TIDMEME

RNS Number : 4659K

Empyrean Energy PLC

22 April 2020

22 April 2020

Empyrean Energy PLC

Open Offer of up to 57,417,375 Open Offer Shares at 3.5 pence

per share

Empyrean Energy plc ("Empyrean" or the "Company") announces that

it proposes to raise up to GBP2.01 million (before expenses)

through an Open Offer pursuant to which Qualifying Shareholders

will have an opportunity to subscribe for an aggregate of

57,417,375 new Ordinary Shares (the "Open Offer Shares"), on the

basis of 1 Open Offer Share for every 8 Existing Ordinary Shares

held on the Record Date, at 3.5 pence per Open Offer Share (the

"Issue Price").

Qualifying Shareholders subscribing for their full entitlement

under the Open Offer may also request additional Open Offer Shares

through the Excess Application Facility.

Empyrean is pleased to announce that it will shortly be posting

a circular to Shareholders (the "Circular") containing detailed

information about the Open Offer, a copy of which will also be

available shortly on the Company's website

(www.empyreanenergy.com).

Further details of the Open Offer are set out in the extract

from the Letter from the Chairman of the Company below, together

with the expected timetable.

For further information please contact the following:

Empyrean Energy plc

Tom Kelly Tel: +61 8 6146 5325

Cenkos Securities plc

Neil McDonald Tel: +44 (0) 131 220 9771

Pete Lynch Tel: +44 (0) 131 220 9772

St Brides Partners Ltd

Priit Piip Tel: +44 (0) 20 7236 1177

LETTER FROM THE CHAIRMAN OF EMPYREAN ENERGY PLC

1. Introduction

The Company is pleased to announce its intention to raise up to

GBP2.01 million (before expenses) pursuant to the launch of an Open

Offer to all Qualifying Shareholders. This will provide Qualifying

Shareholders with an opportunity to subscribe for an aggregate of

57,417,375 Open Offer Shares, on the basis of 1 Open Offer Share

for every 8 Existing Ordinary Shares held on the Record Date, at

3.5 pence per Open Offer Share.

Qualifying Shareholders subscribing for their full entitlement

under the Open Offer may also request additional Open Offer Shares

through the Excess Application Facility. Any allotment of Open

Offer Shares pursuant to the Excess Application Facility will be at

the sole discretion of the Board. In the event that the Open Offer

is not fully subscribed, it is intended that the Board will reserve

the right to use reasonable endeavours to place the excess shares

available under the Open Offer, at not less than the Issue Price,

in order to raise up to the maximum proceeds under the Open

Offer.

The purpose of the Circular is to outline the reasons for, and

to explain the terms of, the Open Offer and to set out the reasons

why your Board believes that the Open Offer is in the best

interests of the Company and its Shareholders as a whole.

On behalf of the Board, I invite Qualifying Shareholders to

consider subscribing for Open Offer Shares in the Open Offer. I

take this opportunity to thank you for your ongoing support of the

Company.

2. Reasons for the Open Offer and use of proceeds

The Company released an Operations Update on 31 March 2020 which

summarised its current and near-term activity across its asset base

and highlighted the adverse impact of the significant volatility in

the financial markets as a result of the COVID-19 outbreak and the

recent oil price war and resulting slump in the oil price has had

on its strategic and near-term financing options.

As announced on 14 April 2020, the Company raised GBP410,950

through a direct subscription by a number of existing investors and

directors of the Company for a total of 11,741,429 new Ordinary

Shares at 3.5p per share. The net proceeds of the Subscription are

sufficient to satisfy the Company's share of final costs in

relation to the drilling of the highly-successful Tambak-1 and

Tambak-2 wells in Q4 2019, including post drilling resource

updates, and to provide sufficient working capital through to the

end of May 2020. However, following receipt of the net proceeds of

the Subscription, the Company has a funding requirement of c.GBP1.2

million to cover its general and administrative costs and working

capital requirements from June 2020 through to the end of April

2021. This amount excludes anticipated costs relating to the final

preparation for, and drilling of, the commitment well at Block

29/11 in the Pearl River Mouth Basin, offshore China.

The Company announced on 18 April 2020 that it has elected not

to proceed with a proposed placing to raise up to a further GBP1

million, due to continued volatility in global commodities markets

and the effect of a further decline in the price of oil over recent

days. The Board has reviewed a number of funding alternatives to

finance the Company's ongoing requirements and has concluded that

it is in the best interests of the Company to proceed with the Open

Offer in the first instance.

