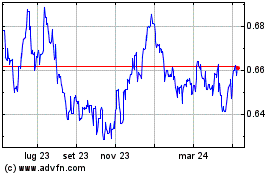

Grafico Cross AUD vs US Dollar (FX:AUDUSD)

Da Apr 2023 a Apr 2024