TIDMSHIP

RNS Number : 9209H

Tufton Oceanic Assets Ltd.

27 March 2020

Tufton Oceanic Assets Limited

("Tufton Oceanic Assets" or the "Company")

Interim Results for the six month period ended 31 December

2019

Tufton Oceanic Assets announces its interim results for the six

month period ended 31 December 2019. A copy of the Interim Report

and Unaudited Financial Statements has been submitted to the

National Storage Mechanism and will shortly be available for

inspection at www.morningstar.co.uk/uk/NSM . The Interim Report and

Unaudited Financial Statements will also shortly be available on

the Company's website in the Investor Relations section under

Company Documents at

www.tuftonoceanicassets.com/financial-statements .

For further information, please contact:

Tufton Investment Management Limited Tel: +44 (0) 20 7518 6700

Andrew Hampson

Paulo Almeida

N+1 Singer Tel: +44 (0) 207 496 3030

James Maxwell, Alex Bond (Corporate Finance)

Alan Geeves, James Waterlow, Sam Greatrex (Sales)

Hudnall Capital LLP Tel: +44 (0) 20 7520 9085

Andrew Cade

Highlights

-- The profit of the Company for the financial period was

US$5.54m, or US$0.023 per Ordinary Share based on weighted average

number of shares over the period

-- The Company declared dividends of US$0.0175 per share for the

third and fourth calendar quarters

-- Gross proceeds of US$31m were raised in September 2019

pursuant to the Placing Programme described in the Company

prospectus published on 25 September 2018

-- Acquisitions of two containerships (Parrot and Vicuna) and

one crude tanker (Bear) for c. US$52.3m, which were delivered to

the Company bringing the total fleet from 14 to 17 vessels in the

6-month period as at the end of the period

-- The acquisitions of another product tanker (Dachshund) and

another handysize bulker (Antler) after the end of the period

involving a further US$20.25m of investment.

-- Expected average charter length was 3.1 years with a minimum

of 2.8 years as at 31 December 2019

-- As at 31 December 2019, 16 of the 17 vessels were employed on

fixed rate medium to long term charters, and so the portfolio is

largely insulated from geopolitical and macroeconomic shocks

-- Unlevered cash flow run rate of the fleet was c. US$32m p.a.

(c. 1.8x the target dividend per share of US$0.07 per annum) after

capital expenditure provision and management fees as of 31 December

2019.

Chairman's Statement

Introduction

I am pleased to present the Company's interim report and

unaudited financial statements for the period ended 31 December

2019.

Since I last wrote to Shareholders we have raised an additional

US$31.0m, bringing the total capital raised since inception to

US$250.4m. The Investment Manager successfully invested these

proceeds in 3 vessels bringing our fleet size to 17 vessels as of

31 December 2019 . The fleet as at the period end consisted of 2

Handysize Bulkers, 7 Containerships, 5 Tankers and 3 General Cargo

vessels. There is a further breakdown of the portfolio in the

Investment Managers Report.

Performance

The performance of the Company during the period held up well

against a backdrop of geopolitical challenges and more recently the

Covid-19 Coronavirus outbreak.

As of the 31 December 2019, the Company's NAV was c.US$253.4m

versus net issue proceeds of US$245.4m. The NAV per share as of 31

December 2019 was US$0.992.

The Company's Earnings per Share for the period ended 31

December 2019 was 2.3 cents and was 15.4 cents since inception. At

the end of the financial period, the Company had forecast dividend

cover of c1.8x with average charter length of 3.1 years and

continues to target a total annual dividend of $0.07 per share.

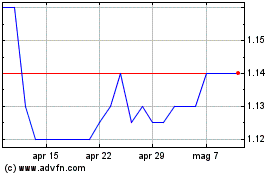

The Share Price increased from US$0.99 as of 30 June 2019 to

US$1.04 as of the close of business 31 December 2019. The Company's

Shares have traded at an average premium to NAV of 1.6% during the

period.

Dividends

During the period the Company declared and paid dividends to

shareholders as follows:

Period end Dividend Announce Ex div Record Paid date

per share date date date

(US$)

Ordinary shareholders

30.06.19 0.0175 29.07.19 08.08.19 09.08.19 23.08.19

30.09.19 0.0175 28.10.19 07.11.19 08.11.19 22.11.19

A further dividend was declared on 30 January 2020 for US$0.0175

per ordinary share for the quarter ending 31 December 2019. The

dividend was paid on 21 February 2020 to holders of ordinary shares

on record date 7 February 2020 with an ex-dividend date of 6

February 2020.

Corporate Governance

The Company complies with the UK Code of Corporate Governance

("UK Code") where applicable and also follows the AIC Corporate

Governance Code ("AIC Code") to ensure that the Directors apply the

most relevant level of corporate governance for the Company. Where

Shareholders or their appointed agent have matters they wish to

raise with the Board in respect to the Company, I would encourage

them to contact us at SHIP@tuftonoceanicassets.com .

Annual General Meeting Results

At the last Annual General Meeting ("AGM") held on 25 October

2019 all of the resolutions were duly passed as advised in our

announcement of the same date, although there were a significant

number of votes against some of resolutions, which require me to

comment accordingly.

Resolution 1 - Annual Report and Audited Financial Statements of

the Company for the year ended 30 June 2019. There were 46,831,744

votes against this resolution being 31.09% of the votes cast. On

engaging with the relevant Shareholders and also their appointed

voting agent, the recommendation to vote against this resolution

was based on the fact that the Company did not provide for

Shareholders to vote on the on-going dividend policy of the

Company. The Board of Directors have considered this feedback and

will include a resolution at future AGM's to allow Shareholders to

vote on the on-going dividend policy of the Company.

Resolution 2 Re-appointment of the Auditors and Resolution 5

Retirement and Re-Election of Steve le Page. There were 46,831,744

votes against each of these resolutions being 31.09% of the votes

cast. On engaging with the relevant Shareholders and also their

appointed voting agent, the recommendation to vote against these

resolutions was based on the voting agent's view that there was a

possible conflict of interest between the Company, represented by

Mr le Page as Chairman of the Audit Committee and PwC as the

appointed Auditors to the Company. Mr le Page was therefore not

deemed, by the voting agency making the recommendation to their

client to be independent. For clarity Mr le Page retired as a

partner of PwC in September 2013 before joining the Board in

February 2017, a gap of more than three years. The voting agency

believes there should be a seven year period between a partner

retiring and becoming independent of their former firm to ensure

that there is not conflict of interest. This period of seven years

is considerably longer than the three years recommended by the UK

Code and the AIC Code. The Board of Directors consider Mr le Page

to be an independent director without any conflicts of interest

with the Company's Auditors and in any event the Board have

determined that by the time of the next AGM of the Company in

October 2020 Mr le Page will have exceeded this seven year period

and thus will satisy the voting agents' criteria.

Resolution 4 - Retirement and Re-Election of Robert King

(Chairman). There were 24,893,063 votes against the resolution

being 17.86% of the votes cast. On engaging with the

representatives of the Shareholder group, they voted against the

re-appointment of the Chairman based on deemed "over-boarding"

which has now been addressed with the Shareholders concerned.

Outlook

During the second half of last year and since the turn of the

year there have been significant geopolitical events, initially the

ongoing US/China trade tariffs disputes followed by the short lived

crisis in the Middle East and Iran, which have had a negative

impact mainly on the bulker and containership sectors. However, the

issues surrounding Covid-19 and the spread of the virus outside of

China into a pandemic, together with the recent drop in oil prices,

also have significant implications for the maritime industry.

