TIDMQFI

RNS Number : 9542H

Quadrise Fuels International PLC

30 March 2020

30 March 2020

Quadrise Fuels International plc

("Quadrise", "QFI", the "Company" and together with its

subsidiaries the "Group")

Interim Results for the 6-month period ended 31 December

2019

Quadrise Fuels International plc (AIM: QFI) announces its

unaudited interim results for the 6 months ended 31 December 2019

and an update on developments during the first quarter of 2020.

Financial Summary

-- GBP3.8 million in cash reserves at 31 December 2019 (31

December 2018: GBP1.0 million) which allows the Company, based on

budgeted expenditure, to pursue its business development and

related project activities until the end of 2020. With additional

cost saving measures being implemented, and the expected savings

arising from Covid-19 travel restrictions we are very confident

that we will be able to extend our period of operation to the end

of Q1 2021.

-- Loss after tax of GBP3.1million (2018: GBP1.70 million). This

included production and development costs of GBP0.7m (2018:

GBP0.9m), administration expenses of GBP1.1m (2018: GBP0.7m) and a

warrant charge of GBP0.9m (2018: GBPnil).

-- Total assets of GBP7.8 million at 31 December 2019 (2018: GBP5.1 million).

Business Summary

Industrial Applications

Trial Agreement in Morocco

-- Following the appointment of Younes Maamar as our agent in

Morocco in Q1 2019, the Group entered into an agreement with an

international chemicals and mining group headquartered in Morocco

on 29 November 2019, to undertake a pilot trial and provide paid

engineering studies for larger commercial scale trials at one of

the client's facilities in Morocco.

-- All the UK based preparation work and testing for the trial

has been completed and the equipment and MSAR(R) fuel required for

the trial are in Morocco.

-- In response to the Covid-19 situation, site access

restrictions have been implemented by the client which have caused

the trial programme to be delayed, but as soon as prevailing

restrictions are lifted and QFI can gain safe access to the site

the trial will proceed.

-- Contingency plans have been developed to minimise the impact

of this delay on the overall programme. The engineering studies for

the next phases have now commenced, earlier than planned, though

payment for the studies is contingent on the successful completion

of the pilot trial. We are highly confident of our ability to

successfully conclude the pilot trial and so bringing forward this

work will reduce the time required to progress to the planned

commercial scale trials at the client's facility. Depending on the

time required to gain access to the site, this approach should

materially reduce the impact of any delay outside of our

control.

Power Applications, Refinery Refuelling & Co-Development

Opportunities

Kingdom of Saudi Arabia (Al Khafrah Holdings Group ("AKHG") and

Aleph Commodities)

-- A meeting was held in Riyadh in early March 2020 with

representatives from key stakeholders on the power project,

initiated by the Chairmen of AKHG and a major KSA utility

respectively. There was a positive and supportive dialogue at the

meeting, where MSAR(R) project economics and environmental benefits

were shared. Follow-up meetings are planned in KSA, once travel is

permitted and the Company continues to liaise with stakeholders

remotely.

South America (Freepoint Commodities)

-- In January 2020 QFI and Freepoint jointly met with the senior

management of a national oil company in South America, where there

are MSAR(R) opportunities for refinery refuelling, domestic power

generation and export that would significantly improve energy

economics and balance of trade for the country.

-- As previously announced, a QFI team visited the oil-company's

refinery and a neighbouring powerplant in early March 2020 with

Freepoint. Detailed information is being shared by the refinery,

which will enable QFI to promptly complete the relevant

techno-economic studies for the MSAR(R) proposal. This is expected

to be followed by testing and emulsification of refinery residue

samples at the Quadrise Research Facility ("QRF"), with planning to

facilitate MSAR(R) trials at the refinery and powerplant

respectively.

Mexico (Redliner & Freepoint Commodities)

-- Quadrise continues to engage with key stakeholders and

decision makers in the energy sector to initiate MSAR(R) technology

testing and deployment in Mexico. MSAR(R) opportunities include

refinery refuelling, domestic power generation and MSAR(R) exports

that can all reduce distillate fuel imports.

-- An agreement is being finalised to enable detailed

information to be shared electronically by the national oil

company, which will allow QFI to promptly complete the relevant

techno-economic studies for MSAR(R) on candidate refineries

currently producing fuel oil.

European Refiner

-- The client is now comparing the economics of MSAR(R)

production and consumption with another option for the refinery to

produce IMO 2020 compliant fuel (which requires complex refinery

testing during Q2 and Q3 2020). Based on the original schedule, the

client is expected to make a decision at the end of Q3 2020, and if

MSAR(R) is selected, the Company would expect to finalise the site

trial agreement, including schedule, for refinery refuelling during

Q4 2020. This timing may be subject to changes by the client driven

by Covid-19 restrictions.

Nouryon

-- We have held positive discussions regarding business

collaboration opportunities between Quadrise, Nouryon and related

companies within the Carlyle Group in the energy sector on

potential opportunities to progress MSAR(R) projects.

Marine Applications

-- The implementation of IMO 2020 compliance was the main focus

for shipping companies and operators as Q1 2020 commenced, with

Covid-19 response and mitigation becoming increasingly important as

the quarter progressed.

-- Positive meetings have been held with senior management of

two major shipping companies, each with large fleets and leading

positions in scrubber implementation in their respective segments

of the shipping industry. Discussions are progressing, with the

intention of investigating potential MSAR(R) Letter Of No Objection

("LONO") testing and commercial deployment, on success, to reduce

fuel costs further whilst improving environmental performance.

-- Quadrise is investigating the merits of establishing, or

linking with, a physical bunker fuel supplier, to provide a supply

network for high sulphur fuels in parallel with MSAR(R) for the

LONO testing opportunities being advanced.

Upstream

-- An MoU has been signed with Valkor Technologies, to

investigate the potential deployment of MSAR(R) technology in Utah,

USA.

Covid-19 Contingency Planning and Cost Saving Measures

In early March the Company implemented a contingency plan to

protect our employees and business as a pre-emptive, pragmatic and

measured approach to prevailing global events, that ensures

business continuity in our London office and at QRF.

London based staff will work remotely with little, if any,

impact on their normal activities. Business development activities

for the Company continue remotely, utilising web conferencing

facilities, and supported by the Group's in-country agents and

representatives, whilst Covid-19 related travel restrictions

prevail.

QRF (based in Essex) remains fully operational, albeit with

social-distancing measures in place and highly restricted

acceptance of third-party visitors.

