TIDMWIN

RNS Number : 8348M

Wincanton PLC

14 May 2020

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

LEI: 213800Z5WTW8QKOHWQ82

For immediate release

14 May 2020

Wincanton plc

("Wincanton" or the "Company")

Trading Update and Financing Arrangements

Wincanton today issues an update on trading and management

actions during this period of unprecedented disruption and

uncertainty. In addition, the Company (together with its

subsidiaries, the "Group") announces an extension to its current

banking facilities.

Key Points

-- April Group revenue down 15% year-on-year, with significant

variations in the level of performance across the Group's

businesses and segments and a negative impact on year-to-date

profitability. Encouraging signs of gradual increase in activity

levels in affected segments.

-- Key focus on cash management actions including the furlough

of 15% of workforce; board and executive management temporary 20%

pay reduction; deferral of pension recovery payments; HMRC payment

deferrals until Q4; delay of non-business critical capex; and

suspension of the final dividend

-- Additional liquidity secured through a GBP40 million RCF

extension, available for 12 months from May 2020, bringing the

total available facility to GBP181 million

-- Performance for the year ended 31 March 2020 was in line with

market expectations with revenue growth of over 5%

Current Trading

Since the announcement of 25 March 2020, the Board has continued

to assess the impact of the disruption and uncertainty caused by

COVID-19.

Our key priority has continued to be to safeguard the health and

wellbeing of our employees and their families, whilst continuing to

provide those logistics services our customers need to help the

nation to function. Where operations have remained active, we have

applied safe systems of working, with appropriate distancing and

cleaning measures, and non-operational staff are working remotely

wherever possible.

It is too early to fully assess the financial implications of

the COVID-19 crisis on the Group's business and there remains

considerable uncertainty regarding the levels of demand and

business interruption for the remainder of the year. Group revenues

in April have been c.15% below the comparable period last year, but

with significant variations across our different businesses and

segments. The profit impact of volume shortfall is also varied

according to contract types, particularly between open and closed

book contracts, but as a whole the Group has seen a negative impact

to its profitability in the financial year to date.

At the onset of the COVID-19 crisis, we saw an increase in

volume and demand from both our grocery and consumer products

customers, particularly in March, as they responded to changes in

consumer buying habits, including initial 'panic buying' in stores.

Both areas have now returned to the volumes we would expect at this

time of year. The financial impact of these effects was a

short-term increase in revenue, although with limited profit uplift

due to the commercial models deployed in these customer

contracts.

In non-grocery retail we have seen a shift of supply chains from

in-store to on-line channels, although many of our larger customers

have been able to keep stores open. The picture varies by customer

and is developing as our customers modify their in-store

arrangements, but in general volumes in April were lower than prior

periods as shopping appears to have been more focused on

'essential' products. However, the open book nature of most of the

contracts has ensured that profitability has some protection in

this segment. Our defence business has started this financial year

more strongly in both revenue and profit versus last year, with

COVID-19 having a limited impact and new business won last year

flowing through.

In our closed book two-person home delivery network we were

required to cease operations at the end of March in line with

safety guidelines. This resulted in a significant negative impact

on profitability during the shutdown. Following a change to

government guidance the service has now restarted, although a

return to normal levels will take time.

Similarly, our construction business has seen major parts of the

network closed from early April, due to the voluntary shutdown of

many construction sites and builders' merchants. Revenues during

April were down by around 70% on the comparable period last year.

We have acted swiftly to reduce the variable elements of our cost

base with significant reductions in subcontractor and agency labour

costs. However, as we operate this business as a largely closed

book network, the reduction in revenue has had a substantial impact

on its profitability in April. Recent announcements in the

housebuilding and construction sectors on the recommencement of

operations are encouraging but we expect the pickup in business to

be gradual.

Container volumes and Pullman Fleet Services ("PFS") revenues

continue to be below expectations, with the container business

impacted by reduced traffic from Asia and PFS workshop volumes

depressed by general lower demand for vehicle maintenance and

repairs as a result of less road activity. Our energy business has

also experienced some slowdown due to reduced retail forecourt fuel

volumes. We have a blend of open and closed book contracts in this

area and there has been therefore some profit impact, however we

expect this to reduce as volumes return post lockdown.

