TIDMANIC

RNS Number : 7222R

Agronomics Limited

01 July 2020

1 July 2020

Agronomics Limited

("Agronomics" or the "Company")

Conclusion of consultation being to remain listed on AIM

Further to the announcement of the Company dated 19 June 2020,

the Board of Agronomics, having reviewed the shareholder feedback,

has agreed unanimously to retain the Company's AIM Market listing,

despite the short-term need for the Company to access capital to

support existing portfolio companies and take advantage of new

investment opportunities.

In particular, the results of its recent shareholder

consultation confirmed a majority of shareholders recognise:

a) the need to raise the required capital to fully realise the Company's business plan;

b) that access to capital is limited at this time (partly due to

the Covid-19 outbreak and also due to other factors); and

c) the need for the Company to access capital over the next 12

months to realise its ambitions and, to protect shareholder value

and deliver growth in the net asset value of the portfolio, the

Board must consider different forms of financing available to the

Company;

In addition, a number of shareholders want:

d) the Company to review alternative structures for the Company

to raise capital that would not result in the stock market listing

being lost or surrendered; and

e) to retain a shareholding in the Company providing that its

shares continue trading on AIM, and they would accordingly vote

against any proposal to de-list.

The Board is conscious that, as a consequence of the

consultation process, some shareholders, and/or potential new

investors, may believe that, despite this decision, the medium-term

ambition of the Board might be still to de-list the Company. To

reassure shareholders that this is not the case, the Board has

today provided Beaumont Cornish Limited (the Company's nominated

adviser) with an undertaking that it will not, other than due to

regulatory reasons beyond its control, or in the context of a

proposed takeover by an arm's length third party (in compliance

with the Takeover Code), seek to de-list the Company's shares for a

period of three years from the date of the undertaking.

Meanwhile, the Board will continue to negotiate with potential

funding partners for additional investment in the Company and/or

its subsidiaries. Whilst terms for any such investment have not

been agreed, and there can be no guarantee that such negotiations

will be successful, to further reassure shareholders, the Board

wishes to make clear that any proposal approved by the Board would

(i) be at an implied net asset value per share ("NAV") equal to or

not less than GBP0.06, being a 8.5% premium to the last published

NAV, and (ii) existing shareholders of the Company would have the

opportunity to participate on the same terms as any new

investment.

As noted by the Board in previous announcements, the Company is

fortunate to have the continued support of Jim Mellon, the largest

shareholder and a non-executive director of the Company, at a time

when funding is not easily available on terms that protect

shareholder value. As such, Galloway Limited, a company indirectly

wholly owned by Jim Mellon, has agreed to provide the Company with

a nil interest unsecured 6-month bridging facility of GBP1.9

million (the "Mellon Facility") on a draw-down basis at its

discretion. This will allow the Company, if required, to take

advantage of the potential opportunities it currently has (within

its existing portfolio and in relation to new investment

opportunities).

The Mellon Facility (via Galloway Limited, a company indirectly

wholly owned by Jim Mellon and of which Denham Eke is a director)

is a Related Party Transaction under the AIM Rules for Companies

and the Independent Directors (being Richard Reed, David Giampaolo

and Anderson Whamond) having consulted with Beaumont Cornish

Limited, the Company's nominated adviser, consider the terms of the

Mellon Facility to be fair and reasonable insofar as the Company's

shareholders are concerned.

Richard Reed, Non-Executive Chairman, Agronomics Limited

commented:

"The Board has listened to its shareholders. In particular,

smaller shareholders (who make up a significant minority of the

shareholder base) made clear that they did not want the AIM listing

to be lost, and would not want to retain a shareholding in a

private company, even if that private company had better prospects

of accessing private capital. The message received was that the

Board had to find a funding solution that retained the public

listing. This message has been heard loud and clear by your Board.

We have gone back to the drawing board and are reaching out to new

investors to find a funding solution that protects shareholder

value, retains liquidity (in the form of the stock market listing),

and allows the Company to grow the net asset value of its portfolio

on a per share basis.

The Company and shareholders are fortunate that while we take

these steps, we continue to have the support of Jim, who has agreed

to provide a nil interest loan facility to bridge the Company so it

can continue to invest and deliver on its business plan. Jim, like

the rest of the directors, believes strongly that the Company can

be a huge success, and deliver exceptional returns for shareholders

if it can access capital and take advantage of its early mover

status. That is the prize, for all shareholders, and that is what

the Board will continue working hard to deliver."

