TIDMTPX

RNS Number : 4622P

Panoply Holdings PLC (The)

10 June 2020

10 June 2020

The Panoply Holdings PLC

("The Panoply", or the "Group")

Acquisition of Arthurly

Advancing the Group 's technical capabilities

The Panoply Holdings PLC, the technology-enabled services group

focused on digital transformation, announces the acquisition of the

entire issued share capital of Arthurly Ltd. ("Arthurly") (the

"Acquisition").

Highlights

-- Acquisition of Arthurly , a technology services business with

particular strength in the Microsoft Technology Stack

-- Arthurly has won and delivered a number of projects alongside

Notbinary (a business within the Group) over the last six

months

-- Consideration of GBP412,000, of which GBP150,000 is to be

paid from existing cash resources and the remainder to be settled

by the allotment and issue of 365,853 shares in The Panoply

-- Acquisition is expected to be immediately margin and earning enhancing to Notbinary

Neal Gandhi, Chief Executive Officer of The Panoply, said:

"Arthurly have been working with Notbinary for several months to

support bids and to deliver on some of our most important public

sector clients. Bringing them into the group adds to our depth of

capabilities in hyperscale cloud projects, in particular giving us

greater strength on the Microsoft stack.

Like many smaller companies, Arthurly sees the opportunity to

maximise the value of their capabilities through being part of a

larger group. They are trusted by numerous large client

organisations to deliver smaller projects but have been unable to

secure larger contracts due to their size. By becoming a wholly

integrated part of Notbinary, we expect to see the team at Arthurly

being able to move up the value chain to fuel further growth .

Our clients continue to entrust us during a period of major

change and that in turn gives us the confidence to continue to

invest in our growth and complete this acquisition at this

time."

Background

Arthurly has been working in partnership with Notbinary, one of

the existing Group companies, over the last six months. Together

they have won and delivered a number of projects, including work

with The Department for Business, Energy and Industrial Strategy

(BEIS), UK Export Finance (UKEF), North East London Commissioning

Alliance (NELCA), North Bristol Health Trust (NBT), British Red

Cross (BRC), Camden Borough Council and a number of other data

intensive government agencies. Arthurly has been working alongside

Notbinary on these projects to provide design, development and

engineering services to The Panoply clients, building software and

data products, services and solutions on the large cloud vendor

platforms, Microsoft Azure, Google Cloud Platform (GCP) and Amazon

Web Services (AWS).

Arthurly is debt free, cash generative and has delivered circa

GBP300,000 (unaudited) of revenue in the last seven months from

external contracts not connected with The Panoply. For the year

ended 30 September 2019, Arthurly generated revenues of GBP189,308

(unaudited) and operating profit of GBP48,918 (unaudited). Had

Arthurly been part of the Group over the last six months, it would

have added GBP87,000 (unaudited) of margin improvement on Notbinary

contracts and is expected to be earnings enhancing with immediate

effect.

The Panoply is paying a purchase price of GBP 412,000 for the

Acquisition on a cash free debt free basis, to be satisfied through

the payment of GBP150,000 in cash and the issue of 365,853 shares

(the "Consideration Shares"). GBP100,000 worth of the shares are

subject to claw back in the event of underperformance in accordance

with the Group's acquisition formula. Further consideration may be

payable based on revenue generated for the 16 months to 30

September 2021. Any such additional consideration shall be

calculated following the agreement of the relevant revenue

calculations and publication of the Group's results relating to the

financial period ending on 30 September 2021 and shall be payable

by the allotment and issue of shares in The Panoply. The number of

such shares to be allotted and issued shall be calculated by

dividing the deferred consideration payable by a price per share in

The Panoply which is the greater of 82 pence and the

volume-weighted average mid-market price (VWAP) over the 30

business days prior to the relevant issue date. Any shares in The

Panoply which are allotted and issued as part of the deferred

consideration will be allotted and issued in 4 tranches at

six-month intervals.

All of the Consideration Shares and any further shares issued by

way of deferred consideration shall be subject to customary lock-in

and orderly market arrangements.

The maximum total consideration is capped at GBP1.5m.

I n addition to the above consideration the shareholders of

Arthurly will receive the available cash on Arthurly's balance

sheet at completion which is expected to be approximately

GBP195,000.

Following the completion of the Arthurly acquisition The Panoply

will operate 10 consulting businesses, providing clients with a

comprehensive digital transformational service offering. Circa 70%

of pro forma revenues will continue to come from public

services.

Stuart Arthur, CTO and Founder of Arthurly, said:

" There is excellent alignment of the core mission and values of

The Panoply and Arthurly, and through our well established

relationship with Notbinary, we have been able to provide solutions

to clients that drive change and have a positive impact.

"Becoming part of the Group is a natural progression for

Arthurly and will enable us to deliver on a much larger scale with

additional support to expand our growing client base. We are

excited to be part of something special and can't wait to get

started."

Admission and total voting rights

An application will be made for the admission of the

Consideration Shares to trading on AIM which is expected to take

place on or around 16 June 2020. Following this issue, the

Company's issued share capital will comprise 55,418,120 Ordinary

Shares and this is the total number of voting rights in the

Company. There are no shares held in treasury.

This figure may be used by shareholders as the denominator for

the calculation by which they may determine if they are required to

notify their interest in, or change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

Enquiries:

The Panoply Holdings

Neal Gandhi (CEO) Via Alma PR

Oliver Rigby (CFO)

Stifel Nicolaus Europe Limited +44 (0)207 710 7600

(Nomad and Broker)

Fred Walsh

Alex Price

Alma PR panoply@almapr.co.uk

(Financial PR) +44(0)203 405 0209

Susie Hudson

Josh Royston

Harriet Jackson

About The Panoply

The Panoply is a digitally native technology services company,

built to service clients' digital transformation needs. Founded in

2016, with the aim of identifying and acquiring best-of-breed

specialist information technology, design and innovation consulting

businesses across Europe, the Group collaborates with its clients

to deliver the technology outcomes they're looking for at the pace

that they expect and demand.

More information is available at www.thepanoply.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQSSFEEUESSEEM

(END) Dow Jones Newswires

June 10, 2020 02:00 ET (06:00 GMT)

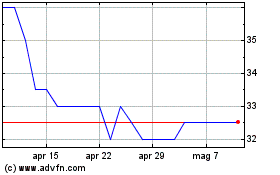

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Apr 2023 a Apr 2024