The net proceeds of the Open Offer will provide the Company with

additional working capital and ensure greater financial flexibility

as the Company seeks to capitalise on and realise a portion of the

significant value created in its diverse asset base. The Company

also has access to financing for its ongoing working capital

requirements through the Long State Facility, which it has yet to

utilise.

The Circular and other information about the Company and our

recent activities, including our regulatory announcements, investor

presentations and financial reports, are available at the Company's

website, www.empyreanenergy.com.

Having successfully completed the direct subscriptions noted

above, and following the significant upgrade of internal resource

estimates at the Mako Gas Field in Indonesia as announced on 14

April 2020 (shown in the table below), the Board feels strongly

that Qualifying Shareholders should, where it is practical for them

to do so, have the opportunity to participate in an issue of new

Ordinary Shares at the Issue Price.

Contingent Resource Gross 100% Field Gross 100% Field Increase

Estimates (2019 GCA Assessment) (Conrad - Mar

2020)

Bcf Bcf %

----------------------- ----------------- ---------

1C (Low Case) 184 323 76

----------------------- ----------------- ---------

2C (Mid Case) 276 493 79

----------------------- ----------------- ---------

3C (High Case) 392 666 70

----------------------- ----------------- ---------

Therefore, on behalf of the Directors, it is my pleasure to

offer Qualifying Shareholders an opportunity to participate in the

Open Offer, by making available up to 57,417,375 new Ordinary

Shares to Qualifying Shareholders at the Issue Price. The Open

Offer provides an opportunity for all Qualifying Shareholders to

participate in a fundraising by subscribing for Open Offer Shares

pro rata to their current holding of Ordinary Shares.

Qualifying Shareholders may subscribe for Open Offer Shares

above their basic entitlement under the Open Offer if they so wish

by use of the Excess Application Facility. Further details of the

Excess Application Facility are given in Part III of the Circular.

In the event that the Open Offer is not fully subscribed, it is

intended that the Board reserves the right to use reasonable

endeavours to place the balance of the Open Offer Shares, at not

less than the Issue Price, in order to raise up to the maximum

proceeds under the Open Offer.

3. Details of the Open Offer

On, and subject to, the terms and conditions of the Open Offer,

the Company invites all Qualifying Shareholders to apply for Open

Offer Shares at the Issue Price, payable in full on application and

free of all expenses, on the following basis:

1 Open Offer Share for every 8 Existing Ordinary Shares

held on the Record Date and so in proportion to the number of

Existing Ordinary Shares then held. Entitlements of Qualifying

Shareholders will be rounded down to the nearest whole number of

Open Offer Shares. Fractional entitlements which would otherwise

arise will not be issued to the Qualifying Shareholders but will be

added to the number of Excess Open Offer Shares (if any).

Once subscriptions under the Open Offer Entitlements have been

satisfied, the Board shall, in its absolute discretion, determine

whether to meet any excess applications in full or in part, and no

assurance can be given that applications by Qualifying Shareholders

under the Excess Application Facility will be met in full or in

part or at all. To the extent that additional Open Offer Shares are

not subscribed by existing Shareholders, Open Offer entitlements

will lapse and the Board reserves the right to use reasonable

endeavours to place the balance of shares available under the Open

Offer, at not less than the Issue Price, in order to raise up to

the maximum proceeds under the Open Offer. Further details of the

Open Offer and the Excess Application Facility are given in Part

III of the Circular.

Not all Shareholders will be Qualifying Shareholders. In

particular, Overseas Shareholders who are located in, or are

citizens of, or have a registered office address in a Restricted

Jurisdiction will not qualify to participate in the Open Offer. The

attention of Qualifying Shareholders and in particular Overseas

Shareholders is drawn to paragraph 6 of Part III of the

Circular.

Valid applications by Qualifying Shareholders will be satisfied

in full up to their Open Offer Entitlements. Qualifying

Shareholders can apply for less or more than their entitlements

under the Open Offer.

Open Offer Entitlements set out in an Application Form may be

converted into uncertificated form, that is, deposited into CREST

(whether such conversion arises as a result or a renunciation of

those rights or otherwise). Similarly, CREST Open Offer

Entitlements held in CREST may be withdrawn from CREST and an

Application Form used instead.

