Travis Perkins: Travis Perkins plc - COVID-19 and Trading update (1030975)

28 Aprile 2020 - 8:00AM

UK Regulatory

Travis Perkins (TPK)

Travis Perkins: Travis Perkins plc - COVID-19 and Trading update

28-Apr-2020 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

28 April 2020

Travis Perkins plc - COVID-19 and Trading update

Nick Roberts, Chief Executive, commented:

"In light of the COVID-19 emergency, we have established a new operating

model that has kept colleagues and customers safe, operating within

Government guidelines, and enabling branches across all of the Group's

businesses to remain open. Moreover, we have provided essential services and

support to keep the nation's critical infrastructure maintained and

operational and the UK's homes warm, dry and safe during this time of need.

"We continue to adapt our operations, applying stringent social distancing

and using technology to enable contactless operations, and we are therefore

able to respond to the Government's call to ensure that the construction

industry can continue to deliver on crucial programmes and projects and be

an engine for future economic recovery.

"As we move forward we will continue to adjust our operations, with our

foremost priority to keep colleagues and customers safe and the industry

supplied with the materials it needs."

AGM

The AGM will take place at 9.30am today at the offices of the Company in

Northampton. As stated in the AGM Notice on 3 April 2020, in light of the

impact of the COVID-19 pandemic the AGM will be held with only the Chairman

of the Board and the Company Secretary & General Counsel present, who

together will form the quorum for the meeting, with no other attendees. A

live audio feed will be accessible to shareholders.

Business operations and trading

Since late March, the Group has been running a "service-light" operating

model, focusing on serving customers through remote, non-contact channels.

Throughout the early weeks of the lockdown, around a third of our total

Merchanting branches and around half of all Plumbing and Heating branches

were operating. These sites have been primarily running call and collect or

direct delivery services to support essential construction programmes. These

include the construction of key NHS assets including the Nightingale

hospital network, the ongoing maintenance of national infrastructure and

support for the essential repair and maintenance of domestic homes.

Wickes and Toolstation have been operating across the vast majority of their

branch networks, with branches acting as fulfilment centres for transactions

completed via digital channels for either direct delivery, or with essential

items being available for collection within a designated time slot. The

Wickes Kitchen & Bathroom design and installation service, usually

contributing around a third of Wickes sales, remains closed.

In the first three weeks of April, operating through the service-light

model, Group total revenue was approximately one-third of the same period in

2019 on a comparable basis.

In recent weeks, the Group has been working closely with customers,

suppliers, trade bodies and the UK Government to develop safe- working

protocols which can be applied across the construction supply chain to

enable more activity to be carried out safely under lockdown.

Since 20 April, the Group has been carefully opening more of its Merchant

branch network, with branches continuing to operate the service-light,

non-contact operating model. This will give greater support to large

construction firms and subcontractors as they restart construction sites,

and give smaller, local trade customers improved access to products. Revenue

performance in Wickes and Toolstation has continued to improve with the

businesses responding at pace to the changing nature of the trading

environment, reconfiguring to significantly increase the capability of

distribution networks to cope with the high levels of consumer demand.

Cost base mitigations

Actions have been taken to reduce and carefully manage the operating cost

base of the Group, with all businesses taking decisive actions to eliminate

discretionary spend. In addition, the Group has accessed the Government

support schemes which have been put in place.

The closure of branches, particularly across the Merchanting businesses, has

led to the furlough of both front line branch teams and colleagues in

support functions. Altogether around half of the Group's 30,000 colleagues

were furloughed for the first three weeks of the lockdown. Colleagues have

been furloughed on full pay, with leadership teams and remaining colleagues

working hard to sustain high levels of communication to maintain team

cohesion and morale.

In addition, a decision was taken and announced internally on 7 April 2020

by the Board of Directors and the Group Leadership Team to voluntarily

reduce their salaries by 20% effective from 1 May for a period of three

months.

The Group is benefitting from the business rates holiday, a saving of around

GBP90m for the Group on an annualised basis.

