Volta Finance Ld Volta Finance Limited : Dividend Declaration

11 Maggio 2020 - 8:00AM

UK Regulatory

TIDMVTA

Volta Finance Limited (VTA/VTAS)

Dividend Declaration

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES

Guernsey, 11 May 2020

Volta Finance Limited (the "Company") announces that it has declared a

first interim dividend of EUR0.10 per share payable in June 2020,

amounting to approximately EUR3.7 million. The ex-dividend date is 21

May 2020 with a record date of 22 May 2020 and a payment date of 16 June

2020 ("the Dividend").

The Company had previously declared a first interim dividend of EUR0.155

per share to be paid on 28 April 2020. As announced on 2 April 2020,

this dividend was then cancelled. At that time financial markets, the

pricing of the Company's holdings and liquidity conditions were very

disorderly. The Directors and Investment Manager felt that, at that

stage, it would be prudent to cancel the dividend given the profound

uncertainty in economies and markets generally and, specifically, in

relation to the cash flows expected to be received by the Company during

April.

Those cash flows have now been received and market and liquidity

conditions have started to revert to more normal levels. None of the

Company's positions had a cash flow shortfall in April and, in

particular, none of Volta's CLO Equity positions suffered any cash flow

diversion, in contrast to the broader market. The cash flows received

are lower than prior periods would have implied but solely because of

the lower level of prevailing interest rates.

The Board and Investment Manager recognise the importance of dividends

to our shareholders. Accordingly, the Company has declared the

Dividend. It believes that this level of dividend, being approximately

8% annualised of the end of March Net Asset Value, is prudent and

appropriate. As at today's date, after deducting for the imminent

repayment of the repo and the payment of the Dividend, it leaves the

Company with around EUR8m of surplus cash. Allowing for a sensible

buffer for working capital, this remaining cash will be deployed, at

highly attractive expected returns, into current commitments and new

investments.

The exact profile of this crisis cannot be known and it is inevitable

that some diversion of cash flow in the Company's CLO Equity holdings

will occur in the coming quarters. This uncertainty means that the

Board will evaluate the cash flows received each quarter and make a

specific dividend decision on each occasion. However, unless conditions

deteriorate meaningfully, our intention going forwards is to seek to

distribute a material proportion of income received and, if possible,

seek to be consistent with our previously stated aim of distributing

approximately 8% of the NAV per annum. Should income levels in the

coming quarters exceed the Company's current central case, then

additional income may well be distributed as an enhanced dividend later

in the year. Because the Board and Investment Manager intend to wait

for the receipt of cash flows before making each determination of

dividend payments, the Company's dividends are likely to be paid later

than previously guided -- therefore in June, September, December &

March. Once conditions and cash flows become more predictable, the

Company may seek to revert to the previous dividend timetable.

The Company has arranged for its shareholders to be able to elect to

receive their dividends in either Euros or Pounds Sterling.

Shareholders will, by default, receive their dividends in Euros, unless

they have instructed the Company's Registrar, Computershare Investor

Services (Guernsey) Limited ("Computershare"), to pay dividends in

Pounds Sterling. Such instructions may be given to Computershare either

electronically via CREST or by using the Currency Election Form which

has been posted to shareholders and a copy of which is also available on

the website www.voltafinance.com within the "Investors -- Other

Documents" section. The deadline for receipt of currency elections is

12:00 (midday) on 26 May 2020.

For further information, please contact:

Company Secretary and Administrator

BNP Paribas Securities Services S.C.A, Guernsey Branch

https://www.globenewswire.com/Tracker?data=Q_1GjaaFFfBW6YIAiqglKjA--uwLADKpzHQK_mfkLRqa-st-XBY61-mv8aHj5Ah3H_Toaed1ib7Gf8Fj5vjXL5dbdYJKvhU_pb7q4N44CPsT6I_y4dXyLuDAgJq2AGSagtUxIFrOgQQ-I6rNcsigSw==

