TIDMVNET

RNS Number : 6348H

Vianet Group PLC

26 March 2020

Press release

26 March 2020

Vianet Group plc

("Vianet" or the "Group")

Trading and COVID-19 Update and Notice of Results

Vianet Group plc (AIM: VNET), the international provider of

actionable data and business insight through devices connected to

its Internet of Things ("IOT") platform, today provides an update

on progress and trading in respect to the situation regarding

COVID-19. The Group also notifies that, subject to FCA and or

auditor guidance relating to COVID-19, it will release its results

for the year ended 31 March 2020 on Tuesday, 2 June 2020.

The Group continues to implement detailed COVID-19 response

plans, as the advice from Government evolves. Our aim remains to

safeguard employee health and wellbeing, whilst continuing to

support our customers and maintain the Group's robust financial

position.

Trading for the second half of the year has been largely as

anticipated and, as a result, subject to any further COVID-19

provisions, the Group's full year profits for the year ended 31

March 2020 will be in line with market expectations at over

GBP4.00m and ahead of the GBP3.85m reported last year.

COVID-19 Commercial Impacts

The mandatory closures of pubs, bars and restaurants in the UK

will have a material effect on almost all our Smart Zones

customers. In anticipation of this, we had therefore proposed a

reduced rate on all our contracts in order to maintain business

continuity and to avoid more expensive reconnection costs for

customers when pubs reopen. We are encouraged by our customers'

responses and expect to be able to protect a meaningful portion of

the Group's recurring revenue during this period of pub

closures.

It is too early to predict the overall impact of COVID-19 on our

Smart Machines business as we have seen mixed trading impacts

across the range of our customers. Some vending machines, including

those in hospitals, supply chains and emergency services are

trading very well, whereas those in closed city centre offices have

experienced little or no sales. As with Smart Zones customers, we

are providing impacted Smart Machines customers with the option of

a reduced weekly charge in closed sites. Positively, we are seeing

increased demand and usage of our contactless payment solution

rather than 'dirty' coins.

Liquidity and Financial Resilience

In addition to the actions taken to protect a meaningful portion

of our recurring revenues, the business has eliminated

non-essential costs and spend, and is working hard to minimise

supply chain exposure. The Group will take advantage of the full

range of business support measures announced by the Government in

recent days, including guaranteed loans, and in particular the

Group is well advanced with the job retention scheme, where the

government refunds 80% of salary for employees who are not

working.

The Group has good liquidity with trade debts of approximately

GBP2.2m, an overdraft facility of GBP1.5m which is 80% utilised

ahead of customer receipts which are expected at the end of the

month, and GBP1.8m in our deposit account.

Taking account of the Group's current cash and available

resources, and modelling various prudent business scenarios, we are

confident that the actions taken mean that the Group has a cash

runway well beyond the period which the Government has indicated as

being the likely duration of this crisis. As such, the Board

believes that the Group is well placed to absorb a prolonged period

of uncertainty .

Dividend

Despite the strong financial position of the Group, given the

rising level of uncertainty as to how the COVID-19 situation will

develop, alongside the other measures we are taking to preserve the

cash position, the Board has decided to withdraw its recommendation

to pay a final dividend at the forthcoming AGM, which would amount

to approximately GBP1.16m. The Board will review this decision

again later in the year once the outlook becomes clearer.

The Board recognises that this is a significant decision, but

believes that it is an appropriate and prudent measure to take at

this point as the Group seeks to preserve its strong liquidity,

cash flow, and financial position through these uncertain

times.

Conclusion and Outlook

Ahead of the very recent impact of the COVID-19 restrictive

measures introduced by the Government, momentum and performance of

the Group had been encouraging across both divisions.

As seen during the past few weeks, the start to the new

financial year will be challenging, however the Group is well

equipped to weather this storm and emerge with even stronger

customer relationships.

The Board's absolute focus is on ensuring that Vianet comes

through this global crisis in a position to continue to take

advantage of its exciting growth opportunities. In the meantime,

the Board's priority is maintaining the health, wellbeing and

safety of our employees and customers.

This announcement contains inside information.

- Ends -

Enquiries:

Vianet Group plc

James Dickson, Chairman Tel: +44 (0) 1642 358

Stewart Darling, CEO / Mark Foster, 800

CFO www.vianetplc.com

Cenkos Securities plc

Stephen Keys / Cameron MacRitchie Tel: +44 (0) 20 7397

8900

www.cenkos.com

Media enquiries:

Yellow Jersey PR

Sarah Hollins Tel: +44 (0)7764 947

Henry Wilkinson 137

vianet@yellowjerseypr.com Tel: +44 (0)7951 402

336

www.yellowjerseypr.com

About Vianet

Vianet Group is a leading provider of actionable management

information and business insight created through combining data

from our smart Internet of Things ('IOT') solutions and external

information sources.

Since Admission to AIM in 2006, the Group has grown from its

core beer monitoring business both organically and through

strategic acquisitions to widen its offering and also develop new

businesses, especially in vending telemetry and contactless payment

solutions particularly for the premium coffee sector.

Servicing over 300 customers across the world and rendering live

data to our IOT platform from over 250,000 connected machines

daily, Vianet is one of the largest business to business (b2b)

connected solutions providers in Europe with established long term

relationships with blue chip customers and growing recurring

revenues which are over 85% of our total revenues.

In our Smart Machines Division we connect a single data

gathering device with its own on-board communication capability to

a customer's asset or system. The device then sends data back via

our IOT platform to cloud based servers. The technology was

originally developed for automated retailing machines, however the

flexibility and functionality of the device means the technology

can be applied to practically any machine which has the capability

to output data. The device is also used to connect our contactless

payment solution and communicate payment terms to our cloud based

payment services providers where that application is also

required.

The Smart Zones Division is where we connect multiple data

gathering devices into one or more systems or assets with the data

from those devices being communicated back to our IOT platform and

cloud based servers via a single 3G communications hub. The

technology was originally developed for flow monitoring devices,

temperature sensors, and asset management in drinks retailing but

practically any data gathering device with a digital output could

be connected to the communications hub where required such as

gaming machines, utilities management and EPOS.

For further information, please visit www.vianetplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBELLLBXLBBBK

(END) Dow Jones Newswires

March 26, 2020 03:00 ET (07:00 GMT)

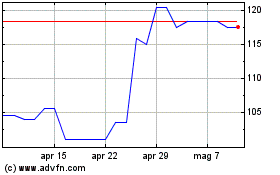

Grafico Azioni Vianet (LSE:VNET)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Vianet (LSE:VNET)

Storico

Da Apr 2023 a Apr 2024