TIDMTRR

RNS Number : 2989R

Trident Resources Plc

29 June 2020

29 June 2020

Trident Resources Plc

US$5 million acquisition of a copper royalty over a significant

producing asset

Trident Resources Plc ("Trident" or the "Company", to be renamed

Trident Royalties Plc) (AIM: TRR), is pleased to announce that it

has entered into an agreement with Moxico Resources plc ("Moxico"),

to acquire a staged Gross Revenue Royalty ("GRR") over production

from the operating Mimbula copper mine and associated stockpiles

(the "Mimbula Mine") located in Zambia's prolific Copperbelt

Province. The GRR is being acquired in exchange for a cash

consideration of US$5.0 million (the "Transaction"). Trident is

entitled to royalty payments on production commencing from 1 July

2020 and extending in perpetuity.

HIGHLIGHTS

An attractive transaction structure, enhancing Trident's

portfolio

-- A highly accretive transaction on an immediately

cash-generative royalty over a long-life, low-cost producing asset

which is currently ramping-up production;

-- Structured as a GRR of 1.25%, decreasing to 0.3% upon

aggregate royalty payments of US$5.0 million being paid to Trident,

with a subsequent decrease to 0.2% once the royalty has been paid

on 575,000 tonnes of copper cathode or other finished copper

product sold; and

-- The GRR is subject to a Minimum Payment Schedule (as defined

below), which ensures that Trident will at minimum be repaid US$5

million within three years.

-- At current copper prices, Moxico's long-term production

profile is expected to exceed that required for the Minimum Payment

Schedule

A significant asset operated by an experienced counterparty

-- The asset is currently ramping-up production, having sold its

first London Metal Exchange registered Grade A copper with a 99.99%

purity in June 2020;

-- The Mimbula Mine has a large, well-defined JORC (2012)

compliant total Mineral Resource of 84 million tonnes of ore

grading 0.95% copper for a total of 798,000 tonnes of contained

copper at a 0.3% cut-off;

-- The GRR covers a large land package of 1,271 hectares, with

attractive exploration and growth potential; and

-- Moxico has a high-quality management team led by Alan Davies

(former Chief Executive of Rio Tinto's Minerals and Energy

division) with additional collective prior experience at Anglo

American, Anglo Gold Ashanti, and First Quantum.

A desirable commodity with sound growth fundamentals

-- Enhances Trident's royalty portfolio diversification by

adding exposure to a highly favourable commodity;

-- Copper is currently in a deficit position which is forecast

to widen in the near future; and

-- Zambia is a favourable mining jurisdiction as the 2(nd)

largest copper producer in Africa and 7(th) largest globally.

The Central African copperbelt is the world's largest and

highest-grade sediment-hosted copper district, with world class

mining operators in the region such as First Quantum, Glencore, Rio

Tinto, Barrick, Ivanhoe and China Non-Ferrous Metals. The Mimbula

Mine is an open pit operation located adjacent to the Konkola

Copper Mine complex. As an established mining district, Zambia

boasts excellent infrastructure, a skilled workforce, and suitable

legal framework for mining royalties.

Mimbula has JORC (2012) Measured and Indicated Resources of

69.8Mt grading 0.96% total copper ("TCu") for approximately 668,000

tonnes of contained copper and an Inferred Resources of 14.2 Mt

grading 0.92% TCu for approximately 130,000 as at August 2019. In

addition, the Company has a non-compliant Resource on the Zuka

licence of 7.3Mt grading 1.1% TCu for 80,400 tonnes of contained

copper. The Company has a strategic, life-of-mine tolling agreement

with Konkola Copper Mines ("KCM") in which the oxide ores are

currently being processed through the Nchanga Tailings Leach Plant

("TLP"), producing LME Grade A copper cathode.

Adam Davidson, Chief Executive Officer and Executive Director of

Trident commented:

"We are delighted to announce the acquisition of a cash

generative royalty over the Mimbula Mine, a long-life asset with

favourable production and cost profiles. The royalty will provide

our investors with exposure to an attractive commodity produced

from an asset located in a prolific region in the Zambian

Copperbelt, operated by an experienced management team.

"In addition, the royalty is structured attractively such that

Trident will rapidly recover its invested capital, while retaining

long-life exposure to the growth of the asset. We are very pleased

to have concluded transactions on two cash generative royalties

within a short time frame and I look forward to reporting further

on our progress as we continue to build a diversified portfolio of

mining royalties and streams."

The Transaction

The Gross Revenue Royalty is being acquired for a cash

consideration of US$5.0 million, payable immediately by Trident.

