Australian, NZ Dollars Higher After China PMI Data

31 Marzo 2020 - 5:25AM

RTTF2

The Australian and NZ dollars moved up against their major

counterparts in the Asian session on Tuesday, as China

manufacturing activity returned to expansion in March, easing fears

over an economic slowdown triggered by the Covid-19 pandemic.

The latest survey from the National Bureau of Statistics said

that the manufacturing sector in China moved back into expansion in

March, with a manufacturing PMI score of 52.0 - beating forecasts

for 45.0. That's up sharply from 35.7 in February, and it moves

back above the boom-or-bust line of 50 that separates expansion

from contraction.

Data from the Reserve Bank of Australia showed that private

sector credit in Australia was up 0.3 percent on month in February

- unchanged from the previous month and in line with

expectations.

On a yearly basis, credit was up 2.8 percent - exceeding

forecasts for 2.6 percent and up from 2.5 percent in January.

The aussie climbed to more than a 2-week high of 0.6213 against

the greenback, from a 4-day low of 0.6078 set at 8:45 pm ET. The

aussie is likely to challenge resistance around the 0.67 level.

Reversing from its early lows of 65.99 against the yen and

1.0198 against the kiwi, the aussie approached 6-day peaks of 67.27

and 1.0293, respectively. The next possible resistance for the

aussie is seen around 75.00 against the yen and 1.08 against the

kiwi.

The aussie advanced to near 3-week highs of 0.8806 against the

loonie and 1.7733 against the euro, after falling to 0.8624 and

1.8105, respectively in early deals. If the aussie rises further,

it may find resistance around 0.92 against the loonie and 1.60

against the euro.

The kiwi rose to a 4-day high of 65.50 against the yen and near

a 2-week high of 1.8249 against the euro, off its early lows of

64.67 and 1.8466, respectively. The kiwi is seen finding resistance

around 72.00 against the yen and 1.70 against the euro.

The NZ currency appreciated to 0.6039 against the greenback,

following a 4-day fall to 0.5951 at 8:45 pm ET. The kiwi is poised

to find resistance around the 0.54 level.

Looking ahead, German jobless rate and Eurozone CPI for March

will be featured in the European session.

In the New York session, Canada GDP data for January and

industrial product price index for February, as well as

S&P/Case-Shiller home price index for January and consumer

confidence index for March are due out.

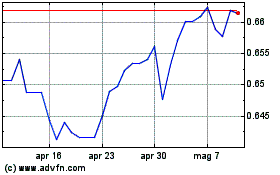

Grafico Cross AUD vs US Dollar (FX:AUDUSD)

Da Mar 2024 a Apr 2024

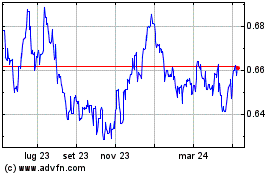

Grafico Cross AUD vs US Dollar (FX:AUDUSD)

Da Apr 2023 a Apr 2024