TIDMPIRI

RNS Number : 4018L

Pires Investments PLC

30 April 2020

Pires Investments plc

("Pires" or the "Company")

Results for the year to 31 October 2019

The Board is pleased to announce the audited results of Pires

for the year ended 31 October 2019.

Highlights

- Pre-tax profits achieved of over GBP865,000 with net asset value in excess of GBP2,564,000

- Investment strategy expanded to include the technology sector

which is already yielding positive results

- Net cash proceeds of GBP1.6 million and net profit of almost

GBP1 million realised from the disposal of investment in Eco

Atlantic

- Investment returns and recent fund raisings leave the Company

well-funded to implement its strategy going forward

Chairman's Statement

I am pleased to report significant further progress in the year

to 31 October 2019. The Company achieved a pre-tax profit of

GBP865,510 (2018: GBP322,069) with the value of our investment

portfolio rising to GBP1,165,409 (2018: GBP1,029,526) after

investment realisations during the period of GBP1,016,114 (2018:

GBP264,882). Net asset value at the year-end was GBP2,564,582

(2018: GBP949,617), equivalent to 3.56p per share, and earnings

were 1.64p per share (2018: 0.95p).

In February 2019, we raised just over GBP780,000 in new equity

capital. In October 2019, we obtained shareholder approval for an

extension of our investing policy to include technology and

invested GBP1.1 million for a 13% stake in Sure Valley Ventures

("SVV"), a venture capital fund which invests in the software

technology sector with a specific focus on artificial intelligence

("AI"), the internet of things ("IoT") and augmented and virtual

reality ("AR/VR"). To date, we have made further investments in SVV

in line with our funding commitment totalling approximately

GBP370,000. Our technology investments now represent much the

larger part of our portfolio, reflecting our change of investment

emphasis.

Shareholders will also be aware that on 24 April 2020, the

Company completed a placing to raise further funds amounting to

GBP1.06 million of which GBP454,286 has been firmly placed and

GBP605,714 placed conditional upon approval at the forthcoming

Annual General Meeting. As part of the placing, we are pleased to

welcome the well-known technology investor, Chris Akers, as a

significant shareholder in the Company. The Company is now seeing a

growing number of new investment opportunities and the Board

believes that the Company now has the resources to enable it to

take advantage of them as they arise.

Our results in the last financial year were largely the result

of the increased value and partial realisation of our holding in

Eco (Atlantic) Oil & Gas Limited ("Eco Atlantic") which has

proved a very successful investment for the Company. The Company

has now disposed of the majority of its holding in Eco Atlantic,

prior to the share price fall triggered by recent market conditions

and the sharp fall in oil prices. Overall, we have generated total

net cash proceeds of GBP1.6 million and realised a total net profit

on disposal of almost GBP1 million from this investment.

Our recent focus on technology has proved successful to date. In

December 2019, very soon after our initial investment in SVV, one

of its portfolio companies, Artomatix Limited, was acquired at a

price 500% the valuation at which the investment was made. As

realisations when achieved are paid out to investors, Pires

received a cash distribution of over EUR720,000 with a balance of

EUR82,000 due eighteen months after the sale.

A number of the other portfolio companies have also made

significant progress since our investment. For example, the share

price of VR Education Holdings plc which is quoted on AIM has

increased by almost 30% since the beginning of the year. In March

2020, VividQ Limited raised a further GBP2.4 million from two

strategic venture capital funds. VividQ has leading edge software

providing holography to consumer electronics. In April 2020, Admix

(the trading name for WAM Group Limited), which has developed a

programmatic monetization platform for gaming and other

entertainment developers, raised US$6.1 million from existing and

new investors at a 450% premium to the valuation at which SVV's

initial investment was made. Also, in April 2020, environmental

technology specialist, Ambisense Limited, announced its involvement

in ground surveys for a very large UK infrastructure project - the

Lower Thames Essex-Kent Crossing. More recently, SVV has invested

in Buymie Technologies Limited, a company that has created a

platform that uses artificial intelligence to provide consumers

with access to multiple large retailers - a particular pertinent

investment given the Covid-19 crisis.

In March 2020, Pires announced a direct investment of EUR250,000

in Getvisibility (the trading name for Visibility Blockchain

Limited), an artificial intelligence security company, addressing

the substantial and increasing problem which corporations face in

storing, sorting, accessing and protecting data. It has developed

and launched a software platform using artificial intelligence that

delivers visibility over a wide range of data.

In view of the current Covid-19 pandemic, it is appropriate to

make some comment on the position of the Company. Pires, unlike

very many other companies, remains able to carry on its activities

effectively. Furthermore, we believe that the Company's technology

investments are well positioned against the background of Covid-19.

We are, however, keeping all such matters under close review

In summary, the Company has made good progress during the

financial year and beyond. The Board's intention is to build a

broadly based technology investment company with interests in a

range of companies with exciting growth potential. We believe that

the fundraisings that we completed, the successful realisation of a

key part of our existing portfolio and the investments that we have

made represent valuable first steps in this direction. We look

forward to further progress in the current financial year.

