TIDMSUN

RNS Number : 1366I

Surgical Innovations Group PLC

31 March 2020

Surgical Innovations Group plc

("SI" or the "Group")

Final Results

Audited results for the year ended 31 December 2019

and update on the effects of Covid-19 pandemic

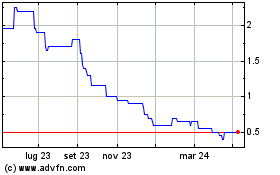

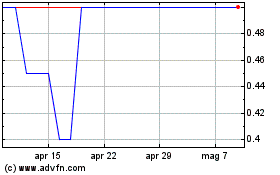

Surgical Innovations Group plc (AIM: SUN), the designer,

manufacturer and distributor of innovative medical technology for

minimally invasive surgery, reports financial results for the year

ended 31 December 2019 in line with expectations and provides an

update on the effects of the Covid-19 pandemic.

Revenues in the second half of the year were up by approximately

10% compared with the first half, and gross margins, adjusted

pre-tax profits and cash conversion were within target range. In

October 2019, the Group repaid GBP1.0m of its term loan early, and

the net cash* balance at the year-end was GBP0.47m (2018:

GBP0.38m).

Financial Highlights:

-- Revenues of GBP10.73m (2018: GBP10.97m)

-- Gross margin within target range at 40.4% (2018: 42.6%)

-- Impairment of goodwill (GBP1.63m) and intangible development costs (GBP0.63m)

-- Adjusted** PBT of GBP0.38m (2018: GBP1.43m), reported loss

before taxation GBP2.60m (2018: PBT of GBP0.52m)

-- Adjusted** EPS of 0.05p (2018: 0.21p), reported EPS of negative 0.33p (2018: positive 0.09p)

-- Cash conversion of adjusted operating profit of 127% (2018: 118%)

-- Closing net cash* of GBP0.47m (2018: GBP0.38m)

* Net cash comprises cash and cash equivalents of GBP1.28m less

bank indebtedness of GBP0.81m.

** Adjusted operating margin, PBT & EPS stated before

deduction of exceptional costs, impairment of intangibles &

amortisation relating to acquisition, and share based payment

costs.

Effects of Covid-19 pandemic

The Board anticipate significant short-term reductions in

revenues in the current year as a result of the Covid-19 pandemic,

as elective surgery in the UK and several other territories has

been, or is expected to be, suspended. The Group has diverse

geographical dispersion of markets, and has been assured of support

from a number of key customers to maintain activity during this

downturn.

Management have taken decisive action to protect the welfare of

employees, whilst continuing to meet the needs of our customers in

the UK and overseas. Production activity has been condensed to

match visible demand, and appropriate measures taken to reduce

operating costs and manage immediate cash flows. We will continue

to take all steps possible in these challenging circumstances, and

ensure that all support mechanisms available to our company from

outside agencies are accessed, in order to preserve value and

capability, and ameliorate the impact on the business, its

workforce and our customers and partners.

Our bankers have moved extremely quickly in providing short-term

relief from capital repayments and covenant compliance, and stand

willing to support our immediate liquidity. In addition, we have

received expressions of support from selected institutional

shareholders.

Accordingly, the Directors have concluded that it continues to

be appropriate to prepare the Annual Report and Accounts on a going

concern basis, whilst acknowledging the material uncertainty that

now exists and has been explained in this announcement and the

annual report and accounts.

Chairman of SI, Nigel Rogers, said:

"Our product ranges are becoming increasingly recognised as a

key part of a sustainable approach to surgery, and this offers

significant medium term growth potential. Our business has net cash

and is operationally sound. We have strong partnerships with the

NHS, our major distributors, OEM customers and key vendors, based

on mutual co-operation and shared success.

"Accordingly, the Board remain confident that, following an

inevitable period of serious disruption requiring careful

navigation, there continues to be strong recovery and growth

drivers within our market, indicating that the medium to long term

outlook is positive."

A copy of this announcement, the investor presentation of these

results and the Annual Report and Accounts are all being made

available shortly on the Group's website:

https://www.sigroupplc.com/

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014.

For further information please contact:

Surgical Innovations Group plc www.sigroupplc.com

Nigel Rogers, Chairman Tel: 0113 230 7597

David Marsh, CEO

N+1 Singer (NOMAD & Broker) Tel: 020 7496 3000

Aubrey Powell (Corporate Finance)

Rachel Hayes (Corporate Broking)

Walbrook PR (Financial PR & Investor Tel: 020 7933 8780 or si@walbrookpr.com

Relations)

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

Notes for editors:

About Surgical Innovations Group plc

Strategy

The Group specialises in the design, manufacture, sale and

distribution of innovative, high quality medical products,

primarily for use in minimally invasive surgery. Our product and

business development is guided and supported by a key group of

nationally and internationally renowned surgeons across the

spectrum of minimally invasive surgical activity.

We design and manufacture and source our branded port access

systems, surgical instruments and retraction devices which are sold

directly in the UK home market through our subsidiary, Elemental

Healthcare, and exported widely through a global network of trusted

distribution partners. Many of our products in this field are based

on a "resposable" concept, in which the products are part

re-usable, part disposable, offering a high quality and

environmentally responsible solution at a cost that is competitive

against fully disposable alternatives.

Elemental also has exclusive UK distribution for a select group

of specialist products employed in laparoscopy, bariatric and

metabolic surgery, hernia repair and breast reconstruction.

In addition, we design and develop medical devices for carefully

selected OEM partners, and have also collaborated with a major UK

industrial partner to provide precision engineering solutions to

complex problems outside the medical arena.

We aim for our brands to be recognised and respected by

healthcare professionals in all major geographical markets in which

we operate and provide by development, partnership or acquisition a

broad portfolio of cost effective, procedure specific surgical

instruments and implantable devices that offer reliable solutions

to genuine clinical needs in the operating theatre environment.

Operations and management

The Group currently employs approximately 100 people across two

sites in the UK. Product design, engineering and manufacturing are

carried out at the SI site in Yorkshire. Commercial activities

including marketing, UK distribution and international sales and

marketing are based at Elemental Healthcare in Berkshire.

Further information

Further details of the Group's businesses are available on

websites:

www.sigroupplc.com

www.surginno.com , and

www.elementalhealthcare.co.uk

Investors and others can register to receive regular updates by

email at si@walbrookpr.com

Surgical Innovations Group plc

Strategic Report

For the year ended 31 December 2019

Chairman's Statement

I am pleased to report improved results in the second half of

what turned out to be a more challenging year than we had

anticipated. Management were faced with some difficult conditions

and uncertainties, mostly in relation to planning for Brexit,

building up the regulatory resource to meet an ever increasing

burden, and a continuation of funding and resource constraints in

the NHS. Much has been achieved towards building strong foundations

for a return to growth, and we believe that the environmental and

economic credentials of many of our products are winning acceptance

to a degree not previously experienced.

The results for the year were in line with the Board's

expectations, and since the year end we have continued to be cash

generative. In the final quarter of 2019, the Group concluded

agreements to extend important contractual relationships, including

the manufacture of the Fix-8 device for Advanced Medical Solutions

plc until June 2024, and the exclusive UK distribution of the

Dexter robot for Distalmotion SA until October 2022.

Subsequent to the year-end, we currently face unprecedented

uncertainty as a consequence of the Covid-19 pandemic and its

effects on elective surgery, and are planning for the short-term

disruption to our business to be severe. We have a highly capable

management team and a committed workforce, who are quickly

adjusting to these extraordinary challenges, and dealing with

problems promptly and effectively as they arise. In addition, our

key trading partners, bankers and selected institutional

shareholders are already providing indications of support, and the

Board believes that Government measures already announced will make

a significant difference in alleviating the worst effects of the

sudden downturn.

