Franc Mixed After SNB Maintains Expansionary Monetary Policy

19 Marzo 2020 - 7:20AM

RTTF2

The Swiss franc showed mixed trading against its major

counterparts in the European session on Thursday, after the Swiss

National Bank retained its interest rates and raised its negative

interest exemption threshold, as coronavirus is posing

exceptionally large challenges to the economy.

The SNB decided to hold its policy rate and interest on sight

deposits at the SNB at -0.75 percent.

The bank said the Swiss franc is even more highly valued.

Negative interest and interventions are necessary to reduce the

attractiveness of Swiss franc investments and thus counteract the

upward pressure on the currency.

The SNB will take additional steps to ensure liquidity as

necessary. The central bank is providing liquidity as part of the

extended swap arrangements with other major central banks,

particularly in US dollars.

The central bank said it is raising the exemption threshold as

of April 1, 2020, thus reducing the negative interest burden on the

banking system. The threshold factor will increase to 30 from

25.

Data from the Federal Customs Administration showed that

Switzerland's exports declined in February after rising in the

previous month, and imports decreased for second month.

Exports decreased by a real 3.3 percent month-on-month in

February, while imports fell 0.1 percent.

The franc declined to a 3-week low of 0.9754 against the

greenback and held steady thereafter. Immediate support for the

franc is seen around the 0.99 level.

The Swiss currency pulled back to 111.87 against the yen, from a

3-day high of 113.02 set at 12:15 am ET. The franc is likely to

challenge support around the 110.00 region, if it drops again.

Data from the ministry of Internal Affairs and Communications

showed that overall nationwide consumer prices in Japan were up 0.4

percent on year in February.

That was shy of expectations for an increase of 0.5 percent and

was down from 0.7 percent in January.

The franc retreated to 1.1242 against the pound, after rising to

a record high of 1.1114 at 11:30 pm ET. The next possible support

for the franc is located around the 1.25 level.

Following a 2-day drop to 1.0602 at 8:30 pm ET, the franc

rebounded to 1.0546 against the euro. If the franc rises further,

it may find resistance around the 1.03 level.

Looking ahead, the U.S. weekly jobless claims for the week ended

March 14 and leading index for February will be featured in the New

York session.

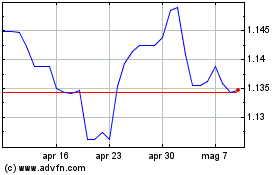

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Apr 2023 a Apr 2024