Cash management

The Group continues to act to reduce cash commitments in order to conserve

liquidity in the short-term, including benefiting from the deferral of VAT

payments. Discussions have been held with landlords across the businesses to

move the timing of rent payments where possible, including moving rental

payments from quarterly in advance to monthly in arrears.

A rigorous review of capital expenditure has been carried out, with

discretionary capex not already committed being postponed until there is a

greater degree of certainty around any future economic recovery. Maintenance

capex, which is primarily focused on the Group's vehicle fleet, has been

curtailed in line with the drop in revenue and delivered sales.

Overall, the combination of current trading levels and the mitigations taken

to control the overhead cost base means that for the first month of lockdown

the Group experienced an overhead cash outflow of around GBP50m. With more

Merchanting branches beginning to open with a corresponding increase in

sales volume and the continued progression of trading in the Wickes and

Toolstation businesses, the Group expects this cash outflow to reduce over

the coming weeks.

Robust financial position maintained

The Group continues to maintain a strong liquidity headroom position with a

robust balance sheet.

The Group has carried out detailed scenario analysis of liquidity headroom

with the key focus being near-term working capital management, and

specifically on the recovery of trade debtor values from customers.

Collections to date have been encouraging and are further supported by the

progressive opening of additional Merchanting branches. With the GBP400m

revolving credit facility (RCF) fully drawn, as at 24 April 2020 the Group

had GBP522m of cash on deposit. The Group maintains a good relationship with

its core lending syndicate.

Outlook

The Group has adapted its business operations at pace, working with industry

and Government to design and implement safe ways of working and accelerating

the use of technology for improved customer convenience, and greater

flexibility and simplicity. These actions have positioned the Group well to

support customers across the wider construction industry as a critical

economic engine for growth.

Given the ongoing, considerable level of uncertainty, the Group is unable to

provide an accurate assessment on trading and withdrew market guidance on 20

March 2020. Whilst the uncertainty continues with respect to both the

duration of the lockdown period and the eventual shape of the UK economic

recovery, the Group remains focused on near-term actions to maintain the

safety and welfare of its colleagues, customers and suppliers, and to

promote safe practices which can enable more construction work to

recommence.

Q1 trading

As reported in our statement on 20 March, the Group delivered a good

performance in the first two and a half months of 2020, continuing the

positive momentum from 2019. Performance was then significantly impacted by

the COVID-19 pandemic and the lockdown measures introduced in the UK from 24

March.

Q1 2020 Merchanting(1) Toolstation(1) Retail(2) P&H(1) Group(1)

sales

growth

LFL (8.7)% 9.1% 4.5% (1.9)% (3.8)%

Sales

Net new (0.6)% 20.8% (1.0)% (12.4)% (2.0)%

space

and

acquisi

tions

Trading 1.4% 1.2% - 1.6% 1.2%

days

Total (7.9)% 31.1% 3.5% (12.7)% (4.6)%

Sales

growth

Enquiries:

Travis Perkins Powerscourt

Graeme Barnes Justin Griffiths / James White

+44 (0) 7469 401819 +44 (0) 207 2501446

graeme.barnes@travisperkins.co.uk travisperkins@powerscourt-group.com

Footnotes

(1) Like-for-like sales growth for the three month period ended 31 March

2020 compared to the three month period ended 31 March 2019. Total sales

growth for the three month period ended 31 March 2020 compared to the three

month period ended 31 March 2019.

(2) Wickes like-for-like and total sales growth for the 13 week period ended

28 March 2020 compared to the 13 week period ended 30 March 2019.

ISIN: GB0007739609

Category Code: QRF

TIDM: TPK

LEI Code: 2138001I27OUBAF22K83

Sequence No.: 60696

EQS News ID: 1030975

End of Announcement EQS News Service

(END) Dow Jones Newswires

April 28, 2020 02:00 ET (06:00 GMT)

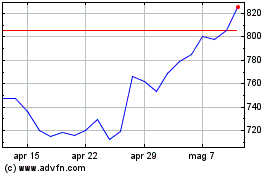

Grafico Azioni Travis Perkins (LSE:TPK)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Travis Perkins (LSE:TPK)

Storico

Da Apr 2023 a Apr 2024