Application will be made for the Open Offer Entitlements to be

admitted to CREST. It is expected that such CREST Open Offer

Entitlements will be credited to CREST on 24 April 2020. The CREST

Open Offer Entitlements will be enabled for settlement in CREST

until 11:00 a.m. on 11 May 2020. Applications through the CREST

system may only be made by the Qualifying CREST Shareholder

originally entitled or by a person entitled by virtue of bona fide

market claims. The Open Offer Shares must be paid in full on

application. The latest time and date for receipt of completed

Application Forms or CREST application and payment in respect of

the Open Offer is 11:00 a.m. on 11 May 2020.

Qualifying Shareholders should note that the Open Offer is not a

rights issue and therefore Open Offer Shares which are not applied

for by Qualifying Shareholders will not be sold in the market for

the benefit of the Qualifying Shareholders who do not apply under

the Open Offer, but will be made available under the Excess

Application Facility and the net proceeds will be retained for the

benefit of the Company. The Application Form is not a document of

title and cannot be traded or otherwise transferred.

The Open Offer Shares will be issued free of all liens, charges

and encumbrances and will, when issued and fully paid, rank pari

passu in all respects with the Existing Ordinary Shares, including

the right to receive all dividends and other distributions

declared, made or paid after the date of their issue. Application

will be made to the London Stock Exchange for the admission of the

Open Offer Shares to trading on AIM. It is expected that Admission

will occur and that dealings will commence at 8.00 a.m. on or about

13 May 2020, at which time it is also expected that the Open Offer

Shares will be enabled for settlement in CREST.

Details of the further terms and conditions of the Open Offer,

including the procedure for application and payment, are contained

in Part III of the Circular and on the Application Form enclosed

with the Circular.

If a Qualifying Shareholder does not wish to apply for Open

Offer Shares, he or she should not complete or return the

Application Form or send a USE message through CREST.

Overseas Shareholders

The attention of Qualifying Shareholders who have registered

addresses outside the United Kingdom, or who are citizens or

residents of countries other than the United Kingdom, or who are

holding Existing Ordinary Shares for the benefit of such persons

(including, without limitation, custodians, nominees, trustees and

agents) or who have a contractual or other legal obligation to

forward the Circular or the Application Form to such persons, is

drawn to the information which appears in paragraph 6 of Part III

of the Circular.

In particular, Qualifying Shareholders who have registered

addresses in or who are resident in, or who are citizens of,

countries other than the UK (including without limitation any

Restricted Jurisdiction), should consult their professional

advisers as to whether they require any governmental or other

consents or need to observe any other formalities to enable them to

take up their Open Offer Entitlements.

4. Action to be taken

Qualifying Non-CREST Shareholders wishing to apply for Open

Offer Shares must complete the Application Form, which accompanies

the Circular, in accordance with the instructions set out in

paragraph 4 of Part III of the Circular and on the accompanying

Application Form and return it with the appropriate payment in the

envelope addressed to the Receiving Agent by post or by hand

(during normal business hours only) to Link Asset Services,

Corporate Actions, The Registry, 34 Beckenham Road, Beckenham, Kent

BR3 4TU, United Kingdom, so as to arrive no later than 11.00 a.m.

on 11 May 2020.

If you are a Qualifying CREST Shareholder, no Application Form

will be sent to you. Qualifying CREST Shareholders will have Open

Offer Entitlements credited to their stock accounts in CREST. You

should refer to the procedure for application set out in paragraph

5 of Part III of the Circular. The relevant CREST instructions must

have settled in accordance with the instructions in paragraph 5 of

Part III of the Circular by no later than 11:00a.m. on 11 May

2020.

Qualifying CREST Shareholders who are CREST sponsored members

should refer to their CREST sponsors regarding the action to be

taken in connection with the Circular and the Open Offer.

If you do not wish to apply for any Open Offer Shares under the

Open Offer, you should not complete or return the Application Form

or send a USE message through CREST.

Any Qualifying Shareholder that is unable to access their

Application Form for the Open Offer or has any other impediment to

participate in the Open Offer (for example as a result of COVID-19

restrictions), please contact the Company Secretary directly on

jonathanwhyte@empyreanenergy.com and the Company will take

reasonable steps to make alternative arrangements for any

Qualifying Shareholder wishing to subscribe for Ordinary Shares on

the same basis as the Open Offer.

