Thai Central Bank Cuts Key Rate To Record Low

20 Maggio 2020 - 10:35AM

RTTF2

Thailand's central bank cut its key interest rate by a

quarter-point to a record low on Wednesday, as the economy is set

to contract more than expected due to weaker domestic demand and

tourism amid the coronavirus pandemic.

The Monetary Policy Committee of Bank of Thailand voted 4-3 to

cut the policy rate to 0.50 percent from 0.75 percent, with

immediate effect. Three members voted to hold the rate at 0.75

percent.

This was the third reduction in rates this year.

GDP is expected to fall more than expected as pandemic has

weighed on tourism and exports. Due to rising unemployment,

consumption and private investment decreased further.

The economy had contracted 1.8 percent in the first quarter,

which was the fastest decline in more than eight years.

The committee observed that timely fiscal measures are required

to support employment and small and medium sized enterprises.

Due to lower energy prices, the annual average of headline

inflation would be more negative in 2020 than the previous

assessment, the bank noted.

The bank said it will monitor developments in economic growth,

inflation and financial stability and the impact of the coronavirus

and vowed to use additional appropriate monetary policy tools if

necessary.

With the policy rate now not much above zero, the central bank

will soon need to turn its attention to non-conventional policy

options, Gareth Leather, an economist at Capital Economics,

said.

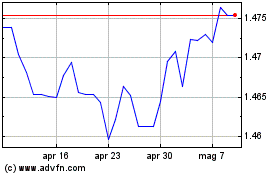

Grafico Cross Euro vs CAD (FX:EURCAD)

Da Mar 2024 a Apr 2024

Grafico Cross Euro vs CAD (FX:EURCAD)

Da Apr 2023 a Apr 2024