With the extension of the Chinese New Year holiday in order to

try and contain the virus in China, we saw a dramatic fall off in

both dry bulk raw material Chinese imports as well as lower

finished good (containership) exports. Since the failure of OPEC to

agree on production cuts and the consequential drop in oil prices,

we have seen significant increase in the movement of crude oil and

oil product as stockpiling takes place against a contango in the

oil price. When land based storage is full, we expect vessel supply

to be taken out of the market for floating storage but it is clear,

however, that oil / oil product consumption demand growth will

remain low until normality is restored.

It is also expected that the bulker and containership sectors

will remain subdued during the continuation of the current reaction

in the western world to the spreading Coronavirus threat.

Interestingly, we have seen a recent increase in the number of port

calls in China, returning to prior year norms for 6-7 weeks post

the Chinese New Year. It is too early to make definitive

projections concerning the medium term response of world trade to

Covid-19 but inevitably there will be some distress leading to

investment opportunities.

We are pleased to note however, the recent news release from the

Investment Manager that as of 29 February 2020, the estimated

unaudited NAV of SHIP was US$0.976 per share compared to US$0.992

per share as of 31 December 2019. As noted in the release, the

revenue earned by and the value of the majority of the Company's

vessels had not thus far been significantly negatively affected by

fluctuations in commodity prices, geopolitical events and other

short-term supply-demand factors. The relative resilience of the

portfolio reaffirmed the Investment Manager's strategy of portfolio

diversification and longer term charter coverage to strong credits,

and continues to insulate the Company against the extreme movements

of the shipping spot markets. In the longer term poor markets may

start to impact on charter renewals as they occur.

The resolution of the UK's exit from the EU has not had an

impact on the portfolio, and is not expected to have one going

forward.

The Company sold three general cargo vessels and acquired one

product tanker and one handysize bulker after the period end

bringing the fleet size from 17 vessels as of 31st December 2019 to

currently 16 vessels. The Company continues to pursue its strategy

of growing a diversified fleet and we are pleased that the

Investment Manager continues to identify attractive opportunities

across a range of the Company's target sectors.

Rob King

Non-executive Chairman

Board Members

The Company's Board of Directors comprises three independent

non-executive Directors. The Board's role is to manage and monitor

the Company in accordance with its objectives. The Board monitors

the Company's adherence to its investment policy, its operational

and financial performance and its underlying assets, as well as the

performance of the Investment Manager and other key service

providers. In addition, the Board has overall responsibility for

the review and approval of the Company's NAV valuations and

financial statements. It also maintains the Company's risk

register, which it monitors and updates on a regular basis.

The Directors of the Company who served during the period and to

date are:

Robert King, Chairman

A non-executive director for a number of open and closed-ended

investment funds including Weiss Korea Opportunity Fund Limited,

Chenavari Capital Solutions Limited (Chairman) and CIP Merchant

Capital Limited. Before becoming an independent non-executive

director in 2011 he was a director of Cannon Asset Management

Limited and their associated companies. Prior to this he was a

director of Northern Trust International Fund Administration

Services (Guernsey) Limited (formerly Guernsey International Fund

Managers Limited) where he had worked from 1990 to 2007. He has

been in the offshore finance industry since 1986 specialising in

administration and structuring of offshore open and closed ended

investment funds. Rob King is British and resident in Guernsey.

Stephen Le Page

A chartered accountant and chartered tax adviser. He was a

partner in PricewaterhouseCoopers CI LLP in the Channel Islands

from 1994 until his retirement in September 2013. During his career

his main role was as an audit partner working with a wide variety

of financial services businesses and structures. Mr Le Page also

led that firm's audit and advisory businesses for approximately ten

years and for five of those years was the Senior Partner

(equivalent to Executive Chairman) for the Channel Islands firm.

Since his retirement Mr Le Page has joined a number of boards as a

non-executive director including three premium London listed funds,

Highbridge Tactical Credit Fund Limited, Volta Finance Limited and

Princess Private Equity Holding Limited and one International Stock

Exchange listed company, Channel Islands Property Fund Limited, all

of which he serves as Chairman of the audit committee. He is a past

chairman of the Guernsey International Business Association and a

past President of the Guernsey Society of Chartered and Certified

Accountants. Stephen Le Page is British and resident in

Guernsey.

Paul Barnes

An investment banker experienced in asset backed, structured and

project financing with wide geographic exposure including Asia,

Central/Eastern Europe, North and Latin America and Scandinavia. Mr

Barnes was managing director at BNP Paribas and co-head of its EMEA

Shipping and Offshore business between 2010 and 2015. He was also

head of risk monitoring for Global Shipping at BNP Paribas. Prior

to that, Mr Barnes had served as head of shipping (London) at

Fortis Bank, head of specialised industries at Nomura International

and as a corporate finance Director of Barclays Bank and as a

Director of its Shipping Industry Unit. Paul Barnes is British and

resident in the United Kingdom.

Investment Manager's Report

Highlights

We are pleased to present our review for the 6-month period

ended 31 December 2019 and our outlook for the next few years.

Highlights include:

-- The profit of the Company for the financial period was

US$5.54m, or US$0.023 per Ordinary Share based on weighted average

number of shares over the period (Note 7)

-- The Company declared dividends of US$0.0175 per share for the

third and fourth calendar quarters

-- Acquisitions of two containerships (Parrot and Vicuna) and

one crude tanker (Bear) for c. US$52.3m, which were delivered to

the Company bringing the total fleet from 14 to 17 vessels in the

6-month period as at the end of the period

-- The acquisitions of another product tanker (Dachshund) and

another handysize bulker (Antler) after the end of the period

involving a further US$20.25m of investment.

-- Expected average charter length was 3.1 years with a minimum

of 2.8 years as at 31 December 2019

-- As at 31 December 2019, 16 of the 17 vessels were employed on

fixed rate medium to long term charters, and so the portfolio is

largely insulated from geopolitical and macroeconomic shocks

-- Unlevered cash flow run rate of the fleet was c. US$32m p.a.

(c. 1.8x the target dividend per share of US$0.07 per annum) after

capital expenditure provision and management fees as of 31 December

2019. Net proceeds of US$30.4m were raised in September 2019

pursuant to the Placing Programme described in the Company

prospectus published on 25 September 2018

The Assets

As of 31 December 2019, the Company owned 17 vessels:

-- The seven containerships operate on time charter contracts,

under which the Company provides fully operational and insured

vessels for use by the charterers. Swordfish, Kale, Patience,

Riposte and Vicuna are chartered to one of the major investment

grade container shipping groups. Parrot is chartered to another

leading, global container shipping group. Citra is chartered to a

leading private operator of containerships specialising in fresh

fruit transportation.

-- The gas carrier Neon operates on a bareboat charter, under

which the Company provides only the vessel to the charterer, who is

responsible for crewing, maintaining, insuring and operating

it.

-- The two handysize bulkers operate under time charters. Dragon

and Aglow are on charter to two different private European

operators.

-- Three product tankers operate under time charters to a major

commodity trading and logistics company. Sierra and Octane are on

fixed rate charters. Pollock is on a floating rate time

charter.

-- The three general cargo carriers Hongi, Darwin and Java

operated under bareboat charters to a private general cargo

shipping operator.

-- The crude oil tanker Bear operates under a time charter with

a profit-sharing mechanism to a major commodity trading and

logistics company.

