TIDMSEQI

RNS Number : 0032R

Sequoia Economic Infra Inc Fd Ld

25 June 2020

SEQUOIA ECONOMIC INFRASTRUCTURE INCOME FUND LIMITED

(the "Company" or "SEQI")

2020 FINAL RESULTS

CONTINUED PORTFOLIO GROWTH AND PERFORMANCE - INCREASED DIVID

TARGET

SEQI, the specialist investor in economic infrastructure debt,

announces its results for the year ended 31 March 2020.

HIGHLIGHTS

-- Dividends totalling 6.1875p per ordinary share paid during

the year following increase in annual target dividend from 6.00p to

6.25p per ordinary share announced in May 2019

-- Diversified portfolio of 72 investments across 8 sectors, 29

sub-sectors and 13 mature jurisdictions

o 93% of investments in private debt

o 70% floating rate investments, capturing short-term rate

rises

o Short weighted average life of 5.3 years creating reinvestment

opportunities

o Weighted average equity cushion of 35%

-- In line with the Company's commitment to implementing an ESG

policy, the Investment Adviser signed up to the United Nations

Principles for Responsible Investment ("UNPRI")

-- Annualised portfolio yield-to-maturity of 12.0% as at 31 March 2020(1)

-- Ongoing charges ratio of 0.96%, down from 1.02% in the prior

year (calculated in accordance with AIC guidance)(1)

-- Three capital raises completed during the year, all of which

were significantly over-subscribed:

o June 2019 - gross proceeds of GBP216 million

o September 2019 - gross proceeds of GBP139 million

o March 2020 - gross proceeds of GBP300 million

Post-year-end

-- Comprehensive portfolio and balance sheet review undertaken

in light of exceptional market volatility and spread widening

arising from the COVID-19 pandemic and oil price collapse

-- Assessment of cash yields and reaffirmation of dividend cover

and target for the financial year ending 31 March 2021

-- Restriction on certain new investments and preservation of

balance sheet capacity to take advantage of difficult market

conditions and opportunities to invest in new loans on attractive

and accretive terms

-- Redirection of the Investment Adviser's resources from

origination to enhanced credit and portfolio monitoring

Financial Highlights to 31 March 31 March

2020 2019

Total net assets GBP1,599,865,271 GBP1,097,139,421

Net Asset Value ("NAV") per ordinary

share (1) * 96.69p 103.41p

Ordinary share price * 94.00p 113.00p

Ordinary share (discount)/premium

to NAV (1) (2.8)% 9.3%

----------------- -----------------

* Cum dividend

Robert Jennings, Chairman of the Company, said:

"SEQI made good progress throughout most of our last financial

year. At the start of it we announced an increased target dividend

of 6.25p per share, which we have gone on to fulfil, and through

the year we undertook three successful and beneficial capital

raises, each of which was significantly oversubscribed.

The turbulent conditions of global financial markets in March

2020 led to a notable reduction in the value of our assets at year

end. However, the combination of our strong balance sheet and the

generally predictable and stable cash flows from our

widely-diversified debt portfolio have allowed us to reaffirm our

target dividend at 6.25p per share for 2020/21.

The relative stability of economic infrastructure debt and our

Investment Adviser's specialist expertise make SEQI well placed to

deliver attractive risk-adjusted returns to Shareholders and to

take advantage of the substantial long-term investment

opportunities in the space."

1. See appendix for Alternative Performance Measures

("APMs")

For further information, please contact:

Sequoia Investment Management Company Limited

Steve Cook

Dolf Kohnhorst

Randall Sandstrom +44 (0)20 7079

Greg Taylor 0480

Jefferies International Limited

Neil Winward +44 (0)20 7029

Gaudi le Roux 8000

Tulchan Communications (Financial PR)

Martin Pengelley

Elizabeth Snow +44 (0)20 7353

Deborah Roney 4200

Praxis Fund Services Limited (Company Secretary)

Matt Falla

Katrina Rowe +44 (0) 1481 755530

About Sequoia Economic Infrastructure Income Fund Limited

The Company seeks to provide investors with regular, sustained,

long-term distributions and capital appreciation from a diversified

portfolio of senior and subordinated economic infrastructure debt

investments. The Company is advised by Sequoia Investment

Management Company Limited.

LEI: 2138006OW12FQHJ6PX91

COMPANY SUMMARY

Principal Activity

Sequoia Economic Infrastructure Income Fund Limited (the

"Company") invests in a diversified portfolio of senior and

subordinated economic infrastructure debt investments through its

subsidiary Sequoia IDF Asset Holdings S.A. (the "Subsidiary",

together the "Fund"). The Company controls the Subsidiary through a

holding of 100% of its shares.

Investment Objective

The Company's investment objective is to provide investors with

regular, sustained, long--term distributions and capital

appreciation from a diversified portfolio of senior and

subordinated economic infrastructure debt investments. This

objective is subject to the Fund having a sufficient level of

investment capital from time to time and the ability of the Fund to

invest its cash in suitable investments.

Investment Policy

The Company's principal investment policy is to invest in a

portfolio of loans, notes and bonds where all or substantially all

of the associated underlying revenues are from business activities

in the following market sectors: transport, transportation

equipment, utilities, power, renewable energy, accommodation and

telecommunications infrastructure. The revenues should derive from

certain eligible jurisdictions, as defined in the Company's

Prospectus. In addition, in excess of 50% of the portfolio should

be floating rate or inflation-linked debt, and not more than 5% by

value of the Fund's investments (at the time of investment) should

relate to any one individual infrastructure asset.

Environmental, Social and Governance ("ESG") Policy

The Company takes its corporate and social responsibilities

seriously. As part of its sustainability strategy, it has

established a number of appropriate ESG policies which it takes

into account at all stages of its investment process. The guiding

principles behind its ESG programme are the United Nations

Principles for Responsible Investment ("UNPRI"), to which the

Investment Adviser is a signatory.

Dividend Policy

In the absence of any significant restricting factors, the Board

expects to pay dividends totalling 6.25p per ordinary share per

annum (increased from 6p per ordinary share with effect from the

quarter ended 30 June 2019) for the foreseeable future. The Company

pays dividends on a quarterly basis.

At an Extraordinary General Meeting of the Company held on 25

February 2020, Shareholders approved the implementation of a scrip

dividend scheme. For further details, please see note 4 to the

Financial Statements.

CHAIRMAN'S STATEMENT

Dear Shareholder,

It is my pleasure to present to you the Annual Report and

Audited Financial Statements of the Company for the financial year

of operations ended 31 March 2020.

Unsurprisingly, the current focus is rightly on COVID-19 and our

actions to protect our investments and our stakeholders. We discuss

that in detail below, but first I want to report on the progress

achieved in the past year.

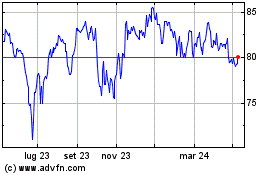

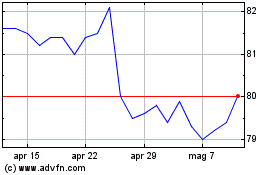

NAV and Share Price Performance

Over the first eleven months of the financial year, the

Company's NAV per share increased from 103.41p to 106.36p, after

paying dividends of 6.1875p, producing a NAV total return of

9.0%(2) , which was in excess of the Company's target return.