5. Risk Factors

Your attention is drawn to the Risk Factors set out in Part II

of the Circular. Shareholders are advised to read the whole of the

Circular and not rely solely on the summary information presented

in this letter.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS 2020

Record Date and time for entitlements under 5.00 p.m. on 21

the Open Offer April

Announcement of the Open Offer 22 April

Posting of the Circular, and to Qualifying 23 April

Non-CREST Shareholders only, the Application

Form

Existing Ordinary Shares marked 'ex' by London 8.00 a.m. on 23

Stock Exchange April

Open Offer Entitlements and Excess CREST Open as soon as practicable

Offer Entitlements credited to stock accounts on 24 April

in CREST of Qualifying CREST Shareholders

Recommended latest time for requesting withdrawal 4.30 p.m. on 4

of CREST Open Offer Entitlements from CREST May

Recommended latest time for depositing CREST 3.00 p.m. on 5

Open Offer Entitlements into CREST May

Latest time and date for splitting of Application 3.00 p.m. on 6

Forms (to satisfy bona fide market claims only) May

Latest time and date for acceptance of the 11.00 a.m. on 11

Open Offer, receipt of completed Application May

Forms from Qualifying Shareholders and payment

in full under the Open Offer or settlement

of relevant CREST instruction (as appropriate)

Results of the Open Offer announced through 12 May

an RIS

Admission and commencement of dealings in the 13 May

Open Offer Shares

Open Offer Shares credited to CREST stock accounts 13 May

Despatch of definitive share certificates for 20 May

Open Offer Shares held in certificated form

Notes:

(1) References to times in the Circular are to London time,

England (unless otherwise stated).

(2) The timing of the events in the above timetable and in the

rest of the Circular is indicative only and may be subject to

change.

(3) If any of the above times or dates should change, the revised

times and/or dates will be notified by an announcement through

an RIS.

(4) In order to subscribe for Open Offer Shares under the Open

Offer, Qualifying Shareholders will need to follow the procedure

set out in Part III of the Circular and, where relevant, complete

the accompanying Application Form. If Qualifying Shareholders

have any queries or questions relating to the Circular, the

completion and return of the Application Form, or the procedure

for acceptance and payment, or wish to request another Application

Form, they should contact Link Asset Services, Corporate Actions,

The Registry, 34 Beckenham Road, Beckenham, Kent, BR3 4TU on

0371 664 0321. Calls are charged at the standard geographic

rate and will vary by provider. Calls outside the UK will be

charged at the applicable international rate. The shareholder

helpline is open between 9.00 a.m. to 5.30 p.m., Monday to Friday

excluding public holidays in England and Wales. Please note

that Link Asset Services cannot provide any financial, legal

or tax advice and calls may be recorded and monitored for security

and training purposes.

OPEN OFFER STATISTICS

Closing Price per Existing Ordinary Share (1) 3.3 pence

Issue Price of each Open Offer Share 3.5 pence

Number of Existing Ordinary Shares in issue

(2) 459,339,006

Maximum number of Open Offer Shares available

pursuant to the Open Offer (3) 57,417,375

Maximum proceeds of the Open Offer (before GBP2,009,608

expenses)

Enlarged Share Capital on Admission following

the Open Offer (4) 516,756,382

Open Offer Shares as a percentage of the Enlarged 11.11 per cent.

Share Capital (4)

Market capitalisation of the Company immediately GBP18,086,473

following the Open Offer at the Issue Price

(1) (4)

SEDOL code B09G235

ISIN code for CREST Open Offer Entitlements GB00BMHZM057

ISIN code for Excess CREST Open Offer Entitlements GB00BMHZM164

Notes:

(1) Closing Price on AIM on 21 April 2020, being the latest

practicable date prior to the publication of the Circular.

(2) As at 21 April 2020, being the latest practicable date

prior to the publication of the Circular.

(3) The actual number of Open Offer Shares to be issued under

the Open Offer will be subject to rounding down to eliminate

fractions.

(4) Assuming the Open Offer is fully subscribed and for the

purpose of this calculation it is assumed that no further Ordinary

Shares will be issued as a result of the exercise of any options

or warrants between the date of the Circular and Admission.

