FuelCell Energy, Inc. (Nasdaq: FCEL), a global

leader in fuel cell technology focused on utilizing its

proprietary, state-of-the-art fuel cell platforms to enable a world

empowered by clean energy, today reported financial results for its

first quarter ended January 31, 2020 and key business highlights.

“Our accomplishments in the quarter were a

manifestation of our successful execution in a number of areas,

including an increase in revenue over the fourth quarter of fiscal

2019, and our continued focus on effective management of operating

expenses, while continuing to deliver on project build-out and

improvements in our balance sheet and cash on hand,” said Jason

Few, President and CEO.

Mr. Few continued, “These results clearly

reflect the overall momentum of FuelCell Energy’s turnaround.

As I noted during our fourth quarter earnings call, while we

continue to strengthen and grow, we have begun to shift our focus

to a longer-term view, where our business model and our

differentiated energy platforms create significant opportunities to

add revenue and earnings as we build on our business development

capabilities.”

First Quarter of Fiscal 2020

Results

Note: All comparisons between periods are

between the first quarter of fiscal 2020 and the first quarter of

fiscal 2019, unless otherwise specified. In this press

release, FuelCell Energy refers to various GAAP (U.S. generally

accepted accounting principles) and non-GAAP financial

measures. These non-GAAP measures may not be comparable to

similarly titled measures being used and disclosed by other

companies. FuelCell Energy believes that this non-GAAP

information is useful to an understanding of its operating results

and the ongoing performance of its business. A reconciliation of

EBITDA, Adjusted EBITDA and any other non-GAAP measures is

contained in the appendix to this press release.

First quarter revenue of $16.3 million

represents a decrease of 9% and reflects a decrease in Service and

License revenues, partially offset by increased Generation and

Advanced Technologies contract revenues.

- Generation revenues increased by 268% to $5.4 million from $1.5

million, as a result of additional revenue recorded for the power

purchase agreement (“PPA”) associated with the Bridgeport Fuel Cell

Park project, which was acquired in 2019.

- Advanced Technologies contract revenues increased by 15% to

$5.2 million from $4.5 million primarily due to the addition of our

Joint Development Agreement with ExxonMobil Research and

Engineering Company (“EMRE”). The balance of the Advanced

Technologies contract revenues in the first quarter of fiscal 2020

relates to the continued development of our solid oxide platform as

we prepare to deliver electrolysis and long-duration hydrogen-based

energy storage platforms.

- Service and License revenues decreased by 52% to $5.6 million

from $11.8 million. Revenue recognized in the first quarter

primarily includes license revenues of $4 million associated with

our Joint Development Agreement with EMRE, with the balance

representing contracted service revenue. The decrease was primarily

due to the fact that there was no module replacement activity

during the quarter.

Gross profit for the first fiscal quarter of

2020 totaled $3.3 million, compared to a loss of $(2.2) million in

the comparable prior-year quarter. Results for the first fiscal

quarter of 2020 benefitted from our restructuring initiative in

2019, which resulted in lower manufacturing costs, contributions

from our larger generation fleet (related to the acquisition of the

Bridgeport Fuel Cell Park project), and the license revenue

recognized in the quarter.

Operating expenses for the first fiscal quarter

of 2020 decreased by 51% to $6.4 million, compared to $13.0 million

in the first fiscal quarter of 2019. Research and development

expenses of $1.2 million and Administrative and Selling expenses of

$5.3 million reflect lower headcount and overhead as a result of

restructuring activities during fiscal 2019 and an increased

allocation of efforts to revenue producing activity. Administrative

and Selling expenses also benefited from a legal settlement of $2.2

million received during the quarter.

Loss from operations improved to $(3.1) million

in the first fiscal quarter of 2020 when compared to loss from

operations of $(15.2) million in the first fiscal quarter of

2019.

“We have made significant progress over the last

9 months in improving the operational effectiveness and financial

health of the company. During the same time, we have also been

laying the foundation for marketplace success through improvements

to our sales and marketing capabilities and to our energy platform

offerings. As a result, we believe that FuelCell Energy is

increasingly viewed as an industry leader delivering innovation and

is well positioned for the global transition to more sustainable

energy solutions, as supported by a robust sales pipeline, to

deliver growth for the company,” said Jason Few.

