TIDMTCAP

RNS Number : 0628K

TP ICAP PLC

17 April 2020

17 April 2020

TP ICAP plc 2019 Annual Report and Notice of 2020 Annual General

Meeting

TP ICAP plc (the 'Company') today publishes its 2019 Annual

Report and circular to shareholders incorporating the Notice of the

2020 Annual General Meeting. Both documents can be viewed at or

downloaded from our website at www.tpicap.com/investors .

Copies of both of these documents, together with the Form of

Proxy, will be available as soon as practicable for inspection via

the National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

The Board has been closely monitoring the developing situation

regarding the COVID-19 pandemic. In normal circumstances the

Directors greatly value the opportunity to meet shareholders in

person at the Annual General Meeting ('AGM'), which is scheduled to

be held on 13(th) May 2020. However, in light of the UK

Government's compulsory measures prohibiting public gatherings of

more than two people and non-essential travel, shareholders will

not be able to attend this year's AGM in person and any shareholder

attempting to gain access to the meeting will be refused entrance.

In order to facilitate participation by shareholders, the Company

has put in place arrangements for shareholders to attend the AGM

electronically, ask questions and vote in real time using their

computer, tablet, or smartphone. Further information on how to

participate in the AGM electronically can be found in the Notice of

the 2020 AGM.

If shareholders are either unable or disinclined to attend the

AGM electronically, shareholders should vote by appointing the

chairman of the meeting as their proxy by submitting the Form of

Proxy in hard-copy or online. Details of how to do this are

included in the Notice of the 2020 AGM and on the Company's

website.

This situation is constantly evolving and the UK Government may

change current restrictions or implement further measures relating

to the holding of AGMs during the affected period. Any changes to

the AGM, including any change to the location of the AGM, will be

communicated to shareholders before the meeting through our website

at www.tpicap.com/investors , which shareholders are advised to

check for updates, and, where appropriate, by RNS announcement.

The following disclosures comply with Disclosure and

Transparency Rule 6.3.5. The Company's full year results

announcement on 10 March 2020 contained a management report and

condensed financial information derived from the TP ICAP Group's

audited statutory accounts. A description of risks and

uncertainties, details of related party transactions and the

Directors' Responsibility Statement, extracted in full unedited

text from the Company's 2019 Annual Report, are set out below. This

information should be read in conjunction with, and not as a

substitute for, reading the Company's 2019 Annual Report. Page

numbers and notes in the following appendices refer to page numbers

and notes in the Company's 2019 Annual Report.

Appendix A: Principal Risks

The Board Risk Committee, on behalf of the Board, has conducted

a robust assessment of the principal risks facing the Group,

including those that would threaten its business model, future

performance, solvency or liquidity.

In undertaking this assessment, the Board Risk Committee has

considered a wide range of information, including reports provided

by the Group Risk function and senior management, as well as key

findings from the Group's various risk assessment processes.

Risk

Adverse change to regulatory framework

Description

The Group is exposed to the risk of a fundamental change to the

regulatory framework which has a material adverse impact on its

business and economic model.

Potential impact

> Reduction in broking activity

> Reduced earnings and profitability

> Material change in applicable regulatory rules and

their interpretation including loss of consolidation

waiver

Change in risk exposure since 2018

No change

Mitigation

> Monitoring of regulatory developments

> Involvement in consultation and rule setting processes

Key risk indicator

> Key regulatory changes

> Status of regulatory change initiatives

Related principal strategic objectives

> Electronification and technology

> Liquidity aggregation

> Diversification

> People, conduct and compliance

Risk

Deterioration in the commercial environment

Description

The risk that due to adverse macro-economic conditions or

geopolitical developments, market activity is suppressed leading to

reduced trading volumes.

The impact of Brexit is addressed separately below.

Potential impact

> Reduction in broking activity

> Pressure on brokerage

> Reduced earnings and profitability

Change in risk exposure since 2018

No change

Mitigation

> Defined business development strategy that seeks to

maintain geographical and product diversification

Key risk indicator

> Operating profit

> Revenues by region

> Trade volumes

> Revenue forecast

> Stress testing scenario outcomes

Related principal strategic objectives

> Electronification and technology

> Liquidity aggregation

> Diversification

Risk

The impact of Brexit

Description

The risk that Brexit leads to a macro-economic downturn and a

consequential reduction in trading

volumes and revenue.

The risk that the legal entity structure implemented to comply

with the loss of EU passporting rights results in a fragmentation

of liquidity between UK and EU liquidity pools.

