TIDMANIC

RNS Number : 4338Q

Agronomics Limited

19 June 2020

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. Upon the publication of

this announcement via a Regulatory Information Service, this inside

information is now considered to be in the public domain.

19 June 2020

Agronomics Limited

("Agronomics" or the "Company")

Shareholder Consultation regarding a De-Listing from AIM

Potential Tender Offer

The Board of Agronomics confirms today that, having carefully

reviewed different funding options, it has initiated a consultation

process with shareholders of the Company ("Shareholders") regarding

a possible de-listing of the Company from the AIM Market. The Board

believes the de-listing from AIM ("De-Listing") together with a

tender offer (together the "Proposals"), would be in the best

interests of the Company and Shareholders for the following

reasons:

a) the Directors believe that in current and foreseeable market

conditions, the Company, as an investor in early-stage pre-revenue

companies, does not expect to be able to secure the level of

funding on public equity markets required to pursue its investment

strategy to maximum effect;

b) the nature of the Company's investment policy means that the

majority of investee companies will continue to be

pre-revenue/loss-making companies which will need additional

capital from their Shareholders to realise their plans;

c) if the Company is unable to access significant amounts of

capital, it will not have the funds to participate in further

investment opportunities which are now available (both for new and

for follow-on investments within the existing portfolio) and may,

therefore, miss out on the potential returns to Shareholders from

its early-mover and market leading position;

d) the Directors believe that the Company, as a private company,

will be able to access substantial equity capital from investors

specialising in private market investment; and

e) the Board believes Shareholders will support the Proposals and the Board's conclusion that the implementation of the Proposals is the best way to preserve Shareholder value in what continue to be difficult markets.

Under AIM Rule 41 the De-Listing would be conditional on 75% of

Shareholders voting to support a resolution to delist. Prior to

convening any such general meeting, the Company has initiated a

14-day consultation process to establish the level of Shareholder

support for the Proposals (the "Shareholder Consultation").

Tender Offer

The Board believes that it is important, considering that

minority Shareholders may not either wish (or indeed be able) to

hold shares in a private company, that the Company makes a tender

offer (the "Tender Offer") to Shareholders to provide a partial or

full cash exit prior to any proposed cancellation of its AIM

listing. The intention is that the Tender Offer will be priced at

six pence (GBP0.06) per ordinary share (the "Tender Price"), with

the amount of cash available under the Tender Offer to be

determined following consultation with Shareholders.

To fund the Tender Offer, the Company intends to raise funds

from parties interested in supporting Agronomics as a private

company, and in this context has received a non-binding commitment

letter from Galloway Limited (a company beneficially owned by Mr

Jim Mellon) to invest up to GBP1.0 million (depending on levels of

third party participation) in an equity placing of up to GBP3.0

million, at a price per ordinary share of six pence (GBP0.06) (the

"Equity Placing") and up to GBP2.0 million in a nil-interest

convertible debt placing with a conversion price of six pence

(GBP0.06) (the "CLN Placing"). The Board anticipate that other

parties will also participate in the Equity Placing and/or the CLN

Placing such that the Company has sufficient funds with which to

execute the Tender Offer and, as such, the total cash resources

from which the Company could execute the Tender Offer are not

presently known.

The Equity Placing and the CLN Placing, and completion of the

Tender Offer, would be conditional on Shareholders approving the

De-Listing.

The Equity Placing price and CLN Placing conversion price is at

a premium to the current net asset value ("NAV") per share reported

by the Company as at 31 March 2020 of 5.53 pence and at a discount

to the mid-market price of the Company's shares on AIM as at close

of business on 18 June 2020 of 6.75 pence per share.

Shareholder Consultation

The Company's intention is to procure undertakings from certain

Shareholders not to accept the Tender Offer, and to consult with

other Shareholders on whether they wish to hold shares in

Agronomics as a private company, and on the proportion of their

shares that they would wish to sell under the Tender Offer. These

discussions will be used to assess Shareholder support for the

Proposals and, therefore, determine whether to proceed with the

De-Listing, and, if so, the size of the Tender Offer.

Following the Shareholder Consultation, if the Company does not

have sufficient Shareholder support for the requisite resolutions

relating to the Proposals to be passed at a general meeting, or is

unable to satisfy the anticipated demand for the Tender Offer such

that sufficient shareholder support for the Proposals can be

achieved, the Company will not proceed with the Proposals.

The Shareholder Consultation is expected to close on 3 July 2020

and the Company will make a further update regarding the Proposals

in the week commencing 6 July 2020.

Participation of Galloway Limited, beneficially owned by Mr Jim

Mellon, a Non-Executive Director of the Company and its largest

Shareholder (holding 65,142,909 ordinary shares representing

approximately 19.64 per cent. of issued shares) with Mr Denham Eke,

CFO of the Company and a Director of Galloway Limited, in the

Equity Placing and the CLN Placing would constitute a Related Party

Transaction under the AIM Rules and this will be considered by the

independent Directors at the appropriate time.