As at 31 December 2019

SPV(+) Vessel Type and Year Acquisition Earliest end Expected end

of Build Date of charter of charter

period period(**)

Swordfish 1700-TEU containership February April 2020 April 2020

built 2008 2018

----------------------- ------------ -------------- --------------

Kale* 1700-TEU containership February April 2020 April 2020

built 2008 2018

----------------------- ------------ -------------- --------------

Patience 2500-TEU containership March 2018 April 2021 October 2022

built 2006

----------------------- ------------ -------------- --------------

Riposte 2500-TEU containership March 2018 March 2020 March 2021

built 2009

----------------------- ------------ -------------- --------------

Neon Mid-sized LPG carrier July 2018 August 2025 August 2025

built 2009

----------------------- ------------ -------------- --------------

Aglow Handysize Bulker July 2018 May 2020 August 2020

built 2011

----------------------- ------------ -------------- --------------

Dragon Handysize Bulker September August 2020 August 2020

built 2010 2018

----------------------- ------------ -------------- --------------

Citra 2500-TEU containership November November 2020 November 2020

built 2006 2018

----------------------- ------------ -------------- --------------

Sierra Medium-range December January 2021 January 2022

product tanker 2018

built 2010

----------------------- ------------ -------------- --------------

Octane Medium-range December January 2021 January 2022

product tanker, built 2018

2010

----------------------- ------------ -------------- --------------

Pollock* Handysize December March 2020 March 2021

product tanker, built 2018

2008

----------------------- ------------ -------------- --------------

Hongi* General Cargo Carrier February April 2026 April 2026

Built 2002 2019

----------------------- ------------ -------------- --------------

Darwin* General Cargo Carrier April 2019 November 2023 November 2023

Built 2004

----------------------- ------------ -------------- --------------

Java* General Cargo Carrier April 2019 January 2026 January 2026

Built 2003

----------------------- ------------ -------------- --------------

Parrot 8200-TEU containership July 2019 May 2025 May 2025

built 2006

----------------------- ------------ -------------- --------------

Bear Crude Oil Tanker September October 2021 October 2021

Built 2005 2019

----------------------- ------------ -------------- --------------

Vicuna 2500-TEU containership October October 2022 October 2024

built 2006 2019

----------------------- ------------ -------------- --------------

Notes:

(+) Special Purpose Vehicle that owns the vessel

* Post 31 December 2019: Hongi, Darwin and Java were sold.

Pollock was fixed on a 3 year fixed rate time charter to a major

commodity trading house. The charter on Kale was extended by a

minimum of seven months in early March

** these may differ from the Annual Report (30 June 2019)

following the re-assessment by the Investment Manager of the

prevailing market conditions

After the financial period, the Company divested three general

cargo vessels for US$19.3m. The realised yield and IRR exceeded the

targets expressed in the Company's prospectus dated 25 September

2018. This was the Company's first divestment. The Company expects

to redeploy the proceeds opportunistically. While the Investment

Manager aims to hold investments over the longer term, it will

continue to consider sale opportunities that generate additional

value for shareholders. The Company committed to acquire Dachshund,

a 2008 built product tanker, in February 2020 for US$13.25m and

Antler, a 2012 built handysize bulker, in March 2020 for US$7.0m.

Dachshund was delivered to the Company in March 2020 and it is on a

fixed rate time charter for 3 to 4 years to a major commodity

trading and logistics company. Antler was also delivered to the

Company in March 2020 and it is on a fixed rate time charter for 6

to 8 months to a major commodity trading company.

The divestment of the three general cargo vessels and the

acquisition of Dachshund and Antler brings the Company's fleet from

17 vessels as of 31st December 2019 to 16 vessels. The Investment

Manager continues to identify an attractive pipeline of

opportunities across a range of the Company's target sectors.

Operating and Investment Highlights

During the 6-month financial period, three vessels were acquired

(totalling c.US$52.3m) and delivered to the Company, bringing the

total number of vessels in operation to 17 vessels. , The vessels

in the fleet are well maintained and performed to expectations.

Some operational details over the period worth mention are: Dragon

had its scheduled second special survey (with 30 days offhire),

minor machinery issues on Swordfish and Riposte were promptly

rectified, Patience had a collision incident in October resulting

in unplanned offhire of 12 days. The cost of repairs minus

deductible was covered by insurance. All the vessels in the

portfolio had an uneventful transition to low sulphur fuel at the

end of 2019 to comply with the International Maritime

Organization's (IMO) new sulphur cap. The containership Parrot was

routed to a shipyard in China for scheduled retrofit of a scrubber

which started in February 2020. Retrofit works are progressing well

towards target completion in late May 2020.

Investment Performance

NAV per share decreased by US$0.013 to US$0.992 per share.

Operating profit contributed US$0.056 per share. There was an

unrealised loss in the charter-adjusted fleet value of US$0.033 per

share during the period. The unrealised loss arose mainly because

of the fall in capital values of containerships and bulkers during

the period.

The second half of 2019 vindicated the Investment Manager's

approach to building a diversified portfolio. The operating profit

from the portfolio was US$14.7m which was partly offset by a fair

value adjustment of US$7.8m. Most of the negative movement in fair

values came from the containership segment. Containership asset

values weakened in a slowing GDP growth environment in the second

half of 2019 despite containership rates improving. We expect the

charter rate and yield for Parrot to increase after its scrubber

retrofit in 2Q20.

On the other hand, the portfolio recorded fair value gains on

both crude and product tankers as both segments benefited from

supply reductions in the crude tanker market from US sanctions. The

crude tanker market tightened and some product tankers switched to

crude service. Yield from the tanker segment remained strong, in

line with expectations.The dry bulk market briefly hit six year

highs in the third quarter but fell rapidly over the fourth quarter

with a small negative impact on fair values. Aglow finished a

charter in December and started on a new short term time charter at

a relatively low rate. Dragon had its second special survey in

September. The scheduled capex and offhire time resulted in a

negative yield for dry bulk over the period but the capex and

offhire time were in line with expectations. The gas tanker is on a

long term charter. The general cargo carriers were also on long

term charters. Performance was in line with expectations. Further

commentary on the shipping market may be found in the next

section.

As of 31 December 2019,vessels corresponding to more than 70% of

NAV were on charters of duration greater than one year. Fixed

employment in the portfolio was across nine different charterers

with the largest exposure to a charterer corresponding to 24% of

NAV.

Shipping Market

Some notable highlights of the shipping market over 2019

include(*)

-- Global seaborne trade grew by 2.2% (tonne miles) in 2019 decelerating from 2.7% in 2018

-- Fleet expansion accelerated to 4.1% as an improving market

reduced yard slippage and limited demolition activity

-- The global orderbook is equivalent to only 9% of the fleet,

compared to over 50% in 2008. The orderbook is at its lowest level

since 2004

-- Newbuild deliveries were up by 22% year on year in 2019,

while newbuild ordering volumes were down 27% year on year

representing the lowest since 2016

-- Secondhand transaction volumes were down 9% year on year in

2019, with the secondhand price index down 2% year on year

-- Bulker average 12-month time charter rates fell 10% year on year in 2019

-- Containership time charter rates index fell 6% year on year in 2019

-- Tanker average 12-month time charter rates rose 24% year on

year in 2019, with VLCC charter rates up 59%

The second half of 2019 was marked by a slowdown in GDP growth

and industrial production. As the benefits on the 2018 tax cuts in

the US faded, business confidence weakened in the face of the

uncertainties of US-China trade negotiations. Manufacturing firms

became more cautious on long range capital expenditure. The

International Monetary Fund revised down its forecasts for World

GDP growth in 2019 from 3.5% to 2.9%. Within this context, the

different segments in shipping markets exhibited a remarkable

variety of outcomes.

