TIDMSSPG

RNS Number : 5162H

SSP Group PLC

25 March 2020

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR

ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE OR

DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

LEI:213800QGNIWTXFMENJ24

For immediate release

25 March 2020

SSP Group plc ("SSP")

COVID-19 Trading Update, Financing Arrangements and Dividend

Declaration

SSP's immediate priority continues to be the health and safety

of all of our colleagues and customers. Across the business, we

have implemented a range of additional health and safety policies

and protocols covering hygiene, travel and self-isolation periods,

and issued regular guidance in order to keep people fully informed

and as well protected as possible against infection.

Current Trading

In our recent update on 26 February 2020, we indicated that we

had seen sharp declines in passenger numbers across the Asia

Pacific regions (which account for approximately 8% of SSP's Group

revenue) in February. Since that update, SSP has seen an

unprecedented and rapidly escalating impact of the COVID-19 virus

on the travel operating environment, particularly in airports. The

widespread travel bans imposed by governments and airline capacity

reductions across our core markets have severely impacted passenger

numbers in the UK, Europe and North America, particularly in

international travel.

As a consequence, like-for-like revenues (based on the latest

week) across the UK and continental Europe are currently running

approximately 80% to 85% lower year-on-year ("YOY"), with the

impact in the air market being greater than in rail. In North

America, like-for-like revenues are approximately 80% lower YOY and

in the Rest of World, which includes Asia Pacific, Eastern Europe,

the Middle East, India and Brazil, like-for-like revenues are

approximately 60% lower YOY.

In terms of the financial impact of COVID-19, our expectation is

that for the month of March 2020, revenue across the Group will be

approximately 40% to 45% lower YOY. This is expected to reduce

Group revenue by approximately GBP125m - GBP135m, with a

corresponding reduction in operating profit of approximately GBP50m

- GBP60m.

Including the impact of COVID-19 on current trading, for the six

months ending 31 March 2020 ("H1 2020"), SSP expects to see a

decrease in total Group revenue of approximately -3% on a constant

currency basis, compared to the same period last year, comprising a

like-for-like sales decline of approximately -8% and net gains of

approximately +5%. Total Group revenue at actual exchange rates is

expected to decline by approximately -4% compared to the same

period last year. SSP expects to have approximately GBP180m -

GBP200m of cash and undrawn committed facilities (before any new

funding as described below) at the end of H1 2020, leaving leverage

at approximately 2.4x net debt / EBITDA (last twelve months).

Management Actions

We are taking all available actions to protect profit and cash,

whilst working closely with our clients to maintain appropriate

service levels for our customers.

Operational reductions

-- Temporary closure of units

-- Reduced operating hours

-- Opening programme ceased for H2 2020

Labour costs

-- Headcount reduction and temporary lay-offs commenced

-- Significant salary reductions across all senior management,

the Group Executive and Group Board

Rents

-- Majority of rent is being paid on a fully variable basis, as a percentage of revenue

-- Ongoing discussions with landlords for further rent relief

Overheads

-- Discretionary overhead expenditure being reduced to minimum levels to operate the business

Capex

-- Capital expenditure to be reduced to approximately GBP10m in H2 2020

Further to the management actions set out above, SSP has

suspended its previously announced share buyback of up to GBP100m,

having only purchased approximately GBP2m of shares to date.

SSP will also defer the payment date of the final dividend of

6.0 pence per ordinary share to 4 June 2020. The dividend was

approved at the Company's annual general meeting held on 26

February 2020 (with a record date and time of 6.00 p.m. on 6 March

2020) and would otherwise have been payable on 27 March 2020. SSP

will also enter into discussions with shareholders to request that

they waive their final dividend entitlement enabling that cash to

be retained in the business.

SSP's Board does not intend to pay an interim dividend for H1

2020.

In addition to management action, on 17 March 2020 and 20 March

2020 HM Treasury announced a package of temporary, timely and

targeted measures to support public services, people and businesses

through this period of disruption caused by COVID-19. These include

the Coronavirus Job Retention Scheme, deferred VAT payments and

changes to business rates. In addition to these UK schemes, SSP is

in active discussions with Governments around the world to secure

support under their local schemes.

Furthermore, the joint HM Treasury and Bank of England lending

facility, named the Covid Corporate Financing Facility ("CCFF") was

launched. This facility is designed to support liquidity among

larger firms, helping them to bridge coronavirus disruption to

their cash flows through the purchase of short-term debt in the

form of commercial paper. SSP expects to qualify for this scheme

and is already well advanced in preparations and discussions with

HM Treasury and the Bank of England to access the scheme.

Outlook

Clearly the duration of COVID-19's impact, including on global

travel is very uncertain at this stage as are its consequences for

our financial performance for the full year. Looking into the

second half of the financial year (April - September 2020, or "H2

2020"), SSP's central planning assumption is that recent trading

conditions seen through March 2020 will likely deteriorate

further.