Few also noted, “We are confident that we are on

the right path to deliver value for all our stakeholders, which is

a testament to the efforts of the FuelCell Energy team who work

tirelessly to deliver these results while staying true to our

purpose of enabling a world empowered by clean energy. We believe

that our clean, always on energy platforms enable our customers to

continue to enjoy the benefits of clean energy without sacrificing

the reliability and stability of the grid or changing the way they

live.”

Net loss was ($40.2) million in the first

fiscal quarter of 2020, compared to net loss of ($17.5) million in

the first fiscal quarter of 2019. The increase in the net loss is

primarily due to a change in the fair value of the liability

associated with the warrants issued to the lenders under our credit

agreement with Orion Energy Partners Investment Agent, LLC and its

affiliated lenders, partially offset by higher gross profit and

lower operating expenses.

Adjusted EBITDA totaled $(0.2) million in the

first fiscal quarter of 2020, compared to Adjusted EBITDA of

$(12.1) million in the first fiscal quarter of 2019. Please see the

discussion of non-GAAP financial measures, including Adjusted

EBITDA, in the appendix at the end of this release.

The net loss per share attributable to common

stockholders in the first fiscal quarter of 2020 was $(0.20),

compared to $(3.97) in the first fiscal quarter of 2019. The lower

net loss per common share is due to higher weighted average shares

outstanding due to share issuances since January 31, 2019.

The net loss per share in the first quarter of fiscal 2020 includes

the change in the fair value of the liability associated with the

warrants issued to the lenders under our credit agreement with

Orion Energy Partners Investment Agent, LLC and its affiliated

lenders of $34.2 million, accounting for approximately a $(0.17)

per share impact on the reported net loss per share. The net loss

per share attributable to common stockholders in the quarter ended

January 31, 2019 included a deemed dividend totaling $0.5 million

and redemption value adjustments of $8.6 million on the Company’s

Series C Convertible Preferred Stock, as well as a deemed dividend

of $1.9 million and $3.8 million of redemption accretion on the

Company’s Series D Convertible Preferred Stock.

“Lastly, I would be remiss if I didn’t discuss

the Coronavirus as it relates to our team members, suppliers and

business overall,” added Few. “We remain vigilant and are taking

precautions to help our team members remain safe and are monitoring

supply lines and the potential impact of the coronavirus on our

operations. In addition, we are complying and will continue

to comply with all state, federal and international government

rules and regulations that dictate how we must respond to the

virus.”

Cash, Restricted Cash and Financing

Activities

Cash and cash equivalents and restricted cash

and cash equivalents totaled $73.9 million as of January 31, 2020

compared to $39.8 million as of October 31, 2019. As of

January 31, 2020, restricted cash and cash equivalents was $35.7

million, of which $8.2 million was classified as current and $27.5

million was classified as non-current, compared to $30.3 million of

total restricted cash and cash equivalents as of October 31, 2019,

of which $3.5 million was classified as current and $26.9 million

was classified as non-current.

Net cash provided by financing activities was

$49.0 million during the three months ended January 31, 2020,

resulting from the receipt of $65.5 million of debt proceeds from

our credit facility with Orion Energy Partners Investment Agent,

LLC and its affiliated lenders, net of a debt discount of $1.6

million, and $3.0 million of debt proceeds from Connecticut Green

Bank and common stock sales of $3.5 million, offset by debt

repayment of $15.5 million, the payment of deferred financing costs

of $2.5 million, and the payment of preferred dividends and return

of capital of $3.4 million.

