Written Communication Relating to an Issuer or Third Party (sc To-c)

02 Agosto 2021 - 2:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section

14(d)(1) or 13(e)(1) of the Securities Exchange Act of 1934

EMPRESA DISTRIBUIDORA

Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(Name of Subject Company (Issuer))

EMPRESA DE ENERGÍA DEL CONO SUR S.A.

(Names of Filing Persons (Offerors))

CLASS B COMMON SHARES, par value 1 Peso per share

(Title of Class of Securities)

29244A102

(CUSIP Number)

Nicolas Mallo Huergo

c/o Maipú 1252, 12th floor,

City of Buenos Aires, (CP1006),

Argentina

With a copy to:

Christopher C. Paci, Esq.

J.A. Glaccum, Esq.

Nicolas Teijeiro, Esq.

DLA Piper LLP (US)

1251 6th Ave

New York, NY 10020

(212) 225-2000

(Name, Address and Telephone

Number of Person Authorized to Receive Notices and Communications)

CALCULATION OF FILING FEE

|

Transaction Valuation*

|

|

Amount of Filing

Fee

|

|

Not applicable.

|

|

Not applicable.

|

* No filing fee is required because the filing contains only

preliminary communications made before the commencement of a tender offer.

|

|

o

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously

paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

Amount Previously Paid: N.A

|

Filing Party: N/A

|

|

Form or Registration No.: N/A

|

Date Filed: N/A

|

|

|

☒

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to

which the statement relates:

|

|

☒

|

third party tender offer subject to Rule 14d-1.

|

|

|

o

|

issuer tender offer subject to 13e-4.

|

|

|

o

|

going-private transaction subject to Rule 13e-3.

|

|

|

o

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the

results of the tender offer: □

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

|

|

o

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

☒

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

Explanatory Note

This notification relates to a possible tender offer (the

“OPA”) by Empresa de Energía del Cono Sur S.A., a sociedad anónima organized under the

laws of Argentina (“Edelcos”), for all of the Class B Common shares, P$1.00 par value per share, of Empresa

Distribuidora y Comercializadora de Energía Norte S.A. (“Edenor”), an Argentine corporation (the “Shares”).

On the date hereof, Edelcos issued a notice (the “Notification”) in Argentina relating to the possible tender offer.

An English-language free translation of the Notification is attached as Exhibit 99.1.

This Notification is neither an offer to purchase nor a

solicitation of an offer to sell any securities. Edelcos has not commenced a tender offer for the shares. In connection with the proposed

transaction, Edelcos intends to file with the U.S. Securities and Exchange Commission a Tender Offer Statement and related materials on

Schedule TO, and Edenor would file a Solicitation Recommendation on Schedule 14D-9. Investors and security holders are encouraged to read

carefully such documents when they become available, and as they may be amended from time to time, before any decision is made with respect

to the potential offer, because they will contain important information. If and when filed, such documents will be available free of charge

at the website of the U.S. Securities and Exchange Commission — www.sec.gov. In addition, if and when filed, Edelcos will provide

copies of such documents free of charge to investors and security holders.

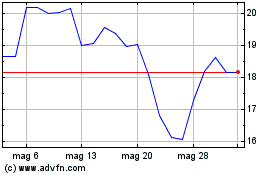

Grafico Azioni Empresa Distribuidora Y ... (NYSE:EDN)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Empresa Distribuidora Y ... (NYSE:EDN)

Storico

Da Mag 2023 a Mag 2024