TIDMTYM

RNS Number : 4054O

Tertiary Minerals PLC

29 May 2020

29 May 2020

TERTIARY MINERALS PLC

("Tertiary" or "the Company")

HALF-YEARLY REPORT 2020

Tertiary Minerals plc, the AIM-traded company building a

multi-commodity project portfolio, announces its unaudited interim

results for the six months ended 31 March 2020.

OPERATIONAL SUMMARY:

Pyramid Gold Project, Nevada, USA

-- The Company's first drill hole on the project was

successfully completed ahead of schedule and drilled to a total

depth of 137m

-- Intersection of 0.55m grading 2.01 g/t Au from 82.6m down

hole, confirming that the target zone is gold-mineralised

-- Further planned exploration work: Soil sampling to fully

delineate the gold, silver and multi-element soil geochemical

anomaly and to define further drill targets

Paymaster Polymetallic Project, Nevada, USA

-- A US based consulting geologist with a background in the

evaluation of skarn deposits has now completed an extensive

programme of mapping and sampling and to help define potential

drilling

New Project Acquisitions

-- Three new projects acquired by low costs claim staking - Peg Leg, Mt Tobin and Lucky

MB Fluorspar Project, Nevada, USA

-- Following the recent fundraisings, the Company has

re-commenced the Scoping Study level metallurgical testwork at SGS

Lakefield in Canada

Storuman Fluorspar Project, Sweden

-- The Mine Permit appeal process is ongoing with the Swedish

Government with no commitment to a decision timeframe

Kaaresselkä and Kiekerömaa Gold Projects, Finland

-- The Company retains pre-production and net smelter royalty

interest in two gold projects owned by Aurion Resources

-- Aurion is a Canadian listed exploration company with primary

focus on the development of its Finnish gold projects, several of

which are under joint venture with B2Gold. Kinross Gold Corporation

is a significant shareholder of Aurion

Strategic Relationship with Possehl Erzkontor GmbH & Co.

KG

-- The Company signed a fluorspar marketing Memorandum of

Understanding (MOU) in 2017 with leading global commodities trading

group, Possehl Erzkontor GmbH & Co. KG ("Possehl"), a wholly

owned subsidiary of CREMER

-- The MOU remains in place with Possehl

FINANCIAL SUMMARY FOR THE SIX MONTHSING 31 MARCH 2020:

-- Operating Loss of GBP278,934 comprises:

o Revenue of GBP94,691; less Administration costs of GBP352,914

(which includes non-cash share-based payments of GBP25,224);

and

o Pre-licence and reconnaissance exploration costs totalling

GBP20,711

o Total Group Loss of GBP278,780 is after crediting Interest

income of GBP154

-- Project expenditure of GBP43,513 was capitalised during the quarter.

Funding and Cash Position:

-- The Company has completed two fundraisings in the period with

Bergen Global Opportunity Fund, LP (Bergen) and through Peterhouse

Capital Limited

-- The closing cash (and cash equivalent) position at the end of the period was GBP407,807

-- Since the period end, a subsequent lump sum investment of

GBP600,000 was made by Precious Metals Capital Group LLC on 7 April

2020, further strengthening the Company's cash position (circa

GBP800,000 on 26 May 2020) during the current challenging times as

well as enabling the Company to progress its planned exploration on

its Paymaster Polymetallic and Pyramid Gold Projects in Nevada

About Tertiary Minerals plc

Tertiary Minerals plc (ticker symbol 'TYM') is an AIM-traded

mineral exploration company building and developing a

multi-commodity project portfolio - Industrial minerals, base and

precious metals.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

For more information please contact:

Enquiries

Tertiary Minerals plc

Patrick Cheetham, Executive

Chairman

Richard Clemmey, Managing Director +44 (0)1625 838 679

SP Angel Corporate Finance LLP

Nominated Adviser & Joint Broker

Richard Morrison/Caroline Rowe +44 (0) 20 3470 0470

Peterhouse Capital Limited

Joint Broker

Lucy Williams/Duncan Vasey +44 (0) 207 469 0930

Chairman's Statement

I am pleased to present our Interim Report for the six-month

period ended 31 March 2020.

During this reporting period we have seen a significant

improvement in market sentiment for junior mining companies,

particularly in relation to precious metals, which has allowed us

to improve our financial position and to kick-start work on a

number of our existing projects. Much of this activity has taken

place since the period end and has focused on our projects in

Nevada, USA.

