BP Expects 1Q Results to be Hurt by Virus, Weak Demand; Expects $1 Billion Impairment

01 Aprile 2020 - 10:59AM

Dow Jones News

By Matteo Castia

Shares in BP PLC fell Wednesday after the company said it

expects results in the first quarter of this year to be hit by the

current weak demand and low commodity pricing, and that it

estimates a $1 billion noncash impairment charge for the

period.

The British oil-and-gas group said it anticipates a reduced

first-quarter upstream production compared with the previous

quarter, in the range of 2.55 million to 2.6 million barrels of oil

equivalent a day.

BP said it also expects a "significant and growing decline in

demand for fuels, jet fuel and lubricants" in the first quarter due

to the restrictions imposed in a number of countries to contain the

spread of coronavirus.

The company also said its $15 billion divestment program remains

on track toward its completion in mid-2021, but that the receipt of

the $10 billion of divestment proceeds by the end of this year

might be revised as transactions complete, given the volatility of

the current trading environment.

Shares at 0820 GMT were down 12.5 pence, or 3.7%, at 331.5

pence.

Write to Matteo Castia at matteo.castia@dowjones.com

(END) Dow Jones Newswires

April 01, 2020 04:44 ET (08:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

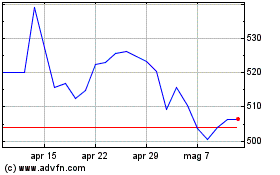

Grafico Azioni Bp (LSE:BP.)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Bp (LSE:BP.)

Storico

Da Apr 2023 a Apr 2024