Bitcoin Not ‘Overvalued’ Yet, Says CryptoQuant CEO: Here’s Why

04 Giugno 2024 - 6:00PM

NEWSBTC

The CEO of the on-chain analytics firm CryptoQuant explained that

Bitcoin’s price isn’t currently overvalued based on its network

fundamentals. Bitcoin Price May Not Be Overvalued Yet Based On

Thermo Cap Ratio In a new post on X, CryptoQuant CEO and founder Ki

Young Ju has discussed about how the recent trend in the Bitcoin

Thermo Cap Ratio has been like. The “Thermo Cap” is a

capitalization model for BTC that calculates the total value of the

asset by taking each token’s value as the same as the spot price

when it was mined on the network. Related Reading: Crypto Analyst

Says Bitcoin Will Rise To $79,600 If This Holds Put another way,

this model calculates the cumulative value of the coins mined by

the miners since the inception of the blockchain. This is quite

different from what, for example, the usual market cap does. In the

market cap’s case, the current spot price is taken as the value of

all coins in circulation. As the coins that miners mine are the

only way to increase the cryptocurrency’s supply, the Thermo Cap

may be considered a measure of the “true” capital inflows coming

into the network. Here is a chart that displays how the Bitcoin

Thermo Cap has changed over its history: As the above graph shows,

the Thermo Cap has seen an accelerating growth curve. This

naturally reflects the increasing amount of capital flowing into

the asset over the years. In the context of the current topic,

though, the indicator of interest isn’t the Thermo Cap itself but

rather the Thermo Cap Ratio. This metric tracks the ratio between

the Bitcoin market cap and the Thermo Cap. The chart below shows

the trend in the Thermo Cap Ratio over the asset’s history. An

interesting pattern is visible in the graph. It appears that very

high values of the Thermo Cap Ratio have coincided with highs in

the cryptocurrency’s price. Related Reading: Bitcoin Has Solid

On-Chain Cushion Below $68,900: Stage Set For Fresh Rally? At high

values, the Bitcoin market cap is quite large compared to the

Thermo Cap, meaning that coins are trading at a much higher rate

than they were mined at. It’s also apparent that bottoms in BTC

occur when the ratio assumes low values. The recent trend in the

indicator has been that of a rise, but its value has not touched

the levels where bull run tops would have happened in the past.

“Bitcoin is not currently overvalued based on network

fundamentals,” notes the CryptoQuant founder. BTC Price Bitcoin has

been unable to break out of its range recently as its price has

kept up the trend of sideways movement. At present, BTC is trading

at around $68,900. Featured image from Dall-E, CryptoQuant.com,

chart from TradingView.com

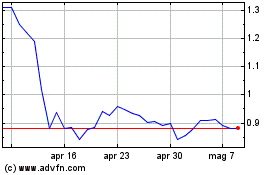

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Mag 2024 a Giu 2024

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Giu 2023 a Giu 2024