Bitcoin Coinbase Premium Index Has Turned Positive At 0.006, Why This Is Important

07 Giugno 2024 - 2:30PM

NEWSBTC

The Bitcoin recent foray into $70,000 price territory has again

become a hot topic among investors, with many looking at a positive

price outlook. As a result of this fascinating price action, the

vast majority of long-term holders have seen their holdings cross

into profit zone. Particularly, the positive outlook seems to be

positive among US-based investors, as shown by the Coinbase premium

turning positive. Some see the return of the Coinbase premium as a

bullish signal that could continue to drive the price higher.

Coinbase Premium Index Flips Positive The Coinbase Premium Index

(CPI), which had been trading in the negative since May 18, has now

turned positive, according to a cryptocurrency analyst who cited

data from CryptoQuant. The Coinbase Premium refers to the

difference in Bitcoin’s price on Coinbase versus other major

exchanges. Related Reading: Shiba Inu Whale Enter Buying Frenzy,

715 Billion SHIB Snapped Up In Days When the premium turns

positive, it means Bitcoin is trading at a higher price on Coinbase

compared to Binance and, subsequently, other major crypto

exchanges. This is important because it shows increased demand for

Bitcoin on one of the largest US-based crypto exchanges. On the

other hand, a negative premium indicates a lack of substantial

buying pressure from US-based traders. Since Coinbase is a popular

entry point for new US crypto investors, a premium price indicates

money is flowing into Bitcoin. At the time of writing, data from

CryptoQuant shows that this premium recently reached 13.11. While

this may seem small, it definitely indicates the beginning of

buying pressure that could send Bitcoin on another leg higher

Interestingly, this flip into a positive Coinbase premium has come

with a less bullish outlook on Bitcoin among Korean and Asian-based

investors, at least in the short term. This information is revealed

by CryptoQuant’s Korea Premium Index, which has been on a downtrend

in the past two weeks. Bitcoin Continues To Hold Strong At the time

of writing, Bitcoin is trading at $71,095 and is up by 4.31% amidst

increased buying momentum, with the Bitcoin Open Interest recently

reaching its all-time high. While a positive Coinbase Premium is a

bullish indicator, the context around why it’s happening matters

greatly in determining where Bitcoin’s price may go next. Related

Reading: VanEck Revises Ethereum Prediction To Put Price At

$22,000, Here’s Why A large part of the positive premium could be

attributed to individual large holders called whales, with on-chain

data showing instances of huge Bitcoin transfers from Coinbase to

unknown private wallets. As mentioned earlier, a sustained

positive premium and interest from institutions and retail buyers

is the most promising scenario for Bitcoin to build on. However,

interest from Coinbase whales alone may not be enough to fuel a

prolonged, substantial price rally. For Bitcoin to continue its

upward trajectory, there must be a corresponding rise in the

interest shown by retail investors. Featured image created with

Dall.E, chart from Tradingview.com

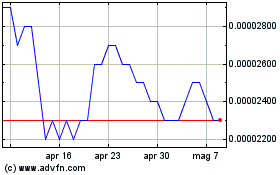

Grafico Azioni SHIBA INU (COIN:SHIBUSD)

Storico

Da Mag 2024 a Giu 2024

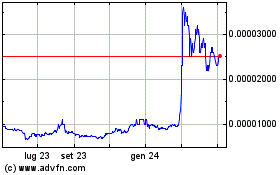

Grafico Azioni SHIBA INU (COIN:SHIBUSD)

Storico

Da Giu 2023 a Giu 2024