Financial Overview

Revenue for the second half of the year was 10% higher than the

first half, and the total for the full year reduced marginally to

GBP10.73m (2018: GBP10.97m).

Market conditions continued to be challenging in the UK for much

of the year, with NHS waiting lists for elective surgery increasing

in both quantum and duration. Sales in Asia Pacific showed a

decline, although this was largely due to unusually high revenues

in 2018 relating to changes in route to market. This weakness was

partly offset by growth in USA and Rest of World regions. European

sales fell slightly, although to a lesser extent than expected

given delays in the availability of fully disposable products due

to continuing regulatory bottlenecks.

Gross margin for the year held within target range at 40.4%

(2018: 42.6%), although a controlled de-stocking exercise commenced

in the final quarter of the year following the reduced risk of a

no-deal Brexit. This affected the overall result by around 2% as a

consequence of reduced factory output. Other income in 2018 related

to compensation for the early termination of a distribution

contract and was non-recurring.

Operating expenses, excluding depreciation and amortisation,

impairment of intangibles, exceptional costs and share based

payments, increased by approximately GBP0.35m, resulting in

Adjusted EBITDA* of GBP1.45m (2018: GBP2.36m), and Adjusted PBT* of

GBP0.38m (2018: GBP1.43m).

Exceptional items relate to payments made to a former Director

in relation to termination, and abortive acquisition costs

totalling GBP0.18m (2018: nil).

Transition to IFRS 16 has been applied using the "modified

retrospective" transition approach. As a result the comparative

information is not on a like-for-like basis in respect of the

treatment of leases. The adoption of IFRS 16 leads to an increase

in cost of GBP0.04m for the year to 31 December 2019, reflecting

depreciation and interest charges of GBP0.28m being GBP0.04m higher

than the lease expenses which would have been recorded prior to the

adoption of the new standard. At EBITDA level, the adoption of IFRS

16 gives a benefit of GBP0.25m being the elimination of the rental

charges.

Cash conversion was good, leading to net cash at the year-end of

GBP0.47m (2018: GBP0.38m).

*Reconciliation of adjusted KPI measures included in the

Operating and Financial Review below.

Brexit Planning

During the year, the business executed contingency arrangements

to de-risk in the event that the UK exited the EU on 29 March 2019

without reaching an appropriate withdrawal agreement, only to

repeat the exercise in October.

The additional working capital investment incurred in inventory

was largely unwound by the end of the year. There continues to be

some uncertainty regarding the conduct of trade with EU member

states following the end of the transitional period, although there

is a reasonable expectation that medical devices will be traded

with minimal regulatory divergence or delays.

Coronavirus

The speed and extent to which the Covid-19 pandemic has taken

hold in Europe and North America greatly exceeds what might have

been expected earlier this month. Whilst there is no evidence at

present of any significant delays or other disruption to the supply

chain for components or distribution products into the UK, we must

anticipate that these are likely to become problematic, and we are

working closely with our key vendors to optimise deliveries based

on latest forecasts. Management are continuing to monitor security

of supply of critical items very closely.

The anticipated effect of more widespread coronavirus infection

in key end user markets is now becoming more apparent, as hospitals

rightly free up capacity to cope with seriously ill patients. These

necessary actions will inevitably lead to delays and cancelation of

routine surgical procedures such as those announced in the NHS over

the last week. Management have devised a series of mitigating

actions, designed to preserve cash resources, maintain delivery of

essential products to our customers and distributors, and protect

our workforce from the health risks and economic impact. We will

continue to take all steps possible in these challenging

circumstances, and ensure that all support mechanisms available to

our company from outside agencies are accessed, in order to

preserve value and capability, and ameliorate the impact on

business, its partners and customers, and our workforce.

Further commentary to the these uncertainties are set out in the

section entitled 'Principal risks and uncertainties' in the

Operating and Financial review.

Environmental and economic considerations

Despite the current climate outlined above, senior management,

procurement and clinicians within our customer base are becoming

increasingly aware that our resposable product ranges (which are

part re-usable, part disposable) offer a dramatic reduction in

clinical waste, are cost effective when compared with expensive

fully disposable alternatives, and have a very low impact on the

environment. The NHS has actively encouraged suppliers to join a

national campaign to turn the tide on plastic waste. Our resposable

product ranges were recently showcased at the NHS Sustainability

Campaign roadshow in Manchester, where recognition was acknowledged

of their suitability as a key part of the 'For a Greener NHS'

agenda. We firmly believe that such initiatives will become more

widespread once normality is restored, and will present a major

opportunity to significantly increase our market share in the UK

and internationally. There has been a similar reaction to the

compelling business case surrounding both sustainability and

economy through distribution partners in some of our key markets,

notably the US and Japan, where evaluations and planning for market

roll out are underway, albeit the launch timing of which is

uncertain due to the pandemic.

Acquisition activity

Management have rightly maintained primary focus on optimising

the commercial and operational aspects of current business streams

over acquisition activity during the year. Although a select number

of targets have been evaluated and not progressed, we will continue

to seek businesses which offer complementary opportunities to

accelerate the rate of growth of the Group's activities, either

through new products and/or geographies. Understandably, however,

we do not expect any significant activity to be likely in coming

months.

People

Following changes in Board structure last year, there have been

a number of key appointments to the senior management team, each of

whom have made a significant contribution to the strengthening of

the business. On behalf of the Board, I recognise that the success

of the Group relies upon the dedication and professionalism of all

of our people, and applaud their enduring commitment. Current

events are testing their resilience beyond a level seen before, and

the Board is both proud and grateful for the progress being made in

such adversity.

Going Concern and funding

Prior to the substantial impact of Covid-19 on the entire

business community, the Directors had carried out an evaluation of

financial forecasts, sensitised to reflect a rational judgement of

the level of inherent risk. This exercise concluded that adequate

financial resources were available to ensure that the Company could

meet its obligations for a twelve month period with reasonable

certainty. It has subsequently become clear that there will need to

be reliance upon outside agencies including the UK Government,

Yorkshire Bank and possibly others, to ensure that these conditions

continue to apply.

This fundamental uncertainty will be common, in varying degrees,

to almost all businesses in every sector. It is premature to be

able to determine with precision the level of support that may

ultimately be required, as events are moving rapidly. Our bankers

have moved extremely quickly in providing short-term relief from

capital repayments and covenant compliance, and stand willing to

support our immediate liquidity requirements. These actions are an

important precursor to enabling access to funding through the

Coronavirus Business Interruption Loan Scheme in coming weeks.

Furthermore, the announcements by the Chancellor of the Exchequer

on 20 March 2020 relating to various forms of government assistance

will provide substantial help. In addition, we have received

expressions of support from some of our key trading partners and

institutional shareholders.

Accordingly, the directors conclude that it continues to be

appropriate to prepare the Annual Report and Accounts on a going

concern basis, whilst acknowledging the material uncertainty that

now exists and has been explained in this statement and further

described in the principal risks and uncertainties, the directors

report and in the financial statements disclosure note 21.

Current trading and outlook

UK revenues in the current year to date have started to show

signs of a slowdown in elective surgery within the NHS, although

other key markets are not yet showing any similar effects. This

will undoubtedly accelerate rapidly as the impact of the pandemic

is fully recognised, and we are preparing to respond to these

unprecedented conditions.

Our product ranges are becoming increasingly recognised as a key

part of a sustainable approach to surgery, and this offers

significant medium term growth potential. Our business is

unleveraged and operationally sound. We have strong partnerships

with our major distributors, OEM customers and key vendors, based

upon mutual cooperation and shared success.