However, during the month of March, the COVID-19 pandemic induced a

sharp downturn in the financial markets generally, including the

sub-investment grade credit markets such as high yield bonds and

leveraged loans. The markets are used by the Company's independent

valuation agents as pricing benchmarks for private debt and,

primarily as a result of that, the Company's NAV per share(2) fell

materially in March 2020, by 9.67p.

The overall outcome for the year, therefore, was that the NAV

per share decreased from 103.41p to 96.69p, resulting in a NAV

total return of -0.9%(2) , once dividends are taken into

account.

Prior to the ongoing pandemic, the Company's shares had

consistently traded at a premium to NAV, averaging 8.5% over the

last year, but fell to a discount of 2.8% to NAV(2) on 31 March

2020. However, after year end the share price partly recovered, and

shares were again trading at a premium by the end of April

2020.

Portfolio Performance

For the six months prior to the current crisis, the Investment

Adviser had been steadily rebalancing the portfolio in favour of

more defensive sectors, such as telecommunications, utilities and

renewables power, bringing the percentage of the portfolio in

defensive sectors from 43% in September 2019 to 47% in March 2020.

The Investment Adviser was also favouring higher credit-quality

transactions, and taking much less construction risk than before,

with those assets falling from 15.7% to 11.7% of the portfolio over

the year. This caution helped to mitigate some of the consequences

of COVID-19. Consequently, and also because infrastructure debt is

one of the least volatile types of lending, the Company

outperformed the liquid credit markets during March 2020 - for

example, the Credit Suisse Leveraged Loan Index fell by 21% over

the month, approximately twice as much as the decline in our asset

values.

It is important to note that 79% of the decline in our asset

values during March 2020 was caused simply by yields increasing in

the benchmarks (such as leveraged loans) used for pricing purposes.

The Company's independent valuers determined that the yield on our

portfolio of loans needed to increase to reflect what was happening

in the wider markets, and this was achieved by reducing the

carrying value of our investments from an average of 97.6% of par

at the end of February 2020 to 88.9% at the end of March 2020.

Consequently, the cash yield on our portfolio rose from 6.9% to

7.5% and its yield to maturity rose from 8.3% to 12.0% over the

same period. These pricing adjustments do not affect the Company's

revenue prospects or its ability to pay a dividend. Moreover, they

are expected to be temporary in nature, in that the price of our

loans will gradually accrete up to par as they get closer to

maturity, or if yields on the pricing benchmarks decline. An

alternative way of thinking about this is that the Company's

portfolio is now much higher yielding than before, and this should

in itself lead to stronger NAV growth over time.

The remaining 21% of the decline in our asset values was caused

by the underperformance of three investments. This was mostly a

result of the brutal fall in the price of oil during March 2020.

These investments are discussed in more detail in the Investment

Adviser's report, but investors should note the outlook for two of

the three investments improved materially in the two months

following year end.

Response to COVID-19

We were fortunate that we entered the current crisis with a

robust balance sheet, primarily due to our most recent GBP300

million capital raise, which closed on 3 March 2020. The proceeds

of the capital raise enabled us to repay the majority of borrowings

under our RCF, after funding new loans in settlement.

The magnitude of the shock to global financial markets in

mid-March 2020 prompted the Board and Investment Adviser to agree a

two-week moratorium on all new loan commitments, to allow for a

more comprehensive review to take place. At the end of March 2020,

the Board, with support from our consultants Kate Thurman and Tim

Drayson, our Investment Adviser, Investment Manager, Broker and

other service providers, jointly considered the findings from the

review in a series of virtual meetings and concluded as

follows:

-- We should aim to deploy funds in new loans at a more measured

pace, focusing on stronger credits within our investment

universe;

-- We should allocate greater resources to the monitoring of all

loans in our portfolio and should be willing to enter into dialogue

with distressed borrowers at an early stage should circumstances

warrant such an approach;

-- We should retain our dividend target of 6.25p per annum for

2020/21 in the expectation that this should be fully covered (net

of expenses and interest costs) by the cash yield on our

portfolio;

-- Our scenario planning indicated that we should have no

difficulty in repaying drawings on our RCF in December 2021 given

the contractual receipts of interest and principal over the

relevant period. For the years ending 31 March 2021 and 31 March

2022, these are expected to give rise to, respectively,

approximately GBP68 million and GBP300 million of free cash after

paying all operating costs, interest on borrowings and our target

dividend;

-- We should retain capacity to fund opportunistic secondary

market activity if attractively priced opportunities emerge;

and

-- We should also retain some capacity to support our share

price should it slip to and remain at a significant discount to NAV

for a protracted period.

The operational response by all of the Company's critical

service providers has been similarly swift and so, on behalf of the

Company, I would like to thank each of them and their staff for the

excellent efforts they have made to adapt to remote working in the

difficult circumstances that the UK and Channel Islands have faced.

It is a tribute to everyone that the contingency plans that had

been made for such an eventuality have worked almost

faultlessly.

While we are proud of the way the team has come together in

response to this crisis, we recognise that the decline in NAV and

our share price is disappointing for shareholders. It may provide

shareholders some reassurance to know that, following the mark-down

of NAV at year end, in the subsequent two months the Portfolio has

been strong and we believe the Company is well-placed to enjoy

further NAV growth.

It is still early days, but we take encouragement from the way

that both our Portfolio and our team have performed over the last

three months. Debt markets have been aided by the actions taken by

Central Banks to provide liquidity, but we remain alert to the

possibility that solvency issues may become more pressing as the

robust steps taken to support businesses during the early period of

difficulty start to run off, potentially causing spreads to widen

again. We expect that the prudent measures that we have implemented

will help to mitigate the impact on the Company of more generalised

solvency problems across the economies in which we operate, while

simultaneously positioning the Company to benefit from more stable

economic circumstances that would be conducive to improved

Shareholder returns over the long term.

ESG 2020

The issue of climate change and carbonisation of the atmosphere

is one which has become a greater concern even over the relatively

short period since our IPO. It naturally affects our credit

assessment processes but, more importantly, it also changes the way

we believe our capital should be deployed. Accordingly, at the

beginning of 2019, our Investment Adviser signed up to the UNPRI

and has been implementing a comprehensive ESG programme ("ESG

2020") across the existing portfolio and all new investments.

In general, our investment portfolio has strong environmental

credentials, with a meaningful allocation to renewable energy and

related sectors such as electricity grid stabilisation and even

highly specialised ships needed for the maintenance of offshore

windfarms. I am pleased to report that the Investment Adviser has

achieved all of the goals set by the Company in relation to the

adoption and implementation of a comprehensive ESG programme,

including a retroactive scoring of the current portfolio and

regular ESG reporting to the Board. The Company's ESG 2020

programme is described more fully in the Investment Adviser's

report. Importantly, this includes adding four positions to a

'run-off portfolio', consisting of legacy investments that have low

ESG scores. As at the date of this report, one of these loans has

already been sold; the others will also be sold, if an acceptable

price can be secured; if not, the Company will not participate in

their refinancing.

Closing

I would like to close this year's letter by thanking my fellow

Board members, the Investment Adviser, Investment Manager, our

Brokers, our Independent Advisers, and all other critical service

providers that have adapted extremely well to an unprecedented

period of disruption. I am also pleased with the way the team has

grown together over the last five years, which gives the Board

confidence that the Company will, over the long-term, continue to

deliver an attractive risk-adjusted return with a relatively low

correlation to the broader financial markets.

Thank you for your commitment and support.

