TIDMTMG

RNS Number : 3165I

Mission Group PLC (The)

01 April 2020

1 APRIL 2020

The Mission Group plc

("MISSION" "The Company" or "The Group")

FINAL RESULTS FOR THE YEARED 31 DECEMBER 2019

NINTH CONSECUTIVE YEAR OF GROWTH DELIVERED AGAINST CHALLENGING

TRADING BACKDROP

MISSION (AIM:TMG), the alternative group for ambitious brands,

is pleased to announce final results for the year ended 31 December

2019.

FINANCIAL HIGHLIGHTS

Year ended 31 December 2019 2018

* REVENUE GBP81.0M GBP77.6M 4%

* OPERATING PROFIT * GBP10.8M GBP9.9M 8%

* PROFIT MARGINS 13.3% 12.8%

* HEADLINE PROFIT BEFORE TAX* GBP10.2M GBP9.2m 11%

* REPORTED PROFIT BEFORE TAX GBP8.3M GBP7.7M 8%

* EARNINGS PER SHARE* 9.47p 8.67p 9%

* DILUTED EARNINGS PER SHARE* 9.00p 8.46p 6%

* Headline results are calculated before acquisition

adjustments, start-up costs and profit/loss on investments (as set

out in Note 4).

* Ninth consecutive year of growth despite challenging

market backdrop

* Robust performance reflects strength of Agencies in

our portfolio

* Strong cash generation with net cash from operating

activities increasing to GBP9.3m

* Debt leverage ratios remain comfortably within Board

limits

* Decision to pay final dividend of 1.53p per share

remains on hold, as part of measures to conserve cash

in current unprecedented trading conditions as a

result of the outbreak of COVID-19

BUSINESS HIGHLIGHTS

* Successful completion of launch and repositioning of

MISSION brand during the year is already driving

early successes in new business development in 2020

* Continued strong Client retention across Agencies

with new Client wins adding to our blue-chip global

client base

* Further progress through our central innovation hub

Fuse, with a strong performance from our embryonic

asset tracking business Pathfindr

* All Agencies successfully onboarded onto MISSION

shared services platform

Commenting, David Morgan, Chairman of The Mission Group plc

said: "Given the well documented UK and sector challenges in 2019,

I can only congratulate the people who run and work in our Agencies

on a remarkable performance that delivered on forecast revenue and

profit growth, thereby maintaining the upward progression that has

been the hallmark of the rebirth of our Group for the last ten

years.

Whilst the impact of Covid-19 on the global economy will

inevitably impact on the Group's performance in the current

financial year, the Board is confident that MISSION is well placed

to continue to serve our Clients' needs and benefit from future

opportunities when normal conditions return."

ENQUIRIES:

THE MISSION GROUP PLC Tel: 020 7462 1415

James Clifton, Chief Executive

Peter Fitzwilliam, Chief Financial

Officer

SHORE CAPITAL (Nomad and Broker) Tel: 020 7408 4090

Mark Percy / James Thomas/ Sarah

Mather

HOUSTON (Financial PR and Investor Tel: 0203 760 7668

Relations)

Kate Hoare / Laura Stewart

NOTES TO EDITORS

MISSION is a collective of creative Agencies. Employing 1,150

people in the UK, Europe, Asia and US, the Group combines the

expertise of Integrated and Specialist Agencies to bring

commercially effective solutions to business challenges.

Founded as a cooperative of like-minded entrepreneurs, MISSION

has built an impressive track record. The Group has grown revenue

and profit each year for the last nine years, winning prestigious

and progressively bigger business across its blue-chip Client base

and acquiring new Agencies with fantastic reputations, expanding

its service capability even further.

In addition to the Group's creative Agencies sits Fuse,

MISSION's central innovation hub through which the Group has

successfully trialled and developed a number of emerging

technologies. Many of these have been grown into successful

commercial products that not only bring value to the MISSION family

of Agencies, but which have been successfully able to realise

market value at sale.

www.themission.co.uk

CHAIRMAN'S STATEMENT

Rising to the Challenge

Given the well documented UK and sector challenges in 2019, I

can only congratulate the people who run and work in our Agencies

on a remarkable performance that delivered on forecast revenue and

profit growth, thereby maintaining the upward progression that has

been the hallmark of the rebirth of our Group for the last ten

years.

2019 was undoubtedly a transitional year for the Group.

Following the appointment of James Clifton, formerly CEO of our

Agency bigdog, as Group Chief Executive in April, MISSION has

undergone a repositioning to reflect its coming of age as a real

and credible challenger to the established agency networks. Our

entrepreneurial spirit, driven culture and diverse offering makes

MISSION more relevant than ever as brands seek alternatives to the

traditional agencies.

MISSION 's new identity has put business development at the

heart of the Group, driving greater multi-Agency collaboration. At

the same time, we have refined our business structure to create a

simplified, more effective service offering. This has included

mergers of some of our Agencies across the UK, including bigdog and

krow. The new-look MISSION celebrates and drives forward the

Group's open, collaborative culture whilst aiming to retain the

entrepreneurial spirit on which it has been built.

Profitable growth delivered during 2019 once again came from

increased mandates from existing Clients, new Client wins and

assignments and a continued focus on operating costs and margins.

We are also very pleased to see continued good progress from our

Pathfindr and wider Fuse initiatives. Giles Lee formally took on

the role of Commercial Director at the start of the year, and new

centralised initiatives and structures are already protecting and

fuelling margin performance.

Board

As well as the appointment of James Clifton as Group CEO in

April 2019, we also welcomed Barry Cook, one of the founding

directors of krow, to MISSION 's Board in June. krow has been a

terrific addition to the Group and I have every confidence in our

leadership team and their ability to deliver going forward.

Dividend

The Board adopts a progressive dividend policy, aiming to grow

dividends each year in line with earnings but always balancing the

desire to reward our shareholders via dividends with the need to

fund the Group's growth ambitions and maintain a strong balance

sheet. When we published our Trading Update in January, it was our

intention to pay a final dividend of 1.53 pence per share, bringing

the total for the year to 2.3 pence per share, representing an

increase of 10% over 2018. The Board has proposed a resolution for

a final dividend in its AGM Notice, recognising how important the

dividend is to our shareholders. However, in the light of the

current economic uncertainty as a result of the impact of Covid-19

on the global economy, we will make a final decision as we approach

the AGM on 15 June.

Outlook and impact of Covid-19

2020 began well for MISSION and whilst we have been delighted

with the early progress we have made against our plans, the

Covid-19 pandemic has resulted in an unprecedented global trading

environment to which few businesses are immune.

The health and well-being of our teams is our priority and we

have taken decisive steps to protect them, in line with the

Government guidance. The majority of our staff are used to working

remotely therefore causing minimum disruption for our Client

service and day to day operations.

Whilst the impact of Covid-19 on the global economy will

inevitably impact on the Group's performance in the current

financial year ending 31 December 2020, MISSION has a strong

balance sheet and a resilient business model servicing a broad

range of Clients operating across numerous sectors and geographies.

As such, the Board is confident that MISSION is well placed to

continue to serve our Clients' needs and benefit from future

opportunities when normal conditions return.

David Morgan

Chairman

1 April 2020

CHIEF EXECUTIVE'S REVIEW

I am delighted to be leading MISSION during this exciting period

for our business. Founded as a cooperative of like-minded

entrepreneurs, over the last ten years MISSION has built an

impressive track record. We have grown revenue and profit each

year, winning prestigious and progressively bigger business from

across our growing, blue-chip Client base and acquired new Agencies

with fantastic reputations, strengthening our standing in our

sector even further.