Accordingly, the Board remain confident that, following an

inevitable period of serious disruption requiring careful

navigation, there continues to be strong recovery and growth

drivers within our business, indicating that the medium to long

term outlook is positive.

Nigel Rogers

Chairman

31 March 2020

Operating and Financial Review

Key Performance Indicators

The Group considers the key performance indicators of the

business to be:

2019 2018 Target Measure

Underlying Revenue Adjusted for the effect

Growth of acquisition -2.2% 12.0% >8%

-------------------------- ---------- ---------- ----------------

Gross Profit Margin Gross profit / revenue 40.4% 42.6% >40%

-------------------------- ---------- ---------- ----------------

Adjusted Operating Adjusted operating

Margin profit / revenue 5.0% 13.9% >12%

-------------------------- ---------- ---------- ----------------

Cash generated from

operations / adjusted

Cash conversion operating profit 127% 118% >85%

-------------------------- ---------- ---------- ----------------

Net Cash/(Net Debt) Cash less debt GBP0.47m GBP0.38m N/A

-------------------------- ---------- ---------- ----------------

Reconciliation of adjusted KPI/ measures

EBITDA* Operating Profit Profit before

taxation

As reported GBP1.08m GBP(2.44)m GBP(2.60)m

---------- ------------------ ---------------

Amortisation of intangible - GBP0.35m GBP0.35m

acquisition costs

---------- ------------------ ---------------

Impairment of product development - GBP0.63m GBP0.63m

intangibles

---------- ------------------ ---------------

Impairment of Goodwill - GBP1.63m GBP1.63m

---------- ------------------ ---------------

Share based payments GBP0.19m GBP0.19m GBP0.19m

---------- ------------------ ---------------

Exceptional items GBP0.18m GBP0.18m GBP0.18m

---------- ------------------ ---------------

Adjusted Measure GBP1.45m GBP0.54m GBP0.38m

---------- ------------------ ---------------

Earnings Per Share EPS

Basic EPS (0.33)p

------------

Loss attributable to shareholders (GBP2.62m)

------------

Add: Share based payments GBP0.19m

------------

Add: Amortisation of intangible GBP0.35m

acquisition costs

------------

Add: Exceptionals GBP0.18m

------------

Add: Impairment of product development GBP0.63m

intangibles

------------

Add: Impairment of Goodwill GBP1.63m

------------

Adjusted profit attributable to GBP0.36m

shareholders

------------

Adjusted EPS 0.05p

------------

*EBITDA is defined as earnings before interest, taxation,

depreciation and amortisation (including impairment). EBITDA is

calculated as operating profit of GBP(2.44)m adding back

depreciation GBP0.62m, amortisation GBP0.64m and impairment

GBP2.25m.

Use of adjusted measures

Adjusted KPIs are used by the Group to understand underlying

performance and exclude items which distort comparability, as well

as being consistent with broker forecasts and measures. The method

of adjustment is consistently applied but may not be comparable

with those used by other companies.

Adjusted measures do not take precedence over the IFRS measures.

The company has elected to apply IFRS16 using the modified

retrospective approach. The accounts are not restated and IFRS

figures and Adjusted profit measures are not comparable to the

prior year. At EBITDA level, the adoption of IFRS 16 gives a

benefit of GBP0.25m being the elimination of the rental

charges.

Revenue and margins

Revenues reduced by 2% to GBP10.73m (2018: GBP10.97m). Gross

margins remained within target range at 40.4% of revenue (2018:

42.6%) with the slight reduction attributable to reduced factory

activity in the final two months of the year to facilitate modest

de-stocking.

GBPm 2019 2018 % change

SIBrand 5.84 6.09 - 4%

======= ======= ==================================

Distribution 3.10 3.04 +2%

======= ======= ==================================

O E M 1.79 1.84 - 3%

======= ======= ==================================

Total 10.73 10.97 - 2%

======= ======= ==================================

Revenues from the sale of Surgical Innovations Brand products

reduced by 4% during the year overall. Market conditions showed no

significant improvement in the UK, however there is clear evidence

of political will to provide more favourable long term funding for

health and social care in coming years. Sales in Continental Europe

steadied after declining in the prior year, as distributors began

to make headway introducing YelloPort Elite , our next generation

Resposable(R) port access system for use in minimally invasive

surgery (MIS), to replace fully disposable competitor products.

SI Brand sales in the US grew by 9%, mostly as a result of

significant gains in market share for surgical scissors. YelloPort

Elite will launch fully in the US market in the current year

following FDA approval last year.

SI Brand revenues from the APAC region showed a reduction,

although this was largely a consequence of timing differences

resulting from structural changes to our distribution arrangements.

Strong growth is anticipated in the current year, led by Japan. SI

brand sales in the Rest of the World was up by 17%. SI brand is

experiencing strong growth in South Africa where a new distributor

was appointed at the end of 2019 and is anticipated in the Middle

East where three new distributors have been appointed.

OEM revenues showed a small reduction in the year, with both

precision engineering (non-medical) and medical virtually

unchanged. We anticipate growth in medical OEM sales in the current

year, but at this early stage have no visibility of further

precision engineering revenues.

Distribution sales grew by 2% year on year which reflected a

continuation of constrained activity levels in the NHS, especially

for elective procedures. We are expecting an improvement in the

hospital bed situation over the course of 2020 which will allow

more elective operations as a consequence of increased funding. The

drive for a more sustainable healthcare system, encapsulated in the

Greener NHS agenda, is very beneficial for the range of

distribution products and the Group is engaged at the highest

levels of the NHS in encouraging the adoption of its Resposable(R)

distribution products.

Adjusted EBITDA

The adjusted EBITDA is a measure of the business performance.

The Group uses this as a proxy for understanding the underlying

performance of the Group. This measure also excludes the items that

distort comparability including the charge for share based payments

as this is a non-cash expense normally excluded from market

forecasts.

Adjusted EBITDA decreased to GBP1.45m (2018: GBP2.36m), mainly

as a result of additional operating overheads to strengthen the

operational capabilities of the business, and particularly to meet

the regulatory demands of transition from the EU Medical Device

Directive to Medical Device Regulation 2017/745. The reported

operating result was a loss of (GBP2.44m) (2018: profit of

GBP0.62m), with an adjusted operating profit of GBP0.54m (2018:

GBP1.53m), before deduction of exceptional costs, amortisation

relating to acquisition, impairment of intangible assets and share

based payments, and an adjusted operating margin of 5.0% (2018:

13.9%).

Capital expenditure on tangible assets continued to reflect a

policy of required replacement only during the year at GBP0.20m

(2018: GBP0.09m) set against a depreciation charge of GBP0.42m

(2018: GBP0.48m). Whilst there are no major capex plans currently

in place, several improvements to the manufacturing facilities were

implemented in Leeds in 2019 and further modest expenditure is

expected this year.

Interest on bank and finance lease obligations for 2019 resulted

in net interest payable of GBP0.16m (2018: GBP0.11m). During the

year the company repaid GBP0.30m of bank indebtedness in accordance

with the original repayment schedule, and also prepaid a further

GBP1.0m on the 31 October not due until July 2022.

Following an impairment review of the goodwill arising on the

acquisition of Elemental Healthcare, an impairment charge of

GBP1.63m was recongnised in the period. The trading environment in

the UK market has become more challenging during 2019, due to both

a progressive tightening of NHS funding for elective surgery as

well as the extended time taken to rebuild the distribution sales

of Cellis branded products. A number of the latter were due for

imminent launch, which has been delayed. Accordingly, the Directors

have adopted a cautious approach to forecasting future net inflows

for this cash generating unit.