Robert Jennings

Chairman

24 June 2020

2. See appendix for Alternative Performance Measures

("APMs")

INVESTMENT ADVISER'S REPORT

The Investment Adviser's Objectives for the Year

Over the course of the financial year ended 31 March 2020,

Sequoia Investment Management Company Limited ("Sequoia") has had a

number of objectives for the Company:

Goal Commentary

----------------------- --------------------------------------------------

Gross portfolio return The Company is fully invested with a portfolio

of 8-9% that yields in excess of 8%

----------------------- --------------------------------------------------

Growth in late cycle 47% of the portfolio is in defensive sectors(3)

strategies as at 31 March 2020.

----------------------- --------------------------------------------------

Capital growth to Gross proceeds of GBP654.8 million raised during

deliver economies the year across three over-subscribed capital

of scale and broader raises

benefits

----------------------- --------------------------------------------------

Timely and transparent Factsheet, commentary, and the full portfolio

investor reporting are provided monthly for full transparency

----------------------- --------------------------------------------------

Dividends of 6.25p We have delivered on our increased dividend

per share target with the declaration of a fourth dividend

of 1.5625p for the quarter ended 31 March 2020,

which was paid to Shareholders on 22 May 2020

----------------------- --------------------------------------------------

3. Accommodation, TMT, utilities, and renewables.

Capital Raised and Share Performance

The Company completed three capital raises during the financial

year ended 31 March 2020, all of which were very significantly

oversubscribed. Two partially pre-emptive offerings were completed

in June 2019 and February 2020, which raised gross proceeds of

GBP216 million and GBP300 million, respectively. A non-pre-emptive

placing of ordinary shares in September 2019 raised gross proceeds

of GBP138.75 million. In each case, the proceeds were used to repay

existing debt and acquire assets from the attractive pipeline of

investments, thereby mitigating cash drag.

As at 31 March 2020, the Company had 1,654,671,448 ordinary

shares in issue. The closing share price on that day was 94.0p per

share, implying a market capitalisation for the Company of

approximately GBP1.6 billion, compared to GBP1.2 billion a year

previously. At the date of signing of these Financial Statements,

the share price had recovered to 105.0p.

NAV Performance

Over the financial year, the Company's NAV decreased from

103.41p per share to 96.69p per share, driven by the following

factors:

Factor NAV

effect

Interest income on the Company's investments 9.71p

--------

Losses on foreign exchange movements, net of the effect of

hedging (0.67)p

--------

Negative market movements (9.17)p

--------

IFRS adjustment from mid-price at acquisition to bid price (0.59)p

--------

Operating costs (1.45)p

--------

Gains from issuing ordinary shares at a premium to NAV 1.64p

--------

Gross decrease in NAV (0.53)p

--------

Less: Dividends paid (6.19)p

--------

Net decrease in NAV after payments of dividends (6.72)p

--------

The year-end portfolio valuation was performed by PwC, who has

been the Company's independent Valuation Agent since April 2017.

PwC's role as valuation agent is to review the discount rates of

the private debt investments and to consider the credit quality and

sector of each, and then benchmark each one to appropriate public

investments or indices where applicable. The goal of this process

is to determine the fair value of the Company's assets on a monthly

basis, however the Company does not apply the IFRS 9 expected

credit losses model to its portfolio as, under IFRS 9, this

requirement applies only to financial assets measured at amortised

cost and not to assets valued at fair value.

March 2020 specifically saw a decline of 11.0p in asset

valuations, of which 79% was attributable to COVID-19-related

spread widening and the assumption of a higher discount rate to

calculate mark to market adjustments to valuations. This is

important to note because any subsequent reduction of the discount

rate will serve to increase the mark to market NAV and will over

time additionally result in a greater pull-to-par effect.

Although the general widening of spreads reduced the Company's

NAV as at 31 March 2020, it does not in itself affect the Company's

expectations at this time for receipt of interest and principal

payments.

In addition, the underlying performance of three of the

Company's investments has been adversely affected to varying

degrees by COVID-19 and the steep decline in the price of oil,

which accounts for a 1.54 pence reduction in the NAV per share when

marked to market. Updates on these investments are included later

on in this report.

Economic infrastructure as a diverse and highly cash-generative

asset class

It is worth taking a moment to provide important context to the

effect of COVID-19 on the Company's portfolio and on the economic

infrastructure debt asset class as a whole.

Economic infrastructure debt is a stable asset class typically

characterised by high barriers-to-entry and relatively stable

cashflows and includes sectors such as Transportation, Utilities,

Power, Telecommunications and Renewables. Economic infrastructure

is often supported by physical assets, long-term concessions or

licenses to operate infrastructure assets and these companies

frequently operate within a regulated framework. This is especially

true in the cases of the Utilities, Telecommunications and parts of

the Power sectors.

A characteristic common to economic infrastructure sectors is

that they earn their revenues from demand, usage or volume. This

means that the project's revenues are linked to its utilisation,

such as a toll road where revenues are dependent or partially

dependent upon traffic volumes. This is in contrast to social

infrastructure, such as schools and hospitals, which are often

compensated for the physical asset simply being available for

use.

To mitigate demand risk, economic infrastructure projects are

typically less highly geared than social infrastructure and have

higher equity buffers, more conservative credit ratios, stronger

loan covenants, and higher levels of asset backing for lenders.

Economic infrastructure also provides higher returns than social

infrastructure and is a much larger market.

These characteristics of economic infrastructure - stable

cashflows, high barriers-to-entry, physical assets, equity buffers

and lower gearing - all form the bedrock upon which the Company's

investment opportunities are based and analysed. This is not

expected to change, regardless of what is going on in the markets,

because these core features of economic infrastructure all

contribute to strong fundamentals that are critical for weathering

storms.

With that said, economic infrastructure debt is not immune to

market volatility and there are certain actions we have taken, some

of which were well before the COVID-19 crisis. These actions have

helped position the portfolio defensively for a potential downturn,

which we have discussed with many of you over the last year.

The market environment during the year

The Company operated in a largely benign environment in the

first eleven months of the year, during which time the NAV per

share grew by 3.25p after servicing the target dividend. However in

the last month of the Company's financial year, the liquid credit

markets especially experienced a historic widening of lending

margins and bond spreads in response to two extraordinary market

forces: the coronavirus pandemic and an oil supply glut resulting

from tensions between the US, Russia, and Saudi Arabia.

When compared to debt indices during the March COVID-19-related

sell-off, the fall in the Company's NAV compares relatively

favourably to non-infrastructure asset classes. For example, the

Credit Suisse Leveraged Loan Index fell approximately 21% on a

price basis in March 2020 yet has since rebounded by nearly

one-third of that amount as global volatility waned since the

middle of March 2020.

Diversified and cash-generative portfolio

The Company took advantage of the favourable market conditions

in 2019 to begin employing sensible late-cycle strategies. These

strategies included keeping a large portion of the portfolio in

defensive sectors, keeping a strong allocation in senior compared

to mezzanine debt, and maintaining the portfolio's credit quality

even as spreads tightened prior to March. We put these into place

over a year ago because we expected a slowdown in the economy, as

the business cycles in the US and the UK reached their 10th year in

the second half of 2019. It is important to note that we did not

chase yield as spreads tightened over the last few years. We did

not need to do this to maintain yield as infrastructure debt

remains an underinvested and uncrowded space.

-- We have 47% of the portfolio in defensive sectors. These

include Telecommunications, Accommodation, Utilities, and

Renewables which are viewed as defensive because they provide

essential services, often operate within a regulated framework and

have high barriers-to-entry.