Key Consolidated Financial Metrics

| |

Three Months Ended January 31, |

| (Amounts

in thousands) |

2020 |

|

2019 |

|

Change |

|

Total revenues |

$ |

16,264 |

|

|

$ |

17,783 |

|

|

-9 |

% |

| Gross

profit (loss) |

|

3,281 |

|

|

|

(2,205 |

) |

|

249 |

% |

| Loss from

operations |

|

(3,140 |

) |

|

|

(15,244 |

) |

|

79 |

% |

|

EBITDA |

|

1,490 |

|

|

|

(13,045 |

) |

|

111 |

% |

| Net loss

to common stockholders |

|

(41,082 |

) |

|

|

(33,038 |

) |

|

-24 |

% |

| Net loss

per basic and diluted share |

$ |

(0.20 |

) |

|

$ |

(3.97 |

) |

|

95 |

% |

| |

|

|

|

|

|

| Adjusted

EBITDA |

$ |

(222 |

) |

|

$ |

(12,063 |

) |

|

98 |

% |

Backlog

| |

As of January 31, |

|

|

| (Amounts

in thousands) |

2020 |

|

2019 |

|

Change |

|

Product |

$ |

- |

|

$ |

1 |

|

- |

|

|

Service(1) |

|

167,828 |

|

|

203,063 |

|

-17 |

% |

|

Generation |

|

1,108,978 |

|

|

982,364 |

|

13 |

% |

|

License |

|

22,650 |

|

|

23,821 |

|

-5 |

% |

| Advanced

Technologies |

|

64,605 |

|

|

36,953 |

|

75 |

% |

|

Total Contract Backlog |

$ |

1,364,061 |

|

$ |

1,246,202 |

|

9 |

% |

|

|

|

(1) In July 2018, we contracted to operate and maintain a 20 MW

plant for Korea Southern Power Company (“KOSPO”). This contract was

originally represented in backlog as twenty years reflecting the

total term of the contract. Under the terms of the contract, KOSPO

has a renewal option in year ten. Thus, under the adoption of

Accounting Standards Update (“ASU”) 2014-09, “Revenue from

Contracts with Customers,” which was implemented on November 1,

2018, service backlog was reduced by $64.3 million in 2019 compared

to amounts previously disclosed. Should KOSPO exercise this option,

service backlog will be adjusted accordingly. |

| |

Backlog increased to $1.36 billion as of January

31, 2020, reflecting additional generation backlog from the

Bridgeport Fuel Cell Park, San Bernardino, and LIPA Yaphank Solid

Waste Management projects. Backlog was impacted by the removal of

the Bolthouse Farms project in the fourth quarter of fiscal 2019,

and revenue recognized during the period. Service backlog decreased

mainly as a result of the acquisition of the Bridgeport Fuel Cell

Park project. Together, the service and generation portion of

backlog had an average weighted term of approximately 18 years

based on dollar backlog and utility service contracts of up to 20

years in duration at inception.

Backlog represents definitive agreements

executed by the Company and our customers. Projects for which the

Company has a power purchase agreement (“PPA”) are included in

generation backlog, which represents future revenue under long-term

PPAs. Projects sold to customers (and not retained by the Company)

are included in product sales and service backlog and the related

generation backlog is removed upon the sale.

Conference Call Information

FuelCell Energy will host a conference call

today beginning at 10:00 a.m. EDT to discuss first quarter fiscal

2020 results and key business highlights. Participants can

access the live call via webcast on the Company website or by

telephone as follows:

- The live webcast of the call and supporting slide presentation

will be available at www.fuelcellenergy.com. To listen to the call,

select “Investors” on the home page, proceed to the “Events &

Presentations” page and then click on the “Webcast” link listed

under the March 16th earnings call event, or click here.

- Alternatively, participants can dial 647-689-4106 and state

FuelCell Energy or the conference ID number 3169993.

The replay of the conference call will be

available via webcast on the Company’s Investors’ page

at www.fuelcellenergy.com approximately two hours after the

conclusion of the call.

Cautionary Language

This news release contains forward-looking

statements within the meaning of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995, including,

without limitation, statements with respect to the Company’s

anticipated financial results and statements regarding the

Company’s plans and expectations regarding the continuing

development, commercialization and financing of its fuel cell

technology and its business plans and strategies. All

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from those

projected. Factors that could cause such a difference include,

without limitation, changes to projected deliveries and order flow,

changes to production rate and product costs, general risks

associated with product development, manufacturing, changes in the

regulatory environment, customer strategies, ability to access

certain markets, unanticipated manufacturing issues that impact

power plant performance, changes in critical accounting policies,

access to and ability to raise capital and attract financing,

potential volatility of energy prices, rapid technological change,

competition, the Company’s ability to successfully implement its

new business strategies and achieve its goals, the Company’s

ability to achieve its sales plans and cost reduction targets, and

the current implications of the novel coronavirus (Covid-19), as

well as other risks set forth in the Company’s filings with the

Securities and Exchange Commission. The forward-looking statements

contained herein speak only as of the date of this press release.