SSP has considered a very pessimistic scenario assuming an

almost total shutdown of the travel market for the whole of the

second half of the financial year, with Group revenue being down

approximately 80% to 85% in H2 2020 against the same period last

year. This reflects a worsening revenue impact in the third quarter

of the financial year (down 85%) and only minimal improvement in

the fourth quarter (down 80%). In considering the impact of this on

operating profit, SSP has assumed that the benefit of the extensive

management action to reduce the cost base would result in a "drop

through" to operating profit from the reduced sales of 25% to 30%,

an improvement compared with that experienced in February and March

2020.

Financing Arrangements and Equity Placing

SSP is taking decisive and immediate action to preserve cash and

ensure sufficient liquidity even in the event of the most

pessimistic trading scenario.

Furthermore, SSP today announces the following financing

arrangements:

SSP announces that it has agreed a new up to GBP112.5m 18-month

committed bank facility with HSBC Bank plc, Lloyds Bank plc and

National Westminster Bank plc, which represents incremental

financing to its existing debt facilities. This is subject to

documentation on terms and conditions in line with such existing

facilities and is conditional on SSP raising new equity. The

Company is confident in its ability to meet its covenant thresholds

as at 31 March 2020.

SSP has separately announced today a proposed equity raising

-- Intention to conduct a non--pre--emptive placing of new

ordinary shares of 1 (17/200) pence each in the capital of the

Company representing up to 19.99% of the Company's existing issued

ordinary share capital (the "Equity Placing")

-- Directors and members of the senior management team including

CEO, CFO and Chairman to participate alongside the Equity Placing

and intend to contribute GBP760,000

-- The net proceeds of the Equity Placing will be used to

strengthen the Company's balance sheet, working capital and

liquidity position during this period of unprecedented disruption

in the global travel market as a result of the COVID-19

outbreak

Based on the scenario planning undertaken by SSP management, the

additional financing arrangements will provide sufficient liquidity

to deal with even the most pessimistic trading scenario and enable

SSP to operate through this unprecedented travel environment and

also be positioned to return to growth as markets normalise.

Summary

The global travel industry is facing unprecedented disruption on

a scale never before seen due to the impact of COVID-19 and the

government implemented travel bans. SSP's Board and management team

is, however, confident that the combination of our management

actions to reduce costs and preserve cash, reduction in planned

capex and the financing arrangements outlined above will position

SSP to withstand the current environment. We remain confident in

the long-term, proven strategy for growth and shareholder value

creation.

Commenting on this announcement, Simon Smith, CEO of SSP Group,

said:

"The COVID-19 outbreak is an unprecedented crisis and is having

a severely negative impact on the travel sector. These are hugely

challenging times and I would like to sincerely thank everyone at

SSP for their support and commitment. In common with the sector, we

have seen a very sharp drop off in passenger numbers and this has

heavily impacted SSP revenues. We've had to take significant action

to reduce our costs while doing everything we can to limit the

impact of this on our colleagues. However, we have had to close a

number of units given the extent to which passenger numbers have

decreased. These decisions have not been taken lightly and I

sincerely hope that we can re-open our units and welcome back our

teams as soon as possible.

We also welcome the actions announced by HM Treasury to support

individuals and businesses though the COVID-19 crisis. This

together with the management action we are taking, and the

additional funding arrangements announced today will put us in a

strong position to manage through this crisis and be in the best

shape possible to return to growth once the market begins to

recover."

CONTACTS

Investor and analyst enquiries

Sarah John, Director of Investor Relations, SSP Group plc

+44 (0) 203 714 5251; E-mail: sarah.john@ssp-intl.com

Media enquiries

Peter Ogden / Lisa Kavanagh, Powerscourt

+44 (0) 207 250 1446; E-mail: ssp@powerscourt-group.com

NOTES TO EDITORS

About SSP

SSP is a leading operator of food and beverage concessions in

travel locations, operating restaurants, bars, cafés, food courts,

lounges and convenience stores in airports, train stations,

motorway service stations and other leisure locations. With over 50

years of experience, today we have more than 39,000 employees,

serving approximately one and a half million customers every day.

We have business at approximately 180 airports and 300 rail

stations, and operate more than 2,800 units in 35 countries around

the world.

SSP operates an extensive portfolio of more than 550

international, national, and local brands. Among these are local

heroes such as Brioche Dorée in Paris, LEON in London, and Hung's

Delicacies in Hong Kong. Our range also includes proprietary brands

created for the travel sector including Upper Crust, Cabin Bar and

Ritazza, as well as international names such as M&S, Burger

King, Starbucks, Jamie's Deli and YO! Sushi. We also create

stunning bespoke concepts such as Five Borough Food Hall in JFK,

New York and Norgesglasset Bar in Oslo Airport.

www.foodtravelexperts.com

IMPORTANT NOTICES

The information contained in this announcement is for background

purposes only and does not purport to be full or complete. No

reliance may be placed for any purpose on the information contained

in this announcement for accuracy or completeness. The information

in this announcement is subject to change.