DEFINITIONS

"Act" the Companies Act 2006 (as amended)

"Admission" the admission of the Open Offer Shares to trading

on AIM becoming effective in accordance with

the AIM Rules

"AIM" the market of that name operated by the London

Stock Exchange

"AIM Rules" the 'AIM Rules for Companies' published by the

London Stock Exchange (as amended from time to

time) governing the admission to and the operation

of AIM

"Application the application form accompanying the Circular

Form" on which Qualifying Non-CREST Shareholders may

apply for Open Offer Shares in respect of the

Open Offer

"Articles" the articles of association of the Company (as

in force from time to time)

"Australia" the Commonwealth of Australia, its states, territories

or possessions

"Bcf" Billions of cubic feet

"Business Day" a day (other than a Saturday or Sunday) on which

commercial banks are open for general business

in London, England

"Canada" Canada, its provinces and territories and all

areas subject to its jurisdiction and any political

sub-divisions thereof

"certificated an ordinary share recorded on a company's share

form" register as being held in certificated form (namely,

not in CREST)

"Circular" the circular to be issued to Shareholders in

respect of the Open Offer which, for the avoidance

of doubt, does not comprise a prospectus (under

the Prospectus Regulation Rules) or an admission

document (under the AIM Rules)

"Closing Price" the closing middle market quotation of an Ordinary

Share as derived from the Daily Official List

of the London Stock Exchange

"Company" or Empyrean Energy plc (incorporated in England

"Empyrean" and Wales with registered number 5387837)

"CREST" the relevant system (as defined in the CREST

Regulations) in respect of which Euroclear is

the operator (as defined in the CREST Regulations)

"CREST Manual" the rules governing the operation of CREST, consisting

of the CREST Reference Manual, CREST International

Manual, CREST Central Counterparty Service Manual,

CREST Rules, CCSS Operations Manual, and CREST

Glossary of Terms (all as defined in the CREST

Glossary of Terms promulgated by Euroclear on

15 July 1996, and as amended since)

"CREST member" a person who has been admitted to CREST as a

system-member (as defined in the CREST Manual)

"CREST member the identification code or number attached to

account ID" a member account in CREST

"CREST Open Offer the entitlement of a Qualifying CREST Shareholder,

Entitlements" pursuant to the Open Offer, to apply to acquire

Open Offer Shares pursuant to the Open Offer

"CREST participant" a person who is, in relation to CREST, a system-participant

(as defined in the CREST regulations)

"CREST participant shall have the meaning given in the CREST Manual

ID" issued by Euroclear

"CREST payment" shall have the meaning given in the CREST Manual

issued by Euroclear

"CREST Regulations" the Uncertificated Securities Regulations 2001

(SI 2001/3755) (as amended)

"CREST sponsor" a CREST participant admitted to CREST as a CREST

sponsor

"CREST sponsored a CREST member admitted to CREST as a sponsored

member" member

"Directors" or the directors of the Company as at the date of

"Board" the Circular

"Duyung PSC" Duyung Production Sharing Contract

"Enlarged Share the issued ordinary share capital of the Company

Capital" as enlarged following the issue of the Open Offer

Shares assuming full subscription of the Open

Offer Shares

"EU" the European Union

"Euroclear" Euroclear UK & Ireland Limited, the operator

of CREST

"Excess Application the arrangement pursuant to which Qualifying

Facility" Shareholders may apply for additional Open Offer

Shares in excess of their Open Offer Entitlement

in accordance with the terms and conditions of

the Open Offer

"Excess CREST in respect of each Qualifying CREST Shareholder,

Open Offer Entitlements" their entitlement (in addition to their Open

Offer Entitlement) to apply for Open Offer Shares

pursuant to the Excess Application Facility,

which is conditional on them taking up their

Open Offer Entitlement in full

"Excess Open Open Offer Shares applied for by Qualifying Shareholders

Offer Shares" under the Excess Application Facility in addition

to their Open Offer Entitlements

"Ex-entitlement the date on which the Existing Ordinary Shares

Date" are marked 'ex' for entitlement under the Open

Offer, being 23 April 2020

"Existing Ordinary each Ordinary Share in issue; and taken together

Share" the "Existing Ordinary Shares"

"Existing Shareholders" the holders of the Existing Ordinary Shares at

the date of the Circular

"FCA" the Financial Conduct Authority of the United

Kingdom

"FSMA" the Financial Services and Markets Act 2000 (as

amended)

"ISIN" International Securities Identification Number

"GCA" Gaffney Cline and Associates

"Issue Price" 3.5 pence per Open Offer Share

"Japan" Japan, its cities, prefectures, territories and

possessions

"Long State Facility" the GBP10 million equity placement facility entered

into with Long State Investment Limited, as announced

on 24 December 2019

"London Stock London Stock Exchange plc

Exchange"