Peter Redmond

Chairman

STATEMENT OF COMPREHENSIVE INCOME

2019 2018

Notes GBP GBP

----------------------------------------- ------- ---------- ----------

CONTINUING ACTIVITIES

Income

Other Income 1,368 11

-------------------------------------------------- ---------- ----------

Total income 1,368 11

Gain on investments held at fair

value through profit or loss 1,151,997 574,987

Operating expenses (287,855) (252,929)

Operating profit from continuing

activities 865,510 322,069

Profit before taxation from continuing

activities 865,510 322,069

Tax - -

----------------------------------------- ------- ---------- ----------

Profit for the year from continuing

activities 865,510 322,069

-------------------------------------------------- ---------- ----------

Other Comprehensive Income - -

----------------------------------------- ------- ---------- ----------

Total Comprehensive Income attributable

to equity holders of the Company 865,510 322,069

================================================== ========== ==========

Basic profit per share

Equity holders

Basic and diluted 1.64p 0.95p

================================================== ========== ==========

STATEMENT OF CHANGES IN EQUITY

Capital

Share Share Redemption Retained

Capital Premium Reserve Earnings Total

GBP GBP GBP GBP GBP

----------------------- ----------- ---------- ------------ -------------- -----------

Balance at 1 November

2017 11,914,727 3,581,055 164,667 (15,032,901) 627,548

Profit and total

comprehensive profit

for the year - - - 322,069 322,069

As at 31 October

2018 11,914,727 3,581,055 164,667 (14,710,832) 949,617

Profit and total

comprehensive profit

for the year - - - 865,510 865,510

Issue of shares (net

of costs) 81,429 668,026 - - 749,455

As at 31 October

2019 11,996,156 4,249,081 164,667 (13,845,322) 2,564,582

======================= =========== ========== ============ ============== ===========

STATEMENT OF FINANCIAL POSITION

2019 2018

GBP GBP

------------------------------------------- ------------- -------------

Non-current assets

Investment in subsidiaries 1 1

Total non-current assets 1 1

Current assets

Investments 1,165,409 1,029,526

Trade and other receivables 11,307 11,357

Cash and cash equivalents 1,426,799 48,028

-------------------------------------------- ------------- -------------

Total current assets 2,603,515 1,088,911

-------------------------------------------- ------------- -------------

Total assets 2,603,516 1,088,912

============================================ ============= =============

Equity

Issued share capital 11,996,156 11,914,727

Share premium 4,249,081 3,581,055

Retained earnings (13,845,322) (14,710,832)

Capital redemption reserve 164,667 164,667

-------------------------------------------- ------------- -------------

Total equity 2,564,582 949,617

Liabilities

Current liabilities

Trade and other payables 38,934 139,295

Total liabilities and current liabilities 38,934 139,295

-------------------------------------------- ------------- -------------

Total equity and liabilities 2,603,516 1,088,912

============================================ ============= =============

1. OPERATING PROFIT

2019 2018

GBP GBP

------------------------------------------------ ----- -----

Operating profit from continuing activities

is stated after charging:

Depreciation of property, plant and equipment - -

2. EARNINGS PER SHARE

2019 2018

GBP GBP

Profit attributable to the owners of the

Company

Continuing Operations 865,510 322,069

---------------------------------------------------- ----------- -----------

2019 2018

No. of No. of

Shares shares

---------------------------------------------------- ----------- -----------

Weighted average number of shares for calculating

basic profit per share 52,900,940 33,900,805

---------------------------------------------------- ----------- -----------

2019 2018

Pence Pence

---------------------------------------------------- ----------- -----------

Basic and diluted profit per share

Continuing Operations - basic and diluted 1.64 0.95

==================================================== =========== ===========

Copies of the accounts will shortly be posted to shareholders

and will be available on the Company's website at

www.piresinvestments.com

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Enquiries:

Pires Investments plc: +44 (0) 20 3 368 8961

Peter Redmond, Director

Nicholas Lee, Director

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

Liam Murray

Ludovico Lazzaretti

Broker: +44 (0) 20 7562 3351

Peterhouse Capital Limited

Duncan Vasey / Lucy Williams

Financial Media and IR: +44 (0) 20 3004 9512

Yellow Jersey pires@yellowjerseypr.com

Sarah Hollins

Henry Wilkinson

Annabel Atkins

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR ILMMTMTITTIM

(END) Dow Jones Newswires

April 30, 2020 02:00 ET (06:00 GMT)

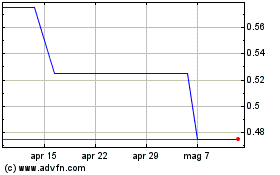

Grafico Azioni Mindflair (LSE:MFAI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Mindflair (LSE:MFAI)

Storico

Da Apr 2023 a Apr 2024