The oil tanker market showed steady improvement over the third

quarter and received an unexpected boost at the end of the period

when the US sanctioned Cosco Tankers, a large Chinese operator -

effectively taking out a significant portion of available tanker

capacity. Benchmark rates for large tankers hit decade highs as the

effect of US sanctions was exacerbated by ships taken out of

service for scrubber retrofit ahead of the transition to low

sulphur fuel on 1 January 2020. The third quarter of 2019 still saw

record demand for many dry bulk products as businesses

opportunistically built inventories ahead of expected changes in

tariff regimes over the fourth quarter. The benchmark Baltic Dry

Index hit a six-year high in the third quarter. However, the fourth

quarter was a perfect storm for dry bulk with the combined effects

of weakening GDP growth, lower steel demand growth and pullback

from the inventory building of the third quarter being exacerbated

by environmental shutdowns in Asia. Containership rates, led by

larger vessels, improved over the course of the third quarter and

consolidated at relatively high levels in the fourth quarter. Over

the period, consumer sentiment remained buoyant (particularly in

the US) as additional easing by the Federal Reserve was followed by

mortgage refinancing and added to disposable income.

The supply-side adjustment across shipping subsectors continued

as new orders lagged deliveries and the orderbook shrunk to 9% of

the fleet, the lowest level since 2004. The shipping market also

encountered one of the most impactful regulatory changes in recent

history at the end of 2019 as the global fuel sulphur cap was

reduced to 0.5%. To date, the transition has been without large

scale technical disruptions although some analysts believe that the

real transition will only take place at the end of March with the

"carriage ban", when ships without exhaust gas cleaning systems are

prohibited from carrying high sulphur fuel oil. After this date,

all ships without scrubbers will be forced to switch to use low

sulphur fuel at all times.

(*) Based on Clarksons Research

Outlook

We believe the supply-led recovery in shipping will continue,

offering strong returns over coming years. A major uncertainty in

the market is the duration and impact of the novel Coronavirus

(Covid-19) outbreak. The outbreak will have direct and indirect

effects on GDP and World trade. A survey of analysts estimates that

World GDP growth may be reduced to 1-1.5% for the full year (from

previous estimates of 3.3%) while Chinese GDP growth may be reduced

to 4-4.5% for the full year 2020. The Chinese government's prompt

and stringent actions to contain the outbreak,appear to have had

initial success. However, the outbreak has spread internationally

and on 11 March 2020, the World Health Organization declared the

Covid-19 a pandemic, urging global powers to take co-ordinated

action to contain the outbreak. The impact of the pandemic may be

limited to the first half of the year, if global measures to

contain it are effective and economic stimulus measures across key

economies are successful. In this scenario, it is reasonable to

expect a balanced shipping market for the year with around 1-1.5%

World GDP growth and 2% growth in World seaborne trade demand,

balanced by 2.0% fleet growth (3.3% in 2019). We expect fleet

growth will continue to slow due to the impact of supply-side

factors discussed in detail below. Fundamentals appear to be most

favourable for tankers followed by dry bulk and containerships.

In the medium term, we continue to believe that a confluence of

supply side factors will lead to slowing fleet growth and will

support the shipping markets. Even as newbuilding prices stabilised

in 2019 (after a 4% rally in 2018), new orders fell by 32% YoY. As

a result, the global shipping orderbook stands at 9% of fleet (the

lowest level since 2004). The diminishing orderbook is an indicator

of slowing fleet growth in years to come. We believe the pace of

new orders will continue to be below trend due to a combination of

lack of capital from traditional sources of funding (banks) and

uncertainty about environmental regulations on decarbonization. The

dearth of new orders is also resulting in rapid consolidation of

global shipyard capacity. Maersk Shipbrokers estimate a 30%

reduction in global shipyard capacity between 2011 and 2018. We

believe the ongoing yard consolidation will also result in better

pricing power for surviving yards, pushing up newbuild prices and

increasing the premium for secondhand ships. The International

Maritime Organization's (IMO) new global sulphur cap was effective

as of 1 January 2020. Satellite data confirmed our expectations,

showing that the average speed of the global fleet fell by 2% over

the second half of 2019 and continues to fall in early 2020. The

decrease in average fleet speed results in lower available capacity

and will further support the market.

The Company continues to pursue a strategy of growing a

diversified fleet. The revenue earned by most of the Company's

vessels is not affected by short-term fluctuations in general

shipping markets. The Company is relatively well positioned to

weather the volatility from the impact of Covid-19 as vessels in

the portfolio which have charters expiring over the next six months

only represent c14% of NAV (as of 29 February 2020). Most of the

vessels in the portfolio are employed on medium to long-term

charters with carefully chosen counterparties to minimise the

impact of fluctuations in commodity prices, geopolitical events and

other short-term supply-demand factors.

Investment Manager

Tufton Investment Management Limited (formerly Tufton Oceanic

Limited)

Principal and Emerging Risks and Uncertainties

The Board has carried out a robust assessment to identify the

principal and emerging risks that could affect the Company,

including those that would threaten its business model, future

performance, solvency or liquidity. Principal risks are those which

the Directors consider to have the greatest chance of materially

impacting the Company's objectives. The Board has adopted a

"controls" based approach to its risk monitoring requiring each of

the relevant service providers including the Investment Manager to

establish the necessary controls to ensure that all identified

risks are monitored and controlled in accordance with agreed

procedures where possible.

The Company's activities are primarily dependent upon global

seaborne trade flows and as seaborne trade activities between

mainland Europe and the UK are not significant to the Company's

portfolio, Brexit is not expected to have a material impact on the

Company or the Investment Manager.

The Directors receive periodic updates at their Board meetings

on principal and emerging risks and have adopted their own control

review to ensure, where possible, risks are monitored

appropriately. Occurrences of principal and emerging risks may have

a number of underlying causes, and it is with respect to those

causes that the Directors have implemented controls or mitigation

as shown in the following table. The Directors also carry out a

regular check on the completeness of risks identified, including a

review of the risk register. No currently relevant risks were

identified as missing. Please note that risk or uncertainty cannot

be eliminated.

Underlying cause of Objective Control or mitigation implemented

risk or uncertainty impacted

(in what

way)

Failure of, or unwillingness Liquidity Charter counterparties are subjected

of, a vessel charter to extensive credit worthiness

counterparty to meet Vessel values checks prior to contracting

the stipulated charter with them. The Investment Manager

payments monitors the credit worthiness

of the charter counterparties

on an ongoing basis.

In the event of default by a

charterer, the generic nature

of the ships in the portfolio

should enable alternatives to

be found, although possibly

at lower charter rates and for

different periods.

--------------- -------------------------------------

Demand for shipping Capital growth This risk cannot be controlled,

may decline, either Vessel values but is mitigated by:

because of a reduction Diversification of the fleet

in international trade held reducing the reliance on

(e.g. "trade wars") any particular economic sector

or because of general or geography;

GDP growth slowing or Ensuring the fleet held is of

declining or increased high quality, and thus more

competition likely to continue to be utilised;

Chartering out vessels for the

longest period possible on sensible

economic terms.

Ultimately, lower charter rates

would be accepted in order to

ensure employment of the vessels.

