TIDMSOLI

RNS Number : 6292J

Solid State PLC

15 April 2020

Solid State plc

("Solid State", the "Group" or the "Company")

Trading Update &

COVID-19 Update

Solid State plc (AIM: SOLI), the AIM listed manufacturer of

computing, power and communications products, and value added

distributor of electronic components , announces a trading update

for the 12 months to 31 March 2020 and a further update on the

impact of COVID-19 on the business.

Trading update for 12 months to 31 March 2020:

The Board expects to announce revenue close to the consensus

forecast of GBP68m and adjusted profit before tax is expected to be

approximately 10% ahead of current consensus forecast of GBP4.2m,

which is a record year for the Group.

During the second half we have continued the successful

integration of Pacer with the consolidation of the two Pacer

offices in Pangbourne into one new office in Pangbourne to

integrate the team. Year on year the UK distribution market has

declined 7% as reported by our industry association AFDEC. Very

pleasingly, in spite of the backdrop of a declining market,

proforma revenue* in our Value Added Distribution ('VAD') division

has significantly outperformed the market, being broadly flat year

on year. Our Manufacturing division has delivered high single digit

organic growth at good margins which has driven record profits.

Net cash at 31 March 2020 stood at circa GBP3.0m as a result of

continued strong cash generation and proactive cash management with

clients and suppliers (2019: net debt GBP2.0m). Cash generation has

also benefitted from a number of advanced payments totalling

approximately GBP2.5m which will unwind across the course of the

financial year ending 31 March 2021.

The open order book at 31 March 2020 was up 11% at GBP39.9m (31

March 2019: GBP35.9m). We have approximately GBP34.5m of orders

scheduled for delivery in the coming year, however, in the current

environment with the COVID-19 lock downs we expect to see some

rescheduling of orders from this financial year into next.

COVID-19 update:

Solid State operates across four independent manufacturing sites

in the UK. These sites are open and operating effectively and

adhering to best practice guidelines on social distancing and

hygiene protocols. In terms of risk mitigation, all measures are in

place to ensure that there is limited risk of cross-contamination

within the business. Where possible, staff are working from

home.

COVID-19 is affecting the business in contrasting ways: On the

plus side, Solid State has been notified by numerous customers in

both its Manufacturing and VAD divisions that the Group has been

designated a critical supplier under the government's critical

industries and key workers guidance. Sectors highlighting this

dependency include medical, food retail, security, transportation

and defence.

Conversely, on the weaker side, the Group is experiencing

softness in the demand for batteries for the commercial aerospace

market and in computing products for certain niche applications in

the industrial sector. Separately, owing to the fall in oil prices,

we are currently experiencing lower levels of orders for battery

packs from the oil and gas industry.

The Group continues to hold relatively high levels of stock to

limit exposure to supply chain volatility. At present, the Group

holds approximately 2.5 months' stock.

Cash management:

The Group had net cash of GBP3.0m at 31 March 2020 and has a

renewed and unutilised Revolving Credit Facility with its bank of

GBP7.5m.

The Board has taken measures to ensure cash conservation in the

short-term. These include a recruitment freeze; a salary increase

freeze for all Directors and staff; delayed payment of accrued

bonuses for FY19/20 for all Directors and staff; adoption of

available deferrals for VAT and PAYE payments to HMRC; and

furloughing of some staff under the Coronavirus Job Retention

Scheme.

The Group's acquisition strategy has been suspended temporarily

during this period of uncertainty. Communication continues with

prospective acquisitions however progress will be limited in the

short-term.

New planned capex has been suspended, for example in new EMC

test equipment for manufacturing; however, ongoing projects around

ERP system upgrades are continuing.

The Board is taking prudent steps to mitigate and manage its

cashflow and cost base to withstand this near-term uncertainty.

Outlook:

Whilst the business has taken all steps to mitigate the risks of

the COVID-19 outbreak, the Board is closely monitoring the

situation.

This began as a supply side risk in our Asian supply chain,

which is now returning to normal. The future uncertainty relates to

the demand side, which is very difficult to predict.

The Board considers that in the current circumstances it is hard

to provide guidance as to the future performance of the Group and

this will remain the case until there is more meaningful visibility

over customer order schedules and broader market conditions.

The Board expects to provide a further update ahead of the full

year results announcement. In addition, it will confirm the notice

of its results announcement date.

Commenting on the trading update and the short-term outlook,

Gary Marsh, Chief Executive commented:

"We are very happy with the performance of the business in the

past year and consider that it demonstrates the cash generative

nature of the business model despite the macroeconomic and

political uncertainties which became defining characteristics of

the period.

"The last two months have presented challenges previously

unseen. That said, the Board is optimistic that the structure of

the Group and the diversity of its exposure to differing product

groups and industrial sectors puts it in a relatively resilient

position to navigate the challenges of the COVID-19 outbreak. We

are not complacent and will respond accordingly to the changing

pressures and opportunities where appropriate.

"Our staff have risen to the challenge presented by COVID-19

admirably and we would like to acknowledge their dedication and

commitment."

*Proforma revenue restates the prior year on a like for like

basis to include the pre-acquisition Pacer revenue and exclude

GBP1.0m non recurring electronics revenue as reported in prior

year.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information please contact:

Solid State plc 01527 830 630

Gary Marsh - Chief Executive investor.information@solidstateplc.com

Peter James - Group Finance Director

WH Ireland (Nominated Adviser & Joint

Broker) 0117 945 3470

Mike Coe / Chris Savidge (Corporate

Finance)

Jasper Berry / David Kilbourn (Corporate

Broking / Sales)

finnCap (Joint Broker)

Ed Frisby / Kate Bannatyne (Corporate

Finance)

Rhys Williams / Tim Redfern (Sales

/ ECM) 020 7220 0500

Walbrook PR (Financial PR) 020 7933 8780

Tom Cooper / Paul Vann 0797 122 1972

tom.cooper@walbrookpr.com

Analyst Research Reports: For further analyst information and

research see the Solid State plc website:

https://solidstateplc.com/research/

Notes to Editors:

Solid State plc (SOLI) is a value added electronics group

supplying industrial and military markets with ruggedised/durable

components, assemblies and manufactured units for use in harsh

environments. The Group's mantra is - 'Trusted technology for

demanding applications'. To see an introductory video on the Group

- https://youtu.be/bp4WfLCEc5Y

Operating through two main divisions: Manufacturing (Steatite)

and Value Added Distribution (Solid State Supplies & Pacer);

the Group specialises in complex engineering challenges often

requiring design-in support and component sourcing for computing,

power, communications, electronic and optoelectronic products.

Headquartered in Redditch, Solid State employs over 200 staff

across the UK with a branch office in the USA, serving specialist

markets in oil & gas production, transportation, medical,

construction, security, military and field maintenance.

Solid State was established in 1971 and admitted to AIM in June

1996. The Group has grown organically and by acquisition - having

made 10 acquisitions since 2002.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTMZGMDKDDGGZM

(END) Dow Jones Newswires

April 15, 2020 02:00 ET (06:00 GMT)

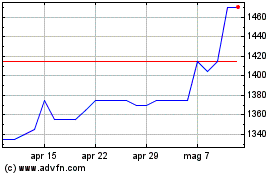

Grafico Azioni Solid State (LSE:SOLI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Solid State (LSE:SOLI)

Storico

Da Apr 2023 a Apr 2024