Neither this announcement nor the information contained herein

nor any copy of it is for publication, distribution or release, in

whole or in part, directly or indirectly, in or into or from the

United States (including its territories and possessions, any State

of the United States and the District of Columbia), Australia,

Canada, Japan, the Republic of South Africa or any other

jurisdiction where to do so would constitute a violation of the

relevant laws of such jurisdiction. The distribution of this

announcement may be restricted by law in certain jurisdictions and

persons into whose possession any document or other information

referred to herein comes should inform themselves about and observe

any such restriction. Any failure to comply with these restrictions

may constitute a violation of the securities laws of any such

jurisdiction.

This announcement is not intended to, and does not constitute,

or form part of, any offer to sell or an invitation to purchase or

subscribe for any securities in any jurisdiction.

Any securities referred to herein may not be offered or sold,

directly or indirectly, in the United States unless registered

under the United States Securities Act of 1933, as amended (the "US

Securities Act") or offered in a transaction exempt from, or not

subject to, the registration requirements of the US Securities Act.

Any potential offer and sale of securities referred to herein will

not be registered under the US Securities Act or under the

applicable securities laws of Australia, Canada, Japan or the

Republic of South Africa. There will be no public offer of the

Shares in the United States, Australia, Canada, Japan or the

Republic of South Africa.

Certain statements contained in this announcement constitute

"forward-looking statements" with respect to the financial

condition, performance, strategic initiatives, objectives, results

of operations and business of the Group. All statements other than

statements of historical fact included in this announcement are, or

may be deemed to be, forward-looking statements. Without

limitation, any statements preceded or followed by or that include

the words "targets", "plans", "believes", "expects", "aims",

"intends", "anticipates", "estimates", "projects", "will", "may",

"would", "could" or "should", or words or terms of similar

substance or the negative thereof, are forward-looking statements.

Forward-looking statements include statements relating to the

following: (i) future capital expenditures, expenses, revenues,

earnings, synergies, economic performance, indebtedness, financial

condition, dividend policy, losses and future prospects; and (ii)

business and management strategies and the expansion and growth of

the Group's operations. Such forward-looking statements involve

risks and uncertainties that could significantly affect expected

results and are based on certain key assumptions. Many factors

could cause actual results, performance or achievements to differ

materially from those projected or implied in any forward-looking

statements. The important factors that could cause the Group's

actual results, performance or achievements to differ materially

from those in the forward-looking statements include, among others,

economic and business cycles, the terms and conditions of the

Group's financing arrangements, foreign currency rate fluctuations,

competition in the Group's principal markets, acquisitions or

disposals of businesses or assets and trends in the Group's

principal industries. Due to such uncertainties and risks, readers

are cautioned not to place undue reliance on such forward-looking

statements, which speak only as of the date hereof. In light of

these risks, uncertainties and assumptions, the events described in

the forward-looking statements in this announcement may not occur.

The forward-looking statements contained in this announcement speak

only as of the date hereof. The Company and its Directors each

expressly disclaim any obligation or undertaking to update or

revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise, unless required to

do so by applicable law or regulation.

The forecast financial information contained in this

announcement was prepared based upon certain assumptions (the

"Assumptions") about the development of the COVID--19 pandemic over

the remainder of the financial year 2020 which are based on

publicly available information published by organisations such as

The World Health Organization and the UK Government and the impact

of the COVID--19 pandemic, together with the impact of certain

actions under consideration that may be taken by the Company in

response, on the Group's condition (financial, operational,

management, legal, regulatory or otherwise), earnings, management,

results of operations, business affairs and business prospects (the

"COVID--19 Impact"). The Assumptions and the extent and nature of

the COVID--19 Impact are subject to a wide variety of significant

uncertainties and the Group's actual financial results for the six

months ending 31 March 2020, for the six months ending 30 September

2020 and for the year ending 30 September 2020 may differ

materially from the forecast financial information contained in

this announcement.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into or forms part of this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTGLGDXISDDGGU

(END) Dow Jones Newswires

March 25, 2020 03:00 ET (07:00 GMT)

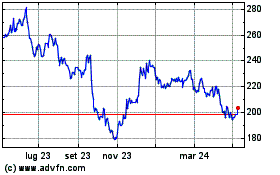

Grafico Azioni Ssp (LSE:SSPG)

Storico

Da Mar 2024 a Apr 2024

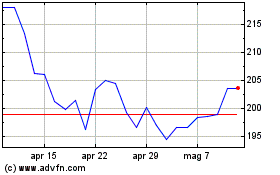

Grafico Azioni Ssp (LSE:SSPG)

Storico

Da Apr 2023 a Apr 2024