2019 has seen us continue to build on this strong momentum to

deliver our 9(th) consecutive year of growth, despite a difficult

trading backdrop during which Brexit uncertainty continued to

hamper Client decision making and restrict budgets. Over the course

of the year we also took stock of the progress that we have

achieved to date, refining our growth plans as we look forward to

2020 and beyond.

Strategy

As a group of collaborative specialists, we are no longer purely

a marketing communications group, selling our marketing wares.

Instead we are a business partner to a broad portfolio of UK and

international brands with a range of creative skills to help solve

business challenges. In recognition of this, in September 2019 we

announced the re-naming of our Group to The MISSION Group plc ("

MISSION ") supported by a launch of the Group's vision, values and

beliefs to our Clients, staff and the industry. This vision puts

MISSION at the heart of both our business model and new business

strategy as the alternative group for ambitious brands.

We see huge opportunity to grow our Client-partner relationships

through increased collaboration across our Agencies and through the

adoption of a more strategic approach to leveraging our global

footprint. I'm delighted that we have already seen early progress

here, with an excellent example during the period being our work

for leading UK sofa retailer DFS, through an integrated campaign

led by krow supported by two other MISSION Agencies.

As we move forwards fostering a cohesive approach, we have

refined our business structure to create a more effective service

offering. This has included the merger of bigdog and krow into a

single integrated Agency, retaining the name krow; the expansion of

Story into Leeds and Newcastle, taking on our Robson Brown Agency;

and the merger of April Six and RLA into a single Agency to

leverage both complementary skillsets and the existing April Six

international footprint.

This transition has been smooth and we have been very pleased

with the initial feedback from these Agencies. Through this

simplified structure we now have an even stronger platform from

which we can deliver further organic growth and identify the right

acquisition opportunities to expand our capabilities and network

both in the UK and overseas.

As we work to develop our vision to be the alternative group for

ambitious brands, we are placing increasing focus on the additive

value that MISSION can bring to the entrepreneurial Agencies within

our network, helping them to unlock new growth opportunities and

optimise their business operations. By the close of the year we had

successfully completed the onboarding of all of the Agencies in our

portfolio onto our shared services platform, giving them access to

centralised functions such as Finance, IT and HR. We are also

making further investments in our central platform to help underpin

better collaboration across our network and expect to see the

results of some of these initiatives start to flow through in the

new financial year.

We will continue to build on our track record of embracing

emerging technologies, providing our Agencies with access to these

evolving capabilities through our central innovation hub Fuse .

Here we bring together the most curious and creative minds from

across our business, collaborating to create new software and

hardware products. We have grown many of these incubator ideas into

successful commercial products that not only bring value to the

MISSION family of Agencies, but which in the case of BroadCare we

were able to realise market value at sale. Some exciting new

initiatives are in development, a couple of which should be ready

for launch in 2020.

There is no doubt that within MISSION we have created unique

skills and processes which enhance what we do for our Clients

within an ever-changing marketplace. We truly believe we have found

an alternative and better way to help our Clients.

Performance Overview

Despite a challenging trading environment as a result of the

heightened level of political uncertainty, we were delighted to

deliver a good full year performance.

Revenue increased 4% to GBP81.0m (2018: GBP77.6m), representing

our ninth consecutive year of growth. Our profit margin (headline

operating profit as a percentage of revenue) again improved, to

13.3% (2018: 12.8%), and headline profit improved by 11% to

GBP10.2m (2018: GBP9.2m), all from our core business.

Our Agencies performed well, with strong Client retention rates

maintained and major new contracts won including Cummins Inc,

Docker and Fuji Xerox. The structural refinements to our Agency

portfolio were completed over the course of the final quarter of

the year and we have been delighted with the smooth integration and

the Client and employee feedback to date.

International expansion over the period continued to be

Client-led, resulting in expansion into Seattle, Chicago and

Beijing. In addition, we have recently opened an office in Munich,

the Group's first opening in Mainland Europe.

We are also pleased with the progress of Mongoose Sports and

Mongoose Promotions, our start-ups of three years ago, both of

which moved into profit far earlier than we expected and continued

to grow through the year.

During the course of the year we were particularly pleased with

the progress achieved by Pathfindr, our embryonic asset tracking

business, which nearly doubled its turnover to GBP0.9m (2018:

GBP0.5m) as it expanded the installed base for its tracking devices

and grew its customer numbers. The time taken from initial quote

and proof of concept to securing invoiced revenue has proven to be

different, and longer, than for our Agency businesses, but the

prospects for further growth in the coming years remain very

strong.

Our People

The collaborative nature and entrepreneurial spirit that MISSION

fosters is the cornerstone of our culture and we are particularly

proud of the focus we place on developing our people, drawing great

talent into our business from across the country and offering

exciting career paths throughout the Group. Through the

introduction of our new Strategic People Plan we have focused on

our priority areas of Developing Talent, Supporting Performance,

Reward and Recognition, Leadership and Development, Equality,

Diversity and Inclusion and Organisational Development.

A particular highlight during 2019 was our new partnership with

Creative Access. As part of our focus on promoting diversity within

our own business, we recognise that people from BAME backgrounds

are under-represented across our industry as a whole. This

important initiative is focussed on helping to attract talent from

more diverse backgrounds and to actively promote opportunities to

join the Group. As part of this programme, senior leaders from

across the Group will mentor young people from BAME backgrounds

looking to progress in the industry.

With collaboration being a core focus for MISSION , we also

launched Ignition, a Group-wide competition led by our Fuse

business. This competition encourages new and innovative

suggestions for tomorrow's products and services. The winning

entrant receives backing from the Group to develop their idea into

proof of concept, prototype and beyond, and the opportunity to

participate personally in its commercial success.

At the time of writing, the world is changing rapidly. But as

demonstrated by these results, MISSION is a diverse mix of

collaborative specialists who work together to deliver real

business growth for our Clients. It is exactly this ethos and

approach that our Clients will continue to demand, arguably even

more so, when the world returns to normality.

James Clifton

Group Chief Executive

1 April 2020

CHIEF FINANCIAL OFFICER'S REPORT

The Group manages its internal operational performance and

capital management by monitoring various key performance indicators

("KPIs"). The KPIs are tailored to the level at which they are used

and their purpose. The Board has reviewed and retained its long

term financial KPIs, which are quantified and commented on in the

financial review of the year below, as follows:

-- operating income ("revenue"), which the Group aims to grow by at least 5% per year;

-- headline operating profit margins, which the Group is

targeting to increase from 11.5% in 2016 to 14% by 2021;

-- headline profit before tax, which the Group aims to increase by 10% year-on-year; and

-- indebtedness, where the Group has set a limit for the ratio

of net bank debt to EBITDA* of x1.5 and for the ratio of total debt

(including both bank debt and deferred acquisition consideration)

to EBITDA of x2.0.

*EBITDA is headline operating profit before depreciation and

amortisation charges and before the impact of IFRS 16.

At the individual Agency level, the Group's financial KPIs

comprise revenue and controllable profitability measures,

predominantly based on the achievement of the annual budget. More

detailed KPIs are applied within individual Agencies. In addition

to financial KPIs, the Board periodically monitors the length of

Client relationships, the forward visibility of revenue and the

retention of key staff.

Comparisons

The Group's BroadCare business was sold in November 2018 and, as

a result, the following financial comparisons and commentary are

based on like-for-like trading from continuing operations.

In addition, the Group has implemented IFRS 16: Leases and 2018

comparatives have been restated accordingly. The impact of IFRS 16

on the Group's net profitability is insignificant but the bringing

onto the balance sheet of future lease commitments and the

reclassification of operating lease costs into depreciation and

interest costs affects EBITDA and leverage ratios. The impact of

the application of IFRS 16 is included in Note 2 and, where

significant, referred to in the following commentary.