We have given notice to break our London office lease, in line

with its terms, on 28(th) September 2020. This will ensure that we

are able to have facilities that are more flexible, significantly

less expensive, and better suited to our current requirements.

This, alongside other measures that we are currently reviewing, and

the expected reduction in our travel costs in the short--term, will

collectively provide a material benefit to the cashflow of the

business.

Outlook - Current trading and prospects

-- We built significant momentum during 2019 and this continued

into Q1 2020, though within the past few weeks we have started to

see the impact of the rapidly developing global response to the

Covid-19 situation. Currently, the only definitive impact has been

the delay to the planned pilot trial at the client's site in

Morocco - and we have already brought forward the latter phases of

work to mitigate this.

-- We are continuing to progress other projects using our local

agents and through phone/web conferencing and are still seeing

active engagement from our clients, which is encouraging.

-- Our business development pipeline provides the platform

needed to deliver our strategy of translating opportunities during

2020 into projects where commercial revenues can be expected to

follow successful trial outcomes and we are focused on delivering

this at the earliest possible opportunity.

Mike Kirk, Chairman of QFI, said:

"Quadrise continued to progress a range of business development

and project opportunities in the period, underlining the advantages

of our strategy of pursuing a diversified range of projects. We are

particularly excited by the progress made in Morocco where we have

an agreement to undertake a pilot trial which could lead to

paid-for engineering studies, with commercial revenues expected to

follow the successful conclusion of these trials. We have already

taken action to mitigate the impact of the Covid-19 restrictions

imposed by the client and we and the client look forward to

commencing the on-site activities as soon as it is safe for us to

do so.

Our other business development activities will continue to be

progressed through our local partners and through web-conferencing

facilities, as appropriate, until travel restrictions are lifted.

This will enable us to make continued progress in these challenging

times.

We have also responded promptly to reduce our costs in the light

of the potential impact of the Covid-19 pandemic on the business,

including giving notice to break the lease at our current London

offices to seek much more flexible and cost-effective options that

meet our business needs. These continuing actions will enable the

business to further extend its activities, through to the end of Q1

2021.

As we did in early 2019, we have instituted the Funding

Committee and will be reviewing the Company's financing needs

throughout the year, so that we will remain in a position to

translate the prospects being progressed during 2020 into projects

where commercial revenues can be expected to follow successful

trial outcomes."

Investor Conference Call

The management team will be hosting an investor conference call

at 10.00am (UK) on Tuesday 30(th) March 2020, where it will provide

investors with an opportunity to ask questions on recent

developments, including the latest results.

Any investors wishing to listen or participate in the call are

encouraged to register through the link provided below. You will

then be provided with a calendar invite and unique pin to join the

call:

https://secure.emincote.com/client/quadrise/quadrise007/vip_connect

For further information, please refer to the Company's website

at www.quadrisefuels.com , or contact ir@quadrisefuels.com or

phone:

Quadrise Fuels International Plc

Mike Kirk, Chairman +44 (0)20 7031 7321

Jason Miles, Chief Executive Officer

Nominated Adviser

Cenkos Securities plc

Ben Jeynes

Katy Birkin +44 (0)20 7397 8900

Joint Brokers

Peel Hunt LLP

Richard Crichton +44 (0)20 7418 8900

David McKeown

Shore Capital Stockbrokers Limited

Toby Gibbs

Fiona Conroy +44 (0)20 7408 4090

Public & Investor Relations

FTI Consulting

Ben Brewerton +44 (0)20 3727 1000

Ntobeko Chidavaenzi Quadrise@fticonsulting.com

Notes to Editors

QFI is the supplier of MSAR(R) emulsion technology and fuels, a

low-cost alternative to heavy fuel oil (one of the world's largest

fuel markets, comprising over 450 million tons per annum) in the

global power generation, shipping, industrial and refining

industries.

This announcement is inside information for the purposes of

article 7 of Regulation 596/2014.

Chairman's Statement

Introduction

The first half of the financial year saw Quadrise continue to

progress, to good effect, its range of business development and

project opportunities across a variety of MSAR(R) applications. Our

strategy of pursuing a diversified range of projects provides

Quadrise with access to a rich body of experience through its

various partners at negligible cash cost, and the scope to fully

leverage its in-house business development capabilities. The

Company remains focused on translating the prospects being

progressed during 2020 into projects where commercial revenues can

be expected to follow successful trial outcomes.

We are particularly pleased with the progress made in Morocco

where we have an agreement to undertake a pilot trial at an

industrial facility, which, if successful, will lead to paid-for

engineering study work to scope and plan for trials on commercial

units at the facility, with commercial revenues expected to follow

the successful conclusion of these trials. Given delays to the

commencement of the pilot trial due to Covid-19 restrictions

imposed by the client, work on engineering studies for the

subsequent phases has now commenced ahead of time to mitigate the

impact on the overall project timeline.

We were delighted to announce a comprehensive funding programme

in Q3 2019, which commenced with the announcement of up to

GBP4million (gross) from Bergen Global Opportunities Fund

("Bergen"). The first GBP2 million tranche was drawn down in

September 2019. Alongside this we announced a planned open offer of

up to GBP1.5 million in August which was subsequently increased by

20% to GBP1.8 million when it was formally announced in early

September that the open offer was fully underwritten by Peel Hunt

and was accompanied by a subscription of a further GBP0.7 million

to raise additional funds of GBP2.5 million (gross). In total this

provided funding for the business through to the end of calendar

2020, without considering the potential additional drawdown of GBP2

million from Bergen which could potentially be available from

October 2020 subject to an increase in share price which would

follow project progress.

During the period under review, the positive shifts in the

liquid fuel markets continued, with the combination of a positive

macro environment and improved MSAR(R) economics, driven by the

widening spread between Heavy Fuel Oil ("HFO") and Gas Oil. In

addition, we saw the continued progression of high-sulphur fuels in

combination with scrubbers as the de-facto lowest cost solution to

meet the International Maritime Organization ("IMO") 2020 sulphur

regulations - resulting in an increased uptake across all major

shipping sectors. Overall, this provides a positive backdrop for

Quadrise to work with refiners and fuel consumers in the power,

marine and industrial markets to progress MSAR(R) projects.

However, the Company's ability to progress these projects is

expected to be impacted by the recent global events relating to the

dispute between KSA and Russia which has had a significant adverse

impact on oil and product prices, and the Covid-19 pandemic which

are discussed further below.