Moxico will utilise the proceeds of the Transaction to fund the

continued ramp-up of the Mimbula Mine, as well as for general

working capital purposes. Royalty payments to Trident will be made

on a quarterly basis.

The GRR rate will be 1.25%, decreasing to 0.3% upon US$5.0

million being paid on the royalty, with a subsequent decrease to

0.2% once the royalty has been paid on 575,000 tonnes of copper. In

addition, the GRR is subject to a Minimum Payment Schedule in which

the higher of the minimum amount, or the Gross Revenue Royalty

amount, are due; specifically:

-- No required minimum payments on production in 2020 (GRR rate still applies);

-- Minimum payments of US$375,000 per quarter in 2021;

-- Minimum payments of US$500,000 per quarter in 2022; and

-- Minimum payments of US$750,000 in each of the first two quarters of 2023.

If, in a given quarter during the Minimum Payment Schedule

period, Moxico makes GRR payments in excess of the quarterly

minimum amount, it may carry over the excess amount to any

subsequent quarter in which the GRR amount is less than the Minimum

Payment Schedule amount.

Mimbula Mine

The GRR is applicable to production from the Mimbula Mine,

comprising of 100% of production from licences 21816-HQ-LML

(Mimbula), 8440-HQ-SML (Zuka), and on 50% of the production from

licence 8514-HQ-SML (OB18). The licences collectively cover 1,271

ha.

Mimbula has a significant JORC (2012) Compliant Measured and

Indicated Resource of 69.8Mt grading 0.96% total copper ("TCu") for

668,000 tonnes of contained copper and an Inferred Resources of

14.2 Mt grading 0.92% TCu as at August 2019. In addition, the Zuka

licence has a non-compliant resource of 9.7Mt grading 1.14% TCu for

111,000 tonnes of contained copper. As the acquisition of 50% of

the OB18 stockpile was completed post- publication of the JORC

Resource, the below does not include OB18.

The Mimbula Mineral Resource Estimate as set out in the Mimbula

Project Phase 1 Feasibility Study Report (dated 31/01/2019) was

prepared by David H. Stock, Consulting Resource Geologist, in line

with the 2012 edition of The Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves ("JORC

(2012)"). Mr Stock is the Qualified Person responsible for the

Mineral Resource Estimate in compliance with the Canadian National

Instrument 43-101 (NI43-101) Standards of Disclosure for Mineral

Projects for a Definitive Feasibility Study.

Mimbula Resource Statement as of August 2019

Measured Indicated Inferred Total

Mt TCu% kt Mt TCu% kt Mt TCu% kt Mt TCu% kt

Cu Cu Cu Cu

--------- ----- ----- ----- ------ ----- ----- ------ ----- ----- ----

Mimbula 46.9 0.98 459.6 22.9 0.91 208.4 14.2 0.92 130.6 84 0.95 795

----- ----- ------ ----- ----- ------ ----- ----- ------ ----- ----- ----

Zuka 4.8 1.2 57.6 2.5 0.91 22.8 2.5 1.12 28.0 9.7 1.14 111

--------- ----- ----- ------ ----- ----- ------ ----- ----- ------ ----- ----- ----

Total 51.7 1.0 517.2 25.4 0.91 231.1 16.7 0.95 158.6 93.7 0.97 909

----- ----- ------ ----- ----- ------ ----- ----- ------ ----- ----- ----

Note: Cut-off at 0.3% Cu. Mimbula Resource is JORC (2012)

compliant, while Zuka Resource is non-compliant.

Mimbula Reserve Statement as of August 2019

Proven Probable Total

Mt TCu% Mt TCu% Mt TCu% kt Cu

--------- ----- ----- ----- ----- ----- -------

Mimbula 47.7 0.96 19.8 0.83 67.5 0.92 622.95

----- ----- ----- ----- ----- ----- -------

Note: Cut-off at 0.35% Cu.

The Resource is open on strike, indicating strong exploration

potential. In addition, <5% of the current Resource is

attributable to sulphide ore, indicating potential for extension at

depth. The Company has a strategic tolling agreement with KCM for

the life-of-mine in which oxides ores and stockpiles are being

processed through the TLP producing LME Grade A copper cathode.

Moxico has a highly experienced Board and management team led by

Alan Davies, who has assembled a strong team of proven mine

operators with significant experience in the Zambian

Copperbelt.

Competent Person's Statement

The technical information contained in this disclosure has been

read and approved by Mr Nick O'Reilly (MSc, DIC, MAusIMM, MIMMM,

FGS), who is a qualified geologist and acts as the Competent Person

under the AIM Rules - Note for Mining and Oil & Gas Companies.