At Pyramid, the Company is targeting high-grade epithermal style

gold mineralisation. An initial drill hole designed to confirm a

high-grade gold intersection made by a previous explorer

demonstrated the target zone to be gold bearing but did not deliver

the same high-grade results. The target zone is defined by an

extensive gold-in-soil anomaly and widespread gold bearing surface

samples and warrants further work over the next few months.

Mineral exploration is high risk and the process of discovery is

not linear but high rewards can come from successful discoveries.

Recent mapping and sampling at our Paymaster Zinc-Silver Skarn

Project by a specialist consulting geologist has confirmed a

large-scale target for zinc skarn mineralisation and drawn

analogies with the setting and style of the large Taylor Zinc

discovery, in the neighbouring state Arizona, now owned by South 32

after the $2 billion takeover of Arizona Mining in 2018. We are now

awaiting the report and recommendations for further work.

We seek to spread the risk of mineral exploration and increase

our chance of discovery through a portfolio-based approach. In line

with this strategy we are steadily re-building our portfolio of

projects with a continuing focus on Nevada. We have recently staked

additional ground on three new projects targeting precious and base

metal deposits - the Peg Leg, Mt Tobin and Lucky Projects. In each

case the projects have been acquired at low cost by staking claims

and they share the characteristics that they can be evaluated with

low cost programmes initially and brought to the drill stage

relatively quickly. Programmes are being designed and permitted and

will be executed over the coming months.

At our large MB Fluorspar Project in Nevada we have commenced a

programme of scoping level metallurgical testwork at SGS Lakefield

in Canada aimed at improving recoveries and concentrate grade for

fluorspar mineralisation in the Central Zone of the deposit. To

date, this has been problematic and a breakthrough is needed if the

potential of this large low-grade resource is to be realised.

There is nothing substantive to report on our Storuman Fluorspar

Project in Sweden, where the mine permit appeal process is ongoing

with the Swedish Government, or on our Lassedalen Fluorspar Project

in Norway which is a low priority for further work.

The Company's financial results for the half-year are in line

with expectations and reflect the Company's project and

administration expenditures. The financial markets have shown

remarkable resilience in the face of the Covid-19 pandemic and this

has allowed us to continue funding our activities and improve the

Company's financial position at the year end through a GBP600,000

fundraising with US Precious Metals Capital Group in April

2020.

The mining industry in Nevada has continued to operate as an

essential industry and our programmes have so far been unaffected.

Our staff continue to work effectively from home. The future of

this pandemic is, however, unpredictable and has potential to

affect our operations and the markets in which we operate in the

future. We will continue to operate in line with World Health

Organisation and Governments' advice and to manage our expenditure

prudently.

I would like to thank all of our employees and directors for

their hard work during the reporting period and to wish Richard

Clemmey well as he leaves the Company at the end of June to return

to employment in the UK quarrying industry. I will continue to act

in an executive capacity until the time is right to make a new

executive director appointment.

Patrick L Cheetham

Executive Chairman

29 May 2020

Consolidated Income Statement

for the six months to 31 March 2020

Six months Six months Twelve months

to 31 March to 31 March to 30 September

2020 2019 2019

Unaudited Unaudited Audited

GBP GBP GBP

------------------------------------------ ------------- ------------- -----------------

Revenue 94,691 106,747 189,742

------------------------------------------ ------------- ------------- -----------------

Administration costs (352,914) (240,163) (502,788)

Pre-licence exploration costs/impairment

costs (20,711) (49,602) (75,778)

Impairment of deferred exploration

asset - - (442,917)

Operating loss (278,934) (183,018) (831,741)

Gain on disposal of available - - -

for sale investment

Interest receivable 154 145 234

Loss before income tax (278,780) (182,873) (831,507)

Income tax - - -

------------------------------------------ ------------- ------------- -----------------

Loss for the period attributable

to equity holders of the parent (278,780) (182,873) (831,507)

========================================== ============= ============= =================

Loss per share - basic and diluted

(pence)

(Note 2) (0.05) (0.05) (0.19)

========================================== ============= ============= =================

