Current Report Filing (8-k)

08 Giugno 2020 - 3:02PM

Edgar (US Regulatory)

ON SEMICONDUCTOR CORP false 0001097864 --12-31 0001097864 2020-06-07 2020-06-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

June 7, 2020

Date of Report (Date of earliest event reported)

ON Semiconductor Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-30419

|

|

36-3840979

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

ON Semiconductor Corporation

5005 E. McDowell Road

Phoenix, Arizona

|

|

85008

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(602) 244-6600

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

ON

|

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

The information set forth in Item 3.03 hereto is incorporated herein by reference.

|

Item 3.03.

|

Material Modifications to Rights of Security Holders.

|

On June 7, 2020, the Board of Directors (the “Board of Directors”) of ON Semiconductor Corporation (the “Company”) authorized and declared a dividend of one preferred share purchase right (a “Right”) for each outstanding share of common stock, par value $0.01 per share, of the Company (the “Common Stock”). The dividend is payable on June 18, 2020 (the “Record Date”), to the holders of record of shares of Common Stock as of 5:00 P.M., New York City time, on the Record Date. The description and terms of the Rights are set forth in a Rights Agreement, dated as of June 8, 2020 (as the same may be amended from time to time, the “Rights Agreement”), between the Company and Computershare Trust Company, N.A., as Rights Agent (the “Rights Agent”).

The following description of the terms of the Rights Agreement (which includes, as exhibits thereto the Form of Certificate of Designations, the Form of Rights Certificate and the Summary of Rights to Purchase Preferred Stock) does not purport to be complete and is qualified in its entirety by reference to the detailed terms and conditions set forth in the Rights Agreement, a copy of which is filed as Exhibit 4.1 hereto and incorporated herein by reference.

The Rights

The Rights will be issued in respect of all shares of Common Stock outstanding on the Record Date. The Rights will initially trade with, and will be inseparable from, the Common Stock, and the record holders of shares of Common Stock will be the record holders of the Rights. The Rights will be evidenced only by certificates (or, in the case of uncertificated shares, by notations in the book-entry account system of the transfer agent for the Common Stock) that represent shares of Common Stock. Rights will also be issued in respect of any shares of Common Stock that shall become outstanding after the Record Date and, subject to certain exceptions specified in the Rights Agreement, prior to the earlier of the Distribution Date (as defined below) and the Expiration Date (as defined below).

Exercise; Distribution Date; Transfer of Rights; Right Certificates

The Rights are not exercisable until the Distribution Date. After the Distribution Date and prior to the time any person or group of affiliated or associated persons becomes an Acquiring Person (as defined below), each Right will be exercisable to purchase from the Company one one-hundred-thousandth of a share (a “Unit”) of Series B Junior Participating Preferred Stock, par value $0.01 per share, of the Company (the “Preferred Stock”), at a purchase price of $100.80 per Unit (the “Purchase Price”), subject to adjustment as provided in the Rights Agreement. This portion of a share of Preferred Stock will give the stockholder approximately the same dividend, voting or liquidation rights as would one share of Common Stock. Prior to exercise or exchange, Rights holders in their capacity as such have no rights as a stockholder of the Company by virtue of holding Rights, including the right to vote and to receive dividends.

The “Distribution Date” is the earlier of (i) the tenth business day after the public announcement that a person or group of affiliated or associated persons has become an Acquiring Person or such earlier date, as determined by the Board of Directors, on which an Acquiring Person has become such, and (ii) such date (prior to such time as any person or group of affiliated or associated persons becomes an Acquiring Person), if any, as may be determined by the Board of Directors following the commencement of, or the first public announcement of an intention to commence, a tender offer or exchange offer the consummation of which would result in any person or group of affiliated or associated persons becoming an Acquiring Person. A person or group of affiliated or associated persons becomes an “Acquiring Person” upon acquiring beneficial ownership of 15% or more of the outstanding shares of Common Stock, except in certain situations specified in the Rights Agreement.

