Shoe Zone PLC Proposed Cancellation of Dividend/ COVID-19 Update (6503I)

02 Aprile 2020 - 6:05PM

UK Regulatory

TIDMSHOE

RNS Number : 6503I

Shoe Zone PLC

02 April 2020

2 April 2020

Shoe Zone PLC

("Shoe Zone" or the "Company")

Proposed Cancellation of Dividend / COVID-19 Update

At the Annual General Meeting of the Company held on 5 March

2020 (the "2020 AGM") Shareholders passed an ordinary resolution

to declare a final dividend of 8.0 pence per ordinary share

in respect of the financial period ended 5 October 2019, amounting

to a total dividend payment of approximately GBP4.0 million

(the "2019 Final Dividend"). The 2019 Final Dividend is currently

payable to Shareholders on the register on 28 February 2020

and was due to be paid on 18 March 2020.

On 17 March 2020, following a material reduction in footfall

across the Company's estate as a result of consumers' response

to the emerging COVID-19 pandemic, the board of directors

of the Company (the "Board") announced that it had taken the

prudent decision to defer the payment of the 2019 Final Dividend,

with the intention of convening a general meeting of the Company

to seek Shareholder approval for the cancellation of the 2019

Final Dividend. The decision to defer and take steps to propose

the cancellation of the 2019 Final Dividend is one of a number

of measures which the Company has implemented in order to

conserve the Company's cash balances with the aim of seeking

to maintain the viability of the Company's business during

an expected sustained period of challenging trading as a result

of the COVID-19 pandemic.

A general meeting of the Company will be held at the registered

office of the Company at Haramead Business Centre, Humberstone

Road, Leicester, Leicestershire, LE1 2LH at 10.00 a.m. on

29 April 2020 (the "General Meeting") for the purpose of seeking

the approval of Shareholders to cancel the 2019 Final Dividend.

A notice convening the General Meeting, at which a special

resolution to cancel the 2019 Final Dividend (the "Resolution")

will be proposed, will be sent to Shareholders shortly. In

order for the Resolution to be passed, at least three-quarters

of the votes cast by Shareholders who vote at the General

Meeting, either in person or by proxy, must be in favour of

the Resolution.

COVID-19 Update

Events have moved extremely rapidly since the 2020 AGM was

held on 5 March 2020, culminating in the UK and Irish governments'

decision to close down non-essential retail stores and for

the general public to self-isolate and reduce social interaction

in order to reduce the transmission of the COVID-19 virus.

As announced on 17 March 2020, the Company had suffered a

reduction in footfall across its estate at that time, and

it is now clear that the COVID-19 pandemic will have a material

impact on the Company's performance in the current financial

year ("FY19/20"), following the decision to close all of its

stores on 24 March 2020, notwithstanding the improvement in

revenues from the Company's online operations. In light of

the ongoing uncertainty caused by the COVID-19 pandemic, the

Company is unable to accurately quantify the expected impact

of the COVID-19 pandemic on the Company's trading and financial

performance for FY19/20 at this time. However, the Board expects

a material reduction to its prior expectations for FY19/20.

The scale of this reduction will depend upon how the situation

develops, over what timeframe, and the impact of further public

health, economic and business support measures being implemented

by the UK and Irish governments. Previous guidance should

therefore not be relied upon as an indicator of FY19/20 performance.

Funding Update

As at 1 April 2020, the Group had net cash balances of approximately

GBP4.7 million, and undrawn banking facilities of GBP3.0 million

from which the 2019 Final Dividend of approximately GBP4.0

million would need to be paid.

The Board is taking steps to conserve cash, maintain a satisfactory

liquidity position and protect its employees. In particular,

the Group has taken the following actions to date:

* Placed the majority of the workforce, other than the

digital teams and key workers, on Government funded

furlough;

* Ceased all capital expenditure;

* ngaged with HM Revenue & Customs ("HMRC") with a view

to deferring UK tax and VAT liabilities that arise

during this difficult trading period;

* Reclaimed GBP1.0 million of Corporation Tax payments

on account from HMRC;

* Sought the maximum Rate Relief Grant available from

the UK Government of GBP0.5 million (EUR0.6 million),

having already utilised EUR0.2 million previously on

retail rates relief;

* Minimised all other costs and expenditure to the

lowest level possible.

The Group has a strong relationship with its lending bank

and is in advanced discussions with it with respect to the

provision of a new 4 year GBP10.0 million term loan (the "Term

Loan"), to provide it with additional liquidity through the

current disruption caused by COVID-19. However, should the

Term Loan not be provided, or the proposed quantum of the

Term Loan be materially reduced, the Group would need to seek

to take further cost saving measures and/or raise additional

capital by early May 2020, assuming that the 2019 Final Dividend

is cancelled and not paid to Shareholders.

The Board is continuing to closely monitor the Group's performance

and financial position in what is a rapidly changing trading

environment and will provide updates as appropriate.

Cancellation of the 2019 Final Dividend

At the 2020 AGM (prior to the significant downturn in the

Company's trading environment), a resolution was proposed

to approve the 2019 Final Dividend, demonstrating the Board's

confidence at that time in the future growth of the Group's

business and rewarding Shareholders for their ongoing support.

However, in light of the unprecedented deterioration in market

conditions and the material impact which this will have on

the Company's financial and trading performance in FY19/20,

the Board is of the view that it is imperative that the 2019

Final Dividend is cancelled and not paid to Shareholders,

in order to conserve the Company's cash balances with the

aim of seeking to maintain the viability of the Company's

business during an expected sustained period of challenging

trading conditions.