--------------- -------------------------------------

Underlying cause of Objective Control or mitigation implemented

risk or uncertainty impacted (in

what way)

Vessel maintenance Capital growth The Company has engaged experienced

or capital expenditure Dividends managers to monitor the need

may be more costly Liquidity for maintenance or Capital

than expected Vessel values expenditure and provision is

made for expected levels of

expenditure when a vessel is

purchased.

Actual spend will be compared

to expected and adjustments

made to the provisions held

if necessary.

------------------ -------------------------------------

A vessel may be lost Capital growth -Insurance, including war risk,

or significantly damaged Vessel values innocent owners insurance and

loss of revenue insurance,

is arranged with reputable

insurers for each vessel

-Charter party terms are in

place to afford suitable protection

to Owners including avoidance

of sanctioned and conflict

areas

-Operational risks are further

mitigated through measures

like daylight sailing, naval

escort, route planning clear

of higher risk areas

-The Asset Manager maintains

a detailed manual that documents

best practices operating procedures

to be followed by crew and

technical staff.

------------------ -------------------------------------

The Company may not Liquidity The Company has engaged a very

have enforceable title Vessel values experienced Investment Manager

to the vessels purchased who is responsible for establishing

such title.

This is then monitored by the

Board using publicly available

information.

------------------ -------------------------------------

Failure of, or unwillingness Capital Growth Operating bank accounts for

of, a non-charter counterparty Loss of invested the SPVs are held with an unrated

to meet its obligations cash bank, because those banks'

to the Company systems are considered highly

suited to such operations,

but are limited in total amount

to $10m per bank.

Surplus funds are invested

only with banks of a single

-A (or equivalent) or higher

credit rating as determined

by an internationally recognised

rating agency.

Operating accounts are swept

monthly into an account with

a rated bank.

Ratings, monthly sweeps and

overall limits are monitored

by the Administrator, who reports

exceptions to the Board.

------------------ -------------------------------------

Failure of systems Capital Growth This risk cannot be directly

or controls in the Loss of assets, controlled but the Board and

operations of the Investment reputation its Audit Committee regularly

Manager, Asset Manager or regulatory review reports from its Service

or the Administrator permissions Providers on their internal

and thereby of the and resulting controls.

Company Fines

------------------ -------------------------------------

As noted in the Chairman's statement, the developing situation

with the Covid-19 virus is at too early a stage to be able to

determine its impact. In considering this risk, the Board's

thinking has been as follows.

The Group has no direct employees, although crews for vessels on

time charters are provided by the SPVs holding those vessels,

arranged by the Company's Asset Manager. In the future, therefore,

it may be difficult for those subsidiary companies to source such

crews, and/or for the asset manager to provide its services. To

date, no such difficulties have been experienced and the asset

manager is taking appropriate steps to ensure it can continue to

service the Group.

In addition, demand for vessels may be depressed for an unknown

amount of time, either by a general reduction in global GDP growth

or by specific reductions in production by the ultimate customers

of the Group's charter counterparties. This again will have no

direct or immediate impact on the Group, as it has no exposure to

the spot market for vessels, but it may cause such charter

counterparties to be unable to pay the Group when due and may also

cause charter rates to fall, decreasing the value of our vessels

and making charter renewals less remunerative. It is the Board's

opinion that all these potential consequences are already managed

and monitored as part of the Groups ongoing approach to risk in

respect of counterparties, values and service providers, as set out

in the table above, and so no additional steps have been taken at

this time.

The Board will of course continue to reassess the position as

more information about the impact of the virus becomes

available.

Interim Report of the Directors

The Directors present their Interim Report and the Condensed

Interim Financial Statements of the Company for the six month

period ended 31 December 2019.

The Company was registered in Guernsey on 6 February 2017 and is

a registered closed-ended investment scheme under the POI Law. The

Company's Ordinary Shares were listed on the Specialist Fund

Segment of the Main Market of the London Stock Exchange on 20

December 2017 under the ticker "SHIP".

Investment Objective

The Company will make investments through a Guernsey holding

company into one or more underlying SPVs which will mainly be

wholly owned by the Guernsey holding company and over which the

Company will exercise control with regards to investment decisions.

The Company may from time to time invest through vehicles which are

not wholly owned by it. In such circumstances, the Company will

seek to secure controlling rights over such vehicles through

shareholder agreements or other legal arrangements.

The Directors and Investment Manager expect that most or all of

the SPVs will be registered in the Isle of Man. Tufton Coporate

Services Limited (formerly Marine Services (IOM) Limited), an

affiliate of the Investment Manager, licensed by the Financial

Services Authority of the Isle of Man, is the corporate secretary,

provides directors to and acts as administrator of the IOM SPVs and

most other SPVs. Regardless of the aforementioned, the SPVs will be

serviced by affiliates of the Investment Manager and be

operationally serviced by entities under the indirect control of

the Investment Manager at all times.

The Company will at all times invest and manage its assets in a

manner which is consistent with the objective of spreading

investment risk. This is achieved by adhering to the Investment

Restrictions as set out in the Prospectus.

Share issues

On 20 September 2019 , the Company announced the results of its

Placing and Offer for Subscription of 30,693,070 Ordinary Shares,

which raised gross proceeds of US$31 million. These ordinary shares

were issued on the Specialist Funds Segment of the Main Market of

the London Stock Exchange effective 24 September 2019.

Results and dividends

The Company's performance during the period is discussed in the

Chairman's Statement. The results for the year are set out in the

Condensed Statement of Comprehensive Income.

Related Parties

Details of related party transactions that have taken place

during the period and any material changes, if any, are set out in

note 14 of the Condensed Interim Financial Statements.

Directors

The Directors of the Company who served during the year and to

date are set out in this Report.

Directors' interests

The Directors held the following interests in the share capital

of the Company either directly or beneficially as of 31 December

2019, and as of the date of signing these Financial Statements:

31 December 30 June 2019

2019

Shares Shares

R King 45,000 45,000

S Le Page 15,000 15,000

P Barnes 5,000 5,000

The Directors fees are as disclosed below:

31 December 30 June 2019

2019

Director GBP GBP

R King 30,000 30,000

S Le Page 28,000 28,000

P Barnes 25,000 25,000

Effective 1 January 2020 director fees were increased to

GBP32,000 for Rob King, GBP30,000 for Stephen Le Page and GBP28,000

for Paul Barnes .

Other Interests

Tufton Group, key employees of the Investment Manager and other

related parties held the following interests in the share capital

of the Company either directly or beneficially.

31 December 2019

% of issued

Share Capital

Ordinary Shares US$

Name 2019 2019

Tufton Group Entities 3,148,350 1.282

Tufton Group Employees 2,296,665 0.935

Tufton Group non-executive

directors 703,279 0.286

30 June 2019

% of issued

Share Capital

Ordinary Shares US$

Name 2019 2019

Tufton Group Entities 3,148,000 1.464

Tufton Group Employees 2,058,179 0.957

Tufton Group non-executive

directors 554,740 0.258

Going concern

Under the UK Corporate Governance Code and applicable

regulations, the Directors are required to satisfy themselves that

it is reasonable to assume that the Company is a going concern. In

assessing the going concern basis of accounting the Directors have

had regard to all the guidance issued by the Financial Reporting

Council, recent market volatility and the potential impact of the

Covid-19 virus on the Company's fleet (as set oun in more detail in

the section entitled Principal and Emerging Risks and

Uncertainties). After making enquiries, and bearing in mind the

nature of the Company's business and assets and the reassessment of

the principal and emerging risks, the Directors consider it

appropriate to adopt the going concern basis of accounting in

preparing the Interim Report and Condensed Interim Financial

Statements.