Consolidated Statement of Comprehensive Income

for the six months to 31 March 2020

Six months Six months Twelve months

to 31 March to to

2020 31 March 30 September

Unaudited 2019 2019

Unaudited Audited

GBP GBP GBP

------------------------------------------ ------------- ----------- --------------

Loss for the period (278,780) (182,873) (831,507)

------------------------------------------ ------------- ----------- --------------

Items that could be reclassified

subsequently to the Income Statement:

Foreign exchange translation differences

on foreign currency net investments

in subsidiaries (10,352) (1,180) 115,415

(10,352) (1,180) 115,415

------------- ----------- --------------

Items that will not be reclassified

to the Income Statement:

Changes in the fair value of equity

investments (12,963) (69,550) (71,670)

(12,963) (69,550) (71,670)

------------------------------------------ ------------- ----------- --------------

Total comprehensive loss for the

period attributable to equity holders

of the parent (302,095) (253,603) (787,762)

========================================== ============= =========== ==============

Company Registration Number 03821411

Consolidated Statement of Financial Position

at 31 March 2020

As at As at As at

31 March 31 March 30 September

2020 2019 2019

Unaudited Unaudited Audited

GBP GBP GBP

----------------------------------- ------------- ------------- --------------

Non-current assets

Intangible assets 2,492,717 2,730,899 2,461,972

Property, plant & equipment 4,220 2,658 4,182

Other investments 19,759 132,778 89,775

----------------------------------- ------------- ------------- --------------

2,516,696 2,866,335 2,555,929

----------------------------------- ------------- ------------- --------------

Current assets

Receivables 55,348 67,786 41,568

Cash and cash equivalents 407,807 217,432 50,617

463,155 285,218 92,185

----------------------------------- ------------- ------------- --------------

Current liabilities

Trade and other payables (89,506) (44,974) (70,686)

Net current assets 373,649 240,244 21,499

----------------------------------- ------------- ------------- --------------

Net assets 2,890,345 3,106,579 2,577,428

=================================== ============= ============= ==============

Equity

Called up Ordinary Shares 73,383 44,307 44,307

Deferred Shares 2,644,062 2,644,062 2,644,062

Share premium account 10,569,399 10,008,687 10,008,687

Merger reserve 131,096 131,096 131,096

Share option reserve 66,830 112,952 67,468

Fair value reserve (21,407) (6,324) (8,444)

Foreign currency reserve 409,400 303,157 419,752

Accumulated losses (10,982,418) (10,131,358) (10,729,500)

----------------------------------- ------------- ------------- --------------

Equity attributable to the owners

of the parent 2,890,345 3,106,579 2,577,428

=================================== ============= ============= ==============

Consolidated Statement of Changes in Equity

Ordinary Deferred Share Merger Share Fair Foreign Accumulated Total

Share Shares Premium Reserve Warrant Value Currency Losses

Capital Account Reserve Reserve Reserve

GBP GBP GBP GBP GBP GBP GBP GBP GBP

--------------- ---------- ---------- ----------- --------- --------- --------- ---------- ------------- ----------

At 30

September

2018 35,932 2,644,062 9,785,702 131,096 168,923 63,226 304,337 (10,007,469) 3,125,809

--------------- ---------- ---------- ----------- --------- --------- --------- ---------- ------------- ----------

Loss for the

period - - - - - - - (182,873) (182,873)

Change in fair

value - - - - - (69,550) - - (69,550)

Exchange

differences - - - - - - (1,180) - (1,180)

Total

comprehensive

loss for

the period - - - - - (69,550) (1,180) (182,873) (253,603)

--------------- ---------- ---------- ----------- --------- --------- --------- ---------- ------------- ----------

Share issue 8,375 - 222,985 - - - - - 231,360

Share based

payments

expense - - - - 3,013 - - - 3,013

Transfer of

expired

warrants - - - - (58,984) - - 58,984 -

---------------

At 31 March

2019 44,307 2,644,062 10,008,687 131,096 112,952 (6,324) 303,157 (10,131,358) 3,106,579

Loss for the

period - - - - - - - (648,634) (648,634)

Change in fair

value - - - - - (2,120) - - (2,120)

Exchange

differences - - - - - - 116,595 - 116,595

--------------- ---------- ---------- ----------- --------- --------- --------- ---------- ------------- ----------

Total

comprehensive

loss for

the period - - - - - (2,120) 116,595 (648,634) (534,159)