"Member Account the identification code or number attached to

ID" any member account in CREST

"Money Laundering the Money Laundering Regulations 2007 (SI 2007/2157)

Regulations" (as amended), the money laundering provisions

of the Criminal Justice Act 1993, the Proceeds

of Crime Act 2002 and the Criminal Finances Act

2017

"MMscf/d" million standard cubic feet per day

"Open Offer" the conditional invitation made to Qualifying

Shareholders to apply to subscribe for the Open

Offer Shares at the Issue Price on the terms

and subject to the terms and conditions set out

in Part III of the Circular and in the Application

Form

"Open Offer Entitlement" the entitlement of a Qualifying Shareholder,

pursuant to the Open Offer, to apply to acquire

Open Offer Shares pursuant to, and subject to

the terms and conditions of, the Open Offer

"Open Offer Shares" the 57,417,375 new Ordinary Shares which Qualifying

Shareholders will be invited to subscribe for

pursuant to the Open Offer

"Ordinary Shares" ordinary shares of 0.2p each in the capital of

the Company

"Overseas Shareholders" a Shareholder on the Record Date with a registered

address, or who is a citizen or resident of,

or incorporated in jurisdictions outside the

United Kingdom

"Prospectus Regulation the Prospectus Regulation Rules Instrument 2019

Rules" published by the FCA (FCA 2019/80), implementing

the EU Prospectus Regulation 2017/1129

"Publicly Available any information published by the Company using

Information" a RIS

"Qualifying CREST Qualifying Shareholders holding Existing Ordinary

Shareholders" Shares in uncertificated form

"Qualifying Non-CREST Qualifying Shareholders holding Existing Ordinary

Shareholders" Shares in certificated form

"Qualifying Shareholders" holders of Existing Ordinary Shares on the register

of members of the Company at the Record Date

(but excluding any Overseas Shareholder who has

a registered address in any Restricted Jurisdiction)

"Receiving Agent" Link Asset Services a trading name of Link Market

Services Limited, a private limited company incorporated

in England & Wales under registered number 02605568

and having its registered office at, The Registry,

34 Beckenham Road, Beckenham, Kent, BR3 4TU

"Record Date" 5.00 p.m. on 21 April 2020 in respect of the

entitlements of Qualifying Shareholders under

the Open Offer

"Restricted Jurisdiction" the United States, Australia, Canada, Japan,

New Zealand, the Republic of South Africa, the

Republic of Ireland and any other jurisdiction

in which it would be unlawful to offer the Open

Offer Shares or where the Open Offer would be

required to be approved by a regulatory body

"Registrar" Link Asset Services of The Registry, 34 Beckenham

Road, Beckenham, Kent BR3 4TU

"RIS" a regulatory information service approved the

London Stock Exchange for the distribution of

announcements to the public

"Securities Act" the US Securities Act of 1933, as amended

"Shareholders" the registered holders of Existing Ordinary Shares

or "Empyrean

Shareholders"

"Sterling", "GBP" pounds sterling, the basic unit of currency in

or "pounds" the UK

"Subscription" the direct subscription for 11,741,429 new Ordinary

Shares at the Issue Price announced on 14 April

2020

"UK" or "United the United Kingdom of Great Britain and Northern

Kingdom" Ireland

"UK Listing Authority" the UK Listing Authority, being the FCA acting

or "UKLA" as competent authority for the purposes of Part

V of FSMA

"uncertificated an ordinary share recorded on a company's share

form" register as being held in uncertificated form

in CREST and title to which, by virtue of the

CREST Regulations, may be transferred by means

of CREST

"United States", the United States of America, its territories

"United States and possessions, any state of the United States

of America" or of America and the District of Columbia and all

"US" areas subject to its jurisdiction

"US$" the United States dollar, the basic unit of currency

of the United States of America

"USE" unmatched stock event

"VAT" UK value added tax

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEEAKLAAADEEEA

(END) Dow Jones Newswires

April 22, 2020 02:26 ET (06:26 GMT)

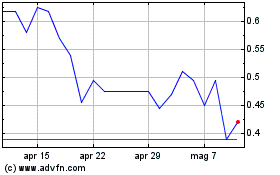

Grafico Azioni Empyrean Energy (LSE:EME)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Empyrean Energy (LSE:EME)

Storico

Da Apr 2023 a Apr 2024