Vodafone Warns Full UK Ban on Huawei Would Cost Billions of Pounds

09 Luglio 2020 - 3:31PM

Dow Jones News

--Vodafone warned a removal of Huawei equipment from its U.K.

networks would cost billions of pounds

--BT Group said costs on top of the GBP500 million hit it has

already disclosed would depend on the timing

--Huawei expects no short-term impact from U.S. restrictions on

its supply capability to the U.K.

By Adria Calatayud

Vodafone Group PLC warned Thursday that a full removal of Huawei

Technologies Co.'s equipment from its U.K. networks would imply

additional costs of low single-digit billions of pounds.

Andrea Dona, head of networks at Vodafone U.K., said a change in

the guidance on telecom-equipment suppliers given by the U.K.

government would delay the rollout of its 5G networks and force it

to book extra costs, as investments would need to refocus on the

removal of equipment already deployed.

"If the current guidance were to be tightened and further

restrictions were to be imposed, we would need to spend in the

order of billions to change our current infrastructure," Mr. Dona

said in a session of the U.K. parliament's science-and-technology

committee.

For rival BT Group PLC, the costs of a full ban on Huawei would

depend on the timing of its implementation, its Chief Technology

and Information Officer Howard Watson told British lawmakers.

BT earlier this year said it expected to take a 500

million-pound ($630.5 million) hit over five years as a result of

the government's restriction on Huawei equipment. If a full removal

is implemented, BT's extra costs would be in the tens-to-a-hundred

million pounds on top of the GBP500 million already disclosed,

because 4G equipment would need to be replaced anyway, Mr. Watson

said.

Victor Zhang, head of Huawei's U.K. operations, told British

lawmakers in the same session that recent U.S. restrictions imposed

on the company will have no immediate impact on its supply

capability to the U.K.

The U.K. government earlier this year allowed China's Huawei to

build parts of its 5G network, but limited its market share to 35%

and banned it from the core parts of the network. However, recent

media reports indicate British officials are leaning toward

advising wireless carriers to reduce or altogether drop Huawei.

Replacing telecom equipment is challenging and costly and a full

removal of Huawei gear would require at least five years, Mr.

Watson said.

"It is logistically impossible to get to zero in a three-year

period. That would literally mean blackouts for customers on 4G, 2G

as well as 5G throughout the country," Mr. Watson said.

The U.K. telecom uses equipment made by Huawei and Finland's

Nokia Corp. in its radio-access networks, with the Chinese company

representing a majority of BT's current 5G network and two-thirds

of its 2G and 4G network, Mr. Watson said. BT's core networks use

Huawei, which is being removed, and Swedish vendor Ericsson AB.

"We have tended to use Huawei in the more urban areas of the

U.K. and that is where we tended to launch 5G initially, so the

majority of our current 5G deployment is on the Huawei network,"

Mr. Watson said.

Vodafone is currently using equipment made by Huawei and

Ericsson in the 5G radio-access networks it is deploying in the

U.K., Mr. Dona said, who didn't give details on the split between

the two suppliers, citing commercial sensitivity. Huawei isn't part

of the core of Vodafone's 5G network, where the aggregation of data

occurs, he added.

A third of Vodafone's 2G, 3G and 4G radio-access networks use

Huawei equipment, and the remaining two thirds use gear made by

Ericsson, Mr. Dona said.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

July 09, 2020 09:16 ET (13:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

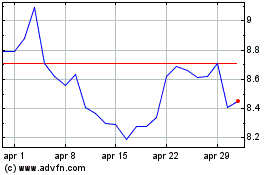

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Mar 2024 a Apr 2024

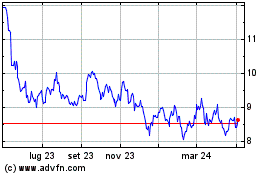

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Apr 2023 a Apr 2024