Schroder Real Estate Industrial Letting Progress

15 Giugno 2020 - 8:00AM

UK Regulatory

TIDMSREI

For release 15 June 2020

Schroder Real Estate Investment Trust Limited

("SREIT"/ the "Company" / "Group")

INDUSTRIAL LETTING PROGRESS

Schroder Real Estate Investment Trust, the actively managed UK-focused REIT,

provides an update on recent asset management activity across its industrial

portfolio.

Since the year end at 31 March 2020, eight lettings, renewals and reviews have

completed across the industrial portfolio with a total rent of GBP840,000 per

annum. This activity generated additional contracted rental income of GBP270,000

per annum compared with the position at the year end. This activity is

outlined below.

Leeds, Millshaw Industrial Estate (multi-let industrial estate)

* Lease renewal with Restore Plc for a new five year lease at a rent of GBP

250,000 per annum, or GBP4.84 per sq ft, compared with the previous rent of GBP

242,500. This represented a 3.1% increase.

* Rent review agreed with Camso UK Limited at a new rent of GBP19,800 per

annum, or GBP7.26 per sq ft, compared with the prior passing rent of GBP18,420.

This represented a 7.5% increase.

Norwich, Union Park (multi-let industrial estate)

* New lease completed with Quentor Ltd for a 10 year term at a rent of GBP

189,175 per annum, or GBP4.79 per sq ft. The unit was vacated by the

previous tenant in May 2020 who was paying GBP181,125 per annum. This

represented a 4.4% increase.

* Rent review agreed and simultaneous new six year lease completed with

ADI-Gardiner Limited resulting in a new rent of GBP18,500 per annum, or GBP5.51

per sq ft, compared with the prior passing rent of GBP17,000 or GBP5.06 per sq

ft. This represented a 8.8% increase.

Milton Keynes, Stacey Bushes (multi-let industrial estate)

* Lease renewal with My Warehouse Limited in Unit 28 with new five year lease

at a rent of GBP82,943 per annum, or GBP7.00 per sq ft, compared with the prior

passing rent of GBP53,321 or GBP4.50 per sq ft. This represented a 55.6%

increase.

* Lease renewal with Vacuum Technologies Limited for a new five year lease at

a rent of GBP15,380 per annum, or GBP10.00 per sq ft, compared with the prior

passing rent of GBP10,766 or GBP7.00 per sq ft. This represented a 42.9%

increase.

* Rent review agreed with The Warehouse (Milton Keynes) Limited resulting in

a new rent of GBP37,464 per annum, or GBP7.00 per sq ft, compared with the

prior passing rent of GBP34,788 or GBP6.50 per sq ft. This represented a 7.7%

increase.

Portsmouth, Walton Road (industrial)

* Rent review agreed with Codestorm Limited resulting in a new rent of GBP

225,000 per annum, or GBP8.36 per sq ft, compared with the prior passing rent

of GBP188,377. This represented a 19.4% increase.

Balance sheet

* The Company has a strong balance with a net loan to value ratio of 23.7% as

at 31 March 2020 and current cash of GBP86 million.

-ENDS-

For further information:

Schroder Real Estate Investment Management 020 7658 6000

Limited:

Duncan Owen / Nick Montgomery / Frank

Sanderson

Northern Trust: 01481 745529

Lisa Garnham

FTI Consulting: 020 3727 1000

Dido Laurimore / Richard Gotla / Meth

Tanyanyiwa

END

(END) Dow Jones Newswires

June 15, 2020 02:00 ET (06:00 GMT)

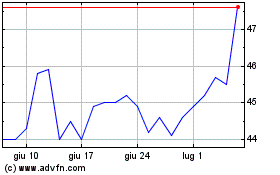

Grafico Azioni Schroder Real Estate Inv... (LSE:SREI)

Storico

Da Mar 2024 a Apr 2024

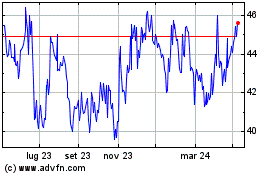

Grafico Azioni Schroder Real Estate Inv... (LSE:SREI)

Storico

Da Apr 2023 a Apr 2024