Research, Development and Innovation ("RDI") activities remain

central to our technology-led offering and QRF remains our hub for

these activities. Work during the period and into the first quarter

of 2020 focused on the design, fabrication and commissioning of a

new lab mill that is suitable for development and testing work on

heavier residues that require higher working temperatures and

pressures for MSAR(R) manufacture. Latterly, the focus was on the

work to support the pilot trial in Morocco including MSAR(R) fuel

manufacturing and burner tip testing.

We continue to have a close working relationship with Nouryon

and were pleased to enter into a new three-year Exclusive Purchase

and Supply Agreement with them in October 2019. QFI holds regular

quarterly meetings with them and have recently started discussions

between QFI, Nouryon and another Carlyle entity in the downstream

sector about MSAR(R) opportunities.

Developments During the Period and Q1 2020

Progress has been made in several areas that have enabled

Quadrise to increase the breadth and depth of its business

development programme, addressing the vast majority of the

potential MSAR(R) market opportunity. Developments by MSAR(R)

market segment are summarised below:

Industrial Applications

Morocco - Two site visits to Morocco took place, in December

2019 and January 2020 respectively, concluding with the completion

of a Hazard and Operability (HAZOP) study of the pilot kiln and the

associated QFI equipment that will be used to undertake the trial.

This enabled the design for the pumping and heating unit to be

finalised, and then be fabricated and commissioned at QRF. This

unit was then used to test burner tips at QRF that will be utilised

in the trial, including specialist tips designed specifically for

MSAR(R) by our in-house combustion experts. The final stage of the

preparations in the UK was the production of over 1 tonne of

MSAR(R) fuel

at QRF for shipment.

All equipment and fuel required for the trial have now been

shipped to Morocco and this will enable the trial to commence as

soon as QFI can safely access the site. At this stage, we do not

have an updated schedule, however, we are confident that once we

can access the site safely, we will be able to progress the trial

rapidly. The original plan was to move into the second phase of

paid feasibility studies for larger trials (that are a precursor to

commercial roll-out in the partners' facilities) following

successful completion of the pilot trial. We have now reached

agreement with the client to commence this work now, to utilise the

delay in the pilot trial to best effect, with the payment for this

work still being conditional on the successful conclusion of the

pilot trial.

Power Applications, Refinery Refuelling, & Co-Development

Opportunities

-- Kingdom of Saudi Arabia - Following discussions between the

Chairman of AKHG and the Chairman of a major power utility in KSA,

QFI attended a meeting in Riyadh in March with representatives from

these key stakeholders, together with a major boiler OEM to discuss

resuming the planned 400MWe boiler trial using in-Kingdom MSAR(R)

manufacture. The presentation was received positively by the

attendees, with follow-up meetings to be held in the power

utility's Western Province division. In parallel, AKHG is

progressing contacts at the highest levels with other major

stakeholders to promote MSAR(R) .

-- South America (Freepoint Commodities) - QFI and Freepoint

jointly met with senior management of a national oil company in

South America in very early January 2020 where there is an exciting

MSAR(R) opportunity for refinery refuelling, leading to domestic

power generation and export opportunities that would reduce energy

costs and emissions for the country. Follow-up meetings at the

relevant refinery were attended, in person, by three members of the

Quadrise team, including Jason Miles (CEO) and Mark Whittle (COO)

in early-March, and actions are progressing from this meeting to

ensure that we have the all the refinery data needed to complete

the required techno-economic studies during March/April. We will

then present a roadmap for trial MSAR(R) testing at the refinery

and a neighbouring powerplant as a precursor to commercial

production and supply.

-- Mexico (Redliner & Freepoint Commodities) - MSAR(R)

opportunities include refinery refuelling, domestic power

generation and fuel exports that reduce distillate fuel imports. At

this stage we are working principally through Redliner in Mexico,

who have been progressing opportunities with the national oil

company. We have been encouraged by Redliner's ability to provide

access at the most senior levels in the country. Agreements are

being finalised to enable detailed information to be shared

electronically by the national oil company, which will enable QFI

to promptly complete the relevant techno-economic studies for

MSAR(R) on candidate refineries currently producing fuel oil. We

are also progressing discussions with a major independent power

project developer, who is supportive of MSAR(R) deployment to

provide economic and environmental advantages to new build power

projects in the region.

-- European Refiner - As noted previously, the client is now

comparing the economics of MSAR(R) with another refinery solution

(which requires complex refinery testing during Q2 and Q3 2020) to

enable IMO 2020 compliant fuel supply. As a result, we are

currently anticipating that the client will decide at the end of Q3

2020, though this timing may be subject to change if the testing is

delayed for operational or other reasons. If MSAR(R) is selected,

the Company would expect to finalise the site trial agreement

during Q4, unless there is a delay, including the schedule for the

refinery refuelling in the quarter following a positive decision

being made.

-- Nouryon - We have held positive initial discussions with

Nouryon regarding business collaboration opportunities between

Quadrise, Nouryon and related companies within the Carlyle Group.

These discussions will be progressed during the remainder of 2020.

Our regular updates with Nouryon are continuing, using

web-conferencing when face-to-face meetings are not

practicable.

-- Kuwait - We are still following-up on the meeting held in

late 2019, to obtain up-to date data for the new refinery, both

directly and through our local agent, Hawazin to finalise the

client data and assumptions for the techno-economic study. Assuming

the project economics are positive, Quadrise will submit the

feasibility study with an implementation plan to present to the

client team in Kuwait.

Marine Applications

-- The implementation of IMO 2020 compliance was the main focus

for shipping companies and operators during the period and through

Q1 2020. The Company has had positive meetings with senior

management of two major shipping companies, each with large fleets

and leading positions in scrubber implementation in their segments

of the shipping industry. Following these positive initial

meetings, further discussions were held with their technical teams

to progress plans. The intention is to progress these opportunities

during H1 2020 to investigate potential MSAR(R) Letter Of No

Objection ("LONO") testing and commercial deployment, and on

success, to reduce fuel costs further whilst improving

environmental performance.

-- We are also investigating the merits of establishing, or

linking with, a physical bunker fuel supplier, to provide a supply

network for high sulphur fuels in parallel with MSAR(R) for the

LONO testing opportunities being pursued. These discussions have

continued and are making steady progress. If we do launch this, it

will be alongside trusted counterparties who can manage the

commodity price risk; provide and manage the working capital

requirements; and manage the logistics of a physical bunkering

operation.

