The Board of Directors of SARAS S.p.A. approves the Half-Year

Financial Report as at 30th June 20131

Milan, 9 August 2013: The Board of Directors of Saras S.p.A. met

yesterday under Chairman Gian Marco Moratti and th approved the

Half-Year Financial Report as at 30 June 2013. The results of the

second quarter, which are not subject to audit review, are also

presented here below for sake of continuity and completeness of the

information provided. After the meeting, the Chairman declared:

"This quarter was particularly dense of important events for the

Group. In June, Rosneft became a Shareholder of Saras, with 21% of

the share capital. The presence of such a prestigious Shareholder

strengthens the competitive positioning of our Company, and it is

an extremely satisfactory acknowledgment for the Group and for the

great commitment of all Saras' employees. Another relevant event

was the signature, on the 24 of June in Saint Petersburg, of an

agreement for the creation of a Joint Venture, on a parity basis

between Rosneft and Saras, aimed at conducting commercial and

marketing activities on crude oil and refined products. Both

companies believe strongly in this project, and are putting great

efforts into its implementation. Finally, on the 1 of July, the

Group completed the corporate reorganisation previously announced

to the markets, transferring all the refining activities held by

Saras to the subsidiary Sarlux. The transition was very successful

and perfectly on time, thanks to the expertise and dedication of

our employees."

st th

th

Saras Group key financial and operational results

EUR Million REVENUES EBITDA Comparable EBITDA EBIT Comparable EBIT

NET RESULT Adjusted NET RESULT NET FINANCIAL POSITION CAPEX

OPERATING CASH FLOW Q2/13 2,774 (26.1) 5.8 (307.2) (42.8) (199.5)

(46.3) (157) 30.9 65 Q2/12 2,672 (147.3) 33.6 (199.4) (18.5)

(131.8) (29.3) (82) 39.8 434 Change % 4% 82% -83% -54% -131% -51%

-58%

2

H1/2013 H1/2012 5,445 28.3 54.0 (301.2) (43.0) (201.3) (57.0) (157)

64.3 125 5,787 (35.4) 54.7 (138.2) (48.1) (117.7) (65.9) (82) 75.9

641

Change % -6% 180% -1% -118% 11% -71% 14%

Pursuant to the provisions of article 154 bis, paragraph 2, of the

Consolidated Finance Act, Mr. Corrado Costanzo, the Executive

Director responsible for the preparation of the company's financial

reporting, states that the financial information set out in this

press release corresponds to the company's documents, books and

accounting records. 2 In order to give a better representation of

the Group's operating performance, and in line with the standard

practice in the oil industry, the operating results (EBITDA and

EBIT) and the Net Result are provided also with an evaluation of

oil inventories based on the LIFO methodology (and not only

according to FIFO methodology, which is adopted in the Financial

Statements prepared according to IFRS accounting principles). The

LIFO methodology does not include revaluations and write downs and

it combines the most recent costs with the most recent revenues,

thus providing a clearer picture of current operating

profitability. Furthermore, for the same reason, non recurring

items and the change in "fair value" of the derivative instruments

are also deducted, both from the operating results and from the Net

Result. Operating results and Net Result calculated as above are

called respectively "comparable" and "adjusted", and they are not

subject to audit review, like the quarterly results.

1

Comments to First Half 2013 results

Group Revenues in H1/13 were EUR 5,445 ml, down 6% vs. H1/12. This

change is primarily due to the decrease in revenues generated by

the Refining and Marketing segments, because of the lower prices

for the refined oil products. In particular, the average price for

gasoline stood at 995 $/ton in H1/13 versus 1,037 $/ton in H1/12,

while diesel traded at an average price of 922 $/ton versus 972

$/ton in H1/12. Group reported EBITDA was EUR 28.3 ml in H1/13, up

180% versus EUR -35.4 ml in H1/12. The main difference is due to

the devaluation of the oil inventories. Indeed, although in both

semesters under comparison there was a reduction in oil prices and

a consequent devaluation of oil inventories, in H1/13 this effect

had a lower impact than in H1/12. However, it should be noted that

the reported EBITDA in H1/13 included a windfall gain of approx.