Mr O'Reilly is a Principal consultant working for Mining Analyst

Consulting Ltd which has been retained by Trident to provide

technical support.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

** Ends **

Contact details:

Trident Resources Plc www.tridentroyalties.com

Adam Davidson +1 (757) 208-5171

Grant Thornton (Nominated Adviser) www.grantthornton.co.uk

Colin Aaronson / Richard Tonthat +44 020 7383 5100

/ Seamus Fricker

-------------------------

Tamesis Partners LLP (Financial www.tamesispartners.com

Adviser and Broker) +44 203 882 2868

Richard Greenfield

-------------------------

Yellow Jersey (Public Relations) www.yellowjerseypr.com

Charles Goodwin +44 203 004 9512

-------------------------

About Trident

Trident is a growth-focused diversified mining royalty and

streaming company, aiming to provide investors with exposure to a

mix of base and precious metals, bulk materials (excluding thermal

coal) and battery metals.

Key highlights of Trident's strategy include:

-- Constructing a royalty and streaming portfolio to broadly

mirror the commodity exposure of the global mining sector

(excluding thermal coal) with a bias towards production or

near-production assets, differentiating Trident from the majority

of peers which are exclusively, or heavily weighted, to precious

metals;

-- Acquiring royalties and streams in resource-friendly

jurisdictions worldwide, while most competitors have portfolios

focused on North and South America;

-- Targeting attractive small-to-mid size transactions which are

often ignored in a sector dominated by large players;

-- Active deal-sourcing which, in addition to writing new

royalties and streams, will focus on the acquisition of assets held

by natural sellers such as: closed-end funds, prospect generators,

junior and mid-tier miners holding royalties as non-core assets,

and counterparties seeking to monetise packages of royalties and

streams which are otherwise undervalued by the market;

-- Maintaining a low-overhead model which is capable of

supporting a larger scale business without a commensurate increase

in operating costs; and

-- Leveraging the experience of management, the board of

directors, and Trident's adviser team, all of whom have deep

industry connections and strong transactional experience across

multiple commodities and jurisdictions.

The acquisition and aggregation of individual royalties and

streams is expected to deliver strong returns for shareholders as

assets are acquired on terms reflective of single asset risk

compared with the lower risk profile of a diversified, larger scale

portfolio. Further value is expected to be delivered by the

introduction of conservative levels of leverage through debt. Once

scale has been achieved, strong cash generation is expected to

support an attractive dividend policy, providing investors with a

desirable mix of inflation protection, growth and income.

Forward-looking Statements

This news release contains forward -- looking information. The

statements are based on reasonable assumptions and expectations of

management and Trident provides no assurance that actual events

will meet management's expectations. In certain cases, forward --

looking information may be identified by such terms as

"anticipates", "believes", "could", "estimates", "expects", "may",

"shall", "will", or "would". Although Trident believes the

expectations expressed in such forward -- looking statements are

based on reasonable assumptions, such statements are not guarantees

of future performance and actual results or developments may differ

materially from those projected. Mining exploration and development

is an inherently risky business. In addition, factors that could

cause actual events to differ materially from the forward-looking

information stated herein include any factors which affect

decisions to pursue mineral exploration on the relevant property

and the ultimate exercise of option rights, which may include

changes in market conditions, changes in metal prices, general

economic and political conditions, environmental risks, and

community and non-governmental actions. Such factors will also

affect whether Trident will ultimately receive the benefits

anticipated pursuant to relevant agreements. This list is not

exhaustive of the factors that may affect any of the forward --

looking statements. These and other factors should be considered

carefully and readers should not place undue reliance on

forward-looking information.

Third Party Information

As a royalty and streaming company, Trident often has limited,

if any, access to non-public scientific and technical information

in respect of the properties underlying its portfolio of royalties

and investments, or such information is subject to confidentiality

provisions. As such, in preparing this announcement, the Company

often largely relies upon information provided by or the public

disclosures of the owners and operators of the properties

underlying its portfolio of royalties, as available at the date of

this announcement.

Glossary of Technical Terms

"cut-off grade" A "cut-off grade" is a fundamental component in

the preparation of Mineral Resources or Mineral

Reserves. It is defined as the grade or value that

is used to differentiate between ore and waste for

a given set of conditions, parameters and time frame.

As such, the criteria and processes by which a cut-off

grade or value are determined will often be different

between mineral properties, for different situations

within a given mining operation, and at different

times.

"grade" The proportion of a mineral within a rock or other

material. For copper mineralisation this is usually

reported as % of copper per tonne of rock (g/t).