TRADING PERFORMANCE

Overview

2019 saw revenue growth on continuing operations of 4%, all

organic, an improvement in operating margins to 13.3% and growth in

headline profit before tax of 11%. Debt leverage ratios remained

comfortably within the Board's limits.

Billings and Revenue

Turnover (billings) was 7% higher than the previous year, at

GBP171.1m (2018: GBP159.9m), but since billings include

pass-through costs (e.g. TV companies' charges for buying airtime),

the Board does not consider turnover to be a key performance

measure for its Agencies. Instead, the Board views operating income

(turnover less third-party costs) as a more meaningful measure of

activity levels. The exception to this is Pathfindr, the Group's

embryonic asset tracking business, where turnover is a more

relevant measure to gauge progress over time and against relevant

competitors.

Operating income (referred to as "revenue") increased 4% to

GBP81.0m (2018: GBP77.6m), representing our ninth consecutive year

of growth. 2019 was undoubtedly a challenging year given the

considerable political uncertainty, and we were pleased that the

mix of businesses in our portfolio was resilient against this

backdrop.

All growth in the year came from our core business, since we

made no acquisitions during 2019, and all of our different business

activities showed year-on-year progress.

Pathfindr showed good progress during the year, nearly doubling

its turnover to GBP0.9m (2018: GBP0.5m) as it expanded the install

base for its tracking devices and grew its customer numbers. The

time taken from initial quote and proof of concept to securing

invoiced revenue has proven to be different, and longer, than for

our Agency businesses, but the prospects for further growth in the

coming years remain very strong.

Profit and Margins

The Directors measure and report the Group's performance

primarily by reference to headline results, in order to avoid the

distortions created by one-off events and non-cash accounting

adjustments relating to acquisitions. Headline results are

calculated before the profit/loss on investments, acquisition

adjustments and losses from start-up activities (as set out in Note

4).

Headline operating profit improved by 8% to GBP10.8m (2018:

GBP9.9m), all from our core business. Our profit margin for the

year (headline operating profit as a percentage of revenue) again

improved, to 13.3% (2018: 12.8%). This was the result of several

factors, including changes in mix between Agencies and lower

central costs.

The bias of profitability towards the second half of the year as

a consequence of Clients' spending patterns repeated itself again,

with 66% (2018: 65%) of our operating profit generated in this

period but, more than ever, Client spending came towards the end of

the year.

After GBP0.1m of profits from joint ventures (2018: GBPnil) and

largely unchanged financing costs of GBP0.7m, headline profit

before tax increased by 11% to GBP10.2m (2018: GBP9.2m).

Adjustments to reported profits, detailed further in Note 4,

totalled GBP1.9m (2018: GBP1.5m), comprising acquisition-related

items of GBP1.3m, up from GBP1.0m in 2018, reflecting the krow

acquisition made during 2018, losses from start-up activities of

GBP0.4m, up from GBP0.1m in 2018 as we expanded into China and

Germany, and investment write-downs of GBP0.1m (2018: GBP0.3m).

After these adjustments, reported profit before tax was GBP8.3m

(2018: GBP7.7m).

Taxation

The Group's headline tax rate increased slightly, to 20.5%

(2018: 20.1%). Consistent with previous years, the rate was above

the statutory rate, mainly as a result of non-deductible trading

losses and entertaining expenditure.

On a reported basis, the Group's tax rate was 22.5% (2018:

16.2%). The tax rate is expected to be consistently higher than the

statutory rate (of 19.0%, unchanged from 2018) since the

amortisation of acquisition-related intangibles is not deductible

for tax purposes but, in 2018, the tax rate was significantly

reduced by the tax-free profit on the sale of BroadCare. Excluding

the BroadCare sale, the reported rate in 2018 was 22.1%.

Earnings Per Share

Headline EPS increased by 9% to 9.47 pence (2018: 8.67 pence)

and, on a diluted basis, increased by 6% to 9.00 pence (2018: 8.46

pence). Growth in diluted EPS was lower than growth in profits due

to the effect of the Growth Share Scheme, for which the performance

condition was met during 2019.

After tax, reported profit for the year was GBP6.4m (2018:

GBP6.0m) and EPS was 7.51 pence (2018: 7.08 pence). On a diluted

basis, EPS was 7.14 pence (2018: 6.91 pence).

DIVIDS

The Board adopts a progressive dividend policy, aiming to grow

dividends each year in line with earnings but always balancing the

desire to reward shareholders via dividends with the need to fund

the Group's growth ambitions and maintain a strong balance

sheet.

A dividend of 0.77 pence per share was paid in December 2019,

representing a 10% increase over last year. The Board has proposed

a resolution for a 10% higher final dividend of 1.53 pence per

share in its AGM Notice, recognising how important the dividend is

to our shareholders, but in the light of the coronavirus pandemic

and the considerable uncertainty about both the severity and

duration of its impact, will make a final decision in the light of

prevailing circumstances as we approach the AGM on 15 June.

BALANCE SHEET

In common with other marketing communications groups, the main

features of our balance sheet are the goodwill and other intangible

assets resulting from acquisitions made over the years, and the

debt taken on in connection with those acquisitions.

The level of intangible assets relating to acquisitions remained

virtually unchanged during the year but in contrast, the level of

total debt (combined net bank debt and acquisition obligations)

reduced by GBP2.0m.

The Board undertakes an annual assessment of the value of all

goodwill, explained further in Note 12, and at 31 December 2019

again concluded that no impairment in the carrying value was

required.

The Group's acquisition obligations at the end of 2019 were

GBP8.9m (2018: GBP11.8m), to be satisfied by a mix of cash and

shares. All of this is dependent on post-acquisition earn-out

profits. GBP3.3m is expected to fall due for payment in cash within

12 months and a further GBP3.7m in cash in the subsequent 12

months.

CASH FLOW

Net cash inflow from operating activities increased to GBP9.3m

despite t he back-ended nature of our trading which resulted in an

increase in working capital requirements at the end of the year.

This cash flow funded capital expenditure of GBP1.3m (2018:

GBP1.0m), increased software development investment of GBP0.8m

(2018: GBP0.4m), the settlement of contingent consideration

obligations relating to the profits generated by previous

acquisitions, totaling GBP2.7m (2018: GBP1.7m), and dividends of

GBP1.8m (2018: GBP1.7m).

At the end of the year, the Group's net bank debt stood at

GBP4.9m (2018: GBP4.0m). On an adjusted basis (pre-IFRS 16), the

leverage ratio of net bank debt to headline EBITDA remained below

x0.5 at 31 December 2019 (2018: x0.5). The Group's adjusted ratio

of total debt, including remaining acquisition obligations, to

EBITDA at 31 December 2019 remained unchanged at x1.1.

GOING CONCERN

As mentioned in our statement of Principal Risks &

Uncertainties, in view of the UK political uncertainty and real

possibility of a no-deal Brexit, we undertook a stress test on our

banking facilities during the year to ensure that the Group could

withstand an economic downturn of the magnitude experienced

following the 2008 global financial crisis, when the Group's

profits reduced by around 30%. The conclusion of this assessment

was that the Group had sufficient facilities to withstand a repeat

of similar magnitude.

The potentially more severe impact from the coronavirus pandemic

has caused us to revisit that stress testing and to model various

scenarios and the Group's ability to adapt and take mitigating

actions. The consensus view at the time of writing is that there is

likely to be a sharp slowdown in the second quarter of the year,

with a recovery in H2. We have modelled downturns of differing

severity and duration and concluded that the Group can weather the

storm within its committed banking facilities, which have recently

been increased to GBP20m.