guernsey.bp2s.volta.cosec@bnpparibas.com

+44 (0) 1481 750 853

Corporate Broker

Cenkos Securities plc

Rob Naylor

Will Talkington

Andrew Worne

+44 (0) 20 7397 8900

For the Investment Manager

AXA Investment Managers Paris

Serge Demay

https://www.globenewswire.com/Tracker?data=UGdp6xFd9rVnCfHy2WBeDMxUh-gSdP3qW1xyJCqdWGE-FWCaIqwFXzCCKWc-XvDLnpRkVUbAiAcLachl9v--8-vM5MPWl9gLQzHEXVO86hs=

serge.demay@axa-im.com

+33 (0) 1 44 45 84 47

*****

ABOUT VOLTA FINANCE LIMITED

Volta Finance Limited is incorporated in Guernsey under The Companies

(Guernsey) Law, 2008 (as amended) and listed on Euronext Amsterdam and

the London Stock Exchange's Main Market for listed securities. Volta's

home member state for the purposes of the EU Transparency Directive is

the Netherlands. As such, Volta is subject to regulation and supervision

by the AFM, being the regulator for financial markets in the

Netherlands.

Volta's investment objectives are to preserve capital across the credit

cycle and to provide a stable stream of income to its shareholders

through dividends. Volta seeks to attain its investment objectives

predominantly through diversified investments in structured finance

assets. The assets that the Company may invest in either directly or

indirectly include, but are not limited to: corporate credits; sovereign

and quasi-sovereign debt; residential mortgage loans; and, automobile

loans. The Company's approach to investment is through vehicles and

arrangements that essentially provide leveraged exposure to portfolios

of such underlying assets. The Company has appointed AXA Investment

Managers Paris an investment management company with a division

specialised in structured credit, for the investment management of all

its assets.

*****

ABOUT AXA INVESTMENT MANAGERS

AXA Investment Managers (AXA IM) is a multi-expert asset management

company within the AXA Group, a global leader in financial protection

and wealth management. AXA IM is one of the largest European-based asset

managers with 739 investment professionals and EUR810 billion in assets

under management as 31 December 2019

*****

This press release is for information only and does not constitute an

invitation or inducement to acquire shares in Volta Finance. Its

circulation may be prohibited in certain jurisdictions and no recipient

may circulate copies of this document in breach of such limitations or

restrictions. This document is not an offer for sale of the securities

referred to herein in the United States or to persons who are "U.S.

persons" for purposes of Regulation S under the U.S. Securities Act of

1933, as amended (the "Securities Act"), or otherwise in circumstances

where such offer would be restricted by applicable law. Such securities

may not be sold in the United States absent registration or an exemption

from registration from the Securities Act. The company does not intend

to register any portion of the offer of such securities in the United

States or to conduct a public offering of such securities in the United

States.

*****

This communication is only being distributed to and is only directed at

(i) persons who are outside the United Kingdom or (ii) investment

professionals falling within Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005 (the "Order") or (iii)

high net worth companies, and other persons to whom it may lawfully be

communicated, falling within Article 49(2)(a) to (d) of the Order (all

such persons together being referred to as "relevant persons"). The

securities referred to herein are only available to, and any invitation,

offer or agreement to subscribe, purchase or otherwise acquire such

securities will be engaged in only with, relevant persons. Any person

who is not a relevant person should not act or rely on this document or

any of its contents. Past performance cannot be relied on as a guide to

future performance.

*****

(END) Dow Jones Newswires

May 11, 2020 02:00 ET (06:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

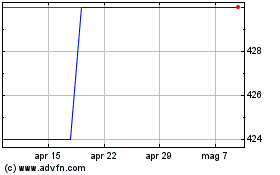

Grafico Azioni Volta Finance (LSE:VTAS)

Storico

Da Mar 2024 a Apr 2024

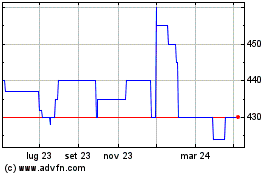

Grafico Azioni Volta Finance (LSE:VTAS)

Storico

Da Apr 2023 a Apr 2024