"Indicated Resource" An 'Indicated Mineral Resource' is that part of

a Mineral Resource for which quantity, grade (or

quality), densities, shape and physical characteristics

are estimated with sufficient confidence to allow

the application of Modifying Factors in sufficient

detail to support mine planning and evaluation of

the economic viability of the deposit.

Geological evidence is derived from adequately detailed

and reliable exploration, sampling and testing gathered

through appropriate techniques from locations such

as outcrops, trenches, pits, workings and drill

holes, and is sufficient to assume geological and

grade (or quality) continuity between points of

observation where data and samples are gathered.

An Indicated Mineral Resource has a lower level

of confidence than that applying to a Measured Mineral

Resource and may only be converted to a Probable

Ore Reserve.

"Inferred Resource" An 'Inferred Mineral Resource' is that part of a

Mineral Resource for which quantity and grade (or

quality) are estimated on the basis of limited geological

evidence and sampling. Geological evidence is sufficient

to imply but not verify geological and grade (or

quality) continuity. It is based on exploration,

sampling and testing information gathered through

appropriate techniques from locations such as outcrops,

trenches, pits, workings and drill holes.

An Inferred Mineral Resource has a lower level of

confidence than that applying to an Indicated Mineral

Resource and must not be converted to an Ore Reserve.

It is reasonably expected that the majority of Inferred

Mineral Resources could be upgraded to Indicated

Mineral Resources with continued exploration.

"JORC" The Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves ('the

JORC Code') is a professional code of practice that

sets minimum standards for Public Reporting of minerals

Exploration Results, Mineral Resources and Ore Reserves.

The JORC Code provides a mandatory system for the

classification of minerals Exploration Results,

Mineral Resources and Ore Reserves according to

the levels of confidence in geological knowledge

and technical and economic considerations in Public

Reports.

"Measured Resource" A 'Measured Mineral Resource' is that part of a

Mineral Resource for which quantity, grade (or quality),

densities, shape, and physical characteristics are

estimated with confidence sufficient to allow the

application of Modifying Factors to support detailed

mine planning and final evaluation of the economic

viability of the deposit.

Geological evidence is derived from detailed and

reliable exploration, sampling and testing gathered

through appropriate techniques from locations such

as outcrops, trenches, pits, workings and drill

holes, and is sufficient to confirm geological and

grade (or quality) continuity between points of

observation where data and samples are gathered.

A Measured Mineral Resource has a higher level of

confidence than that applying to either an Indicated

Mineral Resource or an Inferred Mineral Resource.

It may be converted to a Proved Ore Reserve or under

certain circumstances to a Probable Ore Reserve.

"Mineral Reserve" A "Mineral Reserve" is the economically mineable

part of a Measured and/or Indicated Mineral Resource.

It includes diluting materials and allowances for

losses, which may occur when the material is mined

or extracted and is defined by studies at Pre-Feasibility

or Feasibility level as appropriate that include

application of Modifying Factors. Such studies demonstrate

that, at the time of reporting, extraction could

reasonably be justified.

The reference point at which Mineral Reserves are

defined, usually the point where the ore is delivered

to the processing plant, must be stated. It is important

that, in all situations where the reference point

is different, such as for a saleable product, a

clarifying statement is included to ensure that

the reader is fully informed as to what is being

reported.

"Mineral Resource" A "Mineral Resource" is a concentration or occurrence

of solid material of economic interest in or on

the Earth's crust in such form and quantity and

of such a grade or quality that it has reasonable

prospects for economic extraction. The location,

quantity, grade, geological characteristics and

continuity of a Mineral Resource are known, estimated

or interpreted from specific geological evidence

and knowledge.

"open pit mining" A method of extracting minerals from the earth by

excavating downwards from the surface such that

the ore is extracted in the open air (as opposed

to underground mining).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQKKFBKBBKBDAB

(END) Dow Jones Newswires

June 29, 2020 02:00 ET (06:00 GMT)

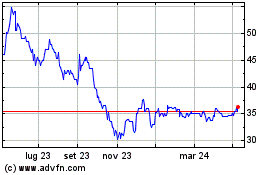

Grafico Azioni Trident Royalties (LSE:TRR)

Storico

Da Mar 2024 a Apr 2024

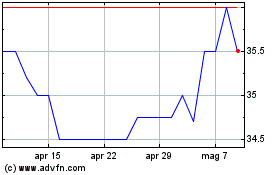

Grafico Azioni Trident Royalties (LSE:TRR)

Storico

Da Apr 2023 a Apr 2024