U.S. Dollar Mixed After ADP Private Payrolls Data

03 Giugno 2020 - 11:51AM

RTTF2

The U.S. dollar showed mixed performance against its major

rivals in the European session on Wednesday, after a data showed

that the nation's private sector hiring declined much less than

forecast in May.

Data from payroll processor ADP showed that the pace of private

sector job losses slowed much more than anticipated in the month of

May.

ADP said private sector employment slumped by 2.76 million jobs

in May after plummeting by a revised 19.557 million jobs in

April.

Economists had expected employment to tumble by about 9.0

million jobs compared to 20.236 million job nosedive originally

reported for the previous month.

Investors await the release of the ISM non-manufacturing PMI and

factory orders at 10:00 am ET.

Weekly jobless claims data is due on Thursday, followed by

nonfarm payrolls report on Friday.

Risk sentiment improved after a survey from Caixin/IHS Markit

showed China's services sector purchasing managers' index jumped to

55.0 in May, the highest since October 2010.

Growing hopes for a global economic recovery after the easing of

lockdown restrictions also supported the market.

The currency showed mixed trading against its key counterparts

in the Asian session. While it dropped against the euro and the

pound, it rose against the yen. Versus the franc, it held

steady.

The greenback recovered to 1.2554 against the pound, from a low

of 1.2612 set in early deals, which was its lowest level since

April 30. The greenback is seen finding resistance around the 1.22

mark.

Data from IHS Markit showed that the UK service providers

reported a steep reduction in business activity in May due to a

fall in business and consumer spending amid the coronavirus, or

Covid-19, pandemic.

The final IHS Markit/Chartered Institute of Procurement &

Supply services Purchasing Managers' Index advanced to 29.0 in May

from 13.4 in the previous month. This was above the flash estimate

of 27.8.

The greenback was trading at 1.1207 against the euro, slightly

up from a 2-1/2-month low of 1.1228 logged at 3:15 am ET. The pair

had closed Tuesday's deals at 1.1169.

Survey results from IHS Markit showed that the euro area private

sector contracted sharply in May, but improved from April as

lockdown restrictions implemented to prevent the spread of

coronavirus loosened in many economies.

The final composite output index rose to 31.9 in May from

April's record low of 13.6. The score was above the flash reading

of 30.5.

The greenback remained higher at a 5-day high of 0.9648 versus

the franc. At Tuesday's close, the pair was valued at 0.9622. Next

key resistance for the greenback is likely seen around the 0.98

level.

After climbing to a 2-month high of 108.85 in the previous

session, the greenback wobbled versus the yen during the European

trading session. The pair was trading near Tuesday's closing value

of 108.66.

Looking ahead, at 10:00 am ET, the Bank of Canada announces

decision on interest rates. Economists forecast the benchmark rate

to remain at 0.25 percent.

In the New York session, U.S. ISM services PMI for May and

factory orders for April are set for release.

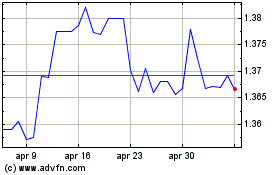

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

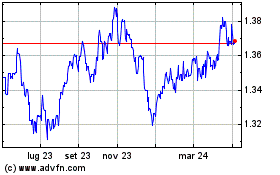

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024