Certain synthetic interests in securities created by derivative positions – whether or not such interests are considered to be ownership of the underlying shares of Common Stock or are reportable for purposes of Regulation 13D of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) – are treated as beneficial ownership of the number of shares of Common Stock equivalent to the economic exposure created by the derivative security, to the extent actual underlying shares of Common Stock are directly or indirectly beneficially owned by the counterparty to such derivative security (or by a counterparty to such first counterparty, or any other successive counterparty). Swaps dealers unassociated with any control intent or intent to evade the purposes of the Rights Agreement are exempted from such imputed beneficial ownership.

Until the earliest of (i) the Distribution Date and (ii) the Expiration Date (as defined below), the Rights will be transferable only in connection with the transfer of the underlying Common Stock, and any transfer of shares of Common Stock will constitute a transfer of the associated Rights. After the Distribution Date, the Rights will separate from the Common Stock and, as soon as practicable after the Distribution Date, separate certificates evidencing the Rights (“Rights Certificates”) will be mailed to holders of

record of the Common Stock as of the close of business on the Distribution Date and such separate Rights Certificates alone will evidence the Rights.

Expiration Date

The Rights will expire on the earliest of (i) the close of business on June 7, 2021, (ii) the time at which the Rights are redeemed pursuant to the Rights Agreement, (iii) the closing of any merger or other acquisition transaction involving the Company that has been approved by the Board of Directors, at which time the Rights are terminated, and (iv) the time at which the Rights are exchanged pursuant to the Rights Agreement (such earliest date, the “Expiration Date”).

Consequences of a Person or Group Becoming an Acquiring Person

Flip-In Trigger. Subject to the Company’s exchange rights (as described below), if any person or group of affiliated or associated persons becomes an Acquiring Person, each holder of a Right (other than Rights beneficially owned by an Acquiring Person, affiliates and associates of an Acquiring Person and certain transferees thereof, which Rights will thereupon become null and void) will thereafter have the right to receive upon exercise of a Right that number of shares of Common Stock having a market value of two times the Purchase Price.

Flip-Over Trigger. If, after any person or group of affiliated or associated persons has become an Acquiring Person, the Company is acquired in a merger, consolidation or combination or 50% or more of its consolidated assets, cash flow or earning power are transferred, proper provisions will be made so that each holder of a Right (other than Rights beneficially owned by an Acquiring Person, affiliates and associates of an Acquiring Person and certain transferees thereof, which Rights will have become null and void) will thereafter have the right to receive upon the exercise of a Right that number of shares of common stock of the person (or its parent) with whom the Company has engaged in the foregoing transaction having a market value of two times the Purchase Price.

Exchange Feature. At any time after any person or group of affiliated or associated persons becomes an Acquiring Person and prior to the earlier of one of the events described in the previous paragraph or the acquisition by an Acquiring Person of 50% or more of the outstanding shares of Common Stock, the Board of Directors may exchange the Rights (other than Rights owned by an Acquiring Person, affiliates and associates of an Acquiring Person and certain transferees thereof, which Rights will have become null and void), in whole or in part, for shares of Common Stock or Units of Preferred Stock (“Exchange Securities”), at an exchange ratio of one Exchange Security per Right.

Redemption of the Rights

At any time before the close of business on the tenth business day after the public announcement that a person or group of affiliated or associated persons has become an Acquiring Person or such earlier date, as determined by the Board of Directors, on which an Acquiring Person has become such, the Board of Directors may redeem the then-outstanding Rights in whole, but not in part, for $0.0001 per Right (the “Redemption Price”). The Redemption Price is payable, at the option of the Company, in cash, Common Stock or such other form of consideration as the Board of Directors shall determine. Immediately upon any redemption of the Rights, the right to exercise the Rights will terminate and the only right of the holders of Rights will be to receive the Redemption Price. The Redemption Price will be subject to adjustment to appropriately reflect any stock split, stock dividend or similar transaction occurring after the date of the Rights Agreement.