Notwithstanding that conclusion, the Board has already taken,

and will be taking further, mitigating actions. The Board has

placed the final dividend due for payment in July under review and

all Board members have voluntarily reduced their salaries.

Capital expenditure has been reduced to a minimum and the Group

will seek to defer a proportion of its other commitments. The Group

will also look to take advantage of the financial assistance being

offered by the Government.

Together, these actions will result in additional headroom

against our banking facilities and are considered sufficient to

enable the Group to withstand the impact of Covid-19.

Peter Fitzwilliam

Chief Financial Officer

1 April 2020

Consolidated Income Statement

For the year ended 31 December 2019

Total

Year to Continuing Discontinued Year to

31 operations operations 31 December

2018

December 2018 2018

2019 (Restated) (Restated)

Note GBP'000 GBP'000 GBP'000 GBP'000

TURNOVER 3 171,091 159,916 1,476 161,392

Cost of sales (90,119) (82,331) (221) (82,552)

OPERATING INCOME 3 80,972 77,585 1,255 78,840

Headline operating expenses (70,219) (67,666) (776) (68,442)

HEADLINE OPERATING PROFIT 10,753 9,919 479 10,398

Acquisition adjustments 4 (1,320) (1,010) - (1,010)

Start-up costs 4 (431) (139) - (139)

(Loss) / profit on investments 4 (109) (312) 2,981 2,669

----------- ------------- -------------- ---------------

OPERATING PROFIT 8,893 8,458 3,460 11,918

Share of results of associates

and joint ventures 69 (1) - (1)

----------- ------------- -------------- ---------------

PROFIT BEFORE INTEREST

AND TAXATION 8,962 8,457 3,460 11,917

Net finance costs 6 (668) (735) - (735)

PROFIT BEFORE TAXATION 7 8,294 7,722 3,460 11,182

Taxation 8 (1,868) (1,710) (96) (1,806)

----------- ------------- -------------- ---------------

PROFIT FOR THE YEAR 6,426 6,012 3,364 9,376

----------- ------------- -------------- ---------------

Attributable to:

Equity holders of the

parent 6,314 5,901 3,364 9,265

Non-controlling interests 112 111 - 111

----------- ------------- -------------- ---------------

6,426 6,012 3,364 9,376

----------- ------------- -------------- ---------------

Basic earnings per share

(pence) 10 7.51 7.08 4.04 11.12

Diluted earnings per share

(pence) 10 7.14 6.91 3.94 10.85

Headline basic earnings

per share (pence) 10 9.47 8.67 0.46 9.13

Headline diluted earnings

per share (pence) 10 9.00 8.46 0.45 8.90

2018 comparative information has been restated in all primary

statements and notes to the financial statements following the

adoption of IFRS16 (see note 2).

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2019

Total

Year to Continuing Discontinued Year to

31 December operations operations 31 December

2019 2018 2018

2018 (Restated)

(Restated)

GBP'000 GBP'000 GBP'000 GBP'000

PROFIT FOR THE YEAR 6,426 6,012 3,364 9,376

Other comprehensive income

- items that may be reclassified

separately to profit or

loss:

Exchange differences on

translation of foreign

operations (50) 73 - 73

-------------- ------------- -------------- --------------

TOTAL COMPREHENSIVE INCOME

FOR THE YEAR 6,376 6,085 3,364 9,449

-------------- ------------- -------------- --------------

Attributable to:

Equity holders of the

parent 6,285 5,933 3,364 9,297

Non-controlling interests 91 152 - 152

-------------- ------------- -------------- --------------

6,376 6,085 3,364 9,449

-------------- ------------- -------------- --------------

Consolidated Balance Sheet

As at 31 December 2019

As at As at

31 December 31 December

2019 2018

(Restated)

Note GBP'000 GBP'000

FIXED ASSETS

Intangible assets 11 95,859 96,121

Property, plant and equipment 3,225 3,125

Right of use assets 8,135 7,733

Investments in associates and

joint ventures 12 177 -

Deferred tax assets - 23

107,396 107,002

------------- -------------

CURRENT ASSETS

Stock 1,091 850

Trade and other receivables 13 40,998 39,727

Cash and short term deposits 5,028 5,899

------------- -------------

47,117 46,476

CURRENT LIABILITIES

Trade and other payables 14 (36,015) (37,060)

Corporation tax payable (742) (668)

Acquisition obligations 17 (3,424) (3,258)

(40,181) (40,986)

------------- -------------

NET CURRENT ASSETS 6,936 5,490

TOTAL ASSETS LESS CURRENT LIABILITIES 114,332 112,492

------------- -------------

NON CURRENT LIABILITIES

Bank loans 15 (9,927) (9,886)

Lease liabilities 16 (6,229) (6,022)

Acquisition obligations 17 (5,458) (8,537)

Deferred tax liabilities (417) (451)

------------- -------------

(22,031) (24,896)

------------- -------------

NET ASSETS 92,301 87,596

------------- -------------

CAPITAL AND RESERVES

Called up share capital 18 8,530 8,436

Share premium account 43,015 42,506

Own shares 19 (659) (299)

Share-based incentive reserve 700 498

Foreign currency translation

reserve 88 117

Retained earnings 40,021 35,826

------------- -------------

EQUITY ATTRIBUTABLE TO EQUITY

HOLDERS OF THE PARENT 91,695 87,084

------------- -------------

Non-controlling interests 606 512

------------- -------------

TOTAL EQUITY 92,301 87,596

------------- -------------

Consolidated Cash Flow Statement

For the year ended 31 December 2019

Year to Year to

31 December 31 December

2019 2018

(Restated)

GBP'000 GBP'000

Operating profit 8,893 11,918

Depreciation and amortisation charges 4,832 4,738

Movements in the fair value of contingent

consideration 433 (67)

Profit on disposal of property, plant

and equipment (49) (5)

Loss on write down of investment - 312

Profit on disposal of BroadCare - (2,981)

Non cash charge for share options, growth

shares and shares awarded 215 183

Increase in receivables (1,271) (2,022)

Increase in stock (241) (182)

Decrease in payables (1,106) (210)

------------- -------------

OPERATING CASH FLOWS 11,706 11,684

Net finance costs paid (626) (826)

Tax paid (1,805) (1,906)

------------- -------------

Net cash inflow from operating activities 9,275 8,952

------------- -------------

INVESTING ACTIVITIES

Proceeds on disposal of property, plant

and equipment 151 30

Purchase of property, plant and equipment (1,472) (1,014)

Investment in software development (848) (377)

Proceeds from disposal of BroadCare - 4,099

Acquisition of subsidiaries - (2,990)

Acquisition of investments in associates

and joint ventures (108) -

Payment relating to acquisitions made

in prior years (2,731) (1,748)

Cash disposed of and costs of disposal

of BroadCare - (584)

Cash acquired with subsidiaries - 553

Net cash outflow from investing activities (5,008) (2,031)

------------- -------------

FINANCING ACTIVITIES

Dividends paid (1,831) (1,546)

Dividends paid to non-controlling interests - (149)

Repayment of lease liabilities (2,579) (2,446)

Repayment of bank loans - (3,125)

Issue of shares to minority interests 3 -

(Purchase) / sale of own shares held

in EBT (681) 311

Net cash outflow from financing activities (5,088) (6,955)

------------- -------------

Decrease in cash and cash equivalents (821) (34)

