U.S. Dollar Lower As Fed Announces New $2.3 Trillion Stimulus Package

09 Aprile 2020 - 1:13PM

RTTF2

The U.S. dollar lost ground against its major counterparts in

the New York session on Thursday, after the Federal Reserve

unveiled $2.3 trillion stimulus package to support the economy amid

the coronavirus pandemic.

The Fed said it will provide up to $2.3 trillion in loans to

assist households and employers of all sizes and bolster the

ability of state and local governments to deliver critical services

during the coronavirus pandemic.

"Our country's highest priority must be to address this public

health crisis, providing care for the ill and limiting the further

spread of the virus," said Federal Reserve Chair Jerome Powell.

He added, "The Fed's role is to provide as much relief and

stability as we can during this period of constrained economic

activity, and our actions today will help ensure that the eventual

recovery is as vigorous as possible."

The Fed said the specific actions it is taking include

bolstering the effectiveness of the Small Business Administration's

Paycheck Protection Program by supplying liquidity to participating

financial institutions.

Data from the Labor Department showed that first-time claims for

U.S. unemployment benefits decreased in the week ended April 4 but

still came in well above economist estimates.

The report said 6.606 million people filed for unemployment last

week, a decrease of 261,000 from the previous week's upwardly

revised level of 6.867 million.

The greenback reversed from its early highs of 1.0841 against

the euro and 0.9734 against the franc, falling to 1-week lows of

1.0942 and 0.9666, respectively. Next key support for the greenback

is likely seen around 1.12 against the euro and 0.94 against the

franc.

The greenback depreciated to 108.52 against the yen, retreating

from a high of 109.06 seen at 9:00 pm ET. The greenback is likely

to face support around the 105.00 region, if it falls again.

The greenback was down at near a 2-week low of 1.2481 against

the pound, after climbing to 1.2361 at 2:00 am ET. Further

downtrend may take the greenback to a support around the 1.28

area.

Data from the Office for National Statistics showed that the UK

economy shrank unexpectedly in February due to a large fall in

construction.

Gross domestic product fell 0.1 percent month-on-month in

February, confounding expectations for a monthly growth of 0.1

percent.

The U.S. currency weakened to near a 4-week low of 0.6307

against the aussie, near 2-week lows of 0.6068 against the kiwi and

1.3935 against the loonie, reversing from its previous highs of

0.6195, 0.5985 and 1.4077, respectively. The greenback is poised to

challenge support around 0.70 against the aussie, 0.645 against the

kiwi and 1.33 against the loonie.

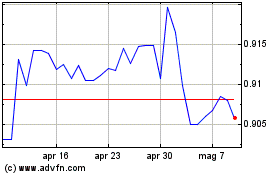

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Mar 2024 a Apr 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Apr 2023 a Apr 2024