Capital & Counties Properties Plc COVID-19 update (6319H)

26 Marzo 2020 - 8:00AM

UK Regulatory

TIDMCAPC

RNS Number : 6319H

Capital & Counties Properties Plc

26 March 2020

26 March 2020

CAPITAL & COUNTIES PROPERTIES PLC ("Capco" or "the

Company")

COVID-19 update

Given the rapidly evolving situation around COVID-19 and current

market conditions, Capco continues to assess the impact on its

business, respond to the latest guidelines issued by relevant

authorities and adapt its activities accordingly. The priority

during this period of uncertainty is the health and safety of our

people, customers and visitors.

The majority of retail and F&B units on the Covent Garden

estate are closed temporarily and whilst Government-related support

measures will be helpful for many occupiers, Capco expects

disruption to income during the course of this year. As a long term

investor in London, Capco will work to assist its customers with

bespoke solutions on a case by case basis through this

unprecedented period.

This will involve moving from quarterly rental payments in

advance to alternative arrangements and the deferral of rental

payments in certain cases, particularly for smaller and independent

operators in order to ease short-term cash flow issues and to

reopen successfully once the current restrictions are lifted. It is

too early at this stage to assess the full impact on rental income

and property valuations.

Capco has a strong balance sheet with access to substantial

liquidity and significant headroom against debt covenants (both

loan to value and interest cover). Total Group cash is currently

approximately GBP250 million with a further GBP120 million to be

received from the Earls Court sale and in addition, Capco has

access to over GBP700 million of committed undrawn facilities.

Further details are set out in the appendix to this

announcement.

The Company is focused on conserving cash during this period of

highly uncertain market conditions. As part of this, the Board has

decided to temporarily suspend the share buyback programme.

The Company will continue to monitor the COVID-19 situation

closely and provide further updates as appropriate.

-ENDS-

Enquiries:

Capital & Counties Properties PLC

+44 (0)20 3214

Ian Hawksworth Chief Executive 9188

+44 (0)20 3214

Situl Jobanputra Chief Financial Officer 9183

+44 (0)20 3214

Sarah Corbett Head of Investor Relations 9165

Media enquiries

+44 (0)20 7796

UK: Hudson Sandler Michael Sandler 4133

SA: Instinctif Frederic Cornet +27 (0)11 447 3030

About Capital & Counties Properties PLC ("Capco")

Capital & Counties Properties PLC is one of the largest

listed property investment companies in central London and is a

constituent of the FTSE-250 Index. Capco's landmark estate at

Covent Garden was valued at GBP2.6 billion (as at 31 December 2019)

where its ownership comprises over 1.2 million square feet of

lettable space. The Company is listed on the London Stock Exchange

and the Johannesburg Stock Exchange. www.capitalandcounties.com

Appendix

As at 31 December 2019, Group net debt was GBP442 million

(including GBP170 million of cash) representing a Group loan to

value ratio of 16 per cent.

Following the recent receipt of GBP90 million of deferred

consideration from the Earls Court sale and the deployment of GBP12

million towards the share buyback programme, total Group cash is

currently approximately GBP250 million.

In addition, a further GBP105 million of deferred consideration

is expected to be received later this year with the balance of

GBP15 million due in 2021. Capco has access to substantial

committed undrawn facilities, in particular the Covent Garden

revolving credit facility of GBP705 million.

Debt covenants:

Loan outstanding(1) LTV Interest

Maturity covenant cover covenant

--------------------------- ------------- --------------------- ---------- ----------------

Covent Garden

--------------------------- ------------- --------------------- ---------- ----------------

Revolving credit facility 2022 - 60% 120%

US private placement

series 1 2024 - 2026 GBP150m 60% 120%

US private placement

series 2 2026 - 2028 GBP175m 60% 120%

US private placement

series 3 2024 - 2037 GBP225m 60% 120%

Lillie Square (50% 2021 GBP55m 75% -

share)

--------------------------- ------------- --------------------- ---------- ----------------

Total GBP605m

------------------------------------------ -------------------- ---------- ----------------

1. The loan values are the nominal values at 31 December 2019

shown on a Group share basis. The balance sheet value of the loans

includes any unamortised fees.

For the year ended 31 December 2019, interest cover for the

purposes of the Covent Garden revolving credit facility and private

placement notes was 2.9 times, compared with a covenant level of

1.2 times.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDFLFSTVTIEFII

(END) Dow Jones Newswires

March 26, 2020 03:00 ET (07:00 GMT)

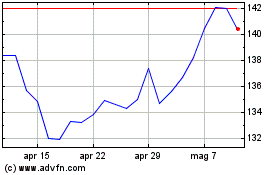

Grafico Azioni Shaftesbury Capital (LSE:SHC)

Storico

Da Mar 2024 a Apr 2024

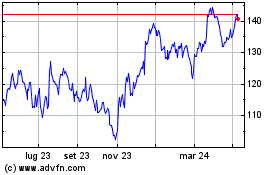

Grafico Azioni Shaftesbury Capital (LSE:SHC)

Storico

Da Apr 2023 a Apr 2024