Imperial Brands Agrees $3.9 Billion Loan

31 Marzo 2020 - 8:56AM

Dow Jones News

By Anthony O. Goriainoff

Imperial Brands PLC said Tuesday that it has agreed to a new 3.5

billion euro ($3.87 billion) loan to provide the business with

committed bank financing until March 2023.

The tobacco company--which houses Winston cigarettes, rolling

tobacco Golden Virginia and rolling paper Rizla among its

brands--said the new facility replaces its existing 3 billion pound

($3.72 billion) facility. The facility is currently undrawn and

underpins the liquidity position of the business, the company

added.

"The new facility was coordinated by NatWest, Santander and SMBC

and is provided by a syndicate of 20 banks," it said.

Imperial said there has been no material effect on the group's

performance to date from the coronavirus pandemic, and current

trading remains in line with expectations.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

March 31, 2020 02:41 ET (06:41 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

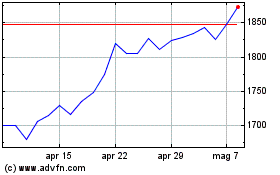

Grafico Azioni Imperial Brands (LSE:IMB)

Storico

Da Mar 2024 a Apr 2024

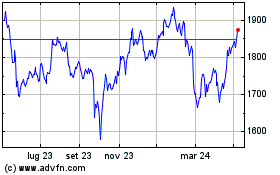

Grafico Azioni Imperial Brands (LSE:IMB)

Storico

Da Apr 2023 a Apr 2024