Subsequent to the year end, the potential effects of the

Covid-19 outbreak and consequential impact on the availability of

NHS resources may have a further and more significant impact on the

Directors' view of short to medium term cash flows. This has not

yet been quantified, as there is insufficient data on which to base

such a judgement. Nevertheless, it is recognised by the Directors

that further impairment is likely to be necessary in 2020,

therefore a non-adjusting post balance sheet event has been

recognised. The financial effect of this adjustment cannot be

estimated.

Development expenditure was tested for impairment and given the

resource contraints, complexity of developing a device and

regulatory challenges, particually in relation to the Medical

Devices Regulation (MDR) transition, an impairment of GBP0.63m

(2018:nil) has been recognised.

The Group recorded a corporation tax credit of GBP0.001m (2018:

credit of GBP0.03m) and a deferred tax charge of GBP0.02m (2018:

credit GBP0.18m). The tax credit represents an enhanced Research

and Development claim in respect of 2017, electing to exchange tax

losses for cash refunds. The tax charge on Elemental Healthcare has

been relieved through Group losses. Overall the Group continues to

hold substantial tax losses on which it holds a cautious view, and

consequently the Group has chosen not to recognise those losses

fully. During the year the Group submitted an enhanced Research and

Development claim in respect of 2018. This claim has been offset

against taxable profits during 2018.

Trade receivables were lower at the year end than 2018,

reflected by a timing difference relating to changes in route to

market in the f inal months of the prior year. Inventories were

higher at GBP2.9m compared to GBP2.0m in 2018. Stock holdings

increased during 2019 to ensure safety stocks supported incremental

customer requirements; however, as revenue expectations

subsequently decreased, stock holdings were affected. A controlled

de-stocking exercise commenced in the final quarter of the year and

will continue throughout 2020. Trade creditors decreased only

slightly over the same period, which reflected the Group's

continued approach towards managing working capital.

The Group generated cash from operations of GBP0.59m (2018:

GBP1.65m) at a conversion rate of adjusted operating profit at 128%

(2018: 118%) primarily as a result of the working capital movements

described above. The Group closed the year with net cash balances

of GBP0.47m compared with opening net cash of GBP0.38m.

Transition to IFRS16

The adoption of this new Standard has resulted in the Group

recognising a right-of-use asset and related liability in

connection with all former operating leases with the exception of

those identified as low-value or having a remaining lease term of

less than 12 months from the date of initial application.

The new standard has been applied using the "modified

retrospective" transition approach. There is no adjustment to the

opening balance of retained earnings for the current period however

reclassifications arising from the new standard have been

recognised in the opening balances as at 1 January 2019. Prior

periods have not been restated, as permitted under the specific

transitional provisions in the standard.

Prior to the adoption of IFRS 16 rental payments were charged to

the income statement on a straight-line basis, under IFRS 16 rental

charges in the income statement are replaced with depreciation on

the right-of-use asset and interest charges on the lease liability.

The adoption of IFRS 16 therefore gives rise to a net cost of

GBP0.04m in the twelve months to 31 December 2019, reflecting

depreciation and interest charges of GBP0.28m being GBP0.04m higher

than the net rental charges which would have been incurred prior to

the adoption of the new standard. At EBITDA level, the adoption of

IFRS 16 gives a benefit of GBP0.25m being the elimination of the

rental charges.

Amount due from associate

In 2020, an agreement , subject to contract, will allow all the

costs incurred via the amount due from associate, Illuminno Ltd

GBP0.17m (2018: GBP0.08m) to be re-imbursed to the Group and once

legally binding, the costs in Illuminno Ltd will be transferred on

the balance sheet as intangible product development costs.

Principal risks and uncertainties

The management of the business and the nature of the Group's

strategy are subject to a number of risks which the Directors seek

to mitigate wherever possible. The principal risks are set out

below.

Issue Indication of risk on Risk and description M iti gating actions

prior year

Funding risk Remains the same The Group currently has a Liquidity and covenant

mixture of borrowings compliance is monitored

comprising a GBP0.8m loan carefully across varying

and a GBP0.5m rolling time horizons to facilitate

credit facility. The Group short term management and

remains dependent upon the also strategic planning.

support of these funders This monitoring enables the

and there is management

a risk that failure, in team to consider and to

particular to meet take appropriate actions

covenants attaching to the within suitable time

rolling credit facility, frames.

could have severe financial

consequences for the Group. In March 2020, the funder

agreed to convert the

existing loan with a three

year committed

Revolving Credit Facility

("RCF") with additional

headroom, a facility limit

of GBP1m, and

less stringent covenants

than the current

facilities. This agreement

was made with credit

approval and full knowledge

of the considerable

challenge presented by

Covid-19. In the event,

the company decided not to

proceed with this change,

and instead agreed with the

funder to

accept a temporary waiver

of all covenants at 31

March 2020, and relief from

the capital repayment

of GBP75,000 due in March

2020.

The funder has indicated

that they are not aware

of any reason why the offer

to convert to RCF at a

later date would not be

made available,

but that fresh credit

approval would be required.

Furthermore, the funder has

confirmed that

they are supportive of

acting as a conduit to

channel additional

liquidity to the company

under the auspices of the

Coronavirus Business

Interruption Loan Scheme

which the company

considers may offer

advantages over the

proposed move to the RCF.

Finally, the company has

received an unsolicited

indication of support from

a substantial

institutional shareholder,

although this is not

binding at this early

stage, and no proposal

has been formulated.

============================ ============================ ============================

Covid-19 and business Increased The recent escalation in All government guidance has

interruption the spread of Covid-19 in been monitored closely and

the UK poses a threat to followed immediately by

the continuation advisory notices

of business operations if to all employees, and

there is a widespread provision of the

infection in any of our appropriate guidance and

facilities or amongst cleaning materials to

the workforce. minimise

any effect.

Where staff members or

their close contacts have

presented with symptoms

they have been asked

to self-isolate away from

company premises and inform

us quickly of any contact

with other

employees which may be

cause for concern.

Recent government

information also provides

for relief from a

substantial portion of the

wage

costs of any staff members

on sick leave, in

self-isolation, or

furloughed due to a

diminution

in their current workload

as a consequence of

Covid-19.

Management have devised a

series of mitigating

actions, designed to

preserve cash resources

and maintain delivery of

essential products to our

customers and distributors.

============================ ============================ ============================

C ustomer concentration Remains the same The Group exports to over The majority of

thirty countries and distributors, including the

distributors around the most significant, are well

world, but certain established and their

distributors are material relationship with the Group

to the financial spans many years. Credit

performance and position of levels and cash collection

the Group. As disclosed is closely

in note 2 to the financial monitored by management,

statements, one customer and issues are quickly

accounted for 11.4% of elevated both within the

revenue in 2019 Group and with the

and the loss, failure or distributor.

actions of this customer

could have a severe impact

on the Group.

============================ ============================ ============================

Fore i gn ex change risk Remains the same The Group's functional The Group monitors currency

currency is UK Sterling; exposures on an on-going

however, it makes basis and enters into

significant purchases in forward currency

Euros and US Dollars. arrangements where

considered appropriate to

The US Dollars are mitigate the risk of

mitigated by US Dollar material adverse movements

sales by creating a natural in exchange rates impacting

hedge. The Group upon the business. Euro and

transferred US Dollar cash balances are

their Euro customers onto a monitored

Euro based pricing regularly and spot rate

structure in 2018 to sales into sterling are

mitigate risk by again, conducted when significant

creating a natural hedge. currency deposits

have accumulated. The

accounting policy for

foreign exchange is

disclosed in accountancy

policy

1d.

