Xerox Pauses Takeover Campaign for HP, Citing Virus Concerns -- WSJ

14 Marzo 2020 - 8:02AM

Dow Jones News

By Dave Sebastian

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 14, 2020).

Xerox Holdings Corp. said it is putting its campaign to take

over HP Inc. on hold, a sign that the coronavirus pandemic is

affecting deal making.

The company said Friday it is postponing additional

presentations, interviews with the press and meetings with HP

shareholders.

"In light of the escalating Covid-19 pandemic, Xerox needs to

prioritize health and safety of its employees, customers, partners

and affiliates over and above all considerations, including its

proposal to acquire HP, " Xerox Vice Chairman and Chief Executive

John Visentin said.

The company said it doesn't consider the market decline since it

put out its bid or the temporary suspensions of HP shares in recent

days as a result of marketwide circuit breakers as a failure of any

condition to acquire HP. Xerox said it would take the same view in

future trading halts.

HP last week rejected Xerox's $35 billion bid to take over the

company, saying a combination would disproportionately benefit

Xerox shareholders and that Xerox doesn't have the operational

experience in HP's sectors, such as personal systems, home printing

and 3-D and digital manufacturing.

A deal would combine household names that have been trying to

reorient their businesses. The two companies dominate different

areas of the printer market and have both been cutting costs as the

need for printed documents declines.

Xerox has argued that a combination could equip the companies to

overcome those declines, potentially yielding savings of more than

$2 billion. The proposed deal has the backing of activist investor

Carl Icahn, who has stakes in both companies.

Xerox primarily makes large printers and copy machines and

generates revenue from renting them to businesses and maintaining

the devices. HP mainly sells smaller printers and printing

supplies, and it is also one of the biggest PC makers in the world,

though its printer business is more lucrative.

HP in February said it would buy back $15 billion of its stock

as it worked to block Xerox from taking over. In January, Xerox

said it plans to nominate 11 independent candidates to replace HP's

board at HP's annual shareholder meeting this summer.

Shares of Xerox rose 0.3%, and HP shares fell 1.9% on Friday.

HP, which had a market value of about $25.83 billion, is

significantly larger than Xerox, whose market capitalization was

about $5.28 billion. Both companies' shares have fallen this year

as equities plunged into the bear market on coronavirus

concerns.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

March 14, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

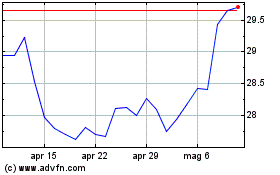

Grafico Azioni HP (NYSE:HPQ)

Storico

Da Mar 2024 a Apr 2024

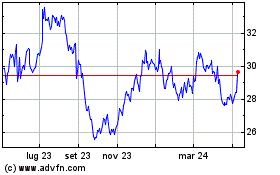

Grafico Azioni HP (NYSE:HPQ)

Storico

Da Apr 2023 a Apr 2024