The Company expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any such statement to

reflect any change in the Company’s expectations or any change in

events, conditions or circumstances on which any such statement is

based.

About FuelCell Energy

FuelCell Energy, Inc. (NASDAQ:

FCEL) is a global leader in developing environmentally responsible

distributed baseload power solutions through our proprietary fuel

cell technology. We develop turn-key distributed power generation

solutions and operate and provide comprehensive services for the

life of the power plant. We are working to expand the proprietary

technologies that we have developed over the past five decades into

new products, markets and geographies. Our mission and purpose

remains to utilize our proprietary, state-of-the- art fuel cell

power plants to reduce the global environmental footprint of

baseload power generation by providing environmentally responsible

solutions for reliable electrical power, hot water, steam,

chilling, hydrogen, microgrid applications, and carbon capture and,

in so doing, drive demand for our products and services, thus

realizing positive stockholder returns. Our fuel cell solution is a

clean, efficient alternative to traditional combustion-based power

generation and is complementary to an energy mix consisting of

intermittent sources of energy, such as solar and wind turbines.

Our systems answer the needs of diverse customers across several

markets, including utility companies, municipalities, universities,

hospitals, government entities and a variety of industrial and

commercial enterprises. We provide solutions for various

applications, including utility-scale distributed generation,

on-site power generation and combined heat and power, with the

differentiating ability to do so utilizing multiple sources of fuel

including natural gas, Renewable Biogas (i.e., landfill gas,

anaerobic digester gas), propane and various blends of such fuels.

Our multi-fuel source capability is significantly enhanced by our

proprietary gas-clean-up skid.

SureSource,

SureSource 1500, SureSource 3000,

SureSource 4000, SureSource Recovery, SureSource

Capture, SureSource Hydrogen, SureSource Storage, SureSource

Service, SureSource Capital, FuelCell

Energy, and FuelCell Energy logo are all

trademarks of FuelCell Energy, Inc.

Contact:

FuelCell Energy,

Inc.ir@fce.com203.205.2491

Source: FuelCell Energy

FUELCELL ENERGY,

INC.Consolidated Balance

Sheets(Unaudited)(Amounts in thousands, except

share and per share amounts)

|

|

|

January 31,2020 |

|

|

October 31, 2019 |

|

ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents, unrestricted |

$ |

38,254 |

|

|

$ |

9,434 |

|

|

Restricted cash and cash equivalents – short-term |

|

8,178 |

|

|

|

3,473 |

|

|

Accounts receivable, net |

|

5,593 |

|

|

|

3,292 |

|

|

Unbilled receivables |

|

7,523 |

|

|

|

7,684 |

|

|

Inventories |

|

58,433 |

|

|

|

54,515 |

|

|

Other current assets |

|

6,805 |

|

|

|

5,921 |

|

|

Total current assets |

|

124,786 |

|

|

|

84,319 |

|

| |

|

|

|

|

|

| Restricted cash and cash

equivalents – long-term |

|

27,481 |

|

|

|

26,871 |

|

| Project assets |

|

147,924 |

|

|

|

144,115 |

|

| Inventory – long-term |

|

6,797 |

|

|

|

2,179 |

|

| Property, plant and equipment,

net |

|

39,794 |

|

|

|

41,134 |

|

| Operating lease right-of-use

assets |

|

10,276 |

|

|

|

- |

|

| Goodwill |

|

4,075 |

|

|

|

4,075 |

|

| Intangible assets |

|

20,939 |

|

|

|

21,264 |

|

| Other assets |

|

9,327 |

|

|

|

9,489 |

|

|

Total assets |

$ |

391,399 |

|

|

$ |

333,446 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Current portion of long-term debt |