Exchange differences on translation

of foreign subsidiaries (50) 73

Cash and cash equivalents at beginning

of year 5,899 5,860

------------- -------------

Cash and cash equivalents at end of

year 5,028 5,899

------------- -------------

Consolidated Statement of Changes in Equity For the year ended

31 December 2019

Total

Share- Foreign attributable

based currency to equity Non-controlling

Share Share Own incentive translation Retained holders interest Total

capital premium shares reserve reserve earnings of parent equity

(Restated) (Restated) GBP'000 (Restated)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2018 8,436 42,506 (602) 341 85 28,072 78,838 509 79,347

--------------- --------- --------- --------- ----------- ------------- ------------ -------------- ----------------- ------------

Profit

for the

year - - - - - 9,265 9,265 111 9,376

Exchange

differences

on

translation

of foreign

operations - - - - 32 - 32 41 73

--------------- --------- --------- --------- ----------- ------------- ------------ -------------- ----------------- ------------

Total

comprehensive

income

for the

year - - - - 32 9,265 9,297 152 9,449

Share option

charge - - - 69 - - 69 - 69

Growth

share charge - - - 88 - - 88 - 88

Shares

awarded

and sold

from own

shares - - 303 - - 35 338 - 338

Dividend

paid - - - - (1,546) (1,546) (149) (1,695)

--------------- --------- --------- --------- ----------- ------------- ------------ -------------- ----------------- ------------

At 31 December

2018 8,436 42,506 (299) 498 117 35,826 87,084 512 87,596

--------------- --------- --------- --------- ----------- ------------- ------------ -------------- ----------------- ------------

Profit

for the

year - - - - - 6,314 6,314 112 6,426

Exchange

differences

on

translation

of foreign

operations - - - - (29) - (29) (21) (50)

--------------- --------- --------- --------- ----------- ------------- ------------ -------------- ----------------- ------------

Total

comprehensive

income

for the

year - - - - (29) 6,314 6,285 91 6,376

New shares

issued 94 509 - - - - 603 3 606

Share option

charge - - - 127 - - 127 - 127

Growth

share charge - - - 75 - - 75 - 75

Own shares

purchased - - (681) - - - (681) - (681)

Shares

awarded

and sold

from own

shares - - 321 - - (288) 33 - 33

Dividend

paid - - - - (1,831) (1,831) - (1,831)

--------------- --------- --------- --------- ----------- ------------- ------------ -------------- ----------------- ------------

At 31 December

2019 8,530 43,015 (659) 700 88 40,021 91,695 606 92,301

--------------- --------- --------- --------- ----------- ------------- ------------ -------------- ----------------- ------------

Notes to the Consolidated Financial Statements

1. Principal Accounting Policies

Basis of preparation

The results for the year to 31 December 2019 have been extracted

from the audited consolidated financial statements, which are

expected to be published by 15 April 2020.

The financial information set out above does not constitute the

Company's statutory accounts for the years to 31 December 2019 or

2018 but is derived from those accounts. Statutory accounts for the

year ended 31 December 2018 were delivered to the Registrar of

Companies following the Annual General Meeting on 15 June 2019 and

the statutory accounts for 2019 are expected to be published on the

Group's website ( www.themission.co.uk ) shortly, posted to

shareholders at least 21 days ahead of the Annual General Meeting

("AGM") on 15 June 2020 and, after approval at the AGM, delivered

to the Registrar of Companies.

The auditors, PKF Francis Clark, have reported on the accounts

for the years ended 31 December 2019 and 31 December 2018; their

reports in both years were (i) unqualified, (ii) did not include a

reference to any matters to which the auditors drew attention by

way of emphasis without qualifying their report and (iii) did not

contain a statement under Section 498 (2) or (3) of the Companies

Act 2006 in respect of those accounts.

New standards, interpretations and amendments to existing

standards

The Group has adopted IFRS 16 Leases for the first time. The

impact on the financial statements of this new standard is detailed

in Note 2.

2. Adoption of IFRS 16 Leases

The Group has applied IFRS 16 Leases for the first time, using

the full retrospective approach, with restatement of comparative

information. IFRS 16 changes how the Group accounts for leases

previously classified off balance sheet as operating leases under

IAS 17, by removing the distinction between operating and finance

leases and requiring the recognition of a right of use asset and a

lease liability at the commencement of all leases except for short

term leases and leases of low value assets.

Applying IFRS 16 for all leases (except as noted below), the

Group:

-- recognises right of use assets and lease liabilities in the

Consolidated Balance Sheet, initially measured at present value of

future lease payments;

-- recognises depreciation on right of use assets and interest

on lease liabilities in the Consolidated Income Statement; and

-- separates the total amount of cash paid into a principal

portion (presented within financing activities) and interest

(presented within operating activities) in the Consolidated Cash

Flow Statement.

For short term leases (lease term of 12 months or less) and

leases of low value assets (such as computer equipment), the Group

has opted to recognise a lease expense on a straight-line basis as

permitted by IFRS 16. This expense is presented within operating

expenses in the Consolidated Income Statement.

Financial impact of initial application of IFRS 16

The tables below show the amount of adjustment for each

financial statement line item affected by the application of IFRS

16 for the current and prior year.

The impact of IFRS 16 on the Group's profitability is

insignificant, with the primary impact being one of

reclassification: from operating lease expenses to depreciation and

interest costs. The impact on the balance sheet is to recognise the

Group's operating lease commitments, most of which relate to

Agencies' premises rentals and which were previously reported in

the Notes to the financial statements, as assets and liabilities on

the face of the balance sheet. The value of these right of use

assets and corresponding liabilities will fluctuate over time as

lease terms expire and new leases are entered into.

Impact on profit or loss

Year to 31 Year to 31

December December

2019 2018

Note GBP'000 GBP'000

Decrease in operating

lease expenses i 2,766 2,649

Increase in depreciation

expense i (2,396) (2,194)

----------- -----------

Increase in headline

operating profit 370 455

Increase in finance

costs i (272) (266)

----------- -----------

Increase in headline

PBT, headline PAT

and profit for the

period 98 189

----------- -----------

Impact on earnings per share

Year to Year to 31

31

December December

2019 2018

Increase in reported and headline

earnings per share:

Basic earnings per share (pence) 0.12 0.23

Diluted earnings per share (pence) 0.11 0.22

The above increases apply to both earnings per share from total

operations and earnings per share for continuing operations. There

is no change in earnings per share from discontinued

operations.

Impact on assets, liabilities and equity

as at 31 December 2019

As if IAS 17 IFRS 16 adjustments As restated

still applied

Note GBP'000 GBP'000 GBP'000

Goodwill iv 91,354 398 91,752

Property, plant and

equipment ii 3,294 (69) 3,225

Right of use assets i, ii - 8,135 8,135

Prepayments iii 2,802 (43) 2,759

Impact on total assets 8,421

Other creditors and

accruals iii (9,154) (179) (9,333)

Short term lease liabilities i (42) (2,533) (2,575)

Long term lease liabilities i - (6,229) (6,229)

--------------------

Impact on total liabilities (8,941)

Retained earnings 40,541 (520) 40,021

--------------------

Notes:

i The application of IFRS 16 to leases previously classified as

operating leases under IAS 17 resulted in the recognition of right

of use assets and lease liabilities. It also resulted in a decrease

in operating leases expenses and an increase in depreciation and

interest expenses.

ii Equipment under finance lease arrangements previously

presented within property, plant and equipment is now presented

within the line item right of use assets. There has been no change

in the amount recognised.

iii Amounts previously recorded in prepayments or accruals under

IAS 17 as a result of differences between operating lease expenses

recognised and amounts paid have been derecognised and the amount

factored into the measurement of the lease liability. The

recognition of accruals for dilapidation costs has also been

adjusted and the amount factored into the measurement of the right

of use assets.

iv Goodwill of companies acquired after 1 January 2018 has been

impacted as a result of the change in net assets as at acquisition

date arising from the application of IFRS 16.