-- Our Accommodation sector, which stands at 11%, is less

exposed to COVID-19 than one may expect, because we have no

exposure to the higher risk subsectors within Accommodation such as

old age care and acute hospitals.

-- We have 55% of the portfolio in senior and 45% in mezzanine

to position the portfolio better for a slow growth environment.

-- We have maintained the credit quality of the portfolio over

the last twelve months while still achieving our target yield. We

have a policy of not purchasing CCC quality names.

The Company's investment portfolio is diversified by borrower,

jurisdiction, sector and sub-sector, with strict investment limits

in place to ensure that this remains the case.

Geographically, the Company invests in stable low-risk

jurisdictions. Under the terms of its investment criteria, the

Company is limited to investment-grade countries, and has chosen to

pursue selected opportunities in Spain, but not in Portugal or

Italy, where in addition to the economic challenges, infrastructure

projects have also been exposed to regulatory and legal risks. The

Company has been focused on the United States, Canada, Australia,

the UK, and Northern and Western Europe.

The Company focuses predominantly on private debt, which on 31

March 2020 represented approximately 93% of its portfolio (compared

to 85% a year previously). This is because, typically, private debt

enjoys an illiquidity premium: i.e. a higher yield than a liquid

bond with otherwise similar characteristics. Since the Company's

main investment strategy is "buy and hold", it makes sense to

capture this illiquidity premium. Sequoia's research indicates that

infrastructure private debt instruments yield approximately 1%-3%

more than public rated bonds. However, in some cases, bonds can

also be an attractive investment for three reasons. Firstly, some

bonds are "private placements" which, whilst in bond format, have a

high yield that is comparable to loans. Secondly, some sectors,

such as US utility companies, predominantly borrow through the bond

markets, and therefore having an allocation to bonds can improve

the diversification of the portfolio. Thirdly, having some liquid

assets in the portfolio enables the Company to take advantage of

future opportunities and can also be used to cover potential calls

on its FX hedges in the event of an FX shock.

The portfolio's regular cash generation is another source of

liquidity to meet liabilities and reinvest in attractive economic

infrastructure debt opportunities. We estimate that the portfolio

will, over the next twelve months and twenty-four months

respectively, generate approximately GBP68 million (c. 4% of NAV)

and GBP300 million (c. 19% of NAV) of free cash based on expected

interest income and contractual repayments (excluding prepayments),

after payment of its operating expenses, interest on borrowings and

our target dividend to Shareholders. The portfolio's strong cash

generation arises from not only the investments' regular,

contractual and therefore predictable interest payments, but also

as a result of the portfolio's short duration, which means that

many of the loans in our portfolio mature over a short time frame.

This affords us considerable comfort that we would have sufficient

cash flow to meet our obligations to our advisers, banks and

Shareholders, even if credit markets were to deteriorate and to

turn illiquid for an extended period of time. Our status as a

closed-ended fund further protects us against unexpected redemption

pressure that from time to time afflicts other structures.

Credit monitoring

Across the range of sectors in which we invest, the outlook for

some is largely unaffected, though the situation remains fluid and

dependent on the length and severity of the economic impact of

continued COVID-19 lockdowns. These sectors include renewables,

data centres, mobile phone cell towers, smart metering, specialised

health care, US power, specialist shipping and residential

infrastructure. Some investments in other sectors, such as

transportation, transportation assets, and midstream oil & gas,

however, have greater exposure to COVID-19 and low oil prices and

will require close monitoring and communication with the borrowers.

Three investments within these sectors have been identified as

assets that will require enhanced monitoring going forward. The

effects of COVID-19 and low oil prices on these three investments

are described in more detail below:

1. US midstream

An investment in the senior and holdco subordinated loans of a

US midstream oil and gas business, based in the Permian basin. The

business also has relatively strong ESG credentials by capturing

gas that would normally be burned in the atmosphere as well as

providing safe disposal of contaminated water. The loans are equal

to 2.8% of the Company's gross asset value and approximately 81% of

the Company's exposure to this borrower is through senior secured

loans. This business is still in its ramp-up phase and capital

expenditure overruns and the fall in the oil price have left it

with short-term liquidity concerns. The Investment Adviser,

together with the other lenders to the business, have appointed

third-party consultants to advise on a range of scenarios which

could include a restructuring of the business. As a result, the

value of this loan has been marked down significantly.

2. Swedish refinery

A loan backed by a Swedish business that owns two oil

refineries, as well as some downstream assets, and which has made

considerable progress towards achieving EU targets for renewable

contents in transportation fuels by 2030. This loan is equal to

2.3% of the Company's gross asset value. The business suffered a

liquidity shock when the decline in the price of oil reduced the

amount of inventory financing it could draw, coupled with margin

calls on its commodity hedging book. However, post-year-end events

have materially improved its situation and the Investment Adviser

expects that the loan will continue to be serviced.

3. German CHP Plant and logistics business

A loan backed by a German Combined Heat and Power plant that

provides heat (in the form of steam) to industrial companies in the

automotive components sector, as well as selling electricity to the

grid. This loan is approximately 1.5% of the Company's gross asset

value. Due to the COVID-19 pandemic the German automotive industry

has almost completely shut down and the key users of power from the

plant are operating at minimum utilisation rates. The Investment

Adviser is closely following the situation and maintains frequent

contact with management and shareholders. It is possible that the

key off-takers will be eligible for German government support, and

in addition, the German government is considering a car scrappage

scheme, which will be positive for the automotive sector.

Origination activities

The Company's strategy is to invest in both the primary and

secondary debt markets. Sequoia believes that this combination

delivers a number of benefits: participating in the primary markets

allows the Company to generate upfront lending fees and to

structure investments to meet its own requirements; and buying

investments in the secondary markets can permit the rapid

deployment of capital into seasoned assets with a proven track

record. As the Company grows in size, Sequoia expects to source an

increasing number of opportunities from the primary market.

Primary market origination

The primary loan markets are the predominant source of

investment opportunities for the Company. The Investment Adviser

has sourced bilateral loans and participated in "club" deals, where

a small number of lenders join together. The Company has also

participated in more widely syndicated infrastructure loans.

Primary market loans often have favourable economics because the

Company, as lender, benefits from upfront lending fees. As the

Company has grown, primary market investment activity has grown to

surpass secondary market investments, with 79% of the portfolio

comprising primary investments as at 31 March 2020.

Secondary market origination

Some of the Company's investments continue to be acquired from

banks or other lenders in the secondary markets. This enables a

relatively rapid deployment of capital, since primary market

transactions in infrastructure debt can often take a considerable

time to execute. In addition, secondary market loans have

performance history that permits credit analysis on actual results

rather than financial forecasts. Research(4) shows that

infrastructure loans improve in credit quality over time so

secondary loans in many cases have improved in credit quality from

the time of their initial origination.

In the current environment, there is the possibility that a

number of high quality economic infrastructure investments will

appear on the secondary market at attractive prices. As the Company

slowly ramps up deployment of its cash as the market improves,

these opportunities could be a significant source of alpha for the

Company without sacrificing credit quality.

4. Average annual European broad infrastructure and global

project finance default rates. Moody's, "Default and Recovery Rates

for Project Finance Bank Loans 1983-2018," March 2020

Strengthening the team at Sequoia Investment Management

Company

As the Company embarks on its sixth year of operations, a number

of initiatives have been taken by the Investment Adviser to ensure

there are ample resources to devote to all monitoring and new

origination activities.

