Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

18 Marzo 2020 - 11:05AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-233608

Final Term Sheet

March 17,

2020

VERIZON COMMUNICATIONS INC.

$750,000,000 3.000% Notes due 2027

$1,500,000,000 3.150% Notes due 2030

$1,250,000,000 4.000% Notes due 2050

|

|

|

|

|

|

|

Issuer:

|

|

Verizon Communications Inc. (“Verizon”)

|

|

|

|

|

Title of Securities:

|

|

3.000% Notes due 2027 (the “Notes due 2027”)

|

|

|

|

3.150% Notes due 2030 (the “Notes due 2030”)

|

|

|

|

4.000% Notes due 2050 (the “Notes due 2050”)

|

|

|

|

|

|

Trade Date:

|

|

March 17, 2020

|

|

|

|

|

|

|

|

Settlement Date (T+3):

|

|

March 20, 2020

|

|

|

|

|

|

|

|

Maturity Date:

|

|

Notes due 2027:

|

|

March 22, 2027

|

|

|

|

Notes due 2030:

|

|

March 22, 2030

|

|

|

|

Notes due 2050:

|

|

March 22, 2050

|

|

|

|

|

|

Aggregate Principal Amount Offered:

|

|

Notes due 2027:

|

|

$750,000,000

|

|

|

|

Notes due 2030:

|

|

$1,500,000,000

|

|

|

|

Notes due 2050:

|

|

$1,250,000,000

|

|

|

|

|

|

Public Offering Price:

|

|

Notes due 2027:

|

|

99.950% plus accrued interest, if any, from March 20, 2020

|

|

|

|

Notes due 2030:

|

|

99.693% plus accrued interest, if any, from March 20, 2020

|

|

|

|

Notes due 2050:

|

|

100.000% plus accrued interest, if any, from March 20, 2020

|

|

|

|

|

|

Underwriting Discount:

|

|

Notes due 2027:

|

|

0.350%

|

|

|

|

Notes due 2030:

|

|

0.400%

|

|

|

|

Notes due 2050:

|

|

0.750%

|

|

|

|

|

|

Proceeds to Verizon (before expenses):

|

|

Notes due 2027:

|

|

99.600%

|

|

|

|

Notes due 2030:

|

|

99.293%

|

|

|

|

Notes due 2050:

|

|

99.250%

|

|

|

|

|

|

Interest Rate:

|

|

Notes due 2027:

|

|

3.000% per annum

|

|

|

|

Notes due 2030:

|

|

3.150% per annum

|

|

|

|

Notes due 2050:

|

|

4.000% per annum

|

|

|

|

|

|

Interest Payment Dates:

|

|

Notes due 2027:

|

|

Semiannually on each March 22 and September 22, commencing September 22, 2020

|

|

|

|

Notes due 2030:

|

|

Semiannually on each March 22 and September 22, commencing September 22, 2020

|

|

|

|

Notes due 2050:

|

|

Semiannually on each March 22 and September 22, commencing September 22, 2020

|

|

|

|

|

|

Optional Redemption:

|

|

Notes due 2027: (i) at any time prior to January 22, 2027 (two months prior to maturity), make-whole call at the greater of 100% of the principal amount of the Notes due 2027 being redeemed or the discounted present value of

the remaining scheduled payments of principal and interest on the Notes due 2027 being redeemed, assuming for such purpose that such Notes due 2027 matured on January 22, 2027, at Treasury Rate plus 35 basis points, plus accrued and unpaid

interest and (ii) at any time on or after January 22, 2027 (two months prior to maturity), at 100% of the principal amount of the Notes due 2027 being redeemed plus accrued and unpaid interest

|

|

|

|

|

|

|

Notes due 2030: (i) at any time prior to December 22, 2029 (three months prior to maturity), make-whole call at the greater of 100% of the principal amount of the Notes due 2030 being redeemed or the discounted present value of

the remaining scheduled payments of principal and interest on the Notes due 2030 being redeemed, assuming for such purpose that such Notes due 2030 matured on December 22, 2029, at Treasury Rate plus 35 basis points, plus accrued and unpaid

interest and (ii) at any time on or after December 22, 2029 (three months prior to maturity), at 100% of the principal amount of the Notes due 2030 being redeemed plus accrued and unpaid interest