EUR 23.5 ml, due to the final accounting, made in Q2/13, of a

non-repayable grant related to a Regional Master Plan dated June

2002. Moreover, in H1/13 the reported EBITDA took a charge of

approx. EUR 25 ml, due to the effects of the IFRS equalization

procedure on the Power Generation results, which was entirely

accounted for in Q2/13. The results of this segment, indeed, were

reviewed according to a new calculation methodology applied to the

CIP6/92 tariff (which regulates the sale of electricity from the

Sarlux subsidiary to the National Grid Operator Gestore dei

Servizi Energetici S.p.A.), as required th by Legislative Decree

69/2013. Further details are provided in the Half-Year Financial

Report as at 30 June 2013. Group reported Net Result stood at EUR

-201.3 ml, down versus EUR -117.7 ml in H1/12, primarily because

the lower devaluation of the oil inventories, as explained at

EBITDA level, was more than offset by the devaluation of the

CIP6/92 contract, which took place in H1/13. Indeed, as established

by an independent appraisal, the revision of the CIP6/92 tariff

according to the new calculation methodology required by the

Legislative Decree 69/2013, determined a devaluation of approx. EUR

232 ml to the above mentioned contract, which was entirely

accounted for into Q2/13 results. Further th details also on this

process are given in the Half-Year Financial Report as at 30 June

2013. Moving to the analysis of the "Financial Charges and Income",

which include also the result of the derivative instruments used

for hedging purposes and the net FOREX result, in H1/13 the Net

Financial Charges were equal to EUR 3.5 ml, while in H1/12 they

stood at EUR 38.9 ml. Group comparable EBITDA amounted to EUR 54.0

ml in H1/13, substantially in line with EUR 54.7 ml achieved in

H1/12. As commented previously, the Power Generation segment

achieved lower results compared to H1/12, due to the effects of the

IFRS equalization procedure which takes into account the new

calculation methodology for the CIP6/92 tariff. Nonetheless, the

lower contribution to the Group comparable EBITDA coming from the

Power Generation segment was entirely offset by the results

achieved in the Refining, Wind and Marketing segments, which in

H1/13 were stronger than the results obtained in H1/12. Finally,

the Group adjusted Net Result stood at EUR -57.0 ml, improved

versus the Group adjusted Net Result of EUR 65.9 ml in H1/12,

mainly because of the lower Net Financial Charges, as previously

discussed. CAPEX in H1/13 was EUR 64.3 ml, in line with the

investment programme of 2013, and almost entirely dedicated to the

Refining segment (EUR 50.7 ml). Group Net Financial Position on the

30 of June 2013 stood at EUR -157 ml, improved by 28% versus the

position at the beginning of the year (EUR -218 ml). The main

contribution comes from the positive cashflow from Operations and

from the self-financing from provisions for depreciation and

amortisation. Furthermore, it should be noted that some payments

for crude oil are still outstanding, due to the oil embargo

declared by the European Union against Iran.

th

Comments to Second Quarter 2013 results

Group Revenues in Q2/13 were EUR 2,774 ml, up 4% vs. Q2/12. Indeed,

in Q2/13 the Refining segment remarkably improved its revenues

because its sales stood at approx. 3.9 ml tons of refined oil

products, which compares with sales of approx. 3.3 ml tons in the

same quarter of 2012. This result more than offset the reduction in

revenues coming from the Marketing segment which, instead, suffered

from the drop in the prices of the main oil products. For reference

purposes, in Q2/13 the average price for gasoline stood at 948

$/ton (versus 1,015 $/ton in Q2/12), while diesel traded at an

average price of 881 $/ton (versus 938 $/ton in Q2/12). Group

reported EBITDA in Q2/13 was EUR -26.1 ml, strongly improved versus

EUR -147.3 ml in Q2/12. As commented already in the results of the

half-year, the difference in the results can be mainly explained

with the different devaluation amounts for the oil inventories, in

the two periods under comparison, due to the price drop for crude

oil and refined products. More specifically, in Q2/13 the

devaluation of oil inventories was considerably lower than in the

same period of last year. Moreover, in Q2/13 all the comments

already made in H1/13 are still applicable, especially with regards

to the accounting of the non-repayable grant related to a Regional

Master Plan dated June 2002, and the effects on the Power

Generation segment's results of the IFRS equalization procedure,

which takes into account the new calculation methodology for the

CIP6/92 tariff.