Responsibility Statement

For the period from 1 July 2019 to 31 December 2019

The Directors are responsible for preparing the Interim Report

and Condensed Interim Financial Statements, which has not been

audited or reviewed by an independent auditor, and confirm that to

the best of their knowledge:

-- the Condensed Interim Financial Statements have been prepared

in accordance with International Accounting Standard (IAS) 34,

Interim Financial Reporting;

-- the interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

Condensed Interim Financial Statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current Financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

Approved by the Board of Directors on 27 March 2020 and signed

on behalf of the Board by:

Rob King Steve Le Page

Director Director

Condensed Statement of Comprehensive Income

For the 6 month period ended 31 December 2019

31 December 31 December

2019 2018

Notes US$ US$

Income (Unaudited) (Unaudited)

Net changes in Financial

Assets at fair value through

profit or loss 4 (4,569,550) 6,477,685

Dividend income 11,439,560 -

Total net income 6,870,010 6,477,685

Expenditure

Aborted deal costs - (18,316)

Administration fees (73,463) (51,878)

Audit fees (68,639) (39,115)

Corporate Broker fees (75,000) (58,537)

Directors' fees 16 (57,544) (53,529)

Foreign exchange loss (3,676) (4,073)

Insurance fee (12,214) (50,356)

Investment management fee 12 (1,040,898) (472,948)

Legal fees (10,166) -

Professional fees (20,187) (27,003)

Sundry expenses (11,868) (18,632)

Total expenses (1,373,655) (794,387)

------------ ------------

Operating profit 5,496,355 5,683,298

Finance income 44,817 267,413

Profit and comprehensive

income for the period / year 5,541,172 5,950,711

============ ============

IFRS Earnings per ordinary

share (cents) 7 2.30 3.51

============ ============

There were no potentially dilutive instruments in issue at 31

December 2019.

All activities are derived from continuing operations.

There is no other comprehensive income or expense apart from

those disclosed above and consequently a Statement of Other

Comprehensive Income has not been prepared.

The accompanying notes are an integral part of these condensed

interim financial statements.

Condensed Statement of Financial Position

At 31 December 2019

31 December 30 June

2019 2019

Notes US$ US$

Non-current assets (Unaudited) (Audited)

Financial assets at fair

value

through profit or loss (Investments) 4 248,534,260 220,998,073

Total non-current assets 248,534,260 220,998,073

------------ ------------

Current assets

Trade and other receivables 34,455 32,248

Cash and cash equivalents 5,481,172 5,500,139

Total current assets 5,515,627 5,532,387

------------ ------------

Total assets 254,049,887 226,530,460

------------ ------------

Current liabilities

Trade and other payables 685,725 687,781

Total current liabilities 685,725 687,781

------------ ------------

Net assets 253,364,162 225,842,679

============ ============

Equity

Share capital 6 245,392,016 215,012,016

Retained reserves 6 7,972,146 10,830,663

Total equity attributable

to ordinary shareholders 253,364,162 225,842,679

============ ============

Net assets per ordinary share

(cents) 9 99.23 100.53

============ ============

The accompanying notes are an integral part of these condensed

interim financial statements.

The financial statements were approved and authorised for issue

by the Board of Directors on 27 March 2020 and signed on its behalf

by:

Rob King Steve Le Page

Director Director

Condensed Statement of Changes in Equity

For the 6 month period ended 31 December 2019

Ordinary Retained

share capital earnings Total

US$ US$ US$

For the six months ended

31 December 2018 (Unaudited)

Balance at 1 July 2019 215,012,016 10,830,663 225,842,679

Share issue 31,000,000 - 31,000,000

Listing costs (620,000) - (620,000)

Profit and comprehensive

income for the period - 5,541,172 5,541,172

Dividends paid - (8,399,689) (8,399,689)

Balance at 31 December

2019 245,392,016 7,972,146 253,364,162

=============== ============ ============

C-Class Ordinary Retained

share capital share capital earnings Total

US$ US$ US$ US$

For the six months ended

31 December 2018 (Unaudited)

Balance at 1 July 2018 - 89,180,000 3,283,443 92,463,443

Share issue 78,400,000 - - 78,400,000

Listing costs (1,568,000) - - (1,568,000)

Profit and comprehensive

income for the period - - 5,950,711 5,950,711

Dividends paid - (2,957,500) (2,957,500)

Balance at 31 December

2018 76,832,000 89,180,000 6,276,654 172,288,654

=============== =============== ============ ============

The accompanying notes are an integral part of these condensed

interim financial statements.

Condensed Statement of Cash Flows

For the 6 month period ended 31 December 2019

31 December 31 December

2019 2018

Notes US$ US$

(Unaudited) (Unaudited)

Cash flows from operating

activities

Profit and comprehensive

income for the period 5,541,172 5,950,711

Adjustments for:

Purchase of investments 4 (32,105,737) (80,740,801)

Change in fair value on investments 4 4,569,550 (6,477,685)

Operating cash flows before

movements in working capital (21,995,015) (81.267,775)

Changes in working capital:

Movement in trade and other

receivables (2,207) (63,845)

Movement in trade and other

payables (2,056) 184,024

Net cash used in operating

activities (21,999,278) (81,147,596)

------------- -------------

Cash flows from financing

activities

Net proceeds from issue of

shares 6 30,380,000 76,832,000

Dividends paid to Ordinary

shareholders 8 (8,399,689) (2,957,500)

Net cash generated from financing

activities 21,980,311 73,874,500

------------- -------------

Net movement in cash and

cash equivalents during the

period (18,967) (7,273,096)

Cash and cash equivalents

at the beginning of the period 5,500,139 43,030,736

Cash and cash equivalents

at the end of the period 5,481,172 35,757,640

============= =============

The accompanying notes are an integral part of these condensed

interim financial statements.

Notes to the Condensed Interim Financial Statements

For the 6 month period ended 31 December 2019

1. General information

The Company was incorporated with limited liability in Guernsey

under the Companies (Guernsey) Law, 2008, as amended, on 6 February

2017 with registered number 63061, and is regulated by the GFSC as

a registered closed-ended investment company. The registered office

and principal place of business of the Company is 1 Le Truchot, St

Peter Port, Guernsey, Channel Islands, GY1 1WD.

On 18 December 2017, the Company announced the results of its

Placing and Offer for Subscription of Ordinary Shares, which raised

gross proceeds of US$91 million. The Company's ordinary shares were

listed on the Specialist Funds Segment of the Main Market of the

London Stock Exchange effective 20 December 2017.

On 11 October 2018, the Company announced that it had raised

gross proceeds of US$78,400,000 pursuant to the Placing and Offer

for Subscription of C-Class Shares. The Company's C-Class Shares

were listed on the Specialist Funds Segment of the Main Market of

the London Stock Exchange effective 16 October 2018.

On 31 January 2019 , the Company announced that the C-Class

Share conversion had been completed . The resulting 84,624,960

ordinary shares were listed on the Specialist Funds Segment of the

Main Market of the London Stock Exchange effective 12 February 2019

.

On 11 March 2019 , the Company announced the results of its

Placing and Offer for Subscription of 49,019,608 Ordinary Shares,

which raised gross proceeds of US$50 million. These ordinary shares

were listed on the Specialist Funds Segment of the Main Market of

the London Stock Exchange effective 14 March 2019.