During 2019, the Investment Adviser has recognised the need for

a senior employee with deep infrastructure experience to lead

Sequoia's risk functions. As a result, Sequoia has appointed Anurag

Gupta as Chief Risk Officer; he comes from KPMG, where he was a

Partner and Global Sector Head of Power in their global

infrastructure advisory practice. The depth of Anurag's strong

infrastructure experience is a valuable asset to Sequoia as the

risks of new and existing investments are evaluated and

monitored.

To support the enhanced monitoring during the ongoing COVID-19

pandemic as well as the deployment of capital into the Company's

pipeline of investments, the Investment Adviser has recently hired

one new analyst and is currently interviewing for a further new

analyst position. These analysts will augment the support available

for the Vice-Presidents and Associates as they continue to enhance

the review of all existing investments as well as exploring new

opportunities. A former 2019 intern will also join as a full-time

analyst this summer. The total headcount with these three

additional analysts will be eighteen, of which seventeen are

investment professionals.

Strong pipeline of opportunities

Sequoia continues to monitor the global effects of the COVID-19

pandemic as well as the primary and secondary effects of

historically low oil prices. As the world slowly emerges from

lockdown, Sequoia believes the Company is particularly

well-positioned to continue deploying capital into its strong

pipeline of mostly private debt infrastructure lending

opportunities. Attractive secondary market opportunities will also

be targeted if the pricing is consistent with the Company

generating a gross return in excess of 8% per annum. If the market

continues to stay soft, this could potentially be an opportunity to

improve the average credit quality of the portfolio without

sacrificing yield.

In terms of the pipeline, Sequoia is especially excited about

potential investments in the renewables, accommodation and TMT

(Telecommunications, Media and Technology) sectors where the

current portfolio is arguably underweight. Lending opportunities

are often attractive and additional investments into these sectors

would be desirable. Investments in these sectors will also provide

additional stability should market conditions deteriorate as a

result of a lengthy recession, a second wave of COVID infections or

another policy-driven market downturn.

Fund performance

31 March 30 September

2020 2019 31 March 2019

Net asset

value per ordinary share 96.69p 105.30p 103.41p

------------------

GBP million 1,599.9 1,459.9 1,097.1

-------------------------- ---------------------- --------- --- ------------- --- ------------------

Invested percentage of net

portfolio asset value 95.8% 99.3% 103.8%

including investments

Total portfolio in settlement 101.2% 108.7% 112.9%

------------------ -------------------------- ---- --------- --- ------------- --- ------------------

Portfolio characteristics

31 March 30 September

2020 2019 31 March 2019

Number of investments 72 78 69

---------------------------------------------- ---- --------- --- ------------- --- ------------------

Single largest

investment

Average investment

size GBP million 56.5 60.4 56.4

----------------------------

percentage

of NAV 3.5% 4.1% 5.1%

GBP million 21.3 18.6 16.5

---------------------- ------------------------- --------- --- ------------- --- ------------------

by number

of invested

Sectors assets 8 8 8

Sub-sectors 29 30 26

Jurisdictions 13 13 13

---------------------------- --------- ------------- ------------------

Private debt percentage 93.1% 88.4% 85.1%

of invested

assets

Senior debt 55.0% 62.0% 64.3%

Floating rate 69.7% 72.0% 69.4%

Construction risk 11.7% 15.7% 16.2%

---------------------------- ---------------- --------- ------------- ------------------

Weighted-average

maturity years 6.6 5.7 5.8

Weighted-average

life years 5.3 4.2 4.4

Yield-to-maturity 12.0% 8.2% 8.6%

Modified duration 1.5 1.2 1.3

---------------------------- --------------------- --------- --- ------------- --- ------------------

In summary, the opportunity for the Company in economic

infrastructure debt remains as strong and the asset class continues

to be under-invested and attractive. It is particularly in times of

market stress that economic infrastructure exhibits itself as a

strong and resilient asset class, and Sequoia is therefore

optimistic about the prospects for growing the Company while

maintaining its track record of sourcing suitable low risk,

resilient investments and delivering to Shareholders a total return

of 7-8% per annum over the long term.

Sequoia Investment Management Company Limited

Investment Adviser

24 June 2020

ESG 2020 - SUMMARY

The Company has begun a comprehensive programme of establishing

and incorporating broad ESG considerations into its approach to

investment.

The Board and the Investment Adviser take their corporate and

social responsibilities seriously. The Company already has strong

ESG credentials. For example, it is invested in a number of

renewable energy assets, such as solar panels and wind turbines, as

well as specialist vessels used in the maintenance of offshore wind

turbines. It is also invested in assets necessary for the

transition to a lower-carbon world such as natural gas pipelines in

the United States, which are needed to reduce the amount of

coal-fired electricity generation. Other investments have societal

benefits such as the provision of healthcare or education.

The Board and Investment Adviser have therefore established a

number of appropriate policies to demonstrate to shareholders how

the Company takes into account the risks associated with climate

change when deploying its capital. The Board as a whole, led by the

Chairman, is responsible for overseeing the development and

implementation of the Company's sustainability strategy.

The guiding principles behind the ESG programme are the UNPRI,

to which the Investment Adviser is a signatory. These principles

now cover investments in private debt, and as such are highly

relevant to the Company's business.

From these high-level principles we have derived the following

set of internal guidelines that require consideration in respect of

each of our loans or prospective loans.

Guidelines Considerations

Alignment with community

goals * Health & safety of residents: pollution & noise

* Historical and cultural elements preservation and

project's visual impact

Commitment to sustainability

goals * Counterparties' commitment to sustainability,

including an adequate maintenance plan

* Other indicators of commitment to sustainability

Efficient use of resources

* Materials recycling, reduction of energy & water

consumption and limitation on use of landfills

* Alternative water sources usage and consumption of

renewable energy

Reduced environmental footprint

* Emissions of greenhouse gasses and air pollutants

* Usage of environmentally friendly and biodegradable

materials

* Use of farmland and natural buffer zones

Sustainable economic development

* Job creation and workforce skills development

* Support of local social and business community

================================= ================================================================

The Investment Adviser has incorporated these principles into

all stages of its investment process:

-- The origination of new investments will include enhanced

negative and positive screening.

-- Due diligence and credit analysis will include assessing

thoroughly the potential impact of climate change, enhanced

environmental impact and technical assessments, the borrower's

social and governance framework, and ESG questionnaires.

-- Loan documentation can include, where appropriate, ESG

considerations. For example, these could include enhanced reporting

by borrowers in relation to their environmental impact.

-- The Company's reporting to its shareholders will be expanded

to cover ESG. In particular, it will take account of the

recommendations of the Task Force on Climate-related Disclosures

(TFCD), including those recommendations specific to the banking

sector, and the Company aims to provide best-in-class

disclosure.

In parallel with this, the Investment Adviser has

retrospectively reviewed the Company's existing portfolio and

assessed whether it is currently holding investments which, had

these policies been in place at the time, would not have been made.

The Investment Adviser positively notes that there were minimal

"red flag" investments in the portfolio at the time of review, and

this is only expected to improve over time as the ESG policy is

more firmly embedded within the investment process. Two "red flag"

investments were sold as a result of this process, including a coal

export terminal and a UK motorway services provider.

Based on its preliminary review, the Investment Adviser does not

believe its ESG policies will materially change the investment

portfolio's yield or diversification, given the portfolio's

existing ESG credentials. There are currently no investments in oil

& gas exploration and production investments, military

infrastructure, tobacco, gambling or alcohol.