Potential impact

> Reduction in broking activity

> Loss of market share

> Reduced earnings and profitability

Change in risk exposure since 2018

No change

Mitigation

> Adoption of a Brexit plan which would accommodate a range

of potential scenarios (including the failure to secure a

UK-EU deal which maintains access between UK and EU markets)

> Incorporation of a new EU subsidiary to hold EU-based business

> Proactive engagement with European regulators and clients

Key risk indicator

> Brexit revenue-at-risk

> Brexit plan tracking

Related principal strategic objectives

> Liquidity aggregation

> People, conduct and compliance

Risk

Failure to respond to client requirements

Description

The risk that the Group fails to respond to rapidly changing

customer requirements, including the demand for enhanced electronic

broking solutions for certain asset classes.

Potential impact

> Loss of market share

> Reduced earnings and profitability

Change in risk exposure since 2018

No change

Mitigation

> Proactive engagement with clients through customer

relationship management process

> Clearly defined business development strategy which

continues to enhance the Group's service offering

Key risk indicator

> Operating profit

> Trade volumes

> Revenues by region

> New business initiatives

> Client satisfaction surveys

Related principal strategic objectives

> Electronification and technology

> Liquidity aggregation

> Diversification

Risk

Cyber-security and data protection

Description

The risk that the Group fails to adequately protect itself

against cyber-attack and/or to adequately secure the data it holds,

resulting in loss of operability as well as potential loss of

critical business or client data.

Potential impact

> Loss of revenue

> Remediation costs

> Damage to reputation

> Regulatory sanctions

> Payment of damages/compensation

Change in risk exposure since 2018

No change

Mitigation

> Ongoing monitoring and assessment of the cyberthreat

landscape

> Appropriate framework of systems and controls to prevent,

identify and contain cyber threats

Key risk indicator

> System outages

> Data loss events

> Cyber-security events/losses

> Vulnerability monitoring

Related principal strategic objectives

> Electronification and technology

Risk

Operational failure

Description

The Group is exposed to operational risk in nearly every facet

of its role as an interdealer broker,

including from its dependence on:

> the accurate execution of a large number of processes,

including those required to execute, clear and settle trades;

and

>a complex IT infrastructure.

Potential impact

> Financial loss which could, in extreme cases, impact

the Group's solvency and liquidity

> Damage to the Group's reputation as a reliable market

intermediary

Change in risk exposure since 2018

No change

Mitigation

> Appropriate framework of systems and controls to minimise

the risk of operational failure

> Incident and crisis management process

> Business continuity plans and capability

> Reverse stress test process to identify key risks that

could undermine the Group's viability

Key risk indicator

> Risk events

> Execution failure

> Settlement fails

> Margin calls

Related principal strategic objectives

> Electronification and technology

> People, conduct and compliance

Risk

Failure to protect proprietary data

Description

The risk that the Group fails to protect unauthorised

dissemination of Group's proprietary data leading to loss of

potential revenue streams.

Potential impact

> Failure to achieve future revenue growth targets due

to non-contractual use of our market information

> Damage to reputation

Change in risk exposure since 2018

No change

Mitigation

> Ongoing audit of licenses

> Appropriate legal remedies incorporated within licence

agreements

Key risk indicator

> Completion of data

> Audit plan

> Data audit findings

Related principal strategic objectives

> Diversification

Risk

Breach of legal and regulatory requirements

Description

The Group operates in a highly regulated environment and is

subject to the laws and regulatory frameworks of numerous

jurisdictions.

Failure to comply with applicable legal and regulatory

requirements could result in enforcement action being taken.

Potential impact

> Regulatory and legal enforcement action including censure,

fines or loss of operating licence

> Severe damage to reputation

Change in risk exposure since 2018

No change

Mitigation

> Compliance function to oversee compliance with regulatory

obligations

> Compliance monitoring and surveillance activity

> Comprehensive compliance training programme to ensure

that staff are aware of regulatory requirements

> Conduct and Cultural framework to foster high standards

of employee conduct

Key risk indicator

> Internal Compliance policy breaches

> Regulatory breaches

> Employee conduct metrics

Related principal strategic objectives

> People, conduct and compliance

Risk

Counterparty credit risk

Description

The Group is exposed to counterparty credit risk arising from

outstanding brokerage receivables, unsettled Matched Principal

trades and cash deposits.

