Seneca Growth Capital VCT plc Omega Diagnostics, Net Asset Value, New B Share Pool Investments

20 Aprile 2020 - 7:36PM

UK Regulatory

TIDMHYG TIDMSVCT

Seneca Growth Capital VCT Plc (the "Company")

20 April 2020

Partial Realisation of Ordinary Share Investment in Omega Diagnostics

Group plc, New Ordinary Share Net Asset Value and New B Share Pool

Investments

The Board of Seneca Growth Capital VCT Plc have noted the announcements

made by Ordinary Share pool investee company, Omega Diagnostics Group

plc ("Omega") on 9 and 20 April 2020. The first announcement confirmed

that Omega had signed a Memorandum of Understanding ("MOU") with three

other companies from across the UK, in conjunction with the University

of Oxford to form the UK Rapid Test Consortium ("UK-RTC") in order to

jointly develop and manufacture a COVID-19 Point of Care antibody test

as part of the Government's five pillar national testing strategy for

COVID-19. The second announcement confirmed that Omega has signed a

Material Transfer Agreement ("MTA") with Mologic Ltd ("Mologic") to

formalise a partnership to provide manufacturing capability for

Mologic's COVID-19 first generation ELISA diagnostics test, the

development of which has been funded in part by the Government.

Following the recent rise in Omega's share price on AIM, the Company has

sold 1,150,000 Omega shares from the Ordinary Share pool, realising

GBP358,696 and generating a profit of GBP278,196 (unaudited) on their

carrying value as at 30 March 2020, being the date of the most recently

announced Net Asset Value ("NAV") per Ordinary Share (equivalent to an

unaudited profit of 346%), and a profit versus original cost of

GBP194,258 (equivalent to an unaudited profit of 118%). The Company's

Ordinary Share pool retains 1,143,868 Omega shares.

The Board have reviewed the carrying value of all Ordinary Share pool

investments, including Omega at a bid price of 33.2p per share, and

report that as at 20 April 2020 the unaudited NAV per Ordinary share was

30.3p per Ordinary share, an increase of 7.2p per Ordinary share from

the unaudited NAV of 23.1p per Ordinary share as at 30 March 2020. This

increase is primarily driven by the change in value of Omega, net of the

associated performance fee accrual.

The Board have also reviewed the carrying value of all B Share pool

investments as at 20 April 2020. As the value of those investments has

not changed materially from the values as at 30 March 2020, the Board

has not issued a revised NAV per B Share (the unaudited NAV per B Share

as at 30 March 2020 was 79.5p per B Share). The Board will issue a

revised NAV of a B Share if required before the next allotment on 28

April 2020.

The Board are also pleased to confirm that the Company has committed to

3 further investments from its B Share pool during the period from 1

January 2020 to 20 April 2020 as follows:

-- On 13 March 2020 the Company's B Share pool invested GBP400,000 into

specialist SAP contractor platform operator Ten80 Group Limited.

-- On 19 March 2020 the Company's B Share pool invested GBP235,000 into

specialist graduate recruitment business Bright Network (UK) Limited.

-- On 17 April 2020 AIM quoted OptiBiotix Health Plc, a life sciences

company specialising in developing and commercialising technologies that

modulate the human microbiome, announced it had raised GBP1.0 million

through a share placing. The shares are expected to be admitted to AIM

on or around 23 April 2020 and the Company's B Share pool has committed

GBP300,000 to this placing.

The above investments take the total number of investments made by the B

Share pool to 8, at a total investment cost of GBP3,685,000. The B

Share pool still has cash reserves in excess of GBP3.2m available to

support the Company's ongoing running costs and B Share pool future

investment activity.

The information above is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU No.

596/2014). Upon the publication of this announcement via a Regulatory

Information Service this inside information is now considered to be in

the public domain.

For further information, please contact:

John Hustler, Seneca Growth Capital VCT Plc at

https://www.globenewswire.com/Tracker?data=j3cz6fRwx3rse4qkrJoU2B0Ven8xqqoIt2fmsLTKLUlgTjEh6NTbs5E35Cdd0hpooaYUDAz32ucktag2bG0ptjdF3eiwxbr5AAo5WQ_hOGeK1KpdeaHU2q4Xro4STUHy

john.hustler@btconnect.com

Richard Manley, Seneca Growth Capital VCT Plc at

https://www.globenewswire.com/Tracker?data=eI5E2JSXhnRGBs5sA8bdJg23ya3LMqaul-gRlF-oUtDeafgdNpSp00QlO4qD0Ay0dqPAogaBejinx8vZ_qmeWfWafahEjqMHxVYy36TOHTtIveFZHccAkRNWVZY37FMRq0zhwnmYE0EnXAm5DyxScA==

Richard.Manley@senecapartners.co.uk

(END) Dow Jones Newswires

April 20, 2020 13:36 ET (17:36 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

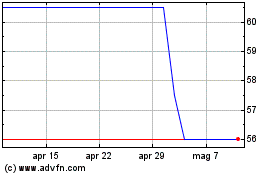

Grafico Azioni Seneca Growth Capital Vct (LSE:SVCT)

Storico

Da Mar 2024 a Apr 2024

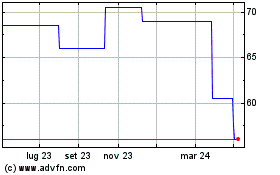

Grafico Azioni Seneca Growth Capital Vct (LSE:SVCT)

Storico

Da Apr 2023 a Apr 2024