Upstream Applications

-- Quadrise and Merlin Energy Resources have jointly met with an

upstream developer with MSAR(R) potential in Africa, and in

parallel, opportunities in South America are being jointly screened

during H1 2020, though there is nothing further to report at this

stage.

-- During Q1 2020 an MOU was signed with Valkor Technologies, to

investigate the potential deployment of MSAR(R) technology in Utah,

USA.

-- Quadrise is also in discussions directly with stakeholders

and government officials regarding an upstream heavy oil project in

Africa, with potential use of MSAR(R) to improve production

economics and for domestic power generation.

Other

There are no material updates to report during the period, or

through Q1, on opportunities with the European Oil Major, Bitumina,

JGC, API Poly-GCL or Maersk Line (both in relation to the Royalty

Agreement and the use of MSAR(R) in their fleet).

Response to Covid-19 Situation and Cost Reduction

Initiatives

We have put in place a pragmatic and measured approach to

protect our staff, their families and the business.

Our London office initially remained open, though staff were

generally working from home and have the necessary facilities and

systems to do so. Since the announcement by the Prime Minister on

the evening of 23(rd) March 2020 our London Office has closed and

will remain closed until current restrictions are lifted.

QRF has remained operational, though with very restricted access

to any third-party visitors, including London-based QFI staff. As

the facility is located in a relatively remote area, with a small

staff that does not use public transport, we believe that we can

continue to keep QRF operational - including the requirements to

abide by social distancing guidelines within the workplace; though

we will, of course, ensure that we take whatever measures are

necessary to protect our staff as the situation develops.

At this stage, we are confident that we can continue to operate

our London-based staff remotely with minimal impact on our

activities. As face to face client meetings are not possible

currently due to Covid-19 social-distancing measures and wider

travel restrictions, these are being replaced with

web-conferencing. In addition, our various local agents/partners,

will continue to provide on-the ground support in the various

regions/countries in which they operate. At this stage, we believe

that these actions will enable us to continue to progress our key

business development activities and projects during the remainder

of 2020

We continue to operate with a lean team at Quadrise. Jason

Miles, CEO, supported by Mark Whittle, COO, spearhead our business

development and project delivery activities. I lead on PR and IR

activities, supported by David Scott, Head of Finance, and QRF is

managed by our Head of Operations Bernard Johnston. With

restrictions on travel in place for an indeterminate time, we will

be significantly reducing our expected business development travel

costs and will seek to minimise the potential adverse impact of

these restrictions on work programmes where possible. The bringing

forward of a significant proportion of the next phase of work on

the activities in Morocco is a good example of how we can reduce

the impact of delays at little, if any, marginal cost to the

business.

Given the unprecedented developments relating to Covid-19 over a

matter of days, we have taken the opportunity to have a close look

at our cost-base, notwithstanding the tight control that we have

always maintained to ensure that we remain in the best possible

position to progress our business development and project

opportunities through the remainder of 2020. At this stage, the

most significant of these measures, is the decision to break the

lease at our current London Office. The notice to break the lease

was served on Thursday 26(th) March 2020 and will be effective from

28(th) September 2020. The coincidence of the break being available

at this time, together with our experience of remote working, has

provided us with the opportunity to fundamentally review our office

requirements and we will look for solutions that deliver much lower

cost, more flexible and appropriately sized facilities from

September 2020. This is expected to reduce our annual costs

relating to a London office very significantly. In addition, we are

looking at all other costs in the business and will be doing

further work on this in the coming weeks. Where appropriate, we

will be accessing the support being provided by the Government,

though for clarity this will not include the Government-backed

loans scheme, as we are not eligible to participate.

Financial Position

The Group held cash and cash equivalents of approximately GBP3.8

million as at 31 December 2019.

The Group recorded a loss of GBP3.1m for the six months to 31

December 2019 (2018: GBP1.7m). This included production and

development costs of GBP0.7m (2018: GBP0.9m), administration

expenses of GBP1.1m (2018: GBP0.7m) and a warrant charge of GBP0.9m

(2018: GBPnil).

Basic and diluted loss per share was 0.32p (2018: 0.19p).

The Group's total assets amounted to GBP7.8 million as at 31

December 2019 (GBP5.1 million as at 31 December 2018). Apart from

the cash and cash equivalents, this included fixed tangible assets

(mainly plant and equipment) of GBP0.7 million and MSAR(R) trade

name of GBP2.9 million.

The Group has accumulated tax losses of approximately GBP50.6

million (2018: GBP48.7 million) available to be carried forward

against future profits.

Funding

Our existing cash resources continue to enable the Group to

pursue our business development activities throughout calendar year

2020, based on the originally budgeted levels of expenditure. With

the significant travel restriction now in place, together with

further active cost saving measures within the business, such as

the decision to terminate the lease of our current London office,

we are very confident that we will be able to operate to the end of

Q1 2021. This work is still in its early stages, but it will

provide the Company with the necessary platform to ensure that it

remains in the best possible position to resume normal business

development and project activities when able to do so safely.

As disclosed previously, a further GBP2 million of funding is

potentially available to the Company from October 2020 through the

agreement with Bergen. However, for Quadrise to have a high degree

of confidence of this being available, it will require a

substantial and sustained improvement in the share price. This is

likely to require a clear demonstration of substantive progress on

our key projects, as well as a continuation of our efforts in

investor relations and market communication. Alongside this, as we

did in 2019, we will continue to evaluate a wide variety of funding

options for the business and have reconstituted the Funding

Committee with immediate effect to assist in this task.

Outlook - Current trading and prospects.

We built significant momentum during 2019 and this continued

into Q1 2020, though within the past few weeks we have started to

see the impact of the rapidly developing global response to the

Covid-19 situation. Currently, the only definitive impact from

Covid-19 has been the delay to the planned pilot trial at the

client's site in Morocco. We do not have a new schedule for this

trial, but we have now brought forward the majority of the second

stage of the work, which will provide the detailed engineering

studies to enable the client to progress trials on the commercial

units at the facility, subject to entering into the new agreements

planned to cover these trials and the satisfactory conclusion of

the pilot trial. We are highly confident of our ability to

successfully conclude the pilot trial and so bringing forward this

work will reduce the time required to progress to the planned

commercial scale trials at the client's facility. Depending on the

time required to gain access to the site, this approach should

materially reduce the impact of any delay outside of our

control.