The Company therefore views its ESG 2020 initiative as building

upon solid foundations and being an evolution rather than a

revolution.

Applying ESG principles to SEQI

ESG principles are applied in three ways to the SEQI

portfolio:

1. Negative screening

2. Thematic investing (positive screening)

3. ESG scoring

Negative screening

The following subsectors or asset types are excluded:

1. Military infrastructure, such as military housing.

2. Infrastructure related to the exploration and production of

oil and gas, such as oil rigs and platforms, fracking facilities

and facilities involved in tar sands. Note that midstream assets

such as pipelines are not necessarily excluded but are subject to

ESG scoring as set out below.

3. Infrastructure related to mining thermal coal.

4. Electricity generation from coal.

5. Alcohol, gambling, pornography and tobacco are already

excluded by SEQI's investment criteria.

Thematic investing (positive screening)

Currently, SEQI has three ESG investment themes. Positive

screening will be employed to increase the Fund's exposure to these

investment themes, subject to existing concentration limits.

1. Renewable energy, such as solar, wind and geothermal

generation, and directly related businesses including companies

that supply renewable energy.

2. Enabling the transition to a lower carbon world, such as grid

stabilization, electric vehicles, traffic congestion reduction and

the substitution of coal by gas.

3. Infrastructure with social benefits, such as healthcare, clean water and education.

As at 31 March 2020, thematic investing covers 55% of SEQI's

investment portfolio, split 15% renewable energy, 20% enabling the

transition to a lower carbon world and 20% infrastructure with

social benefits. The remaining 45% of the portfolio comprises

investments in the Transport, Transport Assets, Power, TMT and

Other sectors and is mostly ESG-neutral.

The following table shows example anonymised investments in each

theme:

Renewable energy Enabling the transition to a lower carbon world Infrastructure with social benefits

============================= ================================================ ====================================

US renewables business Spanish CCGT US telecom towers

US hydro power US midstream UK specialist care

UK flexible generation German toll road UK student housing

Nordic offshore wind repair German CCGT Dutch student housing

US solar panel business US midstream Irish student housing

UK electricity supplier US electricity generation US education

Spanish solar portfolios US pipelines

Nordic specialist shipping

US electric vehicles

============================= ================================================ ====================================

ESG scoring

Some infrastructure assets (for example, the electricity grid)

are neither excluded through negative screening nor positively

selected through thematic investing; therefore, it is necessary to

have a methodology to assess the ESG profile of these projects.

The Company's ESG scoring methodology has been designed to be as

objective as possible. The score primarily reflects the current ESG

performance of the investment but also reflects, to a limited

extent, the "direction of travel". For example, a business that

currently significantly contributes to climate change will receive

some credit if it is investing meaningfully to reduce its

contribution.

Note that the ESG score is distinct to a credit rating. Some

elements of ESG scoring will directly affect a borrower's credit

rating (for example, weak corporate governance has a negative

contribution to credit quality) but nonetheless it is entirely

possible for a business with a weak ESG score to have a strong

credit profile, and vice versa.

To facilitate ESG scoring during the investment process, the

Investment Adviser's new Chief Risk Officer, Anurag Gupta, has been

working closely with the portfolio management team to design an ESG

scoring model that must be completed prior to bringing a new

investment to the Investment Committee. The intention also is to

provide the credit analysts with a guide for ESG considerations at

the earliest stages of due diligence. Implementing the ESG model at

the beginning of the deal lifecycle will flag assets with weaker

ESG credentials much earlier.

Finally, the ESG scoring methodology and model have been

calibrated such that renewable energy projects with the most robust

social and governance practices would receive a score of 100, and a

power plant that burns thermal coal with no redeeming social or

governance policies would receive a score of 0. Needless to say,

the power plant in this example would not make it past the

Investment Adviser's new business committee.

ESG score distributions as at 31 March 2020

The Annual Report includes a chart representing the Company's

portfolio as at 31 March 2020. This is the result of the Investment

Adviser's preliminary review over the past six months

retrospectively scoring portfolio investments. It should serve as a

baseline upon which the Investment Adviser aims to improve

throughout the coming year. Over time, the Investment Adviser

expects the distribution to shift significantly to the right as

investments with weaker credentials repay, and capital is

redeployed in investments with stronger ESG profiles. In order to

accelerate this process, four of the Company's lowest-scoring

investments have been added to a 'run-off portfolio'. These are a

coal-export terminal, a hydrocarbons and chemicals import-export

terminal, a petrol station business and an airport services company

(which has been sold since year end). In aggregate, these positions

represent 6.3% of the Company's NAV at year end. Being in the

run-off portfolio means that the Investment Adviser will actively

look to dispose of these loans and, if it is not possible to sell

them at an attractive price, the Company will not participate in

their refinancing.

Principal Risks and Uncertainties

The Board established a Risk Committee, which is responsible for

reviewing the Company's overall risks and monitoring the risk

control activity designed to mitigate these risks. The Risk

Committee has carried out a robust assessment of the principal

risks facing the Company, including those that would threaten the

Company's business model, future performance, solvency or

liquidity. The Board has appointed International Fund Management

Limited ("IFML" or the "Investment Manager") as the Alternative

Investment Fund Manager ("AIFM") to the Company. IFML is also

responsible for providing risk management services compliant with

that defined in the Alternative Investment Fund Managers Directive

("AIFMD") and as deemed appropriate by the Board.

Under the instruction of the Risk Committee, IFML is responsible

for the implementation of a risk management policy and ensuring

that appropriate risk mitigation processes are in place; for

monitoring risk exposure; preparing quarterly risk reports to the

Risk Committee; and otherwise reporting on an ad hoc basis to the

Board as necessary.

Since their appointment on 30 January 2018, Tim Drayson and Kate

Thurman, independent consultants to the Company, have provided

guidance to the Board on the overall approach to risk management

across the Company's portfolio. Part of their focus has been to

assist the Investment Manager in scrutinising certain of the

Investment Adviser's credit evaluations.

Anurag Gupta's appointment as Chief Risk Officer of the

Investment Adviser provides additional oversight and resource to

the Company's risk management function and the due diligence

process employed by the Investment Adviser.

The principal risks associated with the Company are as

follows:

Market risk

The value of the investments made and intended to be made by the

Company will change from time to time according to a variety of

factors. The performance of the underlying borrowers, expected and

unexpected movements in interest rates, exchange rates, inflation,

bond ratings and general market pricing of similar investments will

all impact the Company and its Net Asset Value.

Credit risk

Borrowers of loans or issuers of bonds in which the Fund has

invested may default on their obligations. Such default may

adversely affect the income received by the Company and the value

of the Company's assets.

Liquidity risk

Infrastructure debt investments in loan form are not likely to

be publicly traded or freely marketable, and debt investments in

bond form may have limited or no secondary market liquidity. Such

investments may consequently be difficult to value or sell and

therefore the price that is achievable for the investments might be

lower than their valuation.

Counterparty risk

Counterparty risk can arise through the Company's exposure to

particular counterparties for executing transactions and the risk

that counterparties cannot meet their contractual obligations.

Leverage risk

Leverage risk arises where the Company takes on additional risk

because of the leverage of exposures, along with the specific

potential for loss arising from a leverage counterparty being

granted a charge over assets. The Board monitors the level of

leverage on an ongoing basis as well as the credit ratings of any

counterparties.