If the Company receives a Qualifying Offer (as defined in the Rights Agreement) and the Company does not redeem the Rights, the Company may exempt such Qualifying Offer from the Rights Agreement, or call a special meeting of stockholders to vote on whether or not to exempt such Qualifying Offer from the Rights Agreement, in each case within 90 days of the commencement of the Qualifying Offer (within the meaning of Rule 14d-2(a) under the Exchange Act). In addition, the holders of record of 25% or more of the outstanding shares of Common Stock (excluding shares held by the person making the Qualifying Offer or by such person’s affiliates or associates) may submit a written demand to the Board of Directors (the “Special Meeting Demand”), not earlier than 90 days and not later than 120 days following the commencement of the Qualifying Offer (within the meaning of Rule 14d-2(a) under the Exchange Act), directing the Board of Directors to propose a resolution exempting the Qualifying Offer from the Rights Agreement to be voted upon at a special meeting to be convened within 120 days following the Board of Director’s receipt of the Special Meeting Demand (the “Special Meeting Period”). The Board of Directors must take the necessary actions to cause such resolution to be submitted to a vote of stockholders at a special meeting within the Special Meeting Period. The Board of Directors may recommend in favor of or against or take no position with respect to the adoption of such resolution, as it determines to be appropriate in the exercise of its fiduciary duties.

Amendment

For so long as the Rights are then redeemable, the Company may supplement and amend the Rights Agreement in any manner. After the Rights are no longer redeemable, the Company may supplement and amend the Rights Agreement in any manner that does not adversely affect the interests of holders of the Rights (other than an Acquiring Person, affiliates and associates of an Acquiring Person and certain transferees thereof).

Anti-Dilution Provisions

The Board of Directors may adjust the Purchase Price, the number of shares of Preferred Stock issuable and the number of outstanding Rights to prevent dilution that may occur from a stock dividend, a stock split, a reclassification of the Preferred Stock or Common Stock or certain other specified transactions. No adjustments to the Purchase Price of less than 1% are required to be made.

Description of the Preferred Stock

Each Unit of Preferred Stock, if issued:

|

|

•

|

Will not be redeemable.

|

|

|

•

|

Will entitle holders to quarterly dividend payments of $0.001 per Unit, or an amount equal to the dividend paid on one share of Common Stock, whichever is greater.

|

|

|

•

|

Will entitle holders upon liquidation either to receive $0.01 per Unit, or an amount equal to the payment made on one share of Common Stock, whichever is greater.

|

|

|

•

|

Will have the same voting power as one share of Common Stock.

|

|

|

•

|

If shares of Common Stock are exchanged as a result of a merger, consolidation, or a similar transaction, will entitle holders to a per share payment equal to the payment made on one share of Common Stock.

|

The value of one Unit of Preferred Stock should approximate the value of one share of Common Stock.

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

In connection with the adoption of the Rights Agreement, the Board of Directors approved a Certificate of Designations of the Series B Junior Participating Preferred Stock (the “Certificate of Designations”). The Certificate of Designations was filed with the Secretary of State of the State of Delaware on June 8, 2020. The Certificate of Designations sets forth the rights, powers and preferences of the Preferred Stock.

The foregoing description of the Certificate of Designations does not purport to be complete and is qualified in its entirety by the full text of such certificate filed as Exhibit 3.1 hereto and incorporated herein by reference.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On June 8, 2020, the Company issued a press release announcing the adoption of the Rights Agreement and the declaration of the dividend of the Rights. The press release is attached hereto as Exhibit 99.1 and incorporated herein in by reference.

The information furnished herewith pursuant to Item 7.01 of this Current Report, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section. The information in this Current Report shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this Current Report, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ON SEMICONDUCTOR CORPORATION

(Registrant)

|

|

|

|

|

|

|

|

|

|

Date: June 8, 2020

|

|

|

|

By:

|

|

/s/ Bernard Gutmann

|

|

|

|

|

|

|

|

Bernard Gutmann

|

|

|

|

|

|

|

|

Executive Vice President, Chief Financial

Officer, and Treasurer

|

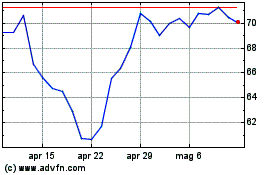

Grafico Azioni ON Semiconductor (NASDAQ:ON)

Storico

Da Mar 2024 a Apr 2024

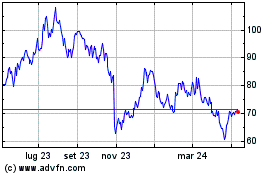

Grafico Azioni ON Semiconductor (NASDAQ:ON)

Storico

Da Apr 2023 a Apr 2024