We are continuing to progress other projects using our local

agents and through phone/web conferencing and are still seeing

active engagement from our clients, which is encouraging. We

believe that the business development pipeline outlined above

provides the platform needed to deliver our strategy of translating

opportunities during 2020 into projects where commercial revenues

can be expected to follow successful trial outcomes

and we are focused on delivering this at the earliest possible

opportunity.

As noted previously, the coincidence of the Covid-19 global

pandemic and the dispute between KSA and Russia in relation to oil

production has had a significant adverse impact on oil and product

prices. Current markets are highly volatile - though we believe

most clients will continue to base their planning on long-run

prices. However, there is no doubt that the operational imperative

to respond to the Covid-19 situation will be the focus for most

organisations and it will remain important that we can respond

flexibly as the situation continues to develop. Our business

development activities, both directly and through our agents, will

progress as quickly as possible during this period and we expect to

be able to make positive progress during the rest of the year and

look forward to providing updates as appropriate.

We announced in December 2019, that due to other work

commitments, Hemant Thanawala resigned with effect from 31(st)

December 2019 and the Board would like to thank him for his many

years of service as both an executive and non-executive director.

In January 2020, we announced changes to the board that became

effective on 1(st) February 2020. Jason Miles was promoted to CEO,

from COO, and Mark Whittle was promoted to COO, from Head of

Projects and joined the Board. I am delighted to be working with

both Jason and Mark in their new roles.

Mike Kirk

Chairman

27 March 2020

Condensed Consolidated Statement of Comprehensive Income

For the 6 months ended 31 December 2019

Note 6 months 6 months Year ended

ended 31 ended 31 30 June

December December 2019

2019 2018 Audited

Unaudited Unaudited GBP'000

GBP'000 GBP'000

Continuing operations

Revenue - - 22

Production and development

costs (730) (934) (1,475)

Other administration expenses (1,078) (738) (1,462)

Share option charge 4 (277) (6) (154)

Warrant charge 5 (881) - (105)

Foreign exchange (loss)/gain (4) 11 10

------------------------------- ----- ----------- ----------- -----------

Operating loss (2,970) (1,667) (3,164)

Finance costs 6 (144) (3) (6)

Finance income 4 1 3

------------------------------- ----- ----------- ----------- -----------

Loss before tax (3,110) (1,669) (3,167)

Taxation - - 184

------------------------------- ----- ----------- ----------- -----------

Total comprehensive loss for

the period from continuing

operations (3,110) (1,669) (2,983)

-------------------------------------- ----------- ----------- -----------

Loss per share - pence

Basic 7 (0.32)p (0.19)p (0.34) p

Diluted 7 (0.32)p (0.19)p (0.34) p

------------------------------- ----- ----------- ----------- -----------

Condensed Consolidated Statement of Financial Position

As at 31 December 2019

Note As at As at As at

31 December 31 December 30 June

2019 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 8 656 811 730

Intangible assets 9 2,924 2,924 2,924

Non-current assets 3,580 3,735 3,654

------------------------------- ----- ------------- ------------- ---------

Current assets

Cash and cash equivalents 3,778 967 1,060

Trade and other receivables 257 166 169

Prepayments 118 163 106

Stock 61 61 61

------------------------------- ----- ------------- ------------- ---------

Current assets 4,214 1,357 1,396

------------------------------- ----- ------------- ------------- ---------

TOTAL ASSETS 7,794 5,092 5,050

------------------------------- ----- ------------- ------------- ---------

Equity and liabilities

Current liabilities

Trade and other payables 501 481 288

Provision for decommissioning - 189 -

Convertible securities 11 1,864 - -

------------------------------- --- --------- --------- ---------

Current liabilities 2,365 670 288

------------------------------- --- --------- --------- ---------

Equity attributable to

equity holders of the parent

Issued share capital 9,958 8,622 9,227

Share premium 76,190 73,642 74,438

Share option reserve 3,732 3,346 3,455

Warrant reserve 1,122 - 105

Reverse acquisition reserve 522 522 522

Accumulated losses (86,095) (81,710) (82,985)

------------------------------- --- --------- --------- ---------

Total shareholders' equity 5,429 4,422 4,762

------------------------------- --- --------- --------- ---------

TOTAL EQUITY AND LIABILITIES 7,794 5,092 5,050

------------------------------- --- --------- --------- ---------

Condensed Consolidated Statement of Changes in Equity

For the 6 months ended 31 December 2019

Issued Reverse

share Share Share Warrant acquisition Accumulated

capital premium option reserve reserve losses Total

GBP'000 GBP'000 reserve GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

As at 1 July

2019 9,227 74,438 3,455 105 522 (82,985) 4,762

Loss and total

comprehensive

loss for the

period - - - - - (3,110) (3,110)

Share option

charge - - 277 - - - 277

------------------ --------- ---------- ---------- ---------- ------------- -------------- ----------

Warrant charge - - - 881 - - 881

------------------ --------- ---------- ---------- ---------- ------------- -------------- ----------

Deferred warrant

charge - - - 136 - - 136

------------------ --------- ---------- ---------- ---------- ------------- -------------- ----------

New shares

issued net

of issue costs 731 1,752 - - - - 2,483

------------------ --------- ---------- ---------- ---------- ------------- -------------- ----------

Shareholders'

equity at 31

December 2019 9.958 76,190 3,732 1,122 522 86,095 5,429

------------------ --------- ---------- ---------- ---------- ------------- -------------- ----------

As at 1 July

2018 8,622 73,642 3,432 - 522 (80,133) 6,085

Loss and total

comprehensive

loss for the

period - - - - (1,669) (1,669)

Share option

charge - - 6 - - - 6

-------------------- ------ ------- ------ ---- ---- --------- ------------------

Transfer of

balances relating

to expired

share options - - (92) - 92 -

-------------------- ------ ------- ------ ---- ---- --------- ------------------

Shareholders'

equity at 31

December 2018 8,622 73,642 3,346 522 (81,710) 4,422

-------------------- ------ ------- ------ ---- ---- --------- ------------------

As at 1 January

2019 8,622 73,642 3,346 - 522 (81,710) 4,422

Loss and total

comprehensive

loss for the

period - - - - - (1,314) (1,314)