Potential impact

> Financial loss which could, in extreme cases, impact

the Group's solvency and liquidity

Change in risk exposure since 2018

No change

Mitigation

> Counterparty exposures managed against thresholds calibrated

to reflect counterparty creditworthiness

> Exposure monitoring and reporting by independent credit

> risk function

Exposure concentration limits to prevent excessive

exposure to one institution

Key risk indicator

> Portfolio exposure

> Exposure concentration

> Aged debt

Related principal strategic objectives

> Diversification

Risk

FX exposure

Description

There is a risk that the Group suffers loss as a result of a

movement in FX rates whether through transaction risk or

translation risk.

Potential impact

> Financial loss which could, in extreme cases, impact

the Group's solvency and liquidity

Change in risk exposure since 2018

No change

Mitigation

> Ongoing monitoring of Group's FX positions

Key risk indicator

> FX translation exposure

> FX transaction exposure

Related principal strategic objectives

> Diversification

Risk

Liquidity risk

Description

The Group is exposed to potential margin calls from clearing

houses and correspondent clearers. The Group also faces liquidity

risk through being required to fund Matched Principal trades which

fail to settle on settlement date.

Potential impact

> Reduction in the Group's liquidity resources which

could, in extreme cases, impact the Group's liquidity

Change in risk exposure since 2018

No change

Mitigation

> Broking limits that restrict potential margin exposure

> Monitoring of liquidity risk drivers

> Group maintains liquidity resources in each operating

centre to provide immediate access to funds

> Committed GBP270m revolving credit facility ('RCF')

Key risk indicator

> Margin call profile

> Settlement fail - funding requirements

> Unplanned intra-Group funding calls

> RCF draw-down

> Managing bond maturity profile

Related principal strategic objectives

> Diversification

Appendix B: Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this Note.

The total amounts owed to and from associates and joint ventures

at 31 December 2019, which also represent the value of transactions

during the year, are set out below:

Amounts owed by related Amounts owed to related

parties parties

2019 2018 2019 2018

GBPm GBPm GBPm GBPm

------------ ------------ ------------ ------------

Associates 3 3 - -

Joint Ventures - 1 (3) (2)

------------ ------------ ------------ ------------

The amounts outstanding are unsecured and will be settled in

cash. No guarantees have been given or received. No provisions have

been made for doubtful debts in respect of the amounts owed by

related parties.

During the year, less than GBP1m of interest was paid on loans

from related parties.

Directors

Costs in respect of the Directors who were the key management

personnel of the Group during the year are set out below in

aggregate for each of the categories specified in IAS 24 'Related

Party Disclosures'. Further information about the individual

Directors is provided in the audited part of the Report on

Directors' Remuneration on pages 87 to 93.

2019 2018

GBPm GBPm

Short term benefits 6 3

------ ------

Social security costs 1 -

------ ------

7 3

------ ------

Appendix C: Directors' Responsibility Statement

The Directors confirm that to the best of their knowledge

that:

> the Financial Statements, prepared in accordance with

the relevant financial reporting framework, give a

true and fair view of the assets, liabilities, financial

position and profit or loss of the Company and the

undertakings included in the consolidation taken as

a whole;

> the Strategic report includes a fair review of the

development and performance of the business and the

position of the Company and the undertakings included

in the consolidation taken as a whole, together with

a description of the principal risks and uncertainties

that they face; and

> the Annual Report and Financial Statements, taken as

a whole, are fair, balanced and understandable and

provide the information necessary for shareholders

to assess the Company's position, performance, business

model and strategy.

ENDS

Enquiries:

Richard Cordeschi

Group Company Secretary

Richard.Cordeschi@tpicap.com

+44 (0) 7580 851104

For media enquiries please contact:

William Baldwin-Charles

Group Media Relations Director

William.Baldwin-Charles@tpicap.com

+44 (0) 7834 524 833

For investor enquiries please contact:

Al Alevizakos

Head of Investor Relations and FP&A

Alevizos.Alevizakos@tpicap.com

+44 (0) 7999 912 672

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSFLFILSEIDLII

(END) Dow Jones Newswires

April 17, 2020 07:10 ET (11:10 GMT)

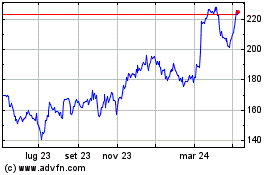

Grafico Azioni Tp Icap (LSE:TCAP)

Storico

Da Mar 2024 a Apr 2024

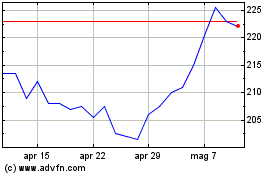

Grafico Azioni Tp Icap (LSE:TCAP)

Storico

Da Apr 2023 a Apr 2024