Richard Reed, Non-Executive Chairman, Agronomics Limited

commented:

"The Board believes a significant majority of shareholders will

support the Proposals. It is however aware that, if the Proposed

De-Listing goes ahead, it needs to consider the best interests of

all shareholders, which is why the tender offer is intended to

ensure minority shareholders who do not wish to remain as

shareholders in a private investment company would have an

opportunity to sell some or all of their shares. The announcement

today allows the Company to gauge the position of its shareholder

base so that, if it proceeds, the tender offer can be structured

accordingly."

For further information, please contact:

Agronomics Limited Beaumont Cornish Zeus Capital Limited Peterhouse Capital

Limited Limited

The Company Nomad Joint Broker Joint Broker

----------------- --------------------- -------------------

Richard Reed Roland Cornish Rupert Woolfenden Lucy Williams

Denham Eke James Biddle Jamie Peel

Daniel Harris

----------------- --------------------- -------------------

+44 (0) 207 628 +44 (0) 20 3829 +44 (0) 207 469

+44 (0) 1624 639396 3396 5000 0936

----------------- --------------------- -------------------

Important Notices

This announcement contains 'forward-looking statements'

concerning the Company that are subject to risks and uncertainties.

Generally, the words 'will', 'may', 'should', 'continue',

'believes', 'targets', 'plans', 'expects', 'aims', 'intends',

'anticipates' or similar expressions or negatives thereof identify

forward-looking statements. These forward-looking statements

involve risks and uncertainties that could cause actual results to

differ materially from those expressed in the forward-looking

statements. Many of these risks and uncertainties relate to factors

that are beyond the Company's ability to control or estimate

precisely. The Company cannot give any assurance that such

forward-looking statements will prove to have been correct. The

reader is cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

announcement. The Company does not undertake any obligation to

update or revise publicly any of the forward-looking statements set

out herein, whether as a result of new information, future events

or otherwise, except to the extent legally required.

Nothing contained herein shall be deemed to be a forecast,

projection or estimate of the future financial performance of the

Company or any other person.

The price of shares and the income from them may go down as well

as up and investors may not get back the full amount invested on

disposal of the shares. Past performance is no guide to future

performance and persons who require advice should consult an

independent financial adviser.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933,

except pursuant to an exemption from registration. No public

offering of securities is being made in the United States.

The distribution of this announcement may be restricted by law.

No action has been taken by the Company, Zeus Capital Limited,

Peterhouse Corporate Finance Limited or Beaumont Cornish Limited

that would permit distribution of this announcement or any other

offering or publicity material relating to such shares in any

jurisdiction where action for that purpose is required. Persons

into whose possession this announcement comes are required by the

Company, Zeus Capital Limited, Peterhouse Corporate Finance Limited

and Beaumont Cornish Limited to inform themselves about, and to

observe, any such restrictions.

This announcement is not for release, publication or

distribution, in whole or in part, directly or indirectly, in or

into Australia, Canada, Japan or the Republic of South Africa or

any jurisdiction into which the publication or distribution would

be unlawful. This announcement is for information purposes only and

does not constitute an offer to sell or issue or the solicitation

of an offer to buy or acquire shares in the capital of the Company

in the United States, Australia, Canada, the Republic of South

Africa or Japan or any jurisdiction in which such offer or

solicitation would be unlawful or require preparation of any

prospectus or other offer documentation or would be unlawful prior

to registration, exemption from registration or qualification under

the securities laws of any such jurisdiction.

This announcement has been issued by, and is the sole

responsibility of, the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by Zeus

Capital Limited, Peterhouse Corporate Finance Limited or Beaumont

Cornish Limited or by any of their respective affiliates or agents

as to or in relation to, the accuracy or completeness of this

announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

THE CONTENT OF THIS ANNOUNCEMENT HAS NOT BEEN APPROVED BY AN

AUTHORISED PERSON WITHIN THE MEANING OF THE FINANCIAL SERVICES AND

MARKETS ACT 2000. RELIANCE ON THIS ANNOUNCEMENT FOR THE PURPOSE OF

ENGAGING IN ANY INVESTMENT ACTIVITY MAY EXPOSE AN INDIVIDUAL TO A

SIGNIFICANT RISK OF LOSING ALL OF THE PROPERTY OR OTHER ASSETS

INVESTED.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGPUMPQUPUGMR

(END) Dow Jones Newswires

June 19, 2020 02:00 ET (06:00 GMT)

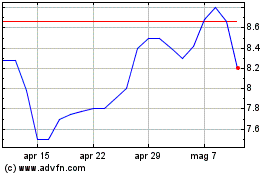

Grafico Azioni Agronomics (LSE:ANIC)

Storico

Da Mar 2024 a Apr 2024

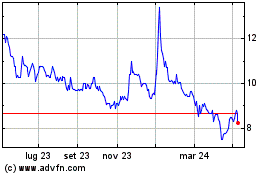

Grafico Azioni Agronomics (LSE:ANIC)

Storico

Da Apr 2023 a Apr 2024