As noted above, payment of the 2019 Final Dividend represents

an aggregate cash payment of approximately GBP4.0 million,

and hence represents the majority of the funds that were available

to the business as at 1 April 2020. The Directors therefore

believe that if the Resolution is not passed at the General

Meeting and the Company is required to pay the 2019 Final

Dividend, this will result in a material uncertainty around

the continued viability of the Company and its ability to

trade during this rapidly changing and uncertain trading environment.

The Board is proud of the part that the dividend has played

in the Company's relationship with its Shareholders and considers

the decision to cancel the 2019 Final Dividend to be in the

best interests of the Company, its Shareholders taken as a

whole, and the Company's other stakeholders.

The General Meeting

A notice convening the General Meeting to be held at 10.00

a.m. on 29 April 2020 at the registered office of the Company

at Haramead Business Centre, Humberstone Road, Leicester,

Leicestershire LE1 2LH will be sent to Shareholders shortly.

The purpose of the General Meeting is to seek Shareholders'

approval for the cancellation of the 2019 Final Dividend by

passing the Resolution.

The Resolution proposes that the resolution to declare the

2019 Final Dividend which was passed at the 2020 AGM shall

not have any effect and shall not be acted upon by the Company

and that the 2019 Final Dividend be cancelled and is not legally

payable by the Company.

The Resolution will be proposed at the General Meeting as

a special resolution and will be put to a vote on a poll.

In order for the Resolution to be passed, at least three-quarters

of the votes cast by Shareholders who vote at the General

Meeting, either in person or by proxy, must be in favour of

the Resolution.

In accordance with the Company's articles of association,

all Shareholders who are entitled to attend and vote at the

General Meeting shall upon a poll have one vote in respect

of every ordinary share held.

The health of our Shareholders, employees and other stakeholders

remains extremely important to the Company and accordingly

the Board has taken into consideration the compulsory "Stay

at Home" measures that have been published by the UK Government.

These measures provide that public gatherings of more than

two people are currently not permitted in the UK. As a result,

the Board has resolved that Shareholders are not allowed to

attend the General Meeting in person and anyone seeking to

attend the General Meeting will be refused entry. Arrangements

will be made by the Company to ensure that the minimum number

of Shareholders required to form a quorum will attend the

General Meeting in order that the meeting and the vote by

a poll may proceed. Therefore, Shareholders are requested

to submit their votes in respect of the Resolution in advance

of the General Meeting by either voting online or by completing

and submitting a form of proxy or a CREST Proxy Instruction,

as discussed in the notice convening the General Meeting.

Votes should be submitted via proxy as early as possible and

Shareholders should appoint the chair of the General Meeting

as their proxy in order that their votes may be taken into

account when the Resolution is voted on by a poll. If a Shareholder

appoints someone else as their proxy, that proxy will not

be able to attend the General Meeting in person or cast the

Shareholder's vote on the poll vote.

If any Shareholder has a question about the General Meeting

they would like to pose to the Board, this should be submitted

to the Chairman of the Board by email at investorrelations@shoezone.com.

In the event that further disruption to the General Meeting

becomes unavoidable, the Company will announce any changes

to the meeting (such as timing or venue) as soon as practicably

possible through the Company's website and by an announcement

to the London Stock Exchange.

Recommendation

The Directors consider the passing of the Resolution to be in

the best interests of the Company and its Shareholders taken as a

whole. Accordingly, the Directors unanimously recommend that

Shareholders vote in favour of the Resolution, as the Directors

intend to do in respect of their own beneficial holdings of

ordinary shares (amounting in aggregate to 25,265,348 ordinary

shares, which represent approximately 50.5 per cent. of the total

issued share capital and voting rights of the Company as at the

date of this announcement).

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Shoe Zone plc Tel: +44 (0) 116 222

Anthony Smith (Chief Executive Officer) 3000

Jonathan Fearn (Chief Financial Officer)

FinnCap Limited (Nominated Adviser & Tel: +44 (0) 20 7220

Broker) 0500

Matt Goode / Carl Holmes / Hannah Boros

(Corporate Finance)

Alice Lane (ECM)

FTI Consulting (Financial PR) Tel: +44 (0) 20 3727

Alex Beagley 1000

Eleanor Purdon

Alice Newlyn

About Shoe Zone

Shoe Zone is a Town Centre, Retail Park and Digital footwear

retailer, offering low price and high-quality footwear for the

whole family.

Shoe Zone operates from a portfolio of around 500 stores and has

approximately 3,500 employees across the UK and the Republic of

Ireland.

The store portfolio consists of over 450 high street stores

containing the core Shoe Zone product range and 45 larger out of

town retail units which also feature brands such as Clarks,

Skechers and Hush Puppies.

The website shoezone.com, combined with the store network

ensures a full multi-channel offering for great customer

service.

Shoe Zone sells 18 million pairs of shoes per annum with an

average retail price per pair of shoes of around GBP10.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCSSEFMEESSESL

(END) Dow Jones Newswires

April 02, 2020 12:05 ET (16:05 GMT)

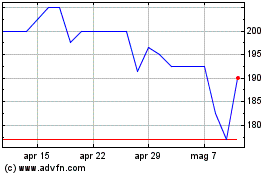

Grafico Azioni Shoe Zone (LSE:SHOE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Shoe Zone (LSE:SHOE)

Storico

Da Apr 2023 a Apr 2024