============================ ============================ ============================

Regulatory approval Remains the same As an international The Group has a dedicated

business, a significant Quality department which

proportion of the Group's assists product development

products require teams with

registration support as required to

from national or federal minimise the risk of

regulatory bodies prior to regulatory approval not

being offered for sale. The being obtained on new

majority of products and ensures that

our major product lines the Group operates

have FDA approval in the US processes and procedures

and we are therefore necessary to maintain

subject to their relevant regulatory

audit and inspection of our approvals.

manufacturing facilities.

Whilst there is no

There is no guarantee that guarantee that this will be

any product developed by sufficient, the Group has

the Group will obtain and invested in people

maintain national with the appropriate

registration or that the experience and skills in

Group will always pass this area which mitigates

regulatory audit of its this risk significantly.

manufacturing processes.

Failure to do so could have

severe consequences upon

the Group's ability to sell

products

in the relevant country.

============================ ============================ ============================

Brexit Reduced The Group exports to a The Group has successfully

number of different reassigned all of the

countries with sales to Company's product

Europe accounting for 11.9% certifications from BSI

of 2019 revenue. As well as Notified Body 0086 (UK) to

exporting, the Group BSI Netherlands Notified

imports goods both for Body 2797, in order to

re-sale through mitigate any risk

Distribution to regulatory clearance

revenue, as well as some both in the EU and in the

raw materials used in UK.

manufacturing.

Any risk to a delay in

Although the UK has now supply chain has also been

exited the EU, the current mitigated by the successful

trade rules remain in place application

until the of Approved Economic

end of the transition Operator Status, which we

period on 1 January 2021. received in March 2019.

Dependent on the

arrangements made between In addition to the above, a

the UK and EU following contingency plan has been

this period, this could implemented to increase

pose risks of delayed inventory levels

customs clearance which to ensure any delays caused

could in turn have a by increased customs

negative impact on the clearance will not impact

Group's supply chain. the Group's supply

chain.

============================ ============================ ============================

Key: Risk levels on prior year

Increased Risk increased on prior year

Remains the same Existing risk remains at the same

level from prior year

-----------------------------------

Reduced Risk has reduced from prior year

-----------------------------------

G oing con c ern

The Directors have prepared forecasts for the period to March

2021. Prior to the substantial impact of Covid-19 on the entire

business community, the directors had carried out an evaluation of

financial forecasts, sensitised to reflect a rational judgement of

the level of inherent risk. This exercise concluded that adequate

financial resources were available to ensure that the Company could

meets its obligations for a twelve month period with reasonable

certainty. It has subsequently become clear that there will need to

be reliance upon outside agencies including the UK Government,

Yorkshire Bank and possibly others, to ensure that these conditions

continue to apply.

As at period end, the Group had access to banking facilities,

which comprised a committed GBP0.5m revolving credit facility. Hire

purchase agreements are utilised where required. The revolving

credit facility of GBP0.5m may be used towards meeting the Group's

general working capital and other commitments. It is subject to

compliance with financial covenants which measure the ratio of

cashflow to debt service and EBITDA. In March 2020, the funder

agreed to convert the existing loan facility into a three year

committed Revolving Credit Facility ("RCF") with additional

headroom,a facility limit of GBP1m, and less stringent covenants

than the current facilities. This agreement was made with credit

approval and full knowledge of the considerable challenge presented

by Covid-19. In the event, the company decided not to proceed with

this change, and instead agreed with the funder to accept a

temporary waiver of all covenants at 31 March 2020, and relief from

the capital repayment of GBP75,000 due in March 2020.

The funder has indicated that, while they are not aware of any

reason why the offer to convert all debt to RCF at a later date

would not be made available, a fresh credit approval would be

required. Furthermore, the funder has confirmed that they are

supportive of acting as a conduit to channel additional liquidity

to the company under the auspices of the Coronavirus Business

Interruption Loan Scheme, which the company considers may offer

advantages over the lender-proposed move to the RCF.

Finally, the company has received an unsolicited indication of

funding support from a substantial institutional shareholder,

although this is not binding at this early stage, and no proposal

has been formulated.

Fundamental uncertainty will be common in varying degrees to

almost all businesses in every sector at the present time. It is

premature to be able to determine with precision the level of

support that may ultimately be required as events are moving

rapidly. Our bankers have moved extremely quickly in providing

short-term relief from capital repayments and covenant compliance,

and stand willing to support our immediate liquidity requirements.

These actions are an important precursor to enabling access to

funding through the Coronavirus Business Interruption Loan Scheme

in coming weeks. Furthermore, the announcements by the Chancellor

of the Exchequer on 20 March 2020 relating to various forms of

government assistance will provide substantial help. In addition,

we have received expressions of support from some of our key

trading partners and institutional shareholders.

Based on the forecasts, the Board has a reasonable expectation

that the Company and the Group have adequate resources and support

to continue in operational existence for the foreseeable future,

considered to be at least 12 months for the date of approval from

the financial statements, whilst acknowledging that there are

material uncertainties that do exist in preparing these financial

statements.

David Marsh

Chief Executive Officer

31 March 2020

Con solidated statem ent of comprehensi ve income

fo r they ear en ded 31 Dece m ber 2 0 19

20 19 20 18

Notes GBP '0 GBP '0

00 00

------------------------------------------------------ ------- ---------------- ---------------

Rev enue 2 10,733 10,969

Cost of s a les (6,400) (6,297)

====================================================== ======= ================ ===============

G ross profit 4,333 4,672

O ther ope r ati ng e x pens es (6,817) (4,327)

Other Income - 275

A djusted EBITDA 1,446 2,364

Amorti sa t ion of i nta n gi b le assets 4 (642) (1,141)

Impairment of intangible assets 4 (2,253) (2)

Depre c iati on of ta n gi b le a s s e ts (618) (481)

E x cep ti o nal ite ms (184) -

Share based payments (188) (120)

------------------------------------------------------ ------- ---------------- ---------------

O perating (loss) / profit (2,439) 620

Fina n ce c o sts (162) (105)

Fina n ce in c o me 5 -

====================================================== ======= ================ ===============

(Loss) / Profit b efore ta xation (2,596) 515

T a x a tion (charge) / credit (23) 210

====================================================== ======= ================ ===============

(Loss) / Profit a nd total comprehensive

Income (2,619) 725

====================================================== ======= ================ ===============

(Loss) / Earnings per share, total and continuing

Bas ic 3 (0.33p) 0.09p

Diluted 3 (0.33p) 0.09p

Adjusted earnings per share 3 0.05p 0.21p

------------------------------------------------------ ------- ---------------- ---------------

The Consolidated statement of comprehensive income above relates

to continuing operations.

Adjusted EBITDA is defined as earnings before interest,

taxation, depreciation, amortisation, impairment, share based

payments and exceptional items.

Profit and total comprehensive income relate wholly to the

owners of the parent Company.

