Vodafone Shares Rise as Fresh Savings Target Eclipses Coronavirus -- Update

12 Maggio 2020 - 1:11PM

Dow Jones News

--Vodafone Group outlined a new savings target and reported a

swing to a pretax profit for fiscal 2020

--The company warned that coronavirus will hit its markets and

didn't give earnings guidance for the year ahead

--Shares in the company rose sharply, topping the FTSE 100

gainers

By Adria Calatayud

Shares of Vodafone Group PLC rose Tuesday after the company

outlined a new savings plan and posted a swing to a pretax profit

for fiscal 2020, but warned that the coronavirus pandemic will deal

a significant economic blow to its markets.

The U.K. telecommunications group said it expects to deliver at

least 1 billion euros ($1.08 billion) of net cost savings over the

next three years. The company said this extends an existing

digital-transformation program, as part of which it has reduced

costs by EUR800 million over the last two years.

Shares at 1020 GMT were up 8.7% at 122.88 pence, making Vodafone

the top riser of the FTSE 100.

Vodafone's cost-savings plan was introduced as the company said

its business model isn't immune to challenges posed by the

coronavirus pandemic. The company is being hit by lower roaming

revenue due to reduced international travel and expects economic

pressures to hurt customers over time, it said. Roaming in Europe

fell by between 65% and 75% in April, but mobile data usage

increased 15%, Vodafone said.

Chief Executive Nick Read believes Vodafone has room to cut

costs further to offset coronavirus effects, which makes it

confident that cash generation can be at least EUR5 billion in

fiscal 2021, excluding spectrum costs, he said in a call with

journalists.

Savings will be mainly driven by technology evolution and

digitization, Chief Financial Officer Margherita Della Valle said

in the call.

However, Vodafone said it isn't able to provide guidance on

adjusted earnings before interest, taxes, depreciation and

amortization for the year ahead because of the uncertainties. Based

on its current assessments, adjusted Ebitda might be flat to

slightly down in fiscal 2021 compared with a rebased fiscal 2020

baseline, Vodafone said.

For the year ended March 31, the company made a pretax profit of

EUR795 million compared with a loss of EUR2.61 billion a year

earlier, when it booked a loss over the sale of its Indian arm and

wrote down the value of some of its assets. The company posted a

narrowed net loss of EUR920 million compared with EUR8.02 billion a

year before.

Revenue for the year increased 3% to EUR44.97 billion, the

company said. Analysts expected revenue of EUR45.42 billion,

according to a consensus taken from FactSet and based on estimates

by 14 analysts.

In the fourth quarter, the company's organic service revenue--a

closely-watched metric that tracks revenue from selling telecom

services--grew 1.6%, it said.

Adjusted Ebitda--one of the company's preferred profit

measures--rose 2.6% to EUR14.88 billion, against Vodafone's

guidance range of EUR14.8 billion to EUR15.0 billion.

The board declared a total dividend of 9.0 European cents a

share, a week after rival BT Group PLC shocked investors with a

suspension of its payout until fiscal 2022.

Vodafone said it remains on track to monetize its European tower

assets in early 2021, as Mr. Read said current market conditions

are favorable for a potential listing due to interest in

telecommunications-infrastructure assets. The U.K. and Germany are

the strongest contenders to host an initial public offering of the

business, Mr. Read said.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

May 12, 2020 06:56 ET (10:56 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

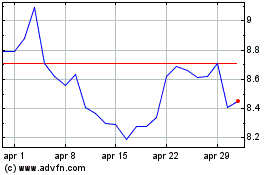

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Mar 2024 a Apr 2024

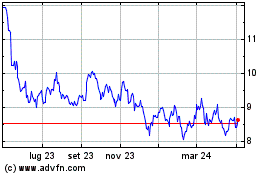

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Apr 2023 a Apr 2024