Share option

charge - - 148 - - - 148

-------------------- ------ ------- ------ ---- ---- --------- ----------------

Warrant charge 105 105

-------------------- ------ ------- ------ ---- ---- --------- ----------------

Transfer of

balances relating

to expired

share options - - (39) - - 39 -

-------------------- ------ ------- ------ ---- ---- --------- ----------------

New shares

issued net

of issue costs 605 796 - - - - 1,401

-------------------- ------ ------- ------ ---- ---- --------- ----------------

Shareholders'

equity at 30

June 2019 9,227 74,438 3,455 105 522 (82,985) 4,762

-------------------- ------ ------- ------ ---- ---- --------- ------ --------

Condensed Consolidated Statement of Cash Flows

For the 6 months ended 31 December 2019

Note 6 months 6 months Year ended

ended 31 ended 31 30 June

December December 2019

2019 2018 Audited

Unaudited Unaudited GBP'000

GBP'000 GBP'000

Operating activities

Loss before tax from continuing

operations (3,110) (1,669) (3,167)

Finance costs paid 6 144 3 6

Finance income received (4) (1) (3)

Loss on disposal of fixed

assets 8 - 25 25

Depreciation 8 94 130 230

Share option charge 4 277 6 154

Warrant charge 5 1,017 - 105

Working capital adjustments

(Increase)/decrease in

trade and other receivables (88) 22 19

(Increase)/decrease in

prepayments (12) (41) 16

Increase/(decrease) in

trade and other payables 213 81 (112)

Increase in provision for - 189 -

decommissioning

Cash utilised in operations (1,469) (1,255) (2,727)

--------------------------------- ------ ----------- ----------- -----------

Finance costs paid 6 (144) (3) (6)

Taxation received - - 184

----------- -----------

Net cash outflow from operating

activities (1,613) (1,258) (2,549)

--------------------------------- ------ ----------- ----------- -----------

Investing activities

Finance income received 4 1 3

Purchase of fixed assets 8 (20) (5) (24)

Net cash outflow from investing

activities (16) (4) (21)

--------------------------------- ------ ----------- ----------- -----------

Financing activities

Increase in borrowings 11 1,864 - -

New shares issued net of

costs 11,12 2,483 - 1,401

Net cash inflow from financing

activities 4,347 - 1,401

--------------------------------- ------ ----------- ----------- -----------

Net increase/(decrease)

in cash and cash equivalents 2,718 (1,262) (1,169)

Cash and cash equivalents

at the beginning of the

period 1,060 2,229 2,229

--------------------------------- ------ ----------- ----------- -----------

Cash and cash equivalents

at the end of the period 3,778 967 1,060

--------------------------------- ------ ----------- ----------- -----------

Notes to the Group Condensed Financial Statements

1. General Information

Quadrise Fuels International plc ("QFI", "Quadrise", or the

"Company") and its subsidiaries (together with the Company, the

"Group") are engaged principally in the manufacture and marketing

of emulsified fuel for use in power generation, industrial and

marine diesel engines and steam generation applications. The

Company's ordinary shares are quoted on the AIM market of the

London Stock Exchange.

QFI was incorporated on 22 October 2004 as a limited company

under UK Company Law with registered number 05267512. It is

domiciled and registered at Gillingham House, 38-44 Gillingham

Street, London, SW1V 1HU.

2. Summary of Significant Accounting Policies

2.1 Basis of Preparation

The interim accounts have been prepared in accordance with IAS

34 'Interim financial reporting' and on the basis of the accounting

policies set out in the annual report and accounts for the year

ended 30 June 2019, which have been prepared in accordance with

International Financial Reporting Standards as adopted for use by

the European Union. The interim accounts are unaudited and do not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006.

The same accounting policies, presentation and methods of

computation have been followed in these unaudited interim financial

statements as those which were applied in the preparation of the

Group's annual statements for the year ended 30 June 2019, upon

which the auditors issued an unqualified opinion, and which have

been delivered to the registrar of companies.

The interim accounts have been drawn up using accounting

policies and presentation expected to be adopted in the Group's

annual financial statements for the year ended 30 June 2020.

The directors have carried out a detailed assessment of going

concern as part of the financial reporting process, and having

conducted a full review of the updated business plan, budgets and

associated commitments at the period end, have concluded that the

Group has adequate financial resources to continue in operational

existence for the foreseeable future, and therefore continue to

adopt the going concern basis in preparing the accounts

A number of new standards and amendments to standards and

interpretations have been issued but are not yet effective and in

some cases have not yet been adopted by the European Union. The

Directors do not expect that the adoption of these standards will

have a material impact on the financial information of the Group in

future periods.

The interim accounts for the six months ended 31 December 2019

were approved by the Board on 27 March 2020.

The directors do not propose an interim dividend.

3. Segmental Information

For the purpose of segmental information the reportable

operating segment is determined to be the business segment. The

Group principally has one business segment, the results of which

are regularly reviewed by the Board. This business segment is a

business to produce emulsion fuel (or supply the associated

technology to third parties) as a low cost substitute for

conventional HFO for use in power generation plants and industrial

and marine diesel engines.

The Group's only geographical segment during the period was the

UK.

4. Share Option charge

During the period to 31 December 2019, no share options were

issued by the Company. During the year to 30 June 2019, the Company

issued 19.15m share options to directors and employees with a

weighted average exercise price of 7.29p and the weighted average

fair value of 4.60p.

The Share Option Schemes are equity settled plans, and fair

value is measured at the grant date of the option. Options issued

under the Schemes vest over a two year or three year period

provided the recipient remains an employee of the Group. Options

may be also exercised within one year of an employee leaving the

Group at the discretion of the Board.

5. Warrant charge

On 6 September 2019, 32.3 million share warrants with an

exercise price of 7.48p per share were granted to shareholders of

the Company as part of the Open Offer and Subscription.

On 27 September 2019, 4.9m share warrants with an exercise price

of 5.78p were granted to Bergen Global Opportunity Fund, LP as part

of the Convertible Securities transaction detailed further in note

11.

On 4 December 2019, 3m share warrants with an exercise price of

3.5p were granted to Younes Maamar under the terms of the

Representation Agreement dated 6 March 2019.

All warrants granted vest immediately.

6. Finance Costs

A commencement fee of GBP140,000 settled by way of issuance of

3,888,889 new ordinary shares in the Company, was paid to Bergen

Global Opportunity Fund, LP as part of the Convertible Securities

transaction detailed further in note 10.