Con solidated statem ent of changes in equ i ty

fo r the y ear en ded 31 Dece m ber 2 0 19

Share Share Capital Merger Retained

capital premium reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- -------------- ------------------- --------- --------- ---------- ---------

Balance as at 1 January 2018 7,826 5,831 329 1,250 (1,658) 13,578

Employee sharebased payment - - - - 120 120

Total - transactions with owners - - - - 120 120

Profit and total comprehensive

income for the period - - - - 725 725

----------------------------------- -------------- ------------------- --------- --------- ---------- ---------

Balance as at 31 December 2018 7,826 5,831 329 1,250 (813) 14,423

Employee sharebased payment - - - - 188 188

Issue of share capital 127 73 - - - 200

Total - transactions with owners 127 73 - - 188 388

Loss and total comprehensive

income for the period - - - - (2,619) (2,619)

----------------------------------- -------------- ------------------- --------- --------- ---------- ---------

Balance as at 31 December 2019 7,953 5,904 329 1,250 (3,244) 12,192

----------------------------------- -------------- ------------------- --------- --------- ---------- ---------

Con solidated balance sheet

A t 31 Dece m b er 20 19

20 19 2018

Notes GBP '0 GBP '0

00 00

======================================== ======= ============= ==============

A sse ts

Non-current a ssets

Property, p l ant and eq u ip m ent 718 934

Right of use assets 1,241 -

Intan g ib le a ss ets 4 7,613 10,191

Deferred tax asset - 91

9,572 11,216

======================================== ======= ============= ==============

Curr ent asse ts

In v entori es 2,925 2,083

T rade and other rec e i v abl es 2,359 2,961

Amount due from associate 173 79

Cashat b a nk a nd in h and 1,282 2,491

======================================== ======= ============= ==============

6,739 7,614

======================================== ======= ============= ==============

Totala ssets 16,311 18,830

======================================== ======= ============= ==============

Equity and liabiliti es

Equity attributable to equity holders

of the p arent compa ny

Sharecap ital 7,953 7,826

Share p r em i um a c co u nt 5,904 5,831

Capital re s erve 329 329

Merger reserve 1,250 1,250

Retain ed e arni n gs (3,244) (813)

======================================== ======= ============= ==============

Total e qui ty 12,192 14,423

======================================== ======= ============= ==============

Non-current l i abiliti es

Borro w ings 5 515 1,820

Deferred tax liabi l iti es 31 98

Dilapidation provision 165 165

Lease liability 7 1,086 -

======================================== ======= ============= ==============

1,797 2,083

======================================== ======= ============= ==============

Curr ent liabi lities

T rade and other pa y ab l es 6 1,518 1,556

Accru als 317 481

Borrowings 5 297 287

Lease liability 7 190 -

======================================== ======= ============= ==============

2,322 2,324

======================================== ======= ============= ==============

Total li abiliti es 4,119 4,407

======================================== ======= ============= ==============

Total e qui ty and liabili ties 16,311 18,830

---------------------------------------- ------- ------------- --------------

T h e acc o m p an y ing a c co u nti ng pol i c i es a nd n

otes fo rm p art of the f in a nc i al sta t em e nts.

T h e consolidated financial statements were approved by the

Board of Directors on 30 March 2020 and were signed on its behalf

by Nigel Rogers and David Marsh

Con solidated cashf l ow statement

fo r the y ear en ded 31 Dece m ber 2 0 19

2019 2018

Notes GBP'000 GBP'000

------------------------------------------- ------- --------- ---------

Cashflo ws from operating a ctivities

Profit after tax for the year (2,619) 725

Adju stm e nts for:

Taxation 23 (210)

Finance income (5) -

Finance costs 162 89

Depre c iati on of pro perty, p l ant

and e qu i pm e nt 415 481

Amorti sa t ion and impairment of i

nta n gi b le a s s ets 4 2,895 1,143

Depreciation ROU assets 7 203

Share-b a s ed pa ym ent cha r ge 188 120

Gain on disposal of fixed assets 1 6

Foreign exchange (56) 48

(Increase)/decrease ini n v entories (842) 384

Decre a se/(increase) in trade and other

rec e i v abl es 508 (1,027)

(Decre a se)/increase in pa y a bles (203) 48

------------------------------------------- ------- --------- ---------

Cash generat ed from operations 670 1,807

T a x a tion paid 1 (68)

Interest received 5

Intere st p aid (82) (89)

------------------------------------------- ------- --------- ---------

Net cash g enerated from ope r ating

activities 594 1,650

------------------------------------------- ------- --------- ---------

Pa y men ts to ac q uire pro p erty,

plant and eq u i p ment (199) (88)

Acqu i si t ion of i n t a n gi b le

a s s e ts 4 (317) (398)

Net cash used in investment activities (516) (486)

------------------------------------------- ------- --------- ---------

Repayment of bank loan 5 (1,300) (318)

Net proceeds from issue of share capital 201 -

Lease liabilities 7 (244)

Repa y ment of o bl i ga t io ns u nd

er fi n an ce l e as es - (16)

------------------------------------------- ------- --------- ---------

Net cash used in fin anc ing a ctivities (1,343) (334)

------------------------------------------- ------- --------- ---------

Net (decrease)/increase in cash and

cash equivalents (1,265) 830

Cash a nd ca sh e q ui v al e nts at

begi n ni ng of y ear 2,491 1,709

Effective exchange rate fluctuations

on cash held 56 (48)

------------------------------------------- ------- --------- ---------

Cash and cash equivalents at end of

year 1,282 2,491

=========================================== ======= ========= =========

Notes to the consolidated f inancial statem ents

1 . Group a c counting policies under IFRS

(a) Basis of prep aration

Surgical Innovations Group PLC (the "Company") is a public AIM

listed company incorporated, domiciled and registered in England in

the UK. The registered number is 02298163 and the registered

address is Clayton Wood House, 6 Clayton Wood Bank, Leeds, LS16

6QZ.

These financial statements have been prepared on the basis of

the International Financial Reporting Standards (IFRS) accounting

policies set out below. The financial statements have been prepared

in accordance with IFRS as adopted for use by the European Union,

including IFRIC interpretations, and in line with those provisions

of the Companies Act 2006 applicable to companies reporting under

IFRS. The preparation of financial statements in conformity with

IFRS requires the use of certain critical accounting estimates. It

also requires management to exercise its judgement in the process

of applying the Group's accounting policies. The financial

statements have been prepared under the historical cost convention,

are presented in Sterling and are rounded to the nearest

thousand.

The financial information set out in this preliminary

announcement does not constitute the Company's Consolidated

Financial Statements for the financial years ended 31 December 2019

or 31 December 2018 but are derived from those Financial

Statements. Statutory Financial Statements for 2018 have been

delivered to the Registrar of Companies and those for 2019 will be

delivered following the company's AGM. The auditors, BDO LLP, have

reported on those financial statements. Their report for 2018 was

unqualified, did not draw attention to any matters by way of

emphasis without qualifying their report and did not contain

statements under Section 498(2) or (3) of the Companies Act 2006 in

respect of the financial statements for 2018.

The report of the auditor for the year ended 31 December 2019

was:

-- unqualified;

-- did include a reference to a matter (Covid-19) to which the

auditor drew attention by way of a Material uncertainty related to

Going Concern without qualifying their report; and,

-- did not contain a statement under section 498(2) or (3) of the Companies Act 2006.

The Statutory accounts will be available on the Company's

website at www.sigroupplc.com with effect from 31 March 2020 and

will be posted to selected shareholders at the end of April.

Shareholders wishing to request a copy can contact the Company's

registered office.

Going concern

The Directors have considered the available cash resources of

the Group and its current forecasts and has a reasonable

expectation that the Group have adequate resources and support to

continue in operational existence for the foreseeable future,

considered to be at least 12 months for the date of approval from

the financial statements, whilst acknowledging that there are

material uncertainties that do exist in preparing these financial

statements.Further details of the Directors' assessment are

provided in the Chairman's Statement, the Operating and Financial

Review and Directors' report. The Directors draw attention to this

extensive disclosure which indicates the current uncertainty in

respect of the Covid-19 global pandemic. This event or condition

indicates that a material uncertainty exists that may cast

significant doubt on the Company's ability to continue as a Going

Concern.

New standards and amendments to standards adopted in the

year

During the year the Group adopted the following standard

effective from the 1 January 2019. The Group has applied this

standard in the preparation of the financial statements, and has

not adopted any new or amended standards early:

IFRS 16 'Leases' The standard is effective for periods beginning

on or after 1 January 2019 and is EU endorsed.

Leases has been adopted by the Group for the financial year

starting on 1 January 2019 (see note 7). The new standard has been

applied using the "modified retrospective" transition approach.