Compliance & regulatory risk

Compliance and regulatory risk can arise where processes and

procedures are not followed correctly or where incorrect judgement

causes the Company to be unable to meet its objectives or

obligation, exposing the Company to the risk of loss, sanction or

action by Shareholders, counterparties or regulators. The

Investment Adviser and the Administrator monitor compliance with

regulatory requirements and the Administrator presents a report at

quarterly Board meetings.

Operational risk

This is the risk of loss resulting from inadequate or failed

internal processes, people and systems or from external events.

This can include, but is not limited to, internal/external fraud,

business disruption and system failures, data entry errors and

damage to physical assets.

Political and economic risk

The Risk Committee reviews risks as they relate to Brexit and

the impact of Brexit on the above risks.

Emerging risks

The Board is constantly alert to the identification of any

emerging risks, in discussion with the Investment Manager and the

Investment Adviser. The Board will then assess the likelihood and

impact of any such emerging risks, and will discuss and agree

appropriate strategies to mitigate and/or manage the identified

risks. Emerging risks are managed through discussion of their

likelihood and impact at each quarterly Board meeting. Should an

emerging risk be determined to have any potential impact on the

Company, appropriate mitigating measures and controls are

agreed.

The emergence of the COVID-19 pandemic, and its ongoing effects,

have presented a significant emerging risk to markets globally, and

prompt action was taken by the Board and its key advisers in March

2020 to assess in full the potential impact to the Company from the

resulting exceptional market volatility and widening of spreads.

The impact of the pandemic is discussed further in the report of

the Audit Committee.

A detailed review of the main financial risks faced by the

Company, and how they are managed or mitigated, is set out in note

5 to the Financial Statements.

Going Concern

The Company has been incorporated with an unlimited life. In

accordance with the Company's Articles of Incorporation, the

Directors were required to propose an ordinary resolution (the

"Continuation Resolution") on or before 3 September 2016 that the

Company continues as a registered closed-ended collective

investment scheme, and to propose further Continuation Resolutions

within every three years thereafter. The first Continuation

Resolution was passed by Shareholders at an Extraordinary General

Meeting of the Company on 25 May 2016, and the second on 16 August

2018 at the Company's Annual General Meeting ("AGM"). Should a

Continuation Resolution not be passed, the Directors are required,

within six months, to put forward proposals for the reconstruction

or reorganisation of the Company to the Shareholders for their

approval. These proposals may or may not involve winding up the

Company and, accordingly, failure to pass a Continuation Resolution

will not necessarily result in the winding up of the Company.

The Directors have considered the possibility that the next

Continuation Resolution, to be proposed at the 2021 AGM, may not be

passed by Shareholders, however they noted the overwhelming

majority vote in favour of the Continuation Resolutions passed in

May 2016 and August 2018, the consistently strong appetite for the

Company's investment proposition, evidenced by a number of

successful share issues, and that the Company's shares have, apart

from a period from late March to early April 2020, consistently

traded at a premium since launch.

The Directors have reviewed the Company's holdings in cash and

cash equivalents and investments, including a consideration of the

revaluation losses arising on certain investments as a result of

the COVID-19 pandemic. Partly as a result of the Company's large

capital raise in early March 2020, its balance sheet was

exceptionally strong when the consequences of COVID-19 impacted on

financial markets, with a very low level of gearing. Moreover, the

losses that were incurred at year end - which have already begun to

reverse, and should continue to do so as the investments mature and

their valuations accrete to par - were unrealised, and therefore

have no direct effect on the solvency of the business. The risk of

realised losses arising through loans defaulting is limited to a

few specific investments, representing a small proportion of the

Company's investment portfolio. The Directors also note that the

reductions in the valuation of investments as a result of COVID-19

have had no impact on the interest income cashflow of the Company

or its ability to pay its target dividend.

As a result of this review, the Directors have concluded that it

is appropriate to adopt the going concern basis in preparing the

Financial Statements as the Company, despite the effects of the

COVID-19 pandemic, has a strong balance sheet and adequate

financial resources to meet its liabilities as they fall due.

Viability Statement

The Directors have assessed the viability of the Company over a

five-year period to May 2025, taking account of the Company's

current position and the potential impact of the principal and

emerging risks outlined in this statement, including risks

associated with the current COVID-19 pandemic.

In making this statement, the Directors have considered the

resilience of the Company, taking into account its current

position, the principal and emerging risks facing the Company in

severe but reasonable scenarios and the effectiveness of any

mitigating actions. This assessment has considered the potential

impacts of these risks on the business model, future performance,

solvency and liquidity over the period.

The Directors have determined that the five year period to May

2025 is an appropriate period over which to provide its viability

statement as the average remaining life to maturity of the Fund's

portfolio of investments has historically generally fallen within

the range of 4 to 5 years. In making their assessment, the

Directors have taken into account the Company's NAV, net income,

cash flows, dividend cover, regulatory compliance, the anticipated

short- to medium-term effects of COVID-19 and other key financial

ratios over the period. These metrics are subject to sensitivity

analysis, which involves flexing a number of main assumptions

underlying the forecast. This analysis is carried out to evaluate

the potential impact of the Company's principal risks actually

occurring, primarily the following: severe changes in

macro-economic conditions, including a 20% Sterling FX shock, which

would trigger margin calls by the Company's FX counterparties;

inability to refinance leverage facilities; defaults of the two

largest investments, representing approximately 7% of the Fund's

portfolio, which would reduce the Company's annual interest income

by c. 6.8%; deterioration in underlying credit ratings; and

downgrading or illiquidity of loans. This analysis included

stress-testing to simulate the combined effects of the recession of

the early 2000s and the 2008 global financial crisis.

The viability model also includes projections for the continuing

deployment of capital into new target investments amounting to

approximately GBP478 million, whilst still supporting the Company's

target dividend and meeting its financial targets.

The Directors have also considered the possibility that a

Continuation Resolution, to be proposed at the 2021 AGM, may not be

passed by Shareholders. The Directors noted the overwhelming

majority vote in favour of the Continuation Proposals passed in May

2016 and August 2018 and the strong appetite for the Company's

investment proposition evidenced by the successful launch in March

2015, and a number of subsequent significantly over-subscribed Open

Offers and Placings, and therefore believe that the likelihood of

the Continuation Resolution failing is low. They also noted that

the rejection of a Continuation Proposal by Shareholders does not

necessarily oblige the Directors to wind up the Company.

Based on this assessment, the Directors have a reasonable

expectation that the Company will be able to continue in operation

and meet its liabilities as they fall due over the period to May

2025.

Management Arrangements

Investment Manager and Investment Adviser

The Directors are responsible for the determination of the

Company's investment policy and have overall responsibility for the

Company's activities. The Company has entered into an Investment

Management Agreement with the Investment Manager with effect from

28 January 2015. On the same date, the Investment Manager, with the

consent of the Company, entered into an Investment Advisory

Agreement with Sequoia Investment Management Company Limited (the

"Investment Adviser") to manage the assets of the Company in

accordance with the Company's investment policy. The Investment

Adviser is responsible for the day-to-day management of the

Company's portfolio and the provision of various other management

services to the Company, subject to the overriding supervision of

the Directors.

The Directors consider that the interests of Shareholders, as a

whole, are best served by the continued appointment of the

Investment Manager and the Investment Adviser to achieve the

Company's investment objectives.

Custody Arrangements

The Company's assets are held in custody by The Bank of New York

Mellon (the "Custodian") pursuant to a Custody Agreement dated 27

February 2015. A summary of the terms, including fees and notice of

termination period, is set out in note 10 to the Financial

Statements.