3. Segmental Information

IFRS 15: Revenue from Contracts with Customers requires the

disaggregation of revenue into categories that depict how the

nature, amount, timing and uncertainty of revenue and cash flows

are affected by economic factors. The Board has considered how the

Group's revenue might be disaggregated in order to meet the

requirements of IFRS 15 and has concluded that the activity and

geographical segmentation disclosures set out below represent the

most appropriate categories of disaggregation. The Board considers

that neither differences between types of Clients, sales channels

and markets nor differences between contract duration and the

timing of transfer of goods or services are sufficiently

significant to require further disaggregation.

For management purposes the Group monitored the performance of

its separate operating units, each of which carries out a range of

activities, as a single business segment. However, since different

activities have different revenue characteristics, the Group's

turnover and operating income has been disaggregated below to

provide additional benefit to readers of these financial

statements.

Following the implementation of a Shared Services function from

the start of 2018 and the resulting transfer of certain

Agency-specific contracts onto centrally-managed arrangements, a

significant portion of the total operating costs are now centrally

managed and segment information is therefore now only presented

down to the operating income level.

Advertising Media Exhibitions Public Total

& Digital Buying & Learning Relations

Year to 31 December 2019 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ -------- ------------ ----------- --------

Turnover 109,421 30,855 20,162 10,653 171,091

------------ -------- ------------ ----------- --------

Operating income 64,510 3,694 5,226 7,542 80,972

------------ -------- ------------ ----------- --------

Advertising Media Exhibitions Public Total

& Digital Buying & Learning Relations

Year to 31 December 2018 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ -------- ------------ ----------- --------

Turnover - continuing operations 96,615 36,473 17,488 9,340 159,916

Turnover - discontinued

operations 1,476 - - - 1,476

------------ -------- ------------ ----------- --------

Turnover - total Group 98,091 36,473 17,488 9,340 161,392

------------ -------- ------------ ----------- --------

Operating income - continuing 61,805 3,469 5,202 7,109 77,585

Operating income - discontinued 1,255 - - - 1,255

------------ -------- ------------ ----------- --------

Operating income - total

Group 63,060 3,469 5,202 7,109 78,840

------------ -------- ------------ ----------- --------

As contracts typically have an original expected duration of

less than one year, the full amount of the accrued income balance

at the beginning of the year is recognised in revenue during the

year. All media buying turnover is recognised at a point in time.

Virtually all other turnover from continuing operations is

recognised over time.

Assets and liabilities are not split between activities.

Geographical segmentation

The following table provides an analysis of the Group's

operating income by region of activity:

Year to 31 Year to

31

December December

2019 2018

GBP'000 GBP'000

From continuing operations

UK 72,228 68,519

USA 4,618 4,005

Asia 4,103 5,061

Rest of Europe 23 -

80,972 77,585

----------- ---------

From discontinued operations

UK - 1,255

-------- ------

From continuing and

discontinued operations

UK 72,228 69,774

USA 4,618 4,005

Asia 4,103 5,061

Rest of Europe 23 -

80,972 78,840

----------- -------

4. Reconciliation of Headline Profit to Reported Profit

The Board believes that headline profits, which eliminate

certain amounts from the reported figures, provide a better

understanding of the underlying trading of the Group. The

adjustments to reported profits generally fall into three

categories: acquisition-related items, start-up costs and profit /

loss on investments.

Year ended Year ended

31 December 31 December

2019 2018

(Restated)

GBP'000 GBP'000

PBT PAT PBT PAT

GBP'000 GBP'000 GBP'000 GBP'000

From continuing operations

Headline profit 10,154 8,075 9,183 7,334

Acquisition-related items (Note

5) (1,320) (1,200) (1,010) (895)

Start-up costs (431) (358) (139) (115)

Write off of investments and

associates (109) (91) (312) (312)

------------ -------- -------- ------

Reported profit 8,294 6,426 7,722 6,012

------------ -------- -------- ------

From discontinued operations

Headline profit - - 479 383

Profit on sale of BroadCare - - 2,981 2,981

Reported profit - - 3,460 3,364

From continuing and discontinued

operations

Headline profit 10,154 8,075 9,662 7,717

Profit on sale of BroadCare - - 2,981 2,981

Acquisition-related items (Note

5) (1,320) (1,200) (1,010) (895)

Start-up costs (431) (358) (139) (115)

Write off of investments and associates (109) (91) (312) (312)

Reported profit 8,294 6,426 11,182 9,376

------------ -------- -------- ------

Start-up costs derive from organically started businesses and

comprise the trading losses of such entities until the earlier of

two years from commencement or when they show evidence of becoming

sustainably profitable. Start-up costs in 2019 relate to the

launches of April Six's new venture in Germany and Story's new

venture in Leeds, and trading losses at April Six's China operation

. Start- up costs in 2018 related to April Six's venture in China

and trading losses at Mongoose Promotions (now profitable).

5. Acquisition Adjustments

Year to Year to

31 December 31 December

2019 2018

GBP'000 GBP'000

Amortisation of other intangibles recognised

on acquisitions (870) (915)

Movement in fair value of contingent consideration (433) 67

Acquisition transaction costs expensed (17) (162)

------------- -------------

(1,320) (1,010)

------------- -------------

The movement in fair value of contingent consideration relates

to a net upward (2018: downward) revision in the estimate payable

to vendors of businesses acquired in prior years . Acquisition

transaction costs relate to professional fees in connection with

acquisitions made or contemplated.

6. Net Finance Costs

Year to Year to

31 December 31 December

2019 2018

(Restated)

GBP'000 GBP'000

Interest on bank loans and overdrafts,

net of interest on bank deposits (351) (394)

Amortisation of bank debt arrangement

fees (41) (66)

Interest expense on lease liabilities (276) (275)

Net finance costs (668) (735)

------------- -------------

7. Profit Before Taxation

Profit on ordinary activities before taxation is stated after

charging / (crediting):

Year to Year to

31 December 31 December

2019 2018

(Restated)

GBP'000 GBP'000

Depreciation of owned tangible fixed assets 1,270 1,164

Depreciation expense on right of use assets 2,452 2,228

Amortisation of intangible assets recognised

on acquisitions 870 915

Amortisation of other intangible assets 240 371

Expense relating to short term leases 77 108

Expense relating to low value leases 23 40

Income from subleasing right of use assets (30) -

Staff costs 52,931 51,363

Bad debts and net movement in provision for

bad debts (3) 27

Auditors' remuneration 205 271

Loss / (gain) on foreign exchange 160 (114)

Auditors' remuneration may be analysed by:

Year to Year to

31 December 31 December

2019 2018

GBP'000 GBP'000

Audit of Group's annual report and financial

statements 42 41

Audit of subsidiaries 110 133

Audit related assurance services 5 5

Tax advisory services 26 26

Corporate finance 16 61

Other services 6 5

205 271

------------- -------------

8. Taxation

Year to Year to

31 December 31 December

2019 2018

GBP'000 GBP'000

Current tax:-

UK corporation tax at 19.00% (2018: 19.00%) 1,693 1,752

Adjustment for prior periods (64) (58)

Foreign tax on profits of the period 290 214

------------- -------------

1,919 1,908

Deferred tax:-

Current year originating temporary differences (51) (102)

Tax charge for the year 1,868 1,806

------------- -------------

Factors Affecting the Tax Charge for the Current Year:

The tax assessed for the year is higher (2018: lower) than the

standard rate of corporation tax in the UK. The differences

are:

Year to Year to

31 December 31 December

2019 2018

(Restated)

GBP'000 GBP'000

Profit before taxation 8,294 11,182

------------- -------------

Profit on ordinary activities before tax

at the standard rate of corporation tax

of 19.00% (2018: 19.00%) 1,576 2,125

Effect of:

Non-deductible expenses 161 238

Losses not utilised 157 54

Non-taxable profit on sale of Broadcare - (581)

Non-deductible impairment of investments 19 60

Adjustments in respect of prior periods (43) (58)

Other differences (2) (32)

------------- -------------

Actual tax charge for the year 1,868 1,806

------------- -------------

9. Dividends

Year to Year to

31 December 31 December

2019 2018

GBP'000 GBP'000

Amounts recognised as distributions to equity

holders in the year:

Interim dividend of 0.77 pence (2018: 0.7

pence) per share 648 585

Prior year final dividend of 1.4 pence (2018:

1.15 pence) per share 1,183 961

------------- -------------

1,831 1,546

------------- -------------

A final dividend of 1.53 pence per share is to be paid in July

2020 should it be approved by shareholders at the AGM. In

accordance with IFRS this final dividend will be recognised in the

2020 accounts.

10. Earnings Per Share

The calculation of the basic and diluted earnings per share is

based on the following data, determined in accordance with the

provisions of IAS 33: Earnings Per Share.

Year to Year to

31 December 31 December

2019 2018

(Restated)

GBP'000 GBP'000

Earnings

Reported profit for the year

From continuing operations 6,426 6,012

Attributable to:

Equity holders of the parent 6,314 5,901

Non-controlling interests 112 111

------------- -------------

6,426 6,012

------------- -------------

From discontinued operations - 3,364

Attributable to:

Equity holders of the parent - 3,364

Non-controlling interests - -

------------- -------------

- 3,364

------------- -------------

From continuing and discontinued operations 6,426 9,376

Attributable to:

Equity holders of the parent 6,314 9,265

Non-controlling interests 112 111

------------- -------------

6,426 9,376

------------- -------------

Headline earnings (Note 4)

From continuing operations 8,075 7,334

Attributable to:

Equity holders of the parent 7,963 7,223

Non-controlling interests 112 111

------------- -------------

8,075 7,334

------------- -------------

From discontinued operations - 383

Attributable to:

Equity holders of the parent - 383

Non-controlling interests - -

------------- -------------

- 383

------------- -------------

From continuing and discontinued operations 8,075 7,717

Attributable to:

Equity holders of the parent 7,963 7,606

Non-controlling interests 112 111

8,075 7,717

Number of shares

Weighted average number of Ordinary shares

for the purpose of basic earnings per share 84,056,636 83,338,888

Dilutive effect of securities:

Employee share options 4,426,774 2,081,410

Weighted average number of Ordinary shares

for the purpose of diluted earnings per

share 88,483,410 85,420,298

From continuing operations

Basic earnings per share (pence) 7.51 7.08

Diluted earnings per share (pence) 7.14 6.91

From discontinued operations

Basic earnings per share (pence) - 4.04

Diluted earnings per share (pence) - 3.94

From continuing and discontinued operations

Basic earnings per share (pence) 7.51 11.12

Diluted earnings per share (pence) 7.14 10.85

Headline basis:

From continuing operations

Basic earnings per share (pence) 9.47 8.67

Diluted earnings per share (pence) 9.00 8.46

From discontinued operations

Basic earnings per share (pence) - 0.46

Diluted earnings per share (pence) - 0.45

From continuing and discontinued operations

Basic earnings per share (pence) 9.47 9.13

Diluted earnings per share (pence) 9.00 8.90

A reconciliation of the profit after tax on a reported basis and

the headline basis is given in Note 4.

11. Intangible Assets

31 December 31 December

2019 2018

(Restated)

GBP'000 GBP'000

Goodwill 91,752 91,752

Other intangible assets 4,107 4,369

95,859 96,121

------------- ------------

Goodwill

Year to Year to

31 December 31 December

2019 2018

(Restated)

GBP'000 GBP'000

Cost

At 1 January 96,025 89,064

Recognised on acquisition of subsidiaries - 6,961

At 31 December 96,025 96,025

------------- -------------

Impairment adjustment

At 1 January and 31 December 4,273 4,273

Net book value at 31 December 91,752 91,752

------- -------

In accordance with the Group's accounting policies, an annual

impairment test is applied to the carrying value of goodwill. The

review performed assesses whether the carrying value of goodwill is

supported by the net present value of projected cash flows derived

from the underlying assets for each cash-generating unit ("CGU").

For all CGUs, the Directors assessed the sensitivity of the

impairment test results to changes in key assumptions (in

particular expectations of future growth) and concluded that a

reasonably possible change to the key assumptions would not cause

the carrying value of goodwill to exceed the net present value of

its projected cash flows.

Other intangible assets

Software Trade names Customer Total

development relationships

and licences

GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January 2018 2,192 1,033 3,985 7,210

-------------- ------------ --------------- --------

Additions 377 748 1,886 3,011

Disposals (832) - - (832)

At 31 December 2018 1,737 1,781 5,871 9,389

-------------- ------------ --------------- --------

Additions 848 - - 848

Disposals (122) - - (122)

At 31 December 2019 2,463 1,781 5,871 10,115

-------------- ------------ --------------- --------

Amortisation and impairment

At 1 January 2018 1,010 174 2,866 4,050

-------------- ------------ --------------- --------

Charge for the year 371 132 783 1,286

Disposals (316) - - (316)

-------------- ------------ --------------- --------

At 31 December 2018 1,065 306 3,649 5,020

-------------- ------------ --------------- --------

Charge for the year 240 75 795 1,110

Disposals (122) - - (122)

-------------- ------------ --------------- --------

At 31 December 2019 1,183 381 4,444 6,008

-------------- ------------ --------------- --------

Net book value at 31

December 2019 1,280 1,400 1,427 4,107

-------- -------- -------- --------

Net book value at 31

December 2018 672 1,475 2,222 4,369

------ -------- -------- --------

Additions of GBP848,000 (2018: GBP377,000) in the year include

costs associated with the development of identifiable software

products that are expected to generate economic benefits in excess

of the costs of development.

Intangible assets include an amount of GBP617,000 (2018:

GBP692,000) relating to the krow trade name, which has attained

recognition in the marketplace and plays a role in attracting and

retaining Clients. This value will be amortised over the next 8

years (2018: 9 years). Also included is an amount of GBP1,336,000

(2018: GBP1,650,000) relating to krow customer relationships. Krow

has developed a base of customers to whom the Group would expect to

continue selling in the future. The remaining useful life of these

customer relationship is deemed to by 4 years (2018: 5 years) and

the value will be amortised over this period.

12. Investments in Associates and Joint Ventures

Year to Year to

31 December 31 December

2019 2018

GBP'000 GBP'000

At 1 January - 313

Profit / (loss) during the year 69 (1)

Additions 108 -

Write down of investment - (312)

------------ ------------

At 31 December 177 -

------------ ------------

In 2019 the Group transferred its Learning activities into an

established company, Fenturi Limited, in exchange for a 25%

shareholding in that company. Fenturi is a Bristol-based digital

learning agency with historical, positive previous associations

with Bray Leino.

In 2018 the activities of Watchable Limited, a film and video

content company based in London, substantially ceased. As a

consequence, the value of the Group's 25% investment in associate

was written down to zero.