7. Loss Per Share

The calculation of loss per share is based on the following loss

and number of shares:

6 months 6 months Year ended

ended 31 ended 30 June

December 31 December 2019

2019 2018 Audited

Unaudited Unaudited

Loss for the period from

continuing operations (GBP'000s) (3,110) (1,669) (2,983)

Weighted average number

of shares:

Basic 961,058,037 862,204,976 888,728,557

Diluted 961,058,037 862,204,976 888,728,557

Loss per share:

----------------------------------- ------------ ------------- ------------

Basic (0.32)p (0.19)p (0.34)p

----------------------------------- ------------ ------------- ------------

Diluted (0.32)p (0.19)p (0.34)p

----------------------------------- ------------ ------------- ------------

Basic loss per share is calculated by dividing the loss for the

period from continuing operations of the Group by the weighted

average number of ordinary shares in issue during the period.

For diluted loss per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

potential dilutive options and warrants over ordinary shares.

Potential ordinary shares resulting from the exercise of share

options and warrants have an anti-dilutive effect due to the Group

being in a loss position. As a result, diluted loss per share is

disclosed as the same value as basic loss per share. The 39.4

million share options and 45.2 million warrants issued by the

Company and which are outstanding at the period-end could

potentially dilute earnings per share in the future if exercised

when the Group is in a profit making position.

8. Property, Plant and Equipment

Leasehold Computer Software Office Plant Total

improvements equipment equipment and machinery

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

Opening balance

- 1 July 2019 181 91 43 16 1,390 1,721

Additions - - - - 20 20

Disposals - - - - - -

--------------------- -------------- ----------- --------- ----------- --------------- --------

Closing balance

- 31 December

2019 181 91 43 16 1,410 1,741

--------------------- -------------- ----------- --------- ----------- --------------- --------

Depreciation

Opening balance

- 1 July 2019 (166) (78) (41) (16) (690) (991)

Depreciation charge

for the period (11) (7) (2) - (74) (94)

Disposals - - - - - -

--------------------- -------------- ----------- --------- ----------- --------------- --------

Closing balance

- 31 December

2019 (177) (85) (43) (16) (764) (1,085)

--------------------- -------------- ----------- --------- ----------- --------------- --------

Net book value

at 31 December

2019 4 6 - - 646 656

--------------------- -------------- ----------- --------- ----------- --------------- --------

Cost

Opening balance

- 1 July 2018 166 91 43 16 1,428 1,744

Additions - - - - 5 5

Disposals - - - - (47) (47)

--------------------- ------ ----- ----- ----- ------ ------

Closing balance

- 31 December

2018 166 91 43 16 1,386 1,702

--------------------- ------ ----- ----- ----- ------ ------

Depreciation

Opening balance

- 1 July 2018 (109) (63) (36) (16) (559) (783)

Depreciation charge

for the period (42) (8) (3) - (77) (130)

Disposals - - - - 22 22

--------------------- ------ ----- ----- ----- ------ ------

Closing balance

- 31 December

2018 (151) (71) (39) (16) (614) (891)

--------------------- ------ ----- ----- ----- ------ ------

Net book value

at 31 December

2018 15 20 4 - 772 811

--------------------- ------ ----- ----- ----- ------ ------

Cost

Opening balance

- 1 July 2018 166 91 43 16 1,428 1,744

Additions 15 - - - 9 24

Disposals - - - - (47) (47)

Closing balance

- 30 June 2019 181 91 43 16 1,390 1,721

--------------------- ------ ----- ----- ----- ------ ------

Depreciation

Opening balance

- 1 July 2018 (109) (63) (36) (16) (559) (783)

Depreciation charge

for the year (57) (15) (5) - (153) (230)

Disposals - - - - 22 22

Closing balance

- 30 June 2019 (166) (78) (41) (16) (690) (991)

--------------------- ------ ----- ----- ----- ------ ------

Net book value

at 30 June 2019 15 13 2 - 700 730

--------------------- ------ ----- ----- ----- ------ ------

9. Intangible Assets

QCC royalty MSAR(R) Technology

payments trade name and know-how Total

Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000

Cost

Balance as at 1 July

2019 and 31 December

2019 7,686 3,100 25,901 36,687

Amortisation and

Impairment

Balance as at 1 July

2019 and 31 December

2019 (7,686) (176) (25,901) (33,763)

Net book value at

31 December 2019 - 2,924 - 2,924

----------------------- ------------ ------------ -------------- ----------

Cost

Balance as at 1 July

2018 and 31 December

2018 7,686 3,100 25,901 36,687

Amortisation and

Impairment

Balance as at 1 July

2018 and 31 December

2018 (7,686) (176) (25,901) (33,763)

Net book value at

31 December 2018 - 2,924 - 2,924

----------------------- -------- -------- --------- ---------

Cost

Balance at 1 July

2018 and 30 June

2019 7,686 3,100 25,901 36,687

- - - -

Amortisation and

Impairment

Balance at 1 July

2018 and 30 June

2019 (7,686) (176) (25,901) (33,763)

Net book value at

30 June 2018 - 2,924 - 2,924

------------------- -------- ------ --------- ---------

Intangibles comprise intellectual property with a cost of

GBP36.69m, including assets of finite and indefinite life. QCC

royalty payments of GBP7.69m and the MSAR(R) trade name of GBP3.10m

are termed as assets having indefinite life as it is assessed that

there is no foreseeable limit to the period over which the assets

are expected to generate net cash inflows for the Group. The assets

with indefinite life are not amortised. The remaining intangibles

amounting to GBP25.90m, primarily made up of technology and

know-how, are considered as finite assets and are now fully

amortised. The Group does not have any internally generated

intangibles.

The Group tests intangible assets annually for impairment, or

more frequently if there are indications that they might be

impaired. As at 30 June 2019, the QCC royalty payments asset was

fully impaired and the MSAR(R) trade name asset had a net book

value of GBP2.924m. For the six month period to 31 December 2019,

there was no indication that the MSAR(R) trade name asset may be

impaired.

As a result, the Directors concluded that no impairment is

necessary for the six month period to 31 December 2019.

10. Investments

At the statement of financial position date, the Group held a

20.44% share in the ordinary issued capital of Quadrise Canada

Corporation ("QCC"), a 3.75% share in the ordinary issued capital

of Paxton Corporation , a 9.54% share in the ordinary issued

capital of Optimal Resources Inc. and a 16.86% share in the

ordinary issued capital of Porient Fuels Corporation, all of which

are incorporated in Canada.

QCC is independent of the Group and is responsible for its own

policy-making decisions. There have been no material transactions

between QCC and the Group during the period or any interchange of

managerial personnel. As a result, the Directors do not consider

that they have significant influence over QCC and as such this

investment is not accounted for as an associate.

The Group has no immediate intention to dispose of its

investments unless a beneficial opportunity to realise these

investments arises.