The Group has material operating lease commitment as set out in

note 7 and therefore the adoption of the standard is has a material

impact on the Financial Statements of the Group.

There is no adjustment to the opening balance of retained

earnings for the current period however reclassifications arising

from the new standard have been recognised in the opening balances

as at 1 January 2019. Prior periods have not been restated, as

permitted under the specific transitional provisions in the

standard. Accordingly the Group is not required to present a third

statement of financial position as at that date.

Other new amended standards and interpretations issued by the

IASB that apply to the financial statements do not impact the group

as they are either not relevant to the group's activities or

require accounting which is consistent with the group's current

accounting policies.

A number of new standards and amendments to standards and

interpretations have been issued but are not yet effective and in

some cases have not yet been adopted by the EU. The Directors do

not expect that the adoption of these standards will have a

material impact on the financial statements of the Group in future

periods.

2 . Segm ental r eporting

Inform ati on re ported to the Board, as Chief Operating

Decision Makers, a nd for the purp o se of a s s es s ing perfo r

ma n ce and m a k i ng in v e stm ent d e c is i o ns is organised

into t hree ope r ati ngs eg m en t s.

T h e Group's ope r ati ng s e g m e nts u nder IFRS 8 a re as f

o llo w s:

SIBrand - the re sea r ch, de v el o pm e nt, m anufa ctu re

a nd d i stri buti on of SI bran d ed mi n im a lly

in v a si ve de v ic es

O E M - The re sea r ch, de v el o pm e nt, m anufa ctu re

a nd d i stri buti on of min i m a lly in v a si ve

de v i ces for third party med i c al de v i ce co

m pa n ies th r ough eith er o wn la b el or c o -

b r andi ng. This now incorporates Precision Engineering,

the re sea r c h,de v el o pm e nt, m anufa ctu re

a nd s ale of m in i m al ly in v asi ve t ec h no

l ogy pro d uc ts for precision engineering applications

Distribution - Distribution of specialist medical products sold through

Elemental Healthcare Ltd

T h e me a sure of profit or l o ss f or e a ch re porta ble se

g m e nt is gro ss m argin l e ss amortization of pro du ct de v e

l o p ment c o sts. Asse ts a nd w orki ng c api t al a re mo n

itored on a Group b a s i s, w ith no s e para te d i s c l o sure

of as s et by s eg m ent ma de in the man a ge m ent a c cou nts,

and h ence no se p arate a s set d i sc lo sure is pro v id ed he r

e. T he f o l l o w ing se g me ntal anal ys is h as been prod u

ced to p r o v ide a re c on c il i ation betw e en t he i nfo r

mati on used by the chief operating d e c i si on m a k er w ithin

t he b u si n e ss a nd t he info r mati on as it is pre se nted u

nder IFRS.

S I Br Distribution OEM T o ta

Y e a r e n d ed 31 De ce m ber 20 a nd GBP'000 GBP '0 l*

19 GBP '0 00 GBP'0 00

00

======================================= =========== ============== ========= ===========

Rev enue 5,840 3,101 1,792 10,733

======================================= =========== ============== ========= ===========

Result

Segment re sult 1,510 (792) 720 1,438

Unall o ca t ed e x pens es (3,977)

======================================= =========== ============== ========= ===========

(Loss) from operations (2,439)

Fina n ce in c o me 5

Fina n ce c o sts (162)

======================================= =========== ============== ========= ===========

(Loss) b efore ta xation (2,596)

T a x charge 23

======================================= =========== ============== ========= ===========

(Loss) for the y ear (2,619)

--------------------------------------- ----------- -------------- --------- -----------

*There were no revenues transactions between the segments during the

year

Inc l uded w ithin t he s eg m ent/o perati ng re s u lts are t he

f o llo w i ng s ign ifi c ant no n - c a sh i t e m s:

S IBr Distribution OEM T o ta

Y e a r e n d ed 31 De ce m ber 20 a nd GBP '0 GBP '0 l

19 GBP '0 00 00 GBP '0

00 00

======================================= =========== ============== ========= ===========

Amorti sa t ion of i nta n gi b le a

s s ets 291 351 - 642

Impairment of i nta n gi b le a s s

ets 628 1,625 2,253

Additions to intangibles 317 - - 317

Additions to tangibles 189 10 - 199

======================================= =========== ============== ========= ===========

Unall o ca t ed e x pens es f or 2 0 19 i n clu de s a l es a nd

m ark eti ng c os ts (GBP 293,0 0 0), r es e arch and de v elo p me

nt c o s ts (GBP922,000), centr al o v e r hea ds (GBP1,004, 00 0),

Direct (Elemental Healthcare) sales & marketing overheads

(GBP1,427,000), share based payments (GBP188,000), exceptionals

(GBP184,000), less Right Of Use (GBP41,000).

S IBr Distribution OEM T o ta

Y e a r e n d ed 31 De ce m ber 2018 a nd GBP'000 GBP '0 l*

GBP '0 00 GBP '0

00 00

========================================= ========= ============== ========= =========

Rev enue 6,088 3,037 1,844 10,969

========================================= ========= ============== ========= =========

Result

Segment re sult 1,733 1,059 737 3,529

Unall o ca t ed e x pens es (2,909)

========================================= ========= ============== ========= =========

Profit from operations 620

Fina n ce in c o me -

Fina n ce c o sts (105)

========================================= ========= ============== ========= =========

Profit b efore ta xation 515

T a x credit 210

========================================= ========= ============== ========= =========

Profit for the y ear 725

========================================= ========= ============== ========= =========

* There were no revenues transactions between the segments

during the year

Inc l uded w ithin t he s eg m ent re

s u lts are t he f o llo w i ng i t

e m s:

S IBr Distribution OEM T o ta

Y e a re n d ed31De ce m ber2018 a nd GBP '0 GBP '0 l

GBP '0 00 00 GBP '0

00 00

========================================== ========= ============== ========= =========

Amorti sa t ion of i nta n gi b le a

s s ets 230 788 125 1,143

Additions to intangibles 398 - - 398

Additions to tangibles 65 23 - 88

========================================== ========= ============== ========= =========

Unall o ca t ed e x pens es f or 2 0 18 i n clu de s a l es a nd

m ark eti ng c os ts (GBP 260,0 0 0), r es e arch and de v elo p me

nt c o s ts (GBP618,000), centr al o v e r hea ds (GBP908, 00 0),

Direct (Elemental Healthcare) sales & marketing overheads

(GBP1,278,000), share based payments (GBP120,000) less Other Income

(GBP275,000).

Disaggregation of revenue

The Group has disaggregated revenues in the following table:

Y e a r e n d ed 31 De ce m ber S IBr Distribution OEM T o ta

20 19 a nd GBP '0 GBP '0 l

GBP '0 00 00 GBP '0

00 00

================================== ========= ============== ========= =========

United Kingdom 1,613 3,101 1,497 6,211

Europe 1,283 - - 1,283

US 1,852 - 295 2,147

Rest of World 636 - - 636

APAC 456 - - 456

---------------------------------- --------- -------------- --------- ---------

5,840 3,101 1,792 10,733

================================== ========= ============== ========= =========

Y e a r e n d ed 31 De ce m ber S IBr Distribution OEM T o ta

20 18 a nd GBP '0 GBP '0 l

GBP '0 00 00 GBP '0

00 00

================================== ========= ============== ========= =========

United Kingdom 1,692 3,037 1,426 6,155

Europe 1,347 - - 1,347

US 1,704 - 418 2,122

Rest of World 560 - - 560

APAC 785 - - 785

---------------------------------- --------- -------------- --------- ---------

6,088 3,037 1,844 10,969

================================== ========= ============== ========= =========

Rev enues are a ll o ca t ed g eog r aph i ca l ly on t he b a s

is of w here re v enu es w ere re c ei v ed f rom a nd not from the

ul t i m ate f i n al des t ina t ion of u se. During 2019

GBP1,226,0 00 (11.4%) of t he Group's re v e n ue d epe n ded on

one distributor in the SI Bra nd se g ment (2018: GBP1,177,000

(10.7%)).