The Company's assets are registered in the name of the Custodian

within a separate account designation and may not be appropriated

by the Custodian for its own account.

The Board conducts an annual review of the custody arrangements

as part of its general internal control review and is pleased to

confirm that the Company's custody arrangements continue to operate

satisfactorily. The Board also monitors the credit rating of the

Custodian, to ensure the financial stability of the Custodian is

being maintained to acceptable levels. As at 31 March 2020, the

long-term credit rating of the Custodian as reported by Standard

and Poor's is AA- (2019: AA-), which is deemed to be an acceptable

level.

In January 2020 representatives of the Company undertook a due

diligence visit to the Custodian's offices in Ireland to meet a

number of personnel and review the performance of the Custodian.

Further details of the review are provided under the description of

the work of the Management Engagement Committee.

Administrator

Administration and Company Secretarial services are provided to

the Company by Praxis Fund Services Limited (the "Administrator").

The Administrator also assists the Company with AIFMD, Common

Reporting Standard and FATCA reporting.

A summary of the terms of appointment of the Investment Manager,

Investment Adviser, Custodian and Administrator, including details

of applicable fees and notice of termination periods, is set out in

note 10 to the Financial Statements.

GOVERNANCE

BOARD OF DIRECTORS

The Directors of Sequoia Economic Infrastructure Income Fund

Limited, all of whom are non-executive and independent, are as

follows:

Robert Jennings, CBE (Chairman)

Robert Jennings is a resident of the United Kingdom and

qualified as a Chartered Accountant in 1979. He has over 30 years'

experience in the infrastructure sector. Mr Jennings was a managing

director of UBS Investment Bank and was joint head of the Bank's

Infrastructure Group until 2007. He has twice acted as a special

senior adviser to HM Treasury; in 2001/02 during Railtrack's

administration and again in 2007/08 in relation to Crossrail.

Mr Jennings served as one of the Department for Transport

appointed non-executives on the Board of Crossrail, and was Chair

of Southern Water until February 2017. He was appointed to the

Board of 3i Infrastructure plc in a non-executive role with effect

from 1 February 2018, which is ongoing. In June 2019, he became one

of the founding directors of Chapter Zero, whose aim is to provide

non-executive directors and other parties a forum by which they can

conveniently access guidance on carbonisation, climate change and

the role of boards in responding to these challenges, having been a

member of its executive steering committee since November 2018.

Sandra Platts (Senior Independent Director)

Sandra Platts is a resident of Guernsey and holds a Masters in

Business Administration. Mrs Platts joined Kleinwort Benson (CI)

Ltd in 1986 and was appointed to the board in 1992. She undertook

the role of Chief Operating Officer for the Channel Islands

business and in 2000 for the Kleinwort Benson Private Bank Group -

UK and Channel Islands. In January 2007, she was appointed to the

position of Managing Director of the Guernsey Branch of Kleinwort

Benson and led strategic change programmes as part of her role as

Group Chief Operating Officer. Mrs Platts also held directorships

on the strategic holding board of the KB Group, as well as sitting

on the Bank, Trust Company and Operational Boards. She resigned

from these boards in 2010. Mrs Platts is a non--executive director

of NB Global Floating Rate Income Fund Limited and UK Commercial

Property REIT (both listed on the Main Market of the London Stock

Exchange) and Investec Bank (Channel Islands) Limited, plus a

number of other investment companies. She is a member of the

Institute of Directors.

Jan Pethick

Jan Pethick is a resident of the United Kingdom and has over 35

years' experience in the debt sector. Mr Pethick was Chair of

Merrill Lynch International Debt Capital Markets for 10 years, from

2000 to 2010. He had previously been Head of Global Debt

Origination at Dresdner Kleinwort Benson which had acquired the

credit research boutique, Luthy Baillie which he had co--founded in

1990. Prior to that, he worked for 12 years at Lehman Brothers

where he was a member of the Executive Management Committee in

Europe. Mr Pethick currently serves as Chair of Troy Asset

Management and was an independent member of the Supervisory Board

of Moody's Investor Services Europe.

Jonathan (Jon) Bridel

Jon Bridel is a resident of Guernsey. Mr Bridel is currently a

non--executive director of a number of London-listed investment

funds. Mr Bridel was previously Managing Director of Royal Bank of

Canada's investment businesses in the Channel Islands.

After qualifying as a Chartered Accountant in 1987, Mr Bridel

worked with Price Waterhouse Corporate Finance in London. He

subsequently held senior positions in banking, credit and corporate

finance, investment management and private international businesses

where he was Chief Financial Officer.

Mr Bridel holds a Master of Business Administration (Dunelm) and

also holds qualifications from the Institute of Chartered

Accountants in England and Wales, where he is a Fellow, the

Chartered Institute of Marketing, where he is a Chartered Marketer,

and the Australian Institute of Company Directors. He is also a

Chartered Director and Fellow of the Institute of Directors and is

a Chartered Fellow of the Chartered Institute for Securities and

Investment.

DISCLOSURE OF DIRECTORSHIPS IN PUBLIC COMPANIES LISTED ON

RECOGNISED STOCK EXCHANGES

The Directors hold the following directorships in other public

companies:

Company Name Stock Exchange

Robert Jennings, CBE

3i Infrastructure plc London Stock Exchange - Main Market

Sandra Platts

NB Global Floating Rate Income Fund Limited London Stock

Exchange - Main Market

UK Commercial Property REIT London Stock Exchange - Main

Market

Marble Point Loan Financing Limited London Stock Exchange -

SFS

Jan Pethick

None

Jon Bridel

DP Aircraft 1 Limited London Stock Exchange - SFS

Fair Oaks Income Limited London Stock Exchange - SFS

SME Credit Realisation Fund Limited (in wind-down) London Stock

Exchange - Main Market

Starwood European Real Estate Finance Limited

(until 31 December 2020) London Stock Exchange - Main Market

The Renewables Infrastructure Group Limited London Stock

Exchange - Main Market

THE SEQUOIA INVESTMENT MANAGEMENT COMPANY TEAM

Sequoia Investment Management Company Limited ("Sequoia") is an

experienced investment adviser, which has acted as Investment

Adviser to the Company from its inception. Sequoia's management

team and Investment Committee are as follows:

Randall Sandstrom, Director and CEO/CIO

28 years of experience in the international and domestic credit

markets and infrastructure debt markets.

Has managed global high yield and investment grade bonds,

leveraged loans, ABS and money market securities.

Board of Directors, LCF Rothschild and MD of Structured Finance.

Former CEO/CIO, Eiger Capital.

Head of Euro Credit Market Strategy, Morgan Stanley.

Institutional Investors "All-American" senior Industrial Credit

Analyst, CS First Boston (energy and transportation). Has worked in

London, New York and Tokyo.

Steve Cook, Director and Head of Portfolio Management

19 years of infrastructure experience.

European Head of Whole Business Securitisation and CMBS and

Co-Head of Infrastructure Finance at UBS.

Head of European Corporate Securitisation at Morgan Stanley with

lending and balance sheet responsibility.

Wide variety of infrastructure projects in the UK and across

Europe as a lender, arranger and adviser.

Dolf Kohnhorst, Director and Co-Head of Infrastructure Debt

36 years of experience in investment banking, debt capital

markets and project finance commercial lending.

Head of Société Générale's Financial Institutions Group covering