Details of the Mellon Facility

The Mellon Facility was agreed at the request of the Company and

the terms of the Mellon Facility were approved by the Company's

Independent Directors for the purposes of the transaction, being

Richard Reed, David Giampaolo and Anderson Whamond. The size of the

Mellon Facility meant that the transaction was a related party

transaction under the AIM Rules. A summary of the terms of the

Mellon Facility are set out below:

-- GBP1.9 million facility made available (no fees or set-off or contribution to costs)

-- D rawn down at the request of the Company (subject to agreed

use of proceeds with Galloway Limited)

-- 6-month availability and repayment term

-- Unsecured

-- Nil interest

-- Accelerated repayment if Company completes a debt or equity

fundraising realising gross proceeds of greater than GBP2

million

-- Standard events of default and warranties from both parties

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Agronomics Limited Beaumont Cornish Zeus Capital Peterhouse Capital

Limited

The Company Nomad Joint Broker Joint Broker

----------------- ------------------ -------------------

Richard Reed Roland Cornish Rupert Woolfenden Lucy Williams

Denham Eke James Biddle Jamie Peel

Daniel Harris

----------------- ------------------ -------------------

+44 (0) 207 628 +44 (0) 20 3829 +44 (0) 207 469

+44 (0) 1624 639396 3396 5000 0936

----------------- ------------------ -------------------

Important Notices

This announcement contains 'forward-looking statements'

concerning the Company that are subject to risks and uncertainties.

Generally, the words 'will', 'may', 'should', 'continue',

'believes', 'targets', 'plans', 'expects', 'aims', 'intends',

'anticipates' or similar expressions or negatives thereof identify

forward-looking statements. These forward-looking statements

involve risks and uncertainties that could cause actual results to

differ materially from those expressed in the forward-looking

statements. Many of these risks and uncertainties relate to factors

that are beyond the Company's ability to control or estimate

precisely. The Company cannot give any assurance that such

forward-looking statements will prove to have been correct. The

reader is cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

announcement. The Company does not undertake any obligation to

update or revise publicly any of the forward-looking statements set

out herein, whether as a result of new information, future events

or otherwise, except to the extent legally required.

Nothing contained herein shall be deemed to be a forecast,

projection or estimate of the future financial performance of the

Company or any other person.

The price of shares and the income from them may go down as well

as up and investors may not get back the full amount invested on

disposal of the shares. Past performance is no guide to future

performance and persons who require advice should consult an

independent financial adviser.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933,

except pursuant to an exemption from registration. No public

offering of securities is being made in the United States.

The distribution of this announcement may be restricted by law.

No action has been taken by the Company, Zeus Capital Limited,

Peterhouse Corporate Finance Limited or Beaumont Cornish Limited

that would permit distribution of this announcement or any other

offering or publicity material relating to such shares in any

jurisdiction where action for that purpose is required. Persons

into whose possession this announcement comes are required by the

Company, Zeus Capital Limited, Peterhouse Corporate Finance Limited

and Beaumont Cornish Limited to inform themselves about, and to

observe, any such restrictions.

This announcement is not for release, publication or

distribution, in whole or in part, directly or indirectly, in or

into Australia, Canada, Japan or the Republic of South Africa or

any jurisdiction into which the publication or distribution would

be unlawful. This announcement is for information purposes only and

does not constitute an offer to sell or issue or the solicitation

of an offer to buy or acquire shares in the capital of the Company

in the United States, Australia, Canada, the Republic of South

Africa or Japan or any jurisdiction in which such offer or

solicitation would be unlawful or require preparation of any

prospectus or other offer documentation or would be unlawful prior

to registration, exemption from registration or qualification under

the securities laws of any such jurisdiction.

This announcement has been issued by, and is the sole

responsibility of, the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by Zeus

Capital Limited, Peterhouse Corporate Finance Limited or Beaumont

Cornish Limited or by any of their respective affiliates or agents

as to or in relation to, the accuracy or completeness of this

announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

THE CONTENT OF THIS ANNOUNCEMENT HAS NOT BEEN APPROVED BY AN

AUTHORISED PERSON WITHIN THE MEANING OF THE FINANCIAL SERVICES AND

MARKETS ACT 2000. RELIANCE ON THIS ANNOUNCEMENT FOR THE PURPOSE OF

ENGAGING IN ANY INVESTMENT ACTIVITY MAY EXPOSE AN INDIVIDUAL TO A

SIGNIFICANT RISK OF LOSING ALL OF THE PROPERTY OR OTHER ASSETS

INVESTED.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCMZGGNGMGGGZM

(END) Dow Jones Newswires

July 01, 2020 07:00 ET (11:00 GMT)

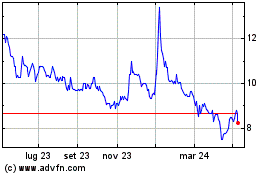

Grafico Azioni Agronomics (LSE:ANIC)

Storico

Da Mar 2024 a Apr 2024

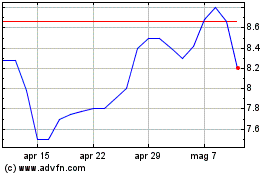

Grafico Azioni Agronomics (LSE:ANIC)

Storico

Da Apr 2023 a Apr 2024