On 20 September 2019 , the Company announced the results of its

Placing and Offer for Subscription of 30,693,070 Ordinary Shares,

which raised gross proceeds of US$31 million. These ordinary shares

were listed on the Specialist Funds Segment of the Main Market of

the London Stock Exchange effective 24 September 2019. Total number

of shares in issue as at 31 December 2019 was 255,337,638 (Note

6).

2. Significant accounting policies

(a) Basis of Preparation

The Condensed Interim Financial Statements have been prepared on

a going concern basis in accordance with IAS 34 Interim Financial

Reporting, and applicable Guernsey law. These Condensed Interim

Financial Statements do not comprise statutory Financial Statements

within the meaning of the Companies (Guernsey) Law, 2008, and

should be read in conjunction with the Financial Statements of the

Company as of and for the year ended 30 June 2019, which were

prepared in accordance with International Financial Reporting

Standards. The statutory Financial Statements for the year ended 30

June 2019 were approved by the Board of Directors on 10 September

2019. The opinion of the auditors on those Financial Statements

were not qualified. The accounting policies adopted in these

Condensed Interim Financial Statements are consistent with those of

the previous financial year and the corresponding interim reporting

period, except for the adoption of new and amended standards as set

out below.

Basis of non-consolidation

The directors consider that the Company meets the investment

entity criteria set out in IFRS 10. As a result, the Company

applies the mandatory exemption applicable to investment entities

from producing consolidated financial statements and instead fair

values its investments in its subsidiaries in accordance with IFRS

13.

Refer to note 3 for further disclosure on accounting for

subsidiaries.

(b) New and amended standards

At the reporting date of these Condensed Interim Financial

Statements, the following standards, interpretations and

amendments, which have not been applied, were in issue but not yet

effective:

Amendments to IFRS 3 "Business Combinations" was issued in July

2001 and become effective for periods beginning on or after 1

January 2020. These amendments will clarify the definition of a

business.

Amendments to IAS 1 "Presentation of Financial Statements" that

become effective for periods beginning on or after 1 January 2020

and 1 January 2022 respectively. These amendments will clarify the

definition of material and the classification of liabilities as

current or non-current.

Amendments to IAS 8 " Accounting Policies, Changes in Accounting

Estimates and Errors" that become effective for periods beginning

on or after 1 January 2020. These amendments will clarify the

definition of material.

It is not anticipated that the revisions to the abovementioned

standards will have any material impact on the Company's financial

position, performance or disclosures in its financial

statements.

There are no other standards, interpretations or amendments to

existing standards that are not yet effective that would be

expected to have a significant impact on the Company.

(c) Standards, amendments and interpretations effective during the period

The new and revised Standards and Interpretations adopted in the

current period did not have any significant impact on the amounts

reported in these condensed interim financial statements.

(d) Segmental reporting

The Chief Operating Decision Maker is the Board of Directors.

The Directors are of the opinion that the Company is engaged in a

single segment of business, being the investment of the Company's

capital in secondhand commercial vessels. The financial information

used to manage the Company presents the business as a single

segment.

(e) Income

Dividend Income

Dividend income is accounted for on an accruals basis from the

date the dividend is declared.

Bank Interest Income

Interest income is accounted for on an accruals basis.

(f) Expenses

Expenses are accounted for on an accruals basis. Any performance

fee liability is calculated on an amortised cost basis at each

valuation date, with the respective expense charged through the

Statement of Comprehensive Income. The Company's investment

management and administration fees, finance costs and all other

expenses are charged through the Condensed Statement of

Comprehensive Income.

(g) Dividends to Shareholders

Dividends are accounted for in the Statement of Changes in

Equity in the year in which they are declared.

(h) Taxation

The Company has been granted exemption from liability to income

tax in Guernsey under the Income Tax (Exempt Bodies) (Guernsey)

Ordinance, 1989 amended by the Director of Income Tax in Guernsey

for the current period. Exemption is applied and granted annually

and subject to the payment of a fee, currently GBP1,200.

(i) Financial Assets and Financial Liabilities

The Company classifies its investments in LS Assets Limited

("LSA") as financial assets at fair value through profit or loss

("FVTPL").

The Company measures and evaluates the net assets of LSA on a

fair value basis. The net assets include the underlying SPVs which

values all vessels on a fair value basis.

The Company reports fair value information to the Directors who

use this to evaluate the performance of investments.

Recognition of financial assets and liabilities

Financial assets and financial liabilities are recognised in the

Company's Condensed Statement of Financial Position when the

Company becomes a party to the contractual provisions of the

instrument. Financial assets and financial liabilities are

initially measured at fair value. Transaction costs that are

directly attributable to the acquisition or issue of financial

assets and financial liabilities (other than financial assets and

financial liabilities at fair value through profit or loss) are

added to or deducted from the fair value of the financial assets or

financial liabilities, as appropriate, on initial recognition.

Transaction costs directly attributable to the acquisition of

financial assets or financial liabilities at fair value through

profit or loss are recognised immediately in the Condensed

Statement of Comprehensive Income.

Financial assets at fair value through profit or loss

Financial assets are classified at FVTPL when the financial

asset is either held for trading or it is designated at FVTPL.

Financial assets at FVTPL are stated at fair value, with any gains

or losses arising on re-measurement recognised in the Condensed

Statement of Comprehensive Income.

The Company's investment in LSA has been designated as at FVTPL

on the basis that it is managed and its performance is evaluated on

a fair value basis, in accordance with the Company's documented

investment strategy, and information about the investments is

provided internally on that basis. The Company measures and

evaluates the performance of the entire investment into LSA on a

fair value basis by using the net asset value of LSA including, in

particular the underlying SPVs and the fair value of the SPVs'

investments into their respective vessel assets as well as the

residual net assets/liabilities of both the SPVs and LSA itself.

The investment in LSA consists of both equity and debt

instruments.

In estimating the fair value of each underlying SPV (as a

constituent part of LSA's net asset value at fair value), the Board

has approved the valuation methodology for valuing the shipping

assets held by the SPVs. The carrying value of a shipping asset

consists of its charter-free value plus or minus the value of any

charter lease contracts attached to the vessel, plus or minus an

adjustment for the capital expenditure associated with the dry

docking of the vessel. Refer to Note 3 which explains in detail the

judgements and estimates applied.

There are Time Charter contracts in place for vessels. Such

Charters will vary in length but would typically be in the 2 - 8

years' range. As the shipping markets can be volatile over time,

the value of such Charters will therefore either add to or detract

from the open market Charter-Free value of the vessel.

Under a time charter, the vessel owner provides a fully

operational and insured vessel for use by the charterer. There is a

fluid Charter market reported daily by freight brokers on the basis

of time charter rates.

Once a contracted time charter is known this is compared to the

market benchmark and the

difference is discounted using an industry weighted average cost

of capital to establish a negative or positive value of the

charter.

The value of the Charter is added to the Charter-Free value to

ascertain a value with Charter.

Loans and receivables

Trade receivables, loans, and other receivables that have fixed

or determinable payments that are not quoted in an active market

are classified as 'loans and receivables'. Loans and receivables

are measured at amortised cost using the effective interest method,

less any expected credit losses.

Derecognition of financial assets

The Company derecognises a financial asset only when the

contractual rights to the cash flows from the asset expire, or when

it transfers the financial asset and substantially all the risks

and rewards of ownership of the asset to another entity.