$ |

8,660 |

|

|

$ |

21,916 |

|

|

Operating lease liabilities |

|

1,149 |

|

|

|

- |

|

|

Accounts payable |

|

14,117 |

|

|

|

16,943 |

|

|

Accrued liabilities |

|

8,958 |

|

|

|

11,452 |

|

|

Deferred revenue |

|

15,341 |

|

|

|

11,471 |

|

|

Preferred stock obligation of subsidiary |

|

945 |

|

|

|

950 |

|

|

Total current liabilities |

|

49,170 |

|

|

|

62,732 |

|

| |

|

|

|

|

|

| Long-term deferred

revenue |

|

29,797 |

|

|

|

28,705 |

|

| Long-term preferred stock

obligation of subsidiary |

|

16,721 |

|

|

|

16,275 |

|

| Long-term operating lease

liabilities |

|

9,466 |

|

|

|

- |

|

| Long-term debt and other

liabilities |

|

161,804 |

|

|

|

90,140 |

|

| Total liabilities |

|

266,958 |

|

|

|

197,852 |

|

| |

|

|

|

|

|

| Redeemable Series B preferred

stock (liquidation preference of $64,020 at January 31, 2020 and

October 31, 2019) |

|

59,857 |

|

|

|

59,857 |

|

| Total Equity: |

|

|

|

|

|

|

Stockholders’ equity Common stock ($0.0001 par value; 225,000,000

shares authorized at January 31, 2020 and October 31, 2019;

210,965,829 and 193,608,684 shares issued and outstanding at

January 31, 2020 and October 31, 2019, respectively) |

|

21 |

|

|

|

19 |

|

|

Additional paid-in capital |

|

1,180,499 |

|

|

|

1,151,454 |

|

|

Accumulated deficit |

|

(1,115,240 |

) |

|

|

(1,075,089 |

) |

|

Accumulated other comprehensive loss |

|

(696 |

) |

|

|

(647 |

) |

|

Treasury stock, Common, at cost (34,194 and 42,496 at January 31,

2020 and October 31, 2019, respectively) |

|

(437 |

) |

|

|

(466 |

) |

|

Deferred compensation |

|

437 |

|

|

|

466 |

|

|

Total stockholders’ equity |

|

64,584 |

|

|

|

75,737 |

|

|

Total liabilities and stockholders’ equity |

$ |

391,399 |

|

|

$ |

333,446 |

|

|

|

FUELCELL ENERGY,

INC.Consolidated Statements of

Operations(Unaudited)(Amounts in thousands, except

share and per share amounts)