--------------- ---------- ---------- ----------- --------- --------- --------- ---------- ------------- ----------

Share issue - - - - - - - - -

Share based

payments

expense - - - - 5,008 - - - 5,008

Transfer of

expired

warrants - - - - (50,492) - - 50,492 -

--------------- ---------- ---------- ----------- --------- --------- --------- ---------- ------------- ----------

At 30

September

2019 44,307 2,644,062 10,008,687 131,096 67,468 (8,444) 419,752 (10,729,500) 2,577,428

--------------- ---------- ---------- ----------- --------- --------- --------- ---------- ------------- ----------

Loss for the

period - - - - - - - (278,780) (278,780)

Change in fair

value - - - - - (12,963) - - (12,963)

Exchange

differences - - - - - - (10,352) - (10,352)

--------------- ---------- ---------- ----------- --------- --------- --------- ---------- ------------- ----------

Total

comprehensive

loss for

the period - - - - - (12,963) (10,352) (278,780) (302,095)

--------------- ---------- ---------- ----------- --------- --------- --------- ---------- ------------- ----------

Share issue 29,076 - 560,712 - - - - - 589,788

Share based

payments

expense - - - - 25,224 - - - 25,224

Transfer of

expired

warrants - - - - (25,862) - - 25,862 -

At 31 March

2020 73,383 2,644,062 10,569,399 131,096 66,830 (21,407) 409,400 (10,982,418) 2,890,345

=============== ========== ========== =========== ========= ========= ========= ========== ============= ==========

Consolidated Statement of Cash Flows

for the six months to 31 March 2020

Six months Six months Twelve months

to 31 March to 31 March to 30 September

2020 2019 2019

Unaudited Unaudited Audited

GBP GBP GBP

------------------------------------------ ------------- ------------- -----------------

Operating activity

Total loss after tax excluding

interest received (278,934) (183,018) (831,741)

Depreciation charge 886 812 1,635

Shares issued in settlement of

outstanding wages 2,738 1,360 1,360

Share based payment charge 25,224 3,013 8,021

Impairment charge - deferred exploration

asset - - 442,917

(Increase)/decrease in receivables (13,779) 28,867 55,084

Increase/(decrease) in payables 18,820 (20,189) 5,523

Net cash outflow from operating

activity (245,045) (169,155) (317,201)

------------------------------------------ ------------- ------------- -----------------

Investing activity

Interest received 154 145 234

Exploration and development expenditures (43,513) (61,318) (121,967)

Disposal of other investments 57,052 - 40,883

Purchase of property, plant &

equipment (924) (162) (2,509)

Net cash (outflow)/inflow from

investing activity 12,769 (61,335) (83,359)

------------------------------------------ ------------- ------------- -----------------

Financing activity

Issue of share capital (net of

expenses) 587,050 230,000 230,000

Net cash inflow from financing

activity 587,050 230,000 230,000

------------------------------------------ ------------- ------------- -----------------

Net (decrease)/increase in cash

and cash

equivalents 354,774 (490) (170,560)

Cash and cash equivalents at start

of period 50,617 218,297 218,297

Exchange differences 2,416 (375) 2,880

Cash and cash equivalents at end

of period 407,807 217,432 50,617

========================================== ============= ============= =================

Notes to the Interim Statement

1. Basis of preparation

The consolidated interim financial information has been prepared

in accordance with the accounting policies that are expected to be

adopted in the Group's full financial statements for the year

ending 30 September 2020 which are not expected to be significantly

different to those set out in Note 1 of the Group's audited

financial statements for the year ended 30 September 2019. These

are based on the recognition and measurement principles of IFRS in

issue as adopted by the European Union (EU) or that are expected to

be adopted and effective at 30 September 2020. The implementation

of new standards and interpretations has not led to any changes in

the Group's accounting policies (other than presentation and

disclosure) or had any other material impact on its financial

position. The financial information has not been prepared (and is

not required to be prepared) in accordance with IAS 34. The

accounting policies have been applied consistently throughout the

Group for the purposes of preparation of this financial

information.