|

|

|

|

|

|

|

Notes due 2050: (i) at any time prior to September 22, 2049 (six months prior to maturity), make-whole call at the greater of 100% of the principal amount of the Notes due 2050 being redeemed or the discounted present value of

the remaining scheduled payments of principal and interest on the Notes due 2050 being redeemed, assuming for such purpose that such Notes due 2050 matured on September 22, 2049, at Treasury Rate plus 40 basis points, plus accrued and unpaid

interest and (ii) at any time on or after September 22, 2049 (six months prior to maturity), at 100% of the principal amount of the Notes due 2050 being redeemed plus accrued and unpaid interest

|

Allocation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal Amount of

Notes due 2027

|

|

|

Principal Amount of

Notes due 2030

|

|

|

Principal Amount of

Notes due 2050

|

|

|

Citigroup Global Markets Inc.

|

|

$

|

135,000,000

|

|

|

$

|

270,000,000

|

|

|

$

|

225,000,000

|

|

|

Goldman Sachs & Co. LLC

|

|

|

135,000,000

|

|

|

|

270,000,000

|

|

|

|

225,000,000

|

|

|

J.P. Morgan Securities LLC

|

|

|

135,000,000

|

|

|

|

270,000,000

|

|

|

|

225,000,000

|

|

|

Santander Investment Securities Inc.

|

|

|

135,000,000

|

|

|

|

270,000,000

|

|

|

|

225,000,000

|

|

|

Wells Fargo Securities, LLC

|

|

|

135,000,000

|

|

|

|

270,000,000

|

|

|

|

225,000,000

|

|

|

ICBC Standard Bank Plc

|

|

|

30,000,000

|

|

|

|

60,000,000

|

|

|

|

50,000,000

|

|

|

Loop Capital Markets LLC

|

|

|

30,000,000

|

|

|

|

60,000,000

|

|

|

|

50,000,000

|

|

|

Samuel A. Ramirez & Company, Inc.

|

|

|

7,500,000

|

|

|

|

15,000,000

|

|

|

|

12,500,000

|

|

|

Siebert Williams Shank & Co., LLC

|

|

|

7,500,000

|

|

|

|

15,000,000

|

|

|

|

12,500,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

750,000,000

|

|

|

$

|

1,500,000,000

|

|

|

$

|

1,250,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC, Santander Investment Securities Inc. and Wells Fargo Securities, LLC

|

|

|

|

|

Reference Document:

|

|

Preliminary Prospectus Supplement, subject to completion, dated March 17, 2020; Prospectus dated September 4, 2019

|

The issuer has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission

(the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about

the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if

you request it by contacting Citigroup Global Markets Inc. toll-free at 1-800-831-9146, Goldman Sachs & Co. LLC

toll-free at 1-866-471-2526, J.P. Morgan Securities LLC collect at 1-212-834-4533, Santander Investment Securities Inc. toll-free at

1-855-403-3636 or Wells Fargo Securities, LLC toll-free at 1-800-645-3751 or contacting the issuer at:

Investor Relations

Verizon Communications Inc.

One Verizon Way

Basking Ridge, New Jersey 07920

Telephone: (212) 395-1525

Internet Site: www.verizon.com/about/investors

Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are

required to settle in two business days, unless the parties to a trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes prior to the second business day before the settlement date will be required, by virtue of the fact

that the notes initially will settle in T+3, to specify alternative settlement arrangements to prevent a failed settlement.

No PRIIPs key

information document has been prepared as neither European Economic Area nor United Kingdom retail investors are targeted.

Any disclaimers or

other notices that may appear below are not applicable to this communication and should be disregarded. Such disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg or another email

system.

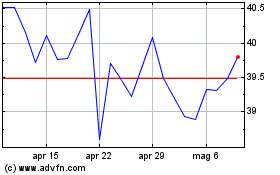

Grafico Azioni Verizon Communications (NYSE:VZ)

Storico

Da Mar 2024 a Apr 2024

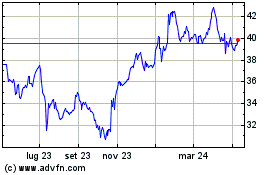

Grafico Azioni Verizon Communications (NYSE:VZ)

Storico

Da Apr 2023 a Apr 2024