13. Trade and Other Receivables

31 December 31 December

2019 2018

GBP'000 GBP'000

Trade receivables 27,451 27,156

Accrued income 9,779 9,788

Prepayments 2,759 2,050

Other receivables 1,009 733

40,998 39,727

------------ ------------

An allowance has been made for estimated irrecoverable amounts

from the provision of services of GBP82,000 (2018: GBP62,000). The

estimated irrecoverable amount is arrived at by considering the

historic loss rate and adjusting for current expectations, Client

base and economic conditions. Both historic losses and expected

future losses being very low, the Directors consider it appropriate

to apply a single average rate for expected credit losses to the

overall population of trade receivables and accrued income. Accrued

income relates to unbilled work in progress and has substantially

the same risk characteristics as the trade receivables for the same

types of contracts. The Directors consider that the carrying amount

of trade and other receivables approximates their fair value.

31 December 31 December

2019 2018

GBP'000 GBP'000

Gross trade receivables 27,533 27,218

Gross accrued income 9,779 9,788

------------ ------------

Total trade receivables and accrued income 37,312 37,006

Expected loss rate 0.2% 0.2%

Provision for doubtful debts 82 62

14. Trade and Other Payables

31 December 31 December

2019 2018

(Restated)

GBP'000 GBP'000

Trade creditors 14,050 13,645

Other creditors and accruals 9,333 9,847

Deferred income 5,754 6,755

Other tax and social security payable 4,303 4,306

Lease liabilities 2,575 2,507

36,015 37,060

------------ ------------

Deferred income has decreased by GBP1,001,000 as a result of

changes to contractual terms and billings to a few Clients who

accounted for a significant portion of the deferred income balance

at 31 December 2018.

The Directors consider that the carrying amount of trade and

other payables approximates their fair value.

15. Bank Overdrafts, Loans and Net Debt

31 December 31 December

2019 2018

GBP'000 GBP'000

Bank loan outstanding 10,000 10,000

Unamortised bank debt arrangement fees (73) (114)

Carrying value of loan outstanding 9,927 9,886

Less: Cash and short term deposits (5,028) (5,899)

------------ ------------

Net bank debt 4,899 3,987

------------ ------------

The borrowings are repayable as follows:

Less than one year - -

In one to two years 10,000 -

In more than two years but less than

three years - 10,000

10,000 10,000

Unamortised bank debt arrangement fees (73) (114)

9,927 9,866

Less: Amount due for settlement within

12 months (shown under current liabilities) - -

------------ ------------

Amount due for settlement after 12 months 9,927 9,886

------------ ------------

Bank debt arrangement fees, where they can be amortised over the

life of the loan facility, are included in finance costs. The

unamortised portion is reported as a reduction in bank loans

outstanding.

At 31 December 2019, the Group's committed bank facilities

comprised a revolving credit facility of GBP15.0m, expiring on 28

September 2021, with an option to extend the facility by a further

GBP5.0m and an option to extend by one year. Interest on the

facility is based on LIBOR plus a margin of between 1.25% and 2.00%

depending on the Group's debt leverage ratio, payable in cash on

loan rollover dates. Since the year end, the option to extend the

facility by GBP5.0m has been implemented and the Group's committed

facilities at the date of this report total GBP20.0m.

In addition to its committed facilities, the Group has available

an overdraft facility of up to GBP3.0m with interest payable by

reference to National Westminster Bank plc Base Rate plus

2.25%.

At 31 December 2019, there was a cross guarantee structure in

place with the Group's bankers by means of a fixed and floating

charge over all of the assets of the Group companies in favour of

Royal Bank of Scotland plc.

All borrowings are in sterling.

16. Lease Liabilities

Obligations under leases are due as follows:

31 December 31 December

2019 2018

(Restated)

GBP'000 GBP'000

In one year or less (shown in trade and

other payables) 2,575 2,507

In more than one year 6,229 6,022

8,804 8,529

------------ ------------

The fair values of the Group's lease obligations approximate

their carrying amount.

The Group's obligations under leases are secured by the lessor's

charge over the leased assets.

17. Acquisition Obligations

The terms of an acquisition provide that the value of the

purchase consideration, which may be payable in cash or shares at a

future date, depends on uncertain future events such as the future

performance of the acquired company. The Directors estimate that

the liability for contingent consideration payments is as

follows:

31 December 2019 31 December 2018

Cash Shares Total Cash Shares Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Less than one year 3,261 163 3,424 2,653 605 3,258

Between one and two

years 3,690 160 3,850 2,116 75 2,191

In more than two years

but less than three

years - - - 5,568 295 5,863

In more than three

years but less than

four years 1,552 56 1,608 483 - 483

8,503 379 8,882 10,820 975 11,795

--------- ---------- --------- --------- ---------- ---------

A reconciliation of acquisition obligations during the period is

as follows:

Cash Shares Total

GBP'000 GBP'000 GBP'000

At 31 December 2018 10,820 975 11,795

Obligations settled in the

period (2,731) (615) (3,346)

Adjustments to estimates of

obligations 414 19 433

At 31 December 2019 8,503 379 8,882

--------- --------- ---------

18. Share Capital

31 December 31 December

2019 2018

GBP'000 GBP'000

Allotted and called up:

85,295,565 Ordinary shares of 10p each

(2018: 84,357,351 Ordinary shares of 10

p each) 8,530 8,436

------------ ------------

Share-based incentives

The Group has the following share-based incentives in issue:

At start Granted/ Waived/ Exercised At end

of year acquired lapsed of year

TMMG Long Term Incentive

Plan 1,505,250 - (104,922) (510,066) 890,262

Growth Share Scheme 5,720,171 - (286,009) - 5,434,162

The TMMG Long Term Incentive Plan ("LTIP") was created to

incentivise senior employees across the Group. Nil-cost options are

awarded at the discretion of, and vest based on criteria

established by, the Remuneration Committee. During the year,

510,066 options were exercised at an average share price of 76.7p

and at the end of the year 70,111 of the outstanding options are

exercisable.

Shares held in an Employee Benefit Trust will be used to satisfy

share options exercised under the Long Term Incentive Plan.

A Growth Share Scheme was implemented on 21 February 2017.

Participants in the scheme subscribed for Ordinary A shares in The

Mission Marketing Holdings Limited (the "growth shares") at a

nominal value. The performance condition attaching to these growth

shares was met during 2019 and the shares can be exchanged for an

equivalent number of Ordinary Shares in MISSION during the period

up to 60 days from the announcement of the Group's financial

results for the year ending 31 December 2019, subject only to

continued employment.

19. Own Shares

No. of shares GBP'000

At 31 December 2017 1,452,367 602

Awarded or sold during the year (711,000) (303)

At 31 December 2018 741,367 299

Own shares purchased during the year 623,570 681

Awarded or sold during the year (288,194) (321)

At 31 December 2019 1,076,743 659

-------------- --------

Shares are held in an Employee Benefit Trust to meet certain

requirements of the Long Term Incentive Plan.

20. Post Balance Sheet Events

The Financial Reporting Council has advised that the global

pandemic Covid-19 is not an adjusting post-balance sheet event for

31 December 2019 financial statements. There have been no other

material post balance sheet events.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR BIGDXRSXDGGB

(END) Dow Jones Newswires

April 01, 2020 02:00 ET (06:00 GMT)

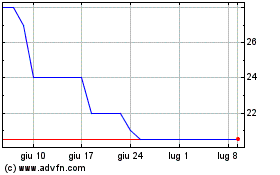

Grafico Azioni The Mission (LSE:TMG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni The Mission (LSE:TMG)

Storico

Da Apr 2023 a Apr 2024