| |

Three Months EndedJanuary

31, |

| |

2020 |

|

2019 |

| Revenues: |

|

|

|

|

|

|

Product |

$ |

- |

|

|

$ |

- |

|

|

Service and license |

|

5,612 |

|

|

|

11,772 |

|

|

Generation |

|

5,442 |

|

|

|

1,479 |

|

|

Advanced Technologies |

|

5,210 |

|

|

|

4,532 |

|

|

Total revenues |

|

16,264 |

|

|

|

17,783 |

|

| |

|

|

|

|

|

| Costs of revenues: |

|

|

|

|

|

|

Product |

|

2,016 |

|

|

|

3,422 |

|

|

Service and license |

|

1,618 |

|

|

|

12,319 |

|

|

Generation |

|

5,557 |

|

|

|

1,636 |

|

|

Advanced Technologies |

|

3,792 |

|

|

|

2,611 |

|

|

Total cost of revenues |

|

12,983 |

|

|

|

19,988 |

|

| |

|

|

|

|

|

| Gross profit (loss) |

|

3,281 |

|

|

|

(2,205 |

) |

| |

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

Administrative and selling expenses |

|

5,266 |

|

|

|

6,759 |

|

|

Research and development expense |

|

1,155 |

|

|

|

6,280 |

|

|

Total costs and expenses |

|

6,421 |

|

|

|

13,039 |

|

|

|

|

|

|

|

|

| Loss from operations |

|

(3,140 |

) |

|

|

(15,244 |

) |

| |

|

|

|

|

|

|

Interest expense |

|

(3,277 |

) |

|

|

(2,464 |

) |

|

Change in fair value of common stock warrant liability |

|

(34,245 |

) |

|

|

- |

|

|

Other income, net |

|

531 |

|

|

|

160 |

|

| |

|

|

|

|

|

| Loss before provision for

income taxes |

|

(40,131 |

) |

|

|

(17,548 |

) |

| |

|

|

|

|

|

|

Provision for income taxes |

|

(20 |

) |

|

|

- |

|

| |

|

|

|

|

|

| Net loss |

|

(40,151 |

) |

|

|

(17,548 |

) |

| |

|

|

|

|

|

|

Series B preferred stock dividends |

|

(931 |

) |

|

|

(800 |

) |

|

Series C preferred stock deemed dividends and redemption value

adjustment |

|

- |

|

|

|

(9,005 |

) |

|

Series D preferred stock deemed dividends and redemption

accretion |

|

- |

|

|

|

(5,685 |

) |

| |

|

|

|

|

|

| Net loss attributable to

common stockholders |

$ |

(41,082 |

) |

|

$ |

(33,038 |

) |

| |

|

|

|

|

|

| Loss per share basic and

diluted: |

|

|

|

|

|

|

Net loss per share attributable to common stockholders |

$ |

(0.20 |

) |

|

$ |

(3.97 |

) |

|

Basic and diluted weighted average shares outstanding |

|

202,216,493 |

|

|

|

8,321,702 |

|

|

|

|

Appendix

Non-GAAP Financial Measures

Financial results are presented in accordance

with accounting principles generally accepted in the United States

(“GAAP”). Management also uses non-GAAP measures to analyze

and make operating decisions on the business. Earnings before

interest, taxes, depreciation and amortization (“EBITDA”) and

Adjusted EBITDA are alternate, non-GAAP measures of cash

utilization by the Company.

These supplemental non-GAAP measures are

provided to assist readers in determining operating performance.

Management believes EBITDA and Adjusted EBITDA are useful in

assessing performance and highlighting trends on an overall basis.

Management also believes these measures are used by companies in

the fuel cell sector and by securities analysts and investors when

comparing the results of the Company with those of other companies.

EBITDA differs from the most comparable GAAP measure, net loss

attributable to the Company, primarily because it does not include

finance expense, income taxes and depreciation of property, plant

and equipment and project assets. Adjusted EBITDA adjusts EBITDA

for stock-based compensation, restructuring charges and other

unusual items such as the legal settlement recorded during the

first quarter of fiscal 2020, which are considered either non-cash

or non-recurring.

While management believes that these non-GAAP

financial measures provide useful supplemental information to

investors, there are limitations associated with the use of these

measures. The measures are not prepared in accordance with GAAP and

may not be directly comparable to similarly titled measures of

other companies due to potential differences in the exact method of

calculation. The Company’s non-GAAP financial measures are not

meant to be considered in isolation or as a substitute for

comparable GAAP financial measures, and should be read only in

conjunction with the Company’s consolidated financial statements

prepared in accordance with GAAP.

The following table calculates EBITDA and

Adjusted EBITDA and reconciles these figures to the GAAP financial

statement measure Net loss.

| |

|

| |

Three Months Ended January 31, |

| (Amounts in thousands) |

2020 |

|

2019 |

|

Net loss |

$ |

(40,151 |

) |

|

$ |

(17,548 |

) |

| Depreciation and

amortization |

|

4,630 |

|

|

|

2,199 |

|

| Provision for income taxes |

|

20 |

|

|

|

- |

|

| Other income, net(1) |

|

(531 |

) |

|

|

(160 |

) |

| Change in fair value of common

stock warrant liability |

|

34,245 |

|

|

|

- |

|

| Interest expense |

|

3,277 |

|

|

|

2,464 |

|

| EBITDA |

$ |

1,490 |

|

|

$ |

(13,045 |

) |

| Stock-based compensation

expense |

|

488 |

|

|

|

982 |

|

| Legal settlement(2) |

|

(2,200 |

) |

|

|

- |

|

| Adjusted EBITDA |

$ |

(222 |

) |

|

$ |

(12,063 |

) |

|

|

|

(1) Other income, net includes gains and losses from

transactions denominated in foreign currencies, changes in fair

value of embedded derivatives, and other items incurred

periodically, which are not the result of the Company’s normal

business operations. |

|

(2) The Company received a legal settlement of $2.2 million

during the three months ended January 31, 2020, which was recorded

as an offset to administrative and selling expenses. |

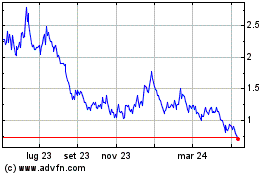

Grafico Azioni FuelCell Energy (NASDAQ:FCEL)

Storico

Da Mar 2024 a Apr 2024

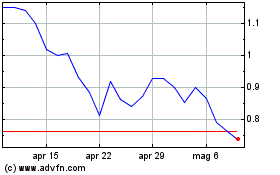

Grafico Azioni FuelCell Energy (NASDAQ:FCEL)

Storico

Da Apr 2023 a Apr 2024