SolGold's London Shares Rise on Funding Package Deal for Alpala Project

11 Maggio 2020 - 10:43AM

Dow Jones News

By Adria Calatayud

London-listed shares in SolGold PLC rose Monday after the

company said it has agreed to a funding package of $100 million

with Franco-Nevada Corporation for its Alpala copper-gold project

in Ecuador.

The copper and gold mining company said it has also entered into

a $15 million bridge loan of immediately available funds with

Franco-Nevada as an initial advance prior to closing the financing

agreement. The advance provides SolGold with short-term funding at

an interest rate of 12% a year for a four-month period, with an

option to extend the maturity for another four months, and is

repayable with interest upon closing of the larger funding package,

it said.

Under the agreement, Franco-Nevada will receive a perpetual 1%

net smelter return interest from SolGold, calculated with reference

to net smelter returns from the Cascabel license in northern

Ecuador where the Alpala project is located, it said. SolGold said

it has an option to increase the size of the funding package by $50

million to a 1.5% net smelter return interest within eight months

from the date of the agreement.

SolGold shares in London at 0802 GMT were up 9% at 27.95 pence,

having earlier peaked at 30.25 pence.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

May 11, 2020 04:28 ET (08:28 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

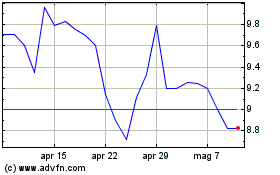

Grafico Azioni Solgold (LSE:SOLG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Solgold (LSE:SOLG)

Storico

Da Apr 2023 a Apr 2024