2

Group reported Net Result in Q2/13 stood at EUR -199.5 ml, down vs.

EUR -131.8 ml in Q2/12, for the same reasons explained in the H1/13

results, with regards to the devaluation of the CIP6/92 contract

(worth approx. EUR 232 ml), which was entirely accounted for into

Q2/13 results. Moreover, in Q2/13 the Net Financial Charges (which

include also the result of the derivative instruments used for

hedging of the commercial activities and the net FOREX result)

stood at EUR 0.7 ml, substantially in line with the Net Financial

Charges for EUR 2.4 ml in the same quarter of 2012. Group

comparable EBITDA in Q2/13 amounted to EUR 5.8 ml, down versus EUR

33.6 ml achieved in Q2/12. Likewise, Group adjusted Net Result was

EUR -46.3 ml, versus the Group adjusted Net Result of EUR -29.3 ml

reported in Q2/12. The difference in the two periods under

comparison is mainly due the Power Generation segment, whose

equalized results take into account the new calculation methodology

adopted for the CIP6/92 tariff, as already explained in the

previous paragraphs. CAPEX in Q2/13 was EUR 30.9 ml, primarily

dedicated to Refinery segment (EUR 24.7 ml). For further details

and comments on the results of each business segment, on the

Group's strategy and on the Outlook, th please refer to the

Half-Year Financial Report as at 30 June 2013.

Programme of the conference call due on 9 August 2013 and other

information

At 15:00 CET of Friday 9 August 2013, there will be a conference

call for analysts and investors, during which Saras Top Management

will discuss a slide presentation on Q2/13 and H1/13 Group results,

and will subsequently answer all the relevant questions. A

dedicated presentation will be available on the Company's website

(www.saras.it), under "Investor Relations/Presentations" starting

from 08:00 CET. The dial-in numbers for the conference call are the

following: From Italy: From the UK: From the USA: +39 02 805 88 11

+ 44 121 281 8003 +1 718 7058794

Link for the live webcast:

http://services.choruscall.eu/links/saras130809.html

Playback and transcript of the webcast will also be available on

the Company's website. For further information, please contact the

Investor Relations department. This press release issued on 9

August 2013 at 08:00 CET, has been prepared pursuant to the

Regulation implementing th th Legislative Decree no. 58 of 24

February 1998, adopted by CONSOB under resolution number 11971 of

14 May 1999, as amended and supplemented. It is available to the

public at the offices of Borsa Italiana S.p.A. and from the

Company's website (www.saras.it), under "Investor

Relations/Financial News/Press Releases". The Half-Year Financial

th Report as at 30 June 2013 is also available to the public at the

company's registered office in Sarroch (CA) SS. 195 Sulcitana, Km.

19, at the administrative office in Milan, Galleria de Cristoforis

n. 1, and it is also available on the Company's website under

"Investor Relations/Quarterly Report".

th

Massimo Vacca Head of Investor Relations & Financial

Communications E-mail: Telephone: ir@saras.it +39 02 7737 642

THE SARAS GROUP

The Saras Group, whose operations were started by Angelo Moratti in

1962, has approximately 1,900 employees and total revenues of about

11.9 billion Euros as of 31st December 2012. The Group is active in

the energy sector, and is a leading Italian and European crude oil

refiner. It sells and distributes petroleum products in the

domestic and international markets, directly and through the

subsidiary Saras Energia S.A. in Spain, and the subsidiaries Arcola

Petrolifera S.r.l. and Deposito di Arcola S.r.l. in Italy. The

Group also operates in the electric power production and sale,

through the subsidiaries Sarlux S.r.l. and Sardeolica S.r.l.. In

addition, the Group provides industrial engineering and scientific

research services to the oil, energy and environment sectors

through the subsidiary Sartec S.p.A.. Finally, the Group operates

also in the field of exploration for gaseous hydrocarbons.

3

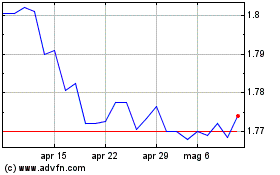

Grafico Azioni Saras Raffinerie Sarde (BIT:SRS)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Saras Raffinerie Sarde (BIT:SRS)

Storico

Da Lug 2023 a Lug 2024