U.S. Dollar Lower On Recovery Hopes

02 Giugno 2020 - 8:57AM

RTTF2

The U.S. dollar depreciated against its most major counterparts

in the European session on Tuesday, as investors pinned hopes on

economic recovery after easing of restrictions across the

globe.

Hopes for a global coronavirus recovery helped offset fears

about U.S.-China tensions and political unrest in the U.S.

Overnight data showed that U.S. manufacturing activity improved

in May after logging an 11-year low in the previous month.

Key economic reports due this week include ADP private payrolls

data, ISM non-manufacturing PMI and U.S. jobs data for May.

The greenback declined to 1.2573 against the pound, its lowest

level since May 1. If the greenback extends decline, 1.30 is

possibly seen as its next support level.

Data from the Nationwide Building Society showed that U.K. house

prices fell 1.7 percent month-on-month in May, in contrast to a 0.9

percent rise in April as the impact of the coronavirus pandemic

filtered through the property market.

This was the biggest fall since February 2009. Economists had

forecast a fall of 1 percent.

After rising to 1.1115 against the euro at 2:45 am ET, the

greenback fell to a 2-1/2-month low of 1.1188. On the downside,

1.15 is possibly seen as the next support level for the

greenback.

The greenback fell to more than a 2-month low of 0.9573 against

the franc, compared to Monday's closing value of 0.9609. Further

weakness in the currency may locate support around the 0.91

level.

Data from the Federal Statistical Office showed that

Switzerland's retail sales declined at a faster rate in April, amid

the Covid-19 outbreak.

Retail sales declined a working-day adjusted 19.9 percent

year-on-year in April, following a 5.8 percent fall in March.

The greenback weakened to more than a 4-month low of 0.6869

against the aussie, 2-1/2-month low of 0.6318 against the kiwi and

a 1-year low of 1.3493 against the loonie, off its early highs of

0.6775, 0.6263 and 1.3585, respectively. The greenback may

challenge support around 0.70 against the aussie, 0.64 against the

kiwi and 1.30 against the loonie, if it slides again.

In contrast, the greenback remained higher against the yen, with

the pair trading at 107.77. Next immediate resistance for the

greenback is likely seen around the 110.00 level.

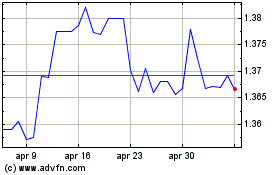

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

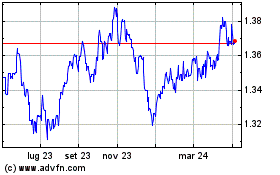

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024