If the Company neither transfers nor retains substantially all

the risks and rewards of ownership and continues to control the

transferred asset, the Company recognises its retained interest in

the asset and an associated liability for amounts it may have to

pay.

On derecognition of a financial asset in its entirety, gains and

losses on the sale of investments, which is the difference between

initial cost and sale value, will be taken to the profit or loss in

the Condensed Statement of Comprehensive Income in the period in

which they arise.

Offsetting financial instruments

Financial assets and liabilities are offset and the net amount

reported in the Condensed Statement of Financial Position when

there is a legally enforceable right to offset the recognised

amounts and there is an intention to settle on a net basis or

realise the asset and settle the liability simultaneously.

Financial liabilities and equity

Debt and equity instruments are classified either as financial

liabilities or as equity in accordance with the substance of the

contractual arrangement.

Derecognition of financial liabilities

The Company derecognises financial liabilities when, and only

when, the Company's obligations are discharged, cancelled or when

they expire.

(j) Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, demand deposits

and other short-term highly liquid investments with original

maturities of 3 months or less and bank overdrafts. As of 31

December 2019, the carrying amount of cash and cash equivalents

approximate their fair value.

(k) Foreign currency translation

i) Functional and presentation currency

The financial statements of the Company are presented in US

Dollars, which is also the currency in which the share capital was

raised and investments were purchased, and is therefore considered

by the Directors' to be the Company's functional currency.

ii) Transactions and balances

At each balance sheet date, monetary assets and liabilities that

are denominated in foreign currencies are translated at the rates

prevailing at that date. Non-monetary items carried at fair value

that are denominated in foreign currencies are translated at the

rates prevailing at the date when the fair value was determined.

Non-monetary items that are measured in terms of historical cost in

a foreign crrency are not retranslated. Exchange differences are

recognised in the Condensed Statement of Comprehensive Income in

the period in which they arise. Transactions denominated in foreign

currencies are translated into US Dollars at the rate of exchange

ruling at the date of the transaction.

(l) Going concern

In assessing the going concern basis of accounting the Directors

have had regard to the Company's investment objective, financial

risk management and associated risks (see note 10), recent market

volatility and the potential impact of the Covid-19 virus on the

Company's fleet (as set out in more detail in the section entitled

Principal and Emerging Risks and Uncertainties) . After making

enquiries and bearing in mind the nature of the Company's business

and assets, the Directors consider that the Company has adequate

resources to continue in operational existence for at least the

next twelve months. For this reason, they continue to adopt the

going concern basis in preparing the condensed interim financial

statements.

(m) Equity instruments

An equity instrument is any contract that evidences a residual

interest in the assets of an entity after deducting all of its

liabilities. Equity instruments issued by the Company are

recognised at the proceeds received, net of direct issue costs.

Repurchase of the Company's own equity instruments is recognised

and deducted directly in equity. No gain or loss is recognised in

profit or loss on the purchase, sale, issue or cancellation of the

Company's own equity instruments.

3. Critical Accounting Judgements and Estimates

The preparation of financial statements requires management to

make estimates and judgements that affect the amounts reported for

assets and liabilities as at the statement of financial position

date and the amounts reported for revenue and expenses during the

period. Information about significant judgements, estimates and

assumptions which have the greatest effect on the recognition and

measurement of assets, liabilities, income and expenses were the

same as those that applied to the Annual Report and Financial

Statements for the year ended 30 June 2019.

Critical judgements in applying the Company's accounting

policies - IFRS 10: Consolidated Financial Statements

The audit committee considered the application of IFRS 10, and

whether the Company meets the definition of an investment

entity.

The directors concluded that the Company met the investment

criteria set out in IFRS 10 and therefore consider the Company to

be an investment entity in terms of IFRS 10. As a result, as

required by IFRS 10 the Company is not consolidating its subsidiary

but is instead measuring it at fair value in accordance with IFRS

13.

The criteria which define an investment entity are, as

follows:

-- An entity that obtains funds from one or more investors for

the purpose of providing those investors with investment services;

and

-- An entity that commits to its investors that its business

purpose is to invest funds solely for returns from capital

appreciation, investment income or both (including having an exit

strategy for investments); and

-- An entity that measures and evaluates the performance of

substantially all of its investments on a fair value basis; and

The Company's objective of pooling investors' funds for the

purpose of generating an income stream and capital appreciation is

consistent with the definition of an investment entity.

Critical judgements and estimates in applying the Company's

accounting policies - financial assets at fair value:

The Company values its investment in LSA at it's net asset

value. The net asset values of LSA's subsidiary SPVs comprise

shipping vessels which are measured at fair value and residual net

assets/liabilities of each of the entities, and is considered by

the Board and Investment Manager as an appropriate measure of fair

value of these investments.

In estimating the fair value of each underlying SPV, the Board

has approved the valuation methodology for valuing the shipping

assets held by the SPVs. The carrying value of a standard vessel

consists of its charter-free value plus or minus the value of any

charter lease contracts attached to the vessel, plus or minus an

adjustment for the capital expenditure associated with the dry

docking cycle of the vessel. This latter adjustment is an addition

to value when the valuation date is nearer to the vessel's last dry

docking than to its next expected visit to dry dock, and vice

versa. In the opinion of the Directors, the carrying value

determined as set out in more detail below represents a reasonable

estimate of the fair value of that shipping asset.

The charter-free and associated charter values of typical

vessels are calculated using an on-line valuation system provided

by VesselsValue Ltd. For charterfree values the system contains a

number of algorithms that combine factors such as vessel type,

technical features, age, cargo capacity, freight earnings, market

sentiment and recent vessel sales.

For charter values, the system provides a DCF (Discounted

Cashflow) module where vessel specific charter details are input

and measured against system provided market benchmark rates to

obtain a premium or discount value of the charter versus the

typical prevailing market.

The adjustment for the capital expenditure associated with the

dry docking of the vessel is time apportioned on a straight line

basis over the period between the vessel's last visit to dry dock

and the date of its next expected visit, by reference to the actual

cost of the last visit and the budgeted cost of the next.

The remaining vessels are considered to be specialist vessels on

long-term bareboat charters and are valued on a pure DCF basis by

the Investment Manager using vessel specific information and both

observable and unobservable data. The VesselsValue Ltd platform is

not used for these assets. This DCF approach determines the present

value of the future lease payments discounted at the project cost

of capital and is deemed to be a fair representation of the

vessel/lease value. Project cost of capital discount rates are

reviewed on a regular basis to ensure they remain relevant to

prevailing project and market risk parameters. The prospectus sets

out the basis on which non-typical and specialist vessels would be

valued.

4. Financial Assets designated at fair value through profit or loss (Investment)

The Company owns the Investment Portfolio through its investment

in LSA. The investment by LSA comprises the NAVs of the SPVs. The

NAVs consist of the fair value of vessel assets and the SPVs

residual net assets/liabilities. The Investment Portfolio is

designated as Level 3 item on the fair value hierarchy because of

the lack of observable market information in determining the fair

value. The investment held at fair value is recorded under

Non-Current Assets in the Condensed Statement of Financial Position

as there is no current intention to dispose of any of the

assets.

31 December 30 June

2019 2019

US$ US$

LSA (Unaudited) (Audited)

Brought forward cost

of investment 199,739,076 46,140,091

Total investment acquired

in the year / period 32,105,737 153,598,985

Carried forward cost

of investment 231,844,813 199,739,076

Expenditure

Brought forward unrealised

gains on valuation 21,258,997 3,482,168

Movement in unrealised