Management's actions in response to COVID-19

As noted in our announcement of 25 March 2020, cash management

remains a key focus. In order to maintain liquidity within the

business, a number of measures have already been taken.

Across the business approximately 2,500 staff (c.15% of our

workforce) have been subject to furloughing arrangements, although

we continue to review staffing levels to ensure we can respond to

returning customer demand as quickly as possible.

We have also undertaken a forensic review of costs across all

operations including the use of agency labour and subcontracted

services and achieved significant reductions. All but business

critical capex and projects have been put on hold, we have

renegotiated payment profiles on certain asset leases and have also

taken advantage of HMRC arrangements to defer VAT.

Actions have been taken across the management population in

respect of remuneration and are under continued review. The Board

and executive management team have agreed to temporary pay

reductions of 20%, effective from 1 April 2020, and no cash

payments in respect of the executive management bonus scheme are

expected to be made in this financial year.

In addition, to retain near-term flexibility, the Board has

determined that the final dividend, which would ordinarily be paid

in July, should be suspended. The Board recognises the importance

of the dividend to our shareholders and will keep dividend payments

under review as the year progresses with a view to return to

payments as soon as appropriate.

We have also reached agreement in principle with the Pension

Trustees of the defined benefit pension scheme to defer upcoming

deficit recovery payments by twelve months which will improve the

Group's liquidity by approximately GBP6 million. The agreement

contains provisions for accelerated payment of deferred

contributions if dividends are paid within the deferral period.

Extension of the Banking facilities

The Group currently has a committed Revolving Credit Facility

("RCF") of GBP141 million, with our banking consortium comprising

HSBC, Barclays, Santander, ABN AMRO and AIB, which matures in

October 2023.

We have explored a range of additional financing options,

including government financial support schemes, bank debt and

equity, and have secured an extension to the RCF of GBP40 million

to be available for drawdown for a period of 12 months from May

2020 in lieu of the uncommitted Accordion facility. The financial

covenant tests remain unchanged as a result of this extension.

During this 12 month period, the payment of any dividends will

result in a corresponding reduction in size of the GBP40 million

extension. We continue to monitor our trading and downside

scenarios and will consider additional financing options in the

longer term should they be required.

James Wroath, CEO of Wincanton, commented:

"I am extremely proud of the response of our colleagues working

in challenging circumstances and embracing the changes that have

been required. Our priority remains the health and wellbeing of

them and their families.

The outlook is uncertain as we wait to see how the country will

emerge from lock-down and the impact varies considerably across our

diverse sectors. I am pleased that we have been able to secure an

extension to our banking facilities which will provide greater

liquidity in this period of uncertainty.

I am confident we are taking the right measures for the business

and stakeholders to put Wincanton in the very best possible

position to get through the coming months and to thrive in the

longer term."

Wincanton +44 (0) 12 4971 0000

Tim Lawlor, Chief Financial Officer

Buchanan (Financial PR) + 44 (0) 20 7466 5000

Richard Oldworth/Vicky Hayns

The person responsible for releasing this announcement is Lyn

Colloff, Company Secretary.

Notes to Editors

About Wincanton

Wincanton is the largest British third-party logistics (3PL)

company, providing supply chain solutions to some of the world's

most admired companies across a wide range of industries including

retail, construction, defence and energy.

As a trusted and respected business partner, we design and

implement services and solutions that range from setting up and

operating distribution networks, through to bonded warehouses,

technology hosting, container transport and storage. We strive for

operational excellence in everything we do.

We work hard to understand and respond to our customers' needs,

build long-term relationships and use our skills and expertise to

deliver a smarter, added value service, every day. Our customers

rely on us to make their businesses operate more efficiently and to

gain a competitive advantage in their sector.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKKNBNFBKDFPD

(END) Dow Jones Newswires

May 14, 2020 02:00 ET (06:00 GMT)

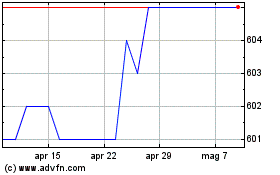

Grafico Azioni Wincanton (LSE:WIN)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Wincanton (LSE:WIN)

Storico

Da Apr 2023 a Apr 2024