Given that there is no active market in the shares of any of

above companies, the Directors have determined the fair value of

the unquoted securities at 31 December 2019. The shares in each of

these companies were valued at CAD $nil on 1 July 2019. Shareholder

communications received during the period to 31 December 2019

indicate that the business models for each of these companies

remain highly uncertain, with minimal possibility of any material

value being recovered from their asset base. On that basis, the

directors have determined that the investments should continue to

remain valued at CAD $nil at 31 December 2019.

11. Convertible securities

On 22 August 2019, the Company entered into an agreement with

Bergen Global Opportunity Fund LP ('the Investor') whereby the

Investor will provide up to GBP4.0 million of interest free

unsecured funding, provided in two tranches through the issue by

the Company of Convertible Securities with a nominal value of up to

GBP4.3 million, convertible into Ordinary Shares.

An initial tranche of Convertible Securities with a nominal

value of GBP2.15 million was subscribed for by the Investor for

GBP2.0 million on 30 August 2019. A second tranche of Convertible

Securities, with a nominal value of up to GBP2.15 million is

conditionally available to the Company with a subscription price of

up to GBP2.0 million. Both tranches have 24 month maturity dates

from the dates of their respective issuance, and any Convertible

Securities not converted prior to such dates will automatically

convert into Ordinary Shares at such time.

The Company also issued 4.9 million 36 month warrants to

subscribe for new Ordinary Shares to the Investor by way of a

Warrant Instrument initially exercisable at 5.78p per Ordinary

Share, subject to anti-dilution and exercise price reduction

provisions.

In connection with the Agreement, on 30 August 2019 the Company

also issued to the Investor 3,888,889 new Ordinary Shares in

settlement of a commencement fee of GBP140,000 and a further

4,500,000 new Ordinary Shares to collateralize the Agreement

subscribed for at nominal value by the Investor.

The Convertible Securities are only converted to the extent that

the Company has corporate authority to do so, and it is a term of

the agreement that the Company must retain sufficient authority to

issue and allot (on a non-pre-emptive basis) a sufficient number of

Ordinary Shares potentially required to be issued under the terms

of the Agreement (and the Warrant Instrument).

Pursuant to the terms of the Agreement, the Company is required

to obtain and maintain sufficient non-pre-emptive share issuance

authority from its shareholders in relation to the Ordinary Shares

that may be required to be issued pursuant to the Agreement and

Warrant Instrument.

The Agreement was completed and the Initial Tranche funded to

the Company on the basis of the remaining current Authority from

the 2018 annual general meeting, and also on the basis that an

updated authority must be obtained at a General Meeting of

shareholders. Such authority was obtained at a General Meeting held

on September 27, 2019.

12. Open Offer and Subscription

On 9 September 2019 the Company announced a fully underwritten

open offer to raise up to approximately GBP1.8 million through the

issue of up to 46,555,039 Open Offer Shares at the Issue Price of

3.96 pence per Open Offer Share on the basis of 1 Open Offer Share

for every 20 Existing Ordinary Shares held on the Record Date (the

"Open Offer").

The Company announced that it had entered into conditional

binding agreements with the Subscribers to raise additional gross

proceeds of GBP716,800 through the issue of an aggregate 18,101,012

Subscription Shares at 3.96 pence per Subscription Share, with

9,050,506 Subscription Warrants attached. inter alia, on the

Resolutions being passed at the General Meeting.

The Open Offer and Subscription were conditional upon

Shareholder approval of the Resolutions at the General Meeting of

27 September 2019, which was duly granted.

13. Related Party Transactions

Non-executive Director Laurie Mutch is also a Director of Laurie

Mutch & Associates Limited, which has provided consulting

services to the Group. The total fees charged for the period

amounted to GBP30k (2019: GBPnil) . The balance payable at the

statement of financial position date was GBPnil (2019: GBPnil).

QFI defines key management personnel as the Directors of the

Company. Other than the above, there are no transactions with

Directors other than their remuneration.

14. Seasonality

The operations of the Group are not affected by seasonal

fluctuations.

15. Commitments and Contingencies

The Group and the Company have entered into commercial leases

for the rental of operational and office premises. The leases

earliest expiry dates are 29(th) February 2020 and 28 September

2020, and there are no restrictions placed on the Group or Company

by entering into these leases. The minimum future lease payments

for the non-cancellable leases are as follows:

31 December 31 December 30 June

2019 GBP'000 2018 2019

GBP'000 GBP'000

Operational and Office

premises:

One year 93 28 136

Two to five years - - 30

After five years - - -

On 1 March 2020, the lease for operational premises was renewed

for a minimum period of 29 months. The minimum non-cancellable

lease payments arising as a result of this lease renewal total

GBP64k.

Additionally, the Group and Company have no capital commitments

or contingent liabilities as at the statement of financial position

date.

16. Events After the End of the Reporting Period

On 15(th) January 2020, the Company announced that Mark Whittle

was appointed to the board as an executive director in his new

capacity as Chief Operating Officer. Additionally, Jason Miles,

formerly Chief Operating Officer, was promoted to Chief Executive

Officer, with Mike Kirk remaining as the Company's Chairman.

On 30(th) January 2020, the Company announced that BDO LLP has

been appointed as the Company's auditors, with shareholder approval

to confirm the appointment being sought at the Company's 2020

Annual General Meeting.

On 24(th) March 2020, the Company announced that following

receipt of a notice of exercise from the Investor (see note 11) in

respect of the Convertible Security issued by the Company on 30

August 2019 to convert GBP100,000 of the Convertible Security into

new ordinary shares in the Company at a conversion price of 1.2p

per new ordinary share, the Company issued 8,333,333 new ordinary

shares. An amount of GBP2,050,000 remains outstanding under the

Convertible Security.

17. Copies of the Interim Accounts

Copies of the interim accounts are available on the Company's

website at www.quadrisefuels.com and from the Company's registered

office, Gillingham House, 38-44 Gillingham Street, London, SW1V 1HU

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BUGDXGXDDGGC

(END) Dow Jones Newswires

March 30, 2020 02:00 ET (06:00 GMT)

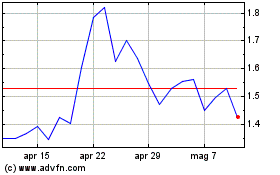

Grafico Azioni Quadrise (LSE:QED)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Quadrise (LSE:QED)

Storico

Da Apr 2023 a Apr 2024