Sales of goods were GBP10,374,000 (2018: GBP10,325,000) and

sales relating to services in the UK were GBP359,000, (2018:

GBP644,000).

3 . Earnin gs per ordina ryshare

Basic e arnings per ordinary share

T h e ca l cul ati on of ba s ic earn i n gs p er ord inary s

hare for t he y ear e n ded 31 De ce m ber 20 19 w as based up on

the (loss)/profit att r i b utab le to ord inary s hare h ol d ers

of ( GBP2,619 ,000) (2018: GBP725,000) a nd a w eig hted a v erage

n u mb er of ordi n ary s hares outs t an d ing f or t he y ear e

nd e`d 31 De ce m ber 2 0 19 of 789,845,629 ( 20 18: 782

,566,177).

Diluted e arnings per ordi n a ry share

T h e ca l cul ati on of di l uted earni ngs per o r din ary sha

re for t he y ear end ed 31 Dec e m ber 2 019 w as ba s ed u pon t

he (loss)/profit attri b uta b le to ord inary s hare h olde rs of

( GBP 2,619,000) (2018: GBP725,000) a nd a w eighted a v erage n u

mber of ordin ary sha r es o utstan d ing f or the y ear end ed 31

De c em b er 2019 of 891,313,476 (2018: 829,578,416). The anti

dilutive effect of unexcercised shares options has not been taken

into account and therefore the diluted earnings per share is equal

to the basic earnings per share.

Adjusted e arnings per ordi n a ry share

T h e ca l cul ati on of adjusted earni ngs per o r din ary sha

re for t he y ear end ed 31 Dec e m ber 2 019 w as ba s ed u pon t

he adjusted profit attri b uta b le to ord inary s hare h olde rs

(profit before exceptional and amortisations and impairment costs

relating to the acquisition of Elemental Heathcare, impairment of

capitalised development costs and share based payments) of

GBP355,000 (2018: GBP1,633,000) a nd a w eighted a v erage n u mber

of ordin ary sha r es o utstan d ing f or the y ear end ed 31 De c

em b er 2019 of 789,845,629 (2018:782,566,177).

No. of sh a r es used in calc ulat i on of e ar

nings p er o r dina ry s h a re ('0 00 s)

20 19 2018

No. of No. of Shares

Shares

===================================================== =========== ================

Bas ic ea r ni n gs p er s hare 789,846 782,566

Diluti ve eff e ct of une x erc i sed s hare o pti

o ns (101,467) 47,012

===================================================== =========== ================

Diluted ea r nin gs p er s hare 891,313 829,578

===================================================== =========== ================

4. Intangible assets

Capitalised Single use Exclusive

development product Goodwill Supplier Total

costs knowledge Agreements

transfer

GBP'000 GBP,000 GBP'000 GBP'000 GBP'000

Cost

At 1 J anuary 2 018 12,701 225 8,180 1,799 22,905

Additi ons 398 - - - 398

At 1 J anuary2 019 13,099 225 8,180 1,799 23,303

Additi ons 317 - - - 317

A t 31 December 2 0 19 13,416 225 8,180 1,799 23,620

======================== ============== ===================== ================ ================== ===============

A cc umulated a mortis

ation

At 1 J anuary 2 018 (11,471) - - (498) (11,969)

Charge f or t he y ear (353) - - (788) (1,141)

Impairment provision (2) - - - (2)

At 1 J anuary 2 019 (11,826) - - (1,286) (13,112)

Charge f or t he y ear (291) - - (351) (642)

Imp a irm e nt p r o v

is i on (403) (225) (1,625) - (2,253)

======================== ============== ===================== ================ ================== ===============

A t 31 December 2 0 19 (12,520) (225) (1,625) (1,637) (16,007)

======================== ============== ===================== ================ ================== ===============

Carr ying amount

A t 31 December 2 0 19 896 - 6,555 162 7,613

======================== ============== ===================== ================ ================== ===============

At 31 De ce m ber 2

018 1,273 225 8,180 513 10,191

======================== ============== ===================== ================ ================== ===============

At 1 January 2018 1,230 225 8,180 1,301 10,936

======================== ============== ===================== ================ ================== ===============

Goodwill and intangibles are allocated to the cash generating

unit (CGU) that is expected to benefit from the use of the

asset.

Capitalised development costs

Capitalised development costs represent expenditure incurred in

developing new products that fulfil the requirements met for

capitalisation as set out in paragraph 57 of IAS38. These costs are

amortised over the future commercial life of the product,

commencing on the sale of the first commercial item, up to a

maximum product life cycle of ten years, and taking account of

expected market conditions and penetration.

An impairment review is carried out annually, due to the

complexity of a device and regulatory challenges, particularly in

relation to the Medical Device Regulation, transition an impairment

of GBP0.24m has been recognised.

Single use product knowledge transfer

Single use product knowledge transfer relates to the acquisition

and of the single use laparoscopic instrumentation products of

Surgical Dynamics Ltd in 2016. Additional expenditure of GBP168,000

in relation to this has been included in Capitalised development

costs.

An impairment review is carried out annually, due to the

constraints on funding the project was a low priority during

2019.With further expenditure on hold a subsequent review was taken

and concluded that, with the continued pressure on resources and no

likelihood of making significant progress without the required

investment, the project has been closed. The impairment for this

project combining the Single Use product knowledge transfer and

additional expenditure on capitalised development is GBP0.40m.

Goodwill

The Group tests goodwill at each reporting date for impairment

and whenever events or changes in circumstances indicate that the

carrying value may not be recoverable. The recoverable amount of a

cash generating unit (CGU) is determined based on value in use

calculations. These calculations use post-tax cash flow projections

based on five year financial budgets approved by management. Cash

flows beyond the five year period are extrapolated using estimated

long term growth rates.

An impairment review is carried out annually for goodwill.

Goodwill arose on the acquisition of Elemental Healthcare Limited

in 2017 and is related to both the Distribution and SI Brand

segments of the Group. Elemental Healthcare Limited is considered

to be a separate CGU of the Group whose recoverable amount has been

calculated on a value in use basis by reference to discounted

future cash flows over a five year period plus a terminal value.

Principal assumptions underlying this calculation are the growth

rate into perpetuity of 2% (2018: 1.5%) and a pre-tax discount rate

of 15% (2018: 15%) applied to anticipated cash flows. In addition

the value in use calculation assumes a gross profit margin of 40.6%

(2018:48.8%) using past experience of sales made and future sales

that were expected at the reporting date based on anticipated

market conditions.

The trading environment in the UK market became more challenging

during 2019, due to a progressive tightening of NHS funding for

elective surgery, and the extended time taken to rebuild the

distribution sales of Cellis branded products, including those due

for imminent launch which have been delayed. Accordingly, the

directors have adopted a cautious approach to forecasting future

net inflows for this CGU.

On this basis, the recoverable amount of the cash-generating

unit does not exceed its carrying value and in view of this excess,

the Directors consider the impairment calculation to be unduly

sensitive to changes to the above assumptions, and are of the

opinion that a provision for impairment is required of

GBP1.63m.

Subsequent to the year end, the potential effects of the

Covid-19 outbreak and consequential impact on the availability of

NHS resources, may have a further and more significant impact on

the directors view of short to medium term cash flows. This has not

been quantified, and there is not yet sufficient experience to make