The financial information in this statement relating to the six

months ended 31 March 2020 and the six months ended 31 March 2019

has neither been audited nor reviewed by the Auditors, pursuant to

guidance issued by the Auditing Practices Board. The financial

information presented for the year ended 30 September 2019 does not

constitute the full statutory accounts for that period. The Annual

Report and Financial Statements for the year ended 30 September

2019 have been filed with the Registrar of Companies. The

Independent Auditor's Report on the Annual Report and Financial

Statement for the year ended 30 September 2019 was unqualified,

although it did draw attention to matters by way of emphasis in

relation to going concern, and did not contain a statement under

498(2) or 498(3) of the Companies Act 2006.

The directors prepare annual budgets and cash flow projections

for a 15 months' period. These projections include the proceeds of

future fundraising necessary within the period to meet the

Company's and Group's planned discretionary project expenditures

and to maintain the Company and Group as a going concern. Although

the Company has been successful in raising finance in the past,

there is no assurance that it will obtain adequate finance in the

future. There is also an, as yet unknown, impact that the COVID-19

pandemic may have on the capital markets. These factors represents

a material uncertainty related to events or conditions which may

cast significant doubt on the entity's ability to continue as a

going concern and, therefore, that it may be unable to realise its

assets and discharge its liabilities in the normal course of

business. However, the directors have a reasonable expectation that

they will secure additional funding when required to continue

meeting corporate overheads and exploration costs for the

foreseeable future and therefore believe that the going concern

basis is appropriate for the preparation of the financial

statements.

2. Loss per share

Loss per share has been calculated on the attributable loss for

the period and the weighted average number of shares in issue

during the period.

Six months Six months Twelve months

to 31 March to 31 March to 30 September

2020 2019 2019

Unaudited Unaudited Audited

---------------------------- ------------- ------------- -----------------

Loss for the period (GBP) (278,780) (182,873) (831,507)

Weighted average shares

in issue (No.) 513,084,724 389,173,054 416,198,199

Basic and diluted loss per

share (pence) (0.05) (0.05) (0.19)

============================ ============= ============= =================

The loss attributable to ordinary shareholders and the weighted

average number of ordinary shares used for the purpose of

calculating diluted earnings per share are identical to those used

to calculate the basic earnings per ordinary share. This is because

the exercise of share warrants would have the effect of reducing

the loss per ordinary share and is therefore not dilutive under the

terms of IAS33.

3. Share capital

During the six months to 31 March 2020 the following share

issues took place:

An issue of 18,000,000 0.01p Ordinary Shares, to Bergen as

collateral shares relating to the convertible securities issuance

deed (19 November 2019).

An issue of 17,000,000 0.01p Ordinary Shares, to Bergen for

settlement of commencement fee (19 November 2019).

An issue of 651,900 0.01p Ordinary Shares at 0.21p per share, to

a director, in satisfaction of

directors' fees, for a total consideration of GBP1,369 (2

December 2019).

An issue of 154,705,883 0.01p Ordinary Shares at 0.17p per

share, by exercise of conversion rights (Bergen convertible loan

note), for a total consideration of GBP263,000 before expenses (18

February 2020).

An issue of 100,000,000 0.01p Ordinary Shares at 0.275p per

share, by way of placing, for a total consideration of GBP275,000

before expenses (25 February 2020).

An issue of 402,644 0.01p Ordinary Shares at 0.34p per share, to

a director, in satisfaction of

directors' fees, for a total consideration of GBP1,369 (27

February 2020).

4. Event after the Balance Sheet date

On 2 April 2020, the Company announced entry into a share

subscription deed with Precious Metals Capital Group LLC ("PMCG"),

a US based institutional specialist investor. PMCG would be making

an investment of GBP600,000, by way of subscription for Company

shares. PMCG made the lump sum investment of GBP600,000 on the 7

April 2020.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR ALMTTMTBTBMM

(END) Dow Jones Newswires

May 29, 2020 08:15 ET (12:15 GMT)

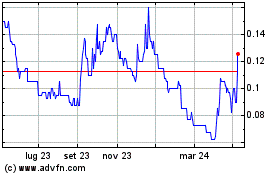

Grafico Azioni Tertiary Minerals (LSE:TYM)

Storico

Da Mar 2024 a Apr 2024

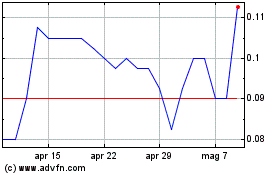

Grafico Azioni Tertiary Minerals (